Prediction markets like Kalshi, a U.S.-regulated platform for betting on real-world events, have gained popularity for allowing users to wager on everything from election outcomes to economic indicators. But a recent controversy surrounding a market tied to Senator Bernie Sanders' rally in Greensboro, North Carolina, has highlighted the pitfalls of these platforms — particularly when it comes to hyper-specific bets on what public figures might say.

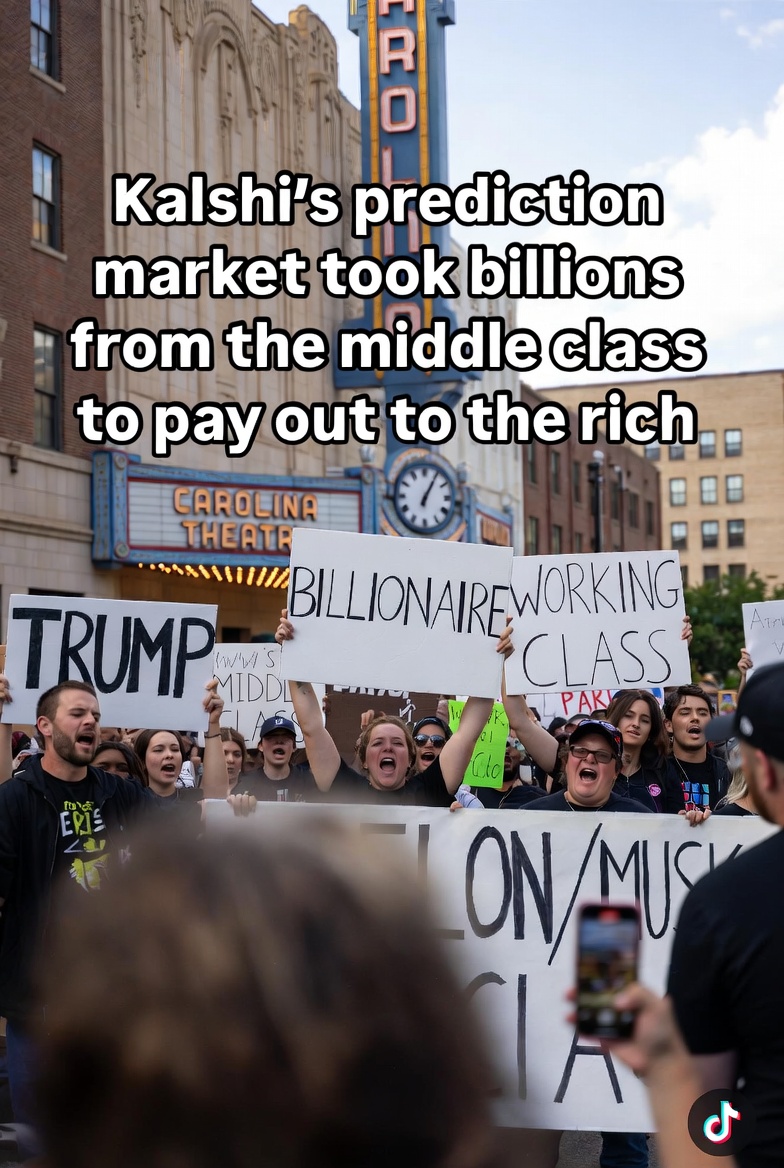

The market in question, titled "What will Bernie say at his Greensboro rally?", invited users to bet on whether Sanders would utter certain words or phrases during his February 12, 2026, event, such as "Trump," "Billionaire," "Middle Class," "Elon / Musk," and "Working Class."

The market in question, titled "What will Bernie say at his Greensboro rally?", invited users to bet on whether Sanders would utter certain words or phrases during his February 12, 2026, event, such as "Trump," "Billionaire," "Middle Class," "Elon / Musk," and "Working Class."

With over $3.6 million in trading volume, it attracted significant interest, as Sanders — a vocal progressive known for railing against wealth inequality and figures like Donald Trump and Elon Musk — seemed like a safe bet to mention these terms. Odds for "Yes" on many options hovered around 90%, reflecting bettors' confidence.

However, despite audio and video evidence from attendees showing Sanders using these exact words multiple times, Kalshi resolved all contracts as "No." This decision led to widespread outrage, with users claiming they lost millions in what felt like a "scam" or "rug pull."

One prominent trader, @CarOnPolymarket, shared their frustration on X, detailing a $300 loss and accusing Kalshi of ignoring reality: "I hear Bernie clearly say the words I bet on. A total of $3M+ was wagered on this event, people lost millions against reality." The post garnered over 10,000 likes and hundreds of replies, with many echoing similar complaints and even threatening legal action.

The devil, as always, was in the details — or rather, the fine print. Kalshi's rules for the market specified that resolutions would be based primarily on video from the event, but if unclear, they would rely on transcripts from approved sources: major outlets like The New York Times, Associated Press, Bloomberg News, Reuters, Axios, Politico, Semafor, The Information, The Washington Post, The Wall Street Journal, ABC, CBS, CNN, Fox News, MSNBC, and NBC.

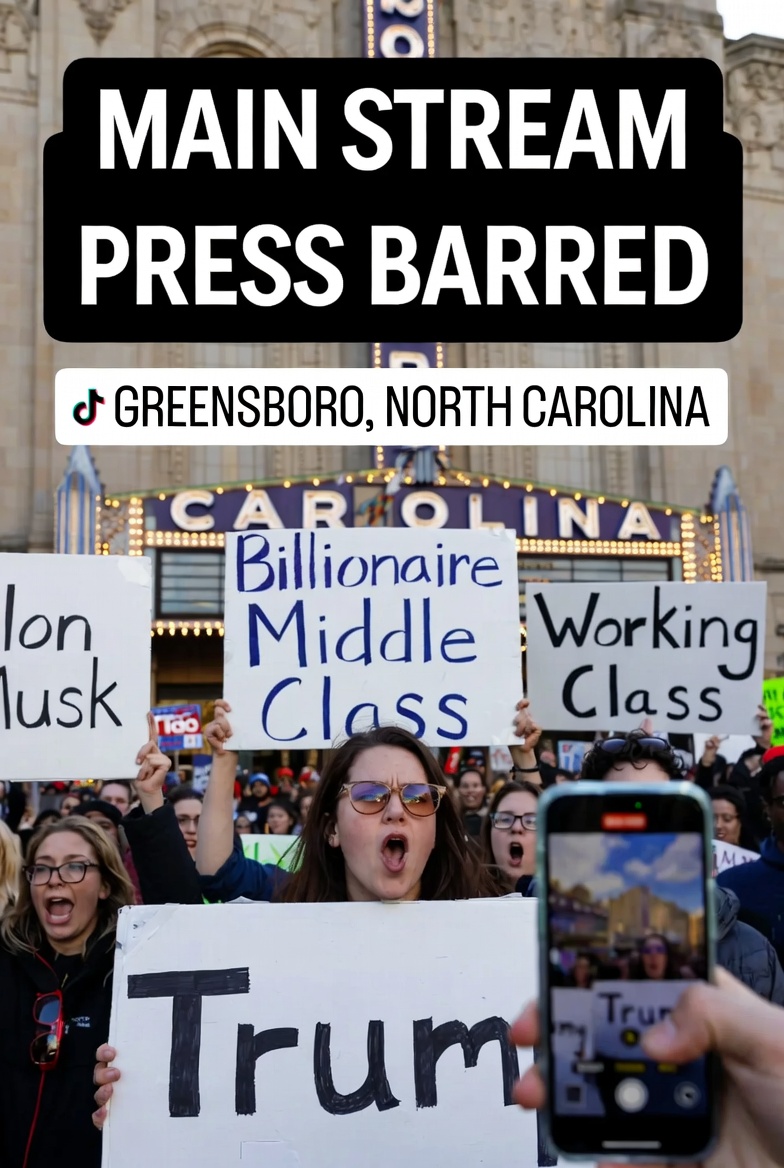

The rally, part of Sanders' "Fighting Oligarchy Tour," was held in a closed format at the Carolina Theatre, with mainstream press reportedly barred from attending. Without coverage from these outlets, Kalshi deemed there were no verifiable sources to confirm the mentions, leading to the "No" resolution.

Bettors pointed to alternative evidence, including a TikTok livestream from an attendee that captured Sanders saying phrases like "billionaires" and "working class" repeatedly during his discussion on wealth inequality. But as one defender of Kalshi's decision noted on X, "I do not see 'random tiktoker with 20 concurrent viewers' listed as a qualifying option here."

Bettors pointed to alternative evidence, including a TikTok livestream from an attendee that captured Sanders saying phrases like "billionaires" and "working class" repeatedly during his discussion on wealth inequality. But as one defender of Kalshi's decision noted on X, "I do not see 'random tiktoker with 20 concurrent viewers' listed as a qualifying option here."

Discussions on Reddit's r/Kalshi subreddit exploded with threads like "Bernie Sanders Greensboro Rally (Mentions)- Drama," where users debated the rules and shared clips, questioning whether the platform should have voided the market instead.

This isn't the first time such "mention markets" have stirred trouble. They are notoriously susceptible to manipulation or self-fulfilling prophecies. For instance, in November 2025, Coinbase CEO Brian Armstrong trolled similar bets on Polymarket and Kalshi during an earnings call by deliberately uttering words like "Bitcoin," "Ethereum," "Blockchain," "Staking," and "Web3" to trigger payouts. Armstrong admitted to being "distracted" by the markets, turning what should be informative calls into meta-games. In Sanders' case, the issue wasn't intentional trolling but a mismatch between real events and rigid resolution criteria.

The fallout has damaged Kalshi's reputation among some users. Trustpilot reviews for the platform include complaints about the rally market, with one user calling it a "total scam." Others on X accused the platform of "screwing patrons" despite "video and audio proof." Kalshi, regulated by the Commodity Futures Trading Commission (CFTC), has remained silent on the specifics, though its rules emphasize reliance on credible sources to prevent disputes.

A screenshot circulating online shows the market's resolution page, with all options marked "No" and a stark ROI of -$378.14, underscoring the financial hit for "Yes" bettors. As one X user lamented, "This is why people are speed-running to Polymarket lmao."

The moral of this mini-scandal? In the world of prediction markets, the headline question is just the hook — always dive into the rules. Failing to do so can turn what seems like "easy money" into a costly lesson, especially when betting on the unpredictable nature of politics and public speeches. As prediction markets mature, incidents like this may push platforms to refine their resolution processes, but for now, bettors are reminded: RTFM (Read The Fine Manual) or risk getting burned.

Also read:

Also read:

- Trader Nets $80,000 Overnight by Tracking Pentagon Pizza Orders on Polymarket

- The Fundamental Rot at the Core of the Crypto Market: Zero Utility and No Fresh Suckers Left

- QUA Crypto Buyback - February 2026

Thank you!