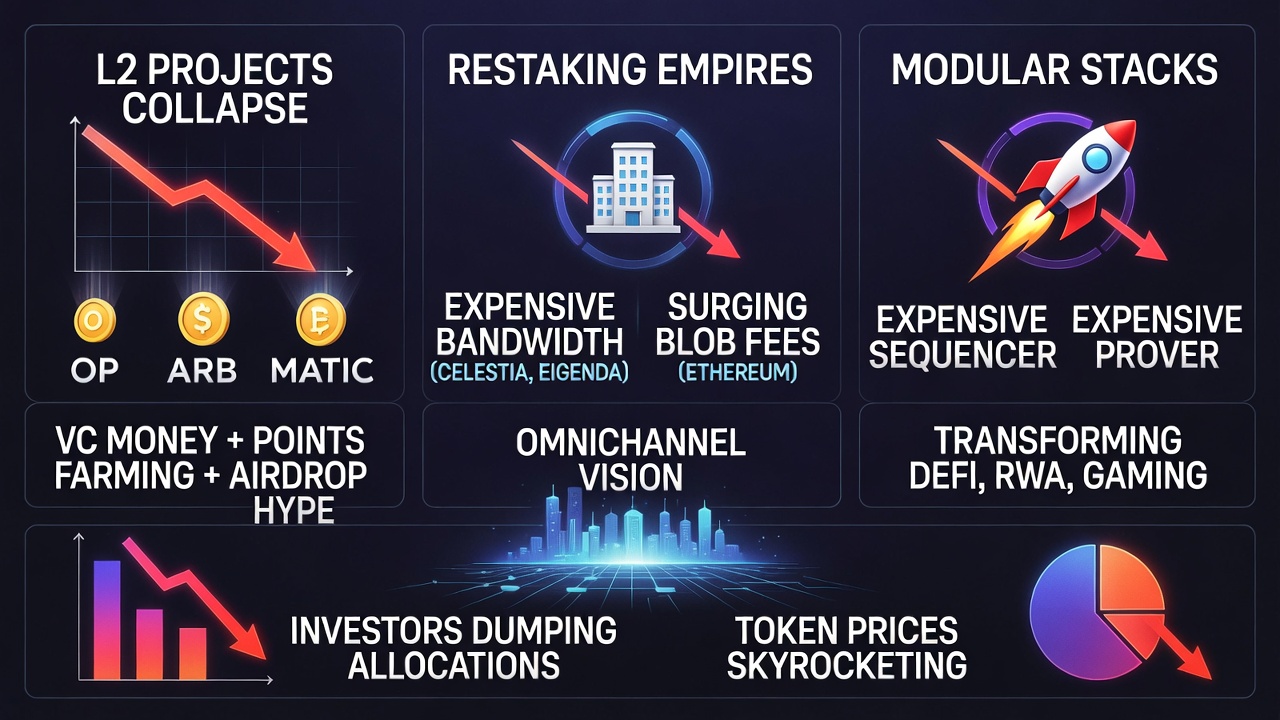

In the whirlwind of today's crypto landscape, Layer 2 (L2) projects, restaking empires, and modular stacks are securing massive funding rounds to build out new rollup chains, Validiums, alternative data availability (Alt-DA) layers, hyperchains, and EigenLayer Actively Validated Services (AVS).

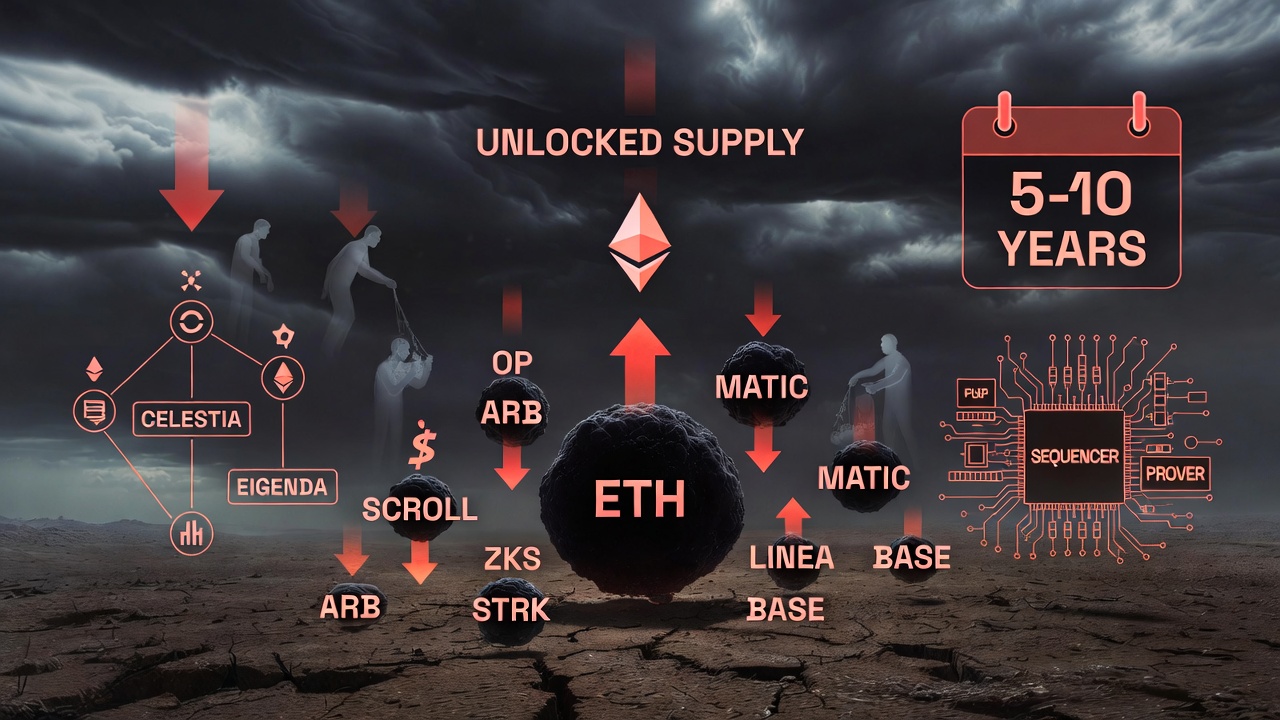

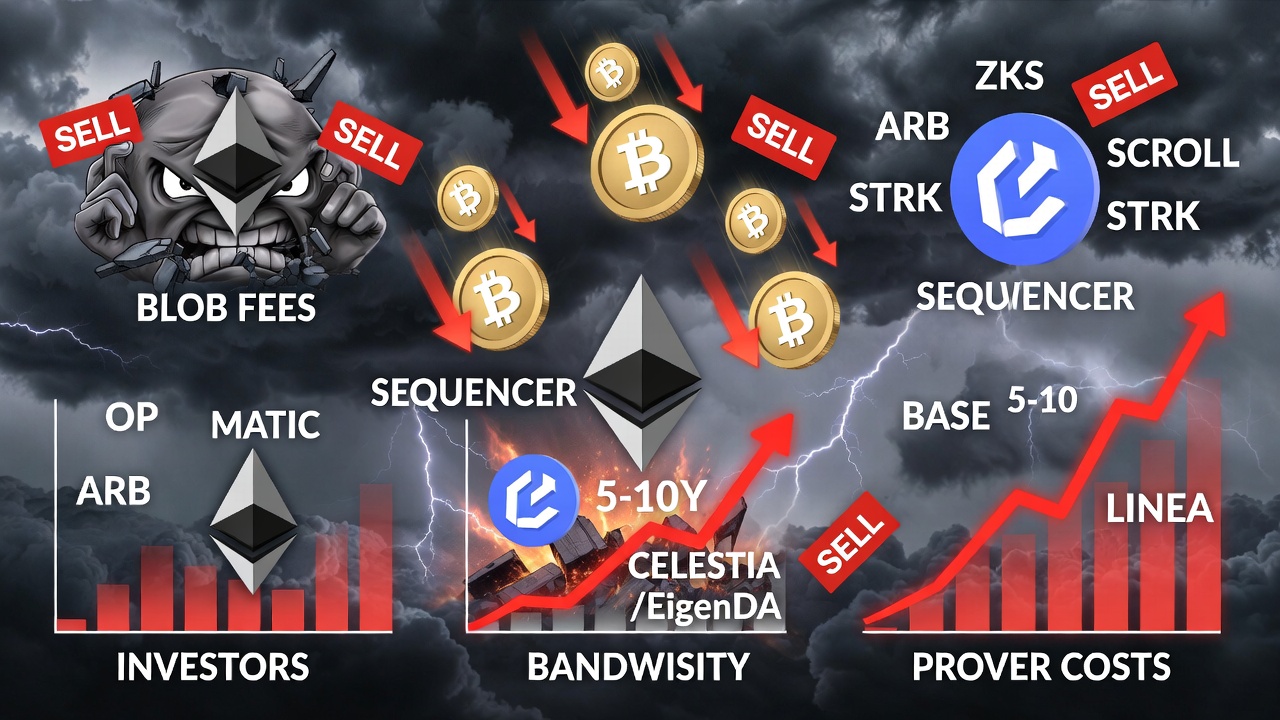

This frenzy is driving costs sky-high: blob fees on Ethereum are surging, bandwidth on Celestia and EigenDA is becoming prohibitively expensive, and sequencer and prover expenses are rocketing into the stratosphere.

This frenzy is driving costs sky-high: blob fees on Ethereum are surging, bandwidth on Celestia and EigenDA is becoming prohibitively expensive, and sequencer and prover expenses are rocketing into the stratosphere.

What once could launch a serious L2 for $50-100 million now demands $400-800 million — and soon, it could climb to $1.5-2 billion or more.

The Foundations of the Boom: VC Money, Points Farming, and Airdrop Hype

This entire L2, modular, and restaking boom is propped up by venture capital (VC) infusions, points farming schemes, airdrop speculation, and wildly optimistic narratives. Projects are pouring $15-30 billion into ecosystems with the dream of dominating DeFi 2.0, Real-World Assets (RWA), AI agents, Decentralized Physical Infrastructure Networks (DePIN), and on-chain gaming — expecting 50-200x returns.

This entire L2, modular, and restaking boom is propped up by venture capital (VC) infusions, points farming schemes, airdrop speculation, and wildly optimistic narratives. Projects are pouring $15-30 billion into ecosystems with the dream of dominating DeFi 2.0, Real-World Assets (RWA), AI agents, Decentralized Physical Infrastructure Networks (DePIN), and on-chain gaming — expecting 50-200x returns.

But even in the most euphoric bull run, this is a pipe dream. Nine out of ten L2s will never achieve self-sustainability once the points drops dry up, tools like OP Stack, Arbitrum Orbit, and Polygon CDK stop being near-free, and users refuse to pay sequencer fees above $0.0001.

Investors in these L2 ventures will soon pause and reflect: Why pour $800 million to $1.5 billion into a rollup project building its own DA farm, proprietary sequencer, and prover network when competitors are doing the same for $150-300 million, complete with native cross-chain functionality that eliminates bridge risks and fragmentation?

Investors in these L2 ventures will soon pause and reflect: Why pour $800 million to $1.5 billion into a rollup project building its own DA farm, proprietary sequencer, and prover network when competitors are doing the same for $150-300 million, complete with native cross-chain functionality that eliminates bridge risks and fragmentation?

That's when the real crash begins. Tokens like OP, ARB, MATIC, SCROLL, ZKS, STRK, LINEA, and BASE could plummet 90-97%, dragging the entire altseason market down with them.

The Turning Point: When the Money Stops Flowing

Early-stage investors who've funneled hundreds of millions into pre-TGE (Token Generation Event) rounds, points systems, and modular narratives will pull back, triggering a cascade of collapses. An L2 or modular project once valued at $6-12 billion purely on Total Value Locked (TVL), Fully Diluted Valuation (FDV), and hype around a "modular future" could crater to $200-400 million overnight.

Early-stage investors who've funneled hundreds of millions into pre-TGE (Token Generation Event) rounds, points systems, and modular narratives will pull back, triggering a cascade of collapses. An L2 or modular project once valued at $6-12 billion purely on Total Value Locked (TVL), Fully Diluted Valuation (FDV), and hype around a "modular future" could crater to $200-400 million overnight.

Mass unlocks will flood the market, centralized exchanges (CEXs) will delist tokens, vesting schedules will release waves of supply, and restaking protocols will enforce slashing penalties.

VC firms will dump their unlocked allocations en masse, points farmers will be left holding worthless bags, and sequencer/prover infrastructure will hit the auction block. Assets that once commanded $8 billion valuations might sell for a fire-sale $40-80 million after dropping to $300 million.

This isn't just a correction — it's the onset of a crypto winter that could last 5-10 years.

The bubble will burst precisely when investors realize their capital won't return. Picture an investor staring at a $700 million bet on an L2 startup focused on yield farming memecoins or NFT minting — activities where users aren't even willing to cover basic gas fees.

The bubble will burst precisely when investors realize their capital won't return. Picture an investor staring at a $700 million bet on an L2 startup focused on yield farming memecoins or NFT minting — activities where users aren't even willing to cover basic gas fees.

Renting rollup sequencers, provers, and DA worldwide will become utterly unprofitable, rendering much of the current infrastructure obsolete.

Also read:

- MrBeast's $5.2 Billion Empire: Breaking Down the Beast Ahead of IPO

- Choosing the Best $20/Month AI Subscription in 2026: Claude Pro, ChatGPT Plus, or Google AI Pro?

- The Illusion of Value: Fake Capitalizations in 90% of Crypto Projects

A Long-Term Vision: The True Omnichain Revolution

Only after about a decade will we witness the genuine transformation brought by omnichain infrastructure. It will reshape DeFi, RWA, gaming, social platforms, and the broader on-chain economy in ways that feel seamless and revolutionary.

Only after about a decade will we witness the genuine transformation brought by omnichain infrastructure. It will reshape DeFi, RWA, gaming, social platforms, and the broader on-chain economy in ways that feel seamless and revolutionary.

Your children, immersed in fully on-chain games with native cross-chain liquidity — no bridges, no risks — won't even recognize the names of yesterday's "giants" like OP Mainnet, Arbitrum One, Base, zkSync Era, or Polygon.

They'll inherit a matured ecosystem where interoperability is the norm, not a hype-fueled experiment.

In the end, this L2/modular/altseason bubble is a classic case of overextension. It's built on fleeting enthusiasm rather than enduring value. When the funding faucet turns off, the house of cards falls — but from its ruins, a more robust crypto world may finally emerge.