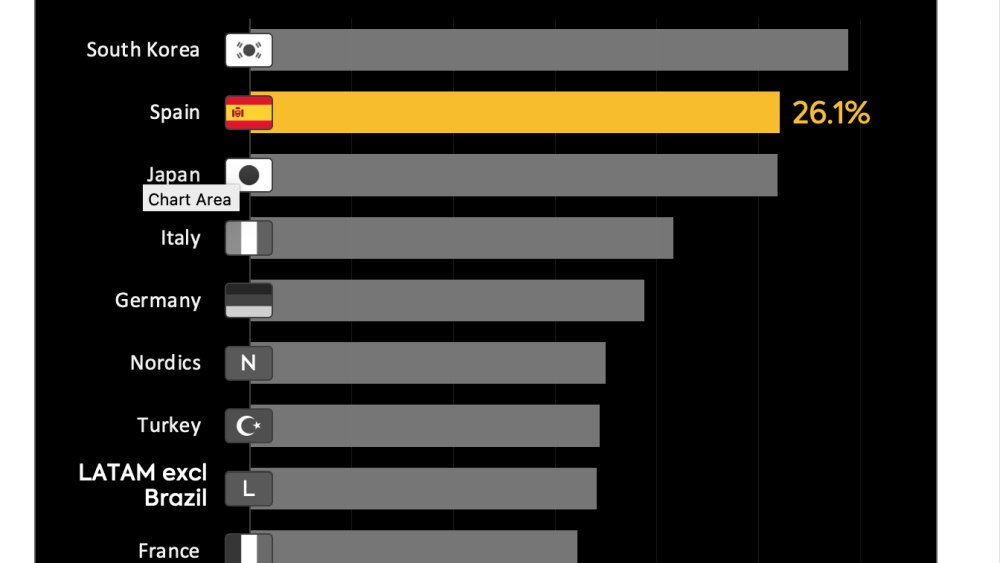

In the ever-expanding universe of global streaming, where algorithms chase cultural crossovers and subscribers crave fresh narratives, Spanish-language series are emerging as the sleeper superstars. According to a groundbreaking report from Parrot Analytics and Spain's ICEX trade agency, unveiled at the Mipcom content market in October 2025, one in every four Spanish TV shows achieves worldwide hit status - boasting a "hit-rate" of 26% beyond its home market.

This places Spain at the forefront of non-English content efficiency, trailing only South Korea's K-dramas but dominating Europe and Latin America. Netflix's early, hefty bets on Iberian and Mexican cinema - pouring billions into local productions - haven't just paid off; they've unearthed a veritable gold mine in the heart of the Spanish-speaking world.

The Parrot Analytics Report: A Spotlight on Global Streaming's Non-English Boom

Parrot Analytics, the gold standard in entertainment data analytics, crunched billions of audience demand signals to evaluate how national industries fare in exporting non-English content.

The findings, presented alongside ICEX at Mipcom, reveal a seismic shift: Non-English titles now drive a disproportionate share of global streaming revenue, with "hit-rates" measuring how often a show transcends borders to captivate international audiences.

The findings, presented alongside ICEX at Mipcom, reveal a seismic shift: Non-English titles now drive a disproportionate share of global streaming revenue, with "hit-rates" measuring how often a show transcends borders to captivate international audiences.

South Korea leads the pack, with K-dramas like Squid Game and its successors achieving over 60% international hit success - turning Seoul into streaming's undisputed export powerhouse. But Spain's 26% hit-rate isn't far behind, outpacing every other European nation and Latin American producer.

"Streamers need reliable bets," noted Jaime Otero, Parrot Analytics' VP of Partnerships, during the Mipcom reveal. "Spain delivers them with uncanny consistency." This metric isn't just fluff; it's a proxy for ROI, factoring in demand across 100+ countries and platforms like Netflix, Prime Video, and Disney+.

The report's data underscores Spain's meteoric rise: From 2020 to H1 2025, the share of Spanish titles generating 80% of the country's global streaming revenue has nearly doubled, from 7.0% to 13.5%.

The report's data underscores Spain's meteoric rise: From 2020 to H1 2025, the share of Spanish titles generating 80% of the country's global streaming revenue has nearly doubled, from 7.0% to 13.5%.

Over the past four years alone, Spanish-originated content has raked in an estimated $5.1 billion worldwide, with projections for 2024 hitting $1.4 billion. Hits like Netflix's Money Heist (La Casa de Papel) and Elite have paved the way, blending high-stakes drama with universal themes that hook viewers from Mexico City to Mumbai.

Netflix's Spanish Gamble: Billions Invested, Hits Delivered

It was no accident. Back in the mid-2010s, Netflix identified Spain and Mexico as crucibles for scalable, exportable storytelling. The streamer funneled hundreds of millions into local hubs - opening production centers in Madrid and Mexico City, greenlighting originals like Society of the Snow (which ranked as Netflix's second-best movie for subscriber renewals in Q1 2024) and Nowhere (the top non-English film for growth in 2023).

It was no accident. Back in the mid-2010s, Netflix identified Spain and Mexico as crucibles for scalable, exportable storytelling. The streamer funneled hundreds of millions into local hubs - opening production centers in Madrid and Mexico City, greenlighting originals like Society of the Snow (which ranked as Netflix's second-best movie for subscriber renewals in Q1 2024) and Nowhere (the top non-English film for growth in 2023).

These weren't charity bets; they were calculated plays on language's reach. With over 500 million native Spanish speakers globally, plus billions more learning it as a second tongue, the linguistic barrier is low - making subtitles a mere speed bump for crossover appeal.

The payoff? Explosive. Spanish and Portuguese originals on platforms like Netflix and Prime Video surged 266% between 2020 and 2024, far outstripping growth in other languages (178%). In Latin America, where non-English content now claims over 50% of demand, Spanish titles account for nearly 25% of revenue from non-Anglo productions.

Globally, Spain ranks fourth among non-English origin countries for streaming revenue - behind Japan, South Korea, and India, but leagues ahead of peers like France or Germany. As Parrot notes, this isn't just volume; it's value. Spanish shows excel at subscriber acquisition and retention, with distinct demographics (younger, more diverse than K-drama fans) broadening platforms' appeal.

Globally, Spain ranks fourth among non-English origin countries for streaming revenue - behind Japan, South Korea, and India, but leagues ahead of peers like France or Germany. As Parrot notes, this isn't just volume; it's value. Spanish shows excel at subscriber acquisition and retention, with distinct demographics (younger, more diverse than K-drama fans) broadening platforms' appeal.

Major streamers' Madrid gold rush tells the tale: Netflix, Amazon, and Apple TV+ have planted flags in Spain, forging strategic partnerships that amplify local talent. ICEX credits this "colossal return" to co-productions and tax incentives, which have supercharged Spain's output. In the EU, no other nation comes close - France's efforts, for instance, hover at a modest 10-15% hit-rate, per Parrot's benchmarks.

Lessons for Europe: France's Netflix Slayer and the Road Ahead

The report's timing couldn't be more poignant, arriving just as France gears up for its own streaming showdown. With the impending launch of "France 2030," a €7 billion state-backed platform touted as Europe's Netflix killer, policymakers are eyeing Parrot's data for blueprints.

The report's timing couldn't be more poignant, arriving just as France gears up for its own streaming showdown. With the impending launch of "France 2030," a €7 billion state-backed platform touted as Europe's Netflix killer, policymakers are eyeing Parrot's data for blueprints.

French content, while culturally rich (Lupin and Call My Agent! have notched global wins), lags in export efficiency - managing only about 12% hit-rate internationally.

The study offers a roadmap: Ramp up streamer collaborations, lean into genre-blending (Spain's thriller-romance hybrids crush it), and prioritize youth-driven narratives. If France can mimic Spain's model - doubling revenue share via targeted investments - it could claw back ground in a market where non-English demand now eclipses 50% in regions like MENA.

Yet, challenges loom. As streaming matures, platforms grapple with churn and ad fatigue; non-English hits like Spain's provide a bulwark, but oversaturation risks dilution.

Parrot warns that while Spanish content's availability on global services jumped 22% from 2021-2023, sustaining quality amid budget pressures will be key.

Also read:

Also read:

- Tragedy in the U.S.: 29-Year-Old Woman Takes Her Life After ChatGPT Interaction, AI Helps Draft Suicide Note

- Tech Experts Gear Up for AI Apocalypse with Islands, Bunkers, and Kill Switches

- New Trend in Brand Marketing: Audio Business Cards

- MZ of the 19th Century: How a Painter Invented the First Internet and Avenged the Silence

The Bigger Picture: Non-English Content as Streaming's New Frontier

Spain's ascent validates a broader truth: The future of streaming isn't Hollywood-centric. Non-English titles - fueled by K-dramas, Bollywood, and now Iberian gems - are reshaping catalogs, with global demand for them up 30% since 2020.

For investors and execs, the message is clear: Bet on borders that blur. Netflix's Spanish windfall isn't a fluke; it's the blueprint for an industry where every fourth Madrid-made series can light up screens from Seoul to Santiago.

As Parrot Analytics' data illuminates, the golden vein runs deep. In a world of 2 billion+ streaming users, ignoring it isn't an option—it's obsolescence. Europe, take note: Spain's not just exporting shows; it's exporting success.