CoinMarketCap and CoinGecko Reflect Latest Changes in QUA Token Circulating Supply

In a significant development for the QUASA ecosystem, leading cryptocurrency data aggregators CoinMarketCap and CoinGecko have updated their listings to reflect the recent adjustments in the circulating supply of QUA tokens.

In a significant development for the QUASA ecosystem, leading cryptocurrency data aggregators CoinMarketCap and CoinGecko have updated their listings to reflect the recent adjustments in the circulating supply of QUA tokens.

This update follows a substantial token buyback executed by the QUASA team in February 2026, underscoring the project's commitment to enhancing token scarcity and long-term value.

Details of the February Buyback

The QUASA team announced the repurchase of 781,536 QUA tokens during February, reducing the overall circulating supply. As of now, the total QUA tokens in circulation stand at 73.75 million. This move is part of a broader strategy to optimize the token's economics amid favorable market conditions.

To put this in perspective:

To put this in perspective:

- The current supply is 5.76 million QUA less than it was a year ago in February 2025, when the circulating supply was 79.51 million QUA.

- Compared to two years ago in February 2024, it represents a reduction of 19.38 million QUA from the then-total of 93.13 million.

- Looking further back to 2023, the supply has decreased by 40.55 million QUA from 114.3 million tokens in circulation.

These reductions highlight QUASA's consistent efforts to manage supply over time.

QUA token buyback by year:

- 2026 - 1,148,229 QUA (366,693 January + 781,536 February)

- 2025 - 5,275,517 QUA

- 2024 - 13,616,883 QUA

- 2023 - 20,000,000 QUA

- 2002 - 2,000 QUA

Circulating Supply

1. Circulating Supply - 73,755,076 QUA

1. Circulating Supply - 73,755,076 QUA

(Circulating supply = Personal wallets + Exchanges + Lost)

- Personal Wallets - 46,956,528 QUA

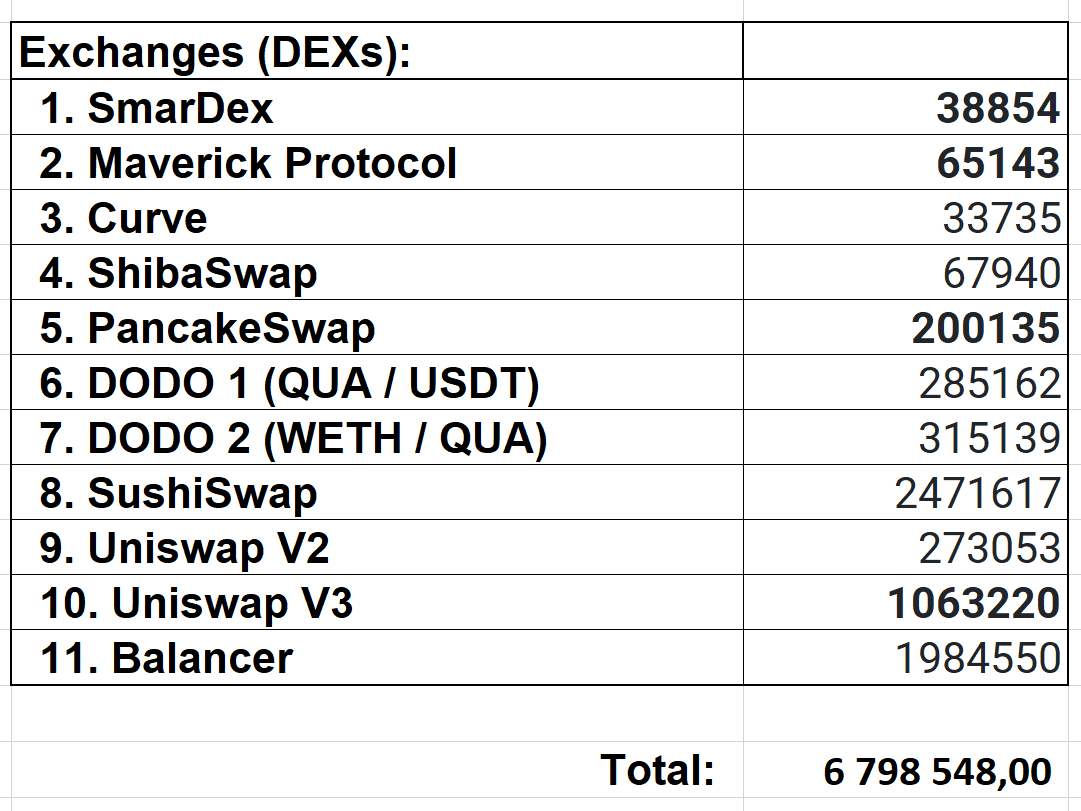

- Exchanges - 6,798,548 QUA

- Lost/Inaccessible ~ 20,000,000 QUA ( Including 4,920,656 million blocked and burned in the accounts of two centralized closed exchanges.)

2. Team Reserves - 46,798,142 QUA

Total Supply (Circulating supply + Team Reserves) - 120,553,218 QUA

Driving Factors Behind the Buyback

QUASA's strong financial position has been a key enabler of this aggressive buyback program. The company has experienced a surge in revenues from its operational activities, coupled with the relatively low market price of QUA tokens.

QUASA's strong financial position has been a key enabler of this aggressive buyback program. The company has experienced a surge in revenues from its operational activities, coupled with the relatively low market price of QUA tokens.

This combination allowed the team to allocate more funds than initially planned to the repurchase initiative.

Since the start of 2026, QUASA has already bought back over 1 million QUA tokens — more than three times the typical volume of its previous buyback efforts. This accelerated pace demonstrates the project's agility in capitalizing on market opportunities.

Looking ahead, the QUASA team has affirmed its intention to continue leveraging favorable periods for additional token repurchases. This proactive approach aims to further tighten the supply dynamics.

Benefits of Reduced Supply

By systematically reducing the circulating supply, QUASA is positioning QUA as a scarce asset in a market flooded with inflationary cryptocurrencies. Unlike 99% of other digital assets that often feature unlimited or expanding supplies, QUA's deflationary mechanics enhance its appeal.

By systematically reducing the circulating supply, QUASA is positioning QUA as a scarce asset in a market flooded with inflationary cryptocurrencies. Unlike 99% of other digital assets that often feature unlimited or expanding supplies, QUA's deflationary mechanics enhance its appeal.

This strategy not only boosts the token's stability but also increases its attractiveness to investors. As supply diminishes, the potential for value appreciation grows, making QUA a more compelling option in a volatile crypto landscape.

Resilience Amid Market Turbulence

QUA has demonstrated remarkable resilience during periods of high turbulence and upheaval in the cryptocurrency market. A major factor contributing to this stability is the token's exclusive trading on decentralized exchanges (DEXes). This shift eliminates the risks of fraud and manipulation that plagued centralized platforms in the past.

QUA has demonstrated remarkable resilience during periods of high turbulence and upheaval in the cryptocurrency market. A major factor contributing to this stability is the token's exclusive trading on decentralized exchanges (DEXes). This shift eliminates the risks of fraud and manipulation that plagued centralized platforms in the past.

The core philosophy of cryptocurrencies inherently opposes centralized trading. Why create a decentralized asset only to subject it to the whims of a single administrator who could block or freeze it with the press of a button? Recognizing this, the QUASA team deliberately delisted QUA from two centralized exchanges (CEXes) in 2025. These platforms had been sites of manipulative trading aimed at discrediting QUASA and eroding the token's value.

Future Outlook on Listings

While QUASA remains open to future listings on centralized exchanges, any such integration must occur on the exchange's own terms. Specifically, the exchange would need to purchase QUA tokens from the open market and provide them for trading to their users, all at their own expense.

The team has no plans to supply tokens directly to CEXes for trading, market making, or marketing purposes. Currently, no centralized exchange meets QUASA's standards of trustworthiness. The broader crypto market, in their view, requires a thorough cleanup —eliminating at least 150 scam exchanges — before reputable platforms can emerge. Only then might selective, reputation-conscious exchanges become viable partners as QUA gains more popularity and buzz.

The team has no plans to supply tokens directly to CEXes for trading, market making, or marketing purposes. Currently, no centralized exchange meets QUASA's standards of trustworthiness. The broader crypto market, in their view, requires a thorough cleanup —eliminating at least 150 scam exchanges — before reputable platforms can emerge. Only then might selective, reputation-conscious exchanges become viable partners as QUA gains more popularity and buzz.

In summary, the recent updates on CoinMarketCap and CoinGecko signal a positive trajectory for QUA. Through strategic buybacks and a focus on decentralization, QUASA is not only weathering market storms but also building a foundation for sustained growth and investor confidence. As the token becomes scarcer and more stable, its role in the evolving crypto economy looks increasingly promising.