Grayscale Research, a leading authority in digital asset investment, has long been at the forefront of organizing and understanding the rapidly evolving crypto asset class.

To provide clarity and structure for investors, Grayscale employs its proprietary Crypto Sectors framework, a system designed to categorize crypto assets based on their use cases and underlying technologies.

This framework draws parallels with the Global Industry Classification Standard (GICS), a widely recognized system used to classify public equities into sectors and industries. In response to the accelerating growth of decentralized artificial intelligence (AI), Grayscale has recently announced the creation of a new Artificial Intelligence Crypto Sector, marking a significant evolution in its taxonomy and reflecting the transformative potential of AI within the crypto ecosystem.

The Crypto Sectors Framework: A GICS for Crypto

The Global Industry Classification Standard (GICS) has been a cornerstone of traditional finance, enabling investors to categorize equities into sectors such as technology, healthcare, or financials, based on their primary business activities.

The Global Industry Classification Standard (GICS) has been a cornerstone of traditional finance, enabling investors to categorize equities into sectors such as technology, healthcare, or financials, based on their primary business activities.

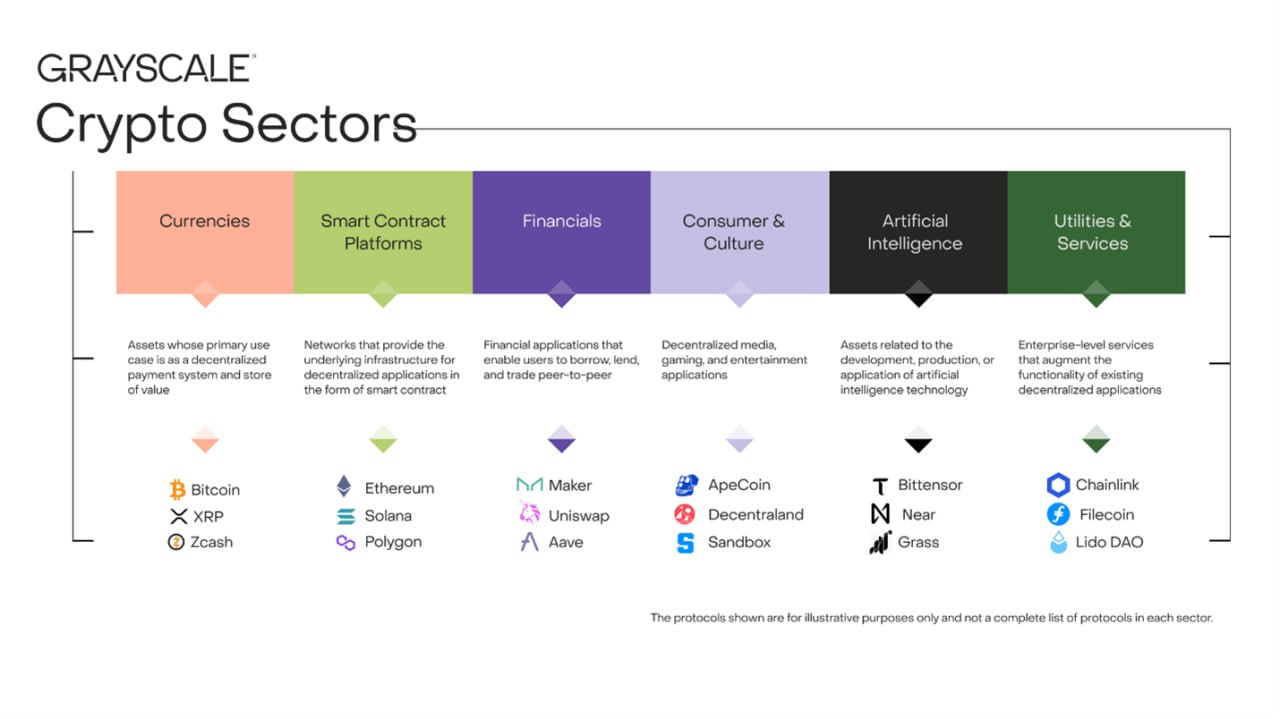

Similarly, Grayscale’s Crypto Sectors framework organizes the diverse universe of digital assets into distinct categories, providing a roadmap for investors to navigate the complexities of the crypto market. Initially introduced in 2023, the framework divides crypto assets into five core sectors: Currencies, Smart Contract Platforms, Financials, Consumer & Culture, and Utilities & Services.

Each sector groups assets by their functional roles, such as serving as a medium of exchange (Currencies) or enabling decentralized applications (Smart Contract Platforms).

In partnership with FTSE Russell, Grayscale has developed a family of benchmark indexes to track the performance of these sectors, offering investors a rigorous tool to monitor price returns and market trends. As of the latest index rebalancing in Q1 2025, the Crypto Sectors framework encompasses 227 distinct assets with a combined market capitalization of approximately $2.6 trillion, representing 85-90% of the total crypto market cap (excluding stablecoins).

This structured approach mirrors the GICS system’s ability to evolve with market developments, as seen when GICS introduced a new Real Estate sector in 2016, reclassifying assets previously under Financials.

The Rise of Decentralized AI and the New Crypto Sector

The rapid advancement of artificial intelligence has positioned it as one of the most consequential technologies of the 21st century, with applications spanning from healthcare to finance. However, concerns over centralized control of AI development — such as data privacy risks, embedded biases, and restricted access — have spurred the growth of decentralized AI solutions built on blockchain technology.

These protocols leverage blockchain’s transparency, immutability, and distributed nature to democratize AI development, reduce reliance on centralized entities, and enhance accessibility for global participants.

Recognizing this trend, Grayscale Research announced on May 27, 2025, the creation of a sixth Crypto Sector: Artificial Intelligence. This new sector, encompassing 20 altcoins with a combined market capitalization of $21 billion, reflects the explosive growth of AI-focused tokens, which have surged over fourfold from $4.5 billion in Q1 2023.

The sector is subdivided into three key categories: AI Platforms (e.g., Bittensor, Near), AI Tools (e.g., Grass, Akash), and AI Apps & Agents (e.g., Virtuals, Worldcoin). These subsectors address critical needs in AI development, including foundational infrastructure, data collection, compute resources, and user-facing applications like autonomous AI agents.

Why Decentralized AI Matters

Centralized AI systems, dominated by a handful of tech giants, have raised significant concerns about governance, transparency, and equitable access. For instance, incidents like Google’s Gemini AI revealing biases or the centralized decision-making at OpenAI have underscored the risks of concentrated control over AI technologies.

Centralized AI systems, dominated by a handful of tech giants, have raised significant concerns about governance, transparency, and equitable access. For instance, incidents like Google’s Gemini AI revealing biases or the centralized decision-making at OpenAI have underscored the risks of concentrated control over AI technologies.

Decentralized AI, powered by blockchain, offers a compelling alternative by distributing ownership and governance, fostering transparency, and enabling broader participation.

Projects like Bittensor exemplify this vision, providing a decentralized neural network where global contributors can collaboratively train AI models, sharing computational resources and benefits.

Similarly, Grass decentralizes data scraping by rewarding users for sharing unused internet bandwidth, while Akash creates a marketplace for idle computing resources critical for AI training.

These protocols reduce dependence on centralized infrastructure, such as AWS, and enhance security and scalability. Additionally, AI Apps & Agents, such as those built on Virtuals Protocol, enable autonomous software to perform tasks like microtransactions, leveraging blockchain’s ability to facilitate fast, low-cost, and programmable transfers.

Grayscale’s inclusion of these protocols in its new AI Crypto Sector highlights their potential to address societal challenges, such as combating deepfakes, ensuring data integrity, and promoting inclusive access to AI development. The firm’s Decentralized AI Fund, launched in July 2024, further underscores its commitment to this space, offering accredited investors exposure to tokens like Bittensor (TAO), Filecoin (FIL), Near (NEAR), Render (RNDR), and Livepeer (LPT).

Recent Developments and Market Impact

The introduction of the AI Crypto Sector comes at a time of significant market momentum. In Q4 2024, the total crypto market capitalization surged from $1 trillion to $3 trillion, driven partly by favorable U.S. election outcomes and growing institutional adoption.

The introduction of the AI Crypto Sector comes at a time of significant market momentum. In Q4 2024, the total crypto market capitalization surged from $1 trillion to $3 trillion, driven partly by favorable U.S. election outcomes and growing institutional adoption.

AI-adjacent tokens have been standout performers, with the top four (TAO, RNDR, AKT, WLD) gaining 522% in the year prior to January 2024, far outpacing the broader Utilities & Services Crypto Sector’s 86% growth.

The new AI sector’s $21 billion market cap reflects its growing relevance, with tokens like Virtuals (VIRTUAL) achieving a remarkable 45,844% growth since its March 2024 launch.

Grayscale’s quarterly rebalancing ensures that its Crypto Sectors framework remains dynamic, adapting to emerging trends like AI integration and Solana’s ecosystem growth. The firm’s Top 20 list for Q1 2025 includes AI-focused projects like Virtuals and Grass, signaling confidence in their risk-adjusted return potential.

This focus aligns with broader market narratives, as social media data from Kaito indicates that AI remains a dominant theme among crypto communities, alongside DeFi and memecoins.

Also read:

- ByteDance Unveils BAGEL: A GPT-4o-Level Image Generator for Local Installation

- OpenAI’s o3 Model Uncovers Critical Vulnerability in Linux Kernel Module

- Oracle’s Historic $40 Billion Investment in Nvidia Chips for OpenAI’s Stargate Data Center

Looking Ahead

The creation of the Artificial Intelligence Crypto Sector underscores Grayscale’s forward-thinking approach to the crypto asset class, mirroring the adaptability of the GICS system in traditional markets. By recognizing the transformative synergy between blockchain and AI, Grayscale is positioning investors to capitalize on a sector poised for exponential growth.

The creation of the Artificial Intelligence Crypto Sector underscores Grayscale’s forward-thinking approach to the crypto asset class, mirroring the adaptability of the GICS system in traditional markets. By recognizing the transformative synergy between blockchain and AI, Grayscale is positioning investors to capitalize on a sector poised for exponential growth.

As AI is projected to become a $15 trillion industry by 2030, decentralized AI protocols could play a pivotal role in reshaping technology development, fostering transparency, and democratizing access.

For investors, the new sector offers a structured way to gain exposure to high-potential AI-focused projects while navigating the inherent volatility of crypto markets. However, as Grayscale emphasizes, investments in digital assets carry significant risks, including potential total loss, and are not suitable for all investors.

As the crypto ecosystem continues to evolve, Grayscale’s Crypto Sectors framework and its new AI sector provide a critical lens for understanding and engaging with the future of decentralized technology.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Investments in digital assets involve high risks, including the potential loss of the entire investment. Always conduct thorough research and consult with a financial advisor before making investment decisions.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).