On January 3, 2009, an anonymous developer known as Satoshi Nakamoto mined the genesis block of Bitcoin, marking the birth of the first decentralized cryptocurrency. This event, often hailed as the true "birthday" of Bitcoin, laid the foundation for a revolutionary financial system that has since transformed global economics, technology, and even politics.

As we celebrate its 17th anniversary in 2026, Bitcoin stands not just as a digital asset but as a symbol of resilience against traditional monetary flaws, having evolved from an obscure experiment to a trillion-dollar powerhouse.

As we celebrate its 17th anniversary in 2026, Bitcoin stands not just as a digital asset but as a symbol of resilience against traditional monetary flaws, having evolved from an obscure experiment to a trillion-dollar powerhouse.

The genesis block itself contains a poignant easter egg: embedded in its code is a headline from The Times newspaper dated January 3, 2009 - "Chancellor on brink of second bailout for banks."

This was no accident. It served as a subtle critique of the 2008 financial crisis, where governments and central banks funneled taxpayer money to rescue failing institutions, highlighting issues like inflation and centralized control.

This was no accident. It served as a subtle critique of the 2008 financial crisis, where governments and central banks funneled taxpayer money to rescue failing institutions, highlighting issues like inflation and centralized control.

Satoshi's message underscored Bitcoin's core ethos: a peer-to-peer electronic cash system free from intermediaries, as outlined in the whitepaper published just months earlier on October 31, 2008. By embedding this timestamped reference, Nakamoto ensured the blockchain's immutability, creating an unalterable record that has anchored Bitcoin's narrative ever since.

In its infancy, Bitcoin was virtually worthless. The reward for mining the genesis block was 50 bitcoins, coins that had no market value at the time and couldn't be spent until later blocks were added. Fast-forward 17 years, and Bitcoin's journey is nothing short of extraordinary. As of early 2026, one Bitcoin trades around $90,000, with a market capitalization exceeding $1.8 trillion.

Also read:

- Champagne and the Stroke of Midnight: How Moët & Chandon Engineered a Global New Year's Ritual

- 2026 Entertainment Outlook: Nolan's Epic Triumph, Streaming Shakeups, Disney Drama, and AI's Cautious Embrace

- How AI Giants Are Powering Their Data Centers Amid the Energy Crisis

- Who Is Satoshi Nakamoto? The Mystery, The Myths, and the Latest Clues Behind Bitcoin’s Creator

This places it among the top eight largest assets globally, surpassing many traditional commodities and trailing only gold, silver, and shares of tech giants like Apple and Nvidia. Remarkably, Bitcoin has achieved this without a central authority, relying instead on a network of miners, nodes, and users worldwide.

Over the past 17 years, Bitcoin has weathered numerous storms, from regulatory crackdowns to market crashes, emerging stronger each time - a phenomenon often described as "anti-fragility."

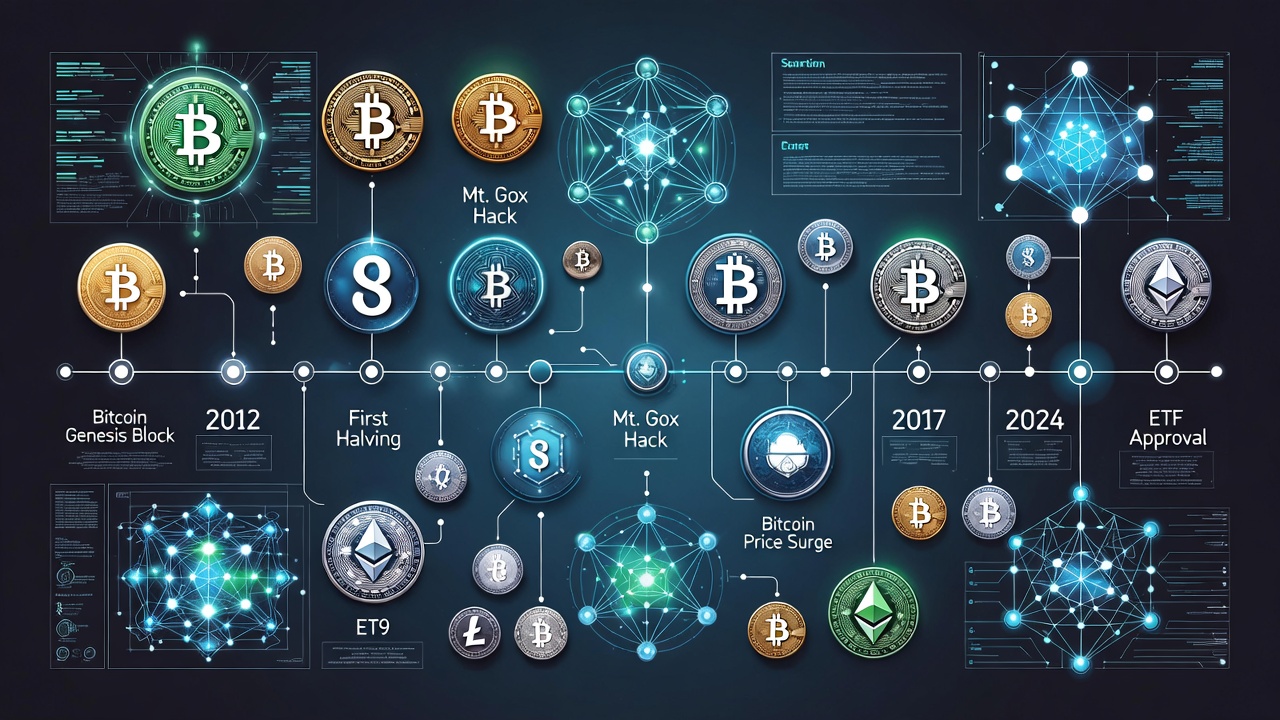

Key milestones punctuate its history:

Key milestones punctuate its history:

- Early Adoption and the First Halving (2012): Bitcoin's first real-world transaction occurred in 2010 when a programmer famously spent 10,000 BTC on two pizzas, now worth hundreds of millions. The first halving event in 2012 reduced mining rewards from 50 to 25 BTC, kickstarting a cycle of supply scarcity that has driven price appreciation.

- Boom Cycles and Institutional Entry (2017-2021): The 2017 bull run saw Bitcoin surge over 20 times in value, fueled by retail enthusiasm and initial coin offerings (ICOs). By 2021, it climbed sevenfold amid the COVID-19 pandemic, as stimulus checks and low interest rates pushed investors toward alternatives. This era also marked the entry of institutions, with companies like Tesla and MicroStrategy adding Bitcoin to their treasuries.

- Maturation and ETFs (2024-2025): The approval of spot Bitcoin ETFs in 2024 was a game-changer, becoming the most successful ETF launch in history and attracting billions in inflows. By 2025, volatility had trended downward, thanks to stronger long-term holders and sophisticated financial products like Bitcoin options and credit facilities. Real estate funds backed by Bitcoin and treasury companies have further integrated it into mainstream finance.

Today, Bitcoin's network boasts unprecedented security, surpassing 1 zettahash per second in computational power—a testament to its growing robustness. With nearly 20 million bitcoins mined (the 20 millionth expected in March 2026), its fixed supply of 21 million coins continues to contrast sharply with fiat currencies prone to inflation.

The Lindy effect - where longevity predicts future survival - applies here, as Bitcoin's 17 years of uninterrupted operation bolster confidence in its endurance.

Looking ahead, 2026 could be pivotal. Analysts predict Bitcoin reaching new all-time highs in the first half of the year, potentially trading between $130,000 and $200,000 by year-end, driven by bipartisan regulatory support and the dawn of an "institutional era."

Looking ahead, 2026 could be pivotal. Analysts predict Bitcoin reaching new all-time highs in the first half of the year, potentially trading between $130,000 and $200,000 by year-end, driven by bipartisan regulatory support and the dawn of an "institutional era."

Some even forecast a "supercycle" extending into Q2 2026, with prices climbing to $465,000 or higher, as sovereign nations and more corporations adopt it. This shift isn't just about price; it's about Bitcoin's role in reshaping transactions, from everyday payments to nation-state reserves.

Bitcoin's 17th birthday reminds us of its origins as a response to financial inequality and its evolution into a mature asset class. What began as code scribbled on Christmas Day 2008 has become a $2 trillion gift to humanity, proving that decentralized innovation can challenge and coexist with legacy systems. As Satoshi envisioned, Bitcoin isn't just money—it's a tool for economic freedom, and its story is far from over.