The artificial intelligence boom has transformed the tech landscape, but it's also sparked an unprecedented energy crisis. Data centers, the backbone of AI training and inference, are power-hungry beasts. Projections from just a few years ago estimated that AI data center power demand in the US would surge from about 3 GW in 2023 to over 28 GW by 2026, but current realities suggest even steeper growth, with some forecasts pointing to 45 GW shortfalls by 2028 and OpenAI alone eyeing 250 GW by 2033.

This explosive demand is overwhelming aging power grids, leading to interconnection delays of up to seven years in some regions. In Texas, for instance, monthly requests for gigawatts of power flood in, but approvals trickle at barely one gigawatt per year.

This explosive demand is overwhelming aging power grids, leading to interconnection delays of up to seven years in some regions. In Texas, for instance, monthly requests for gigawatts of power flood in, but approvals trickle at barely one gigawatt per year.

For AI giants like Google, Microsoft, Amazon, Meta, OpenAI, and xAI, waiting isn't an option - every six-month delay in launching a 400 MW data center could mean billions in lost revenue, given that one gigawatt of AI compute can generate $10-12 billion annually.

The Grid Bottleneck: Why Traditional Power Falls Short

America's power infrastructure, much of it decades old, simply wasn't built for the volatile, high-density loads of modern AI. A single rack of NVIDIA's Blackwell GPUs can draw 180-200 kW, pushing entire sites toward 1.2-1.5 GW—four to five times previous generations.

America's power infrastructure, much of it decades old, simply wasn't built for the volatile, high-density loads of modern AI. A single rack of NVIDIA's Blackwell GPUs can draw 180-200 kW, pushing entire sites toward 1.2-1.5 GW—four to five times previous generations.

Wholesale electricity prices have spiked 267% in some US regions since 2022, with averages projected to hit $51/MWh by 2026. Utilities face backlogs for transformers and substations, while community pushback over rising bills and environmental impacts adds friction. In response, Big Tech has shifted to an "all-of-the-above" strategy, blending renewables, nuclear, and fossil fuels to secure fast, reliable power.

But the most immediate innovation is "Bring Your Own Generation" (BYOG) - building onsite power plants to bypass grid delays entirely.

BYOG: Bringing Power to the Data Center Doorstep

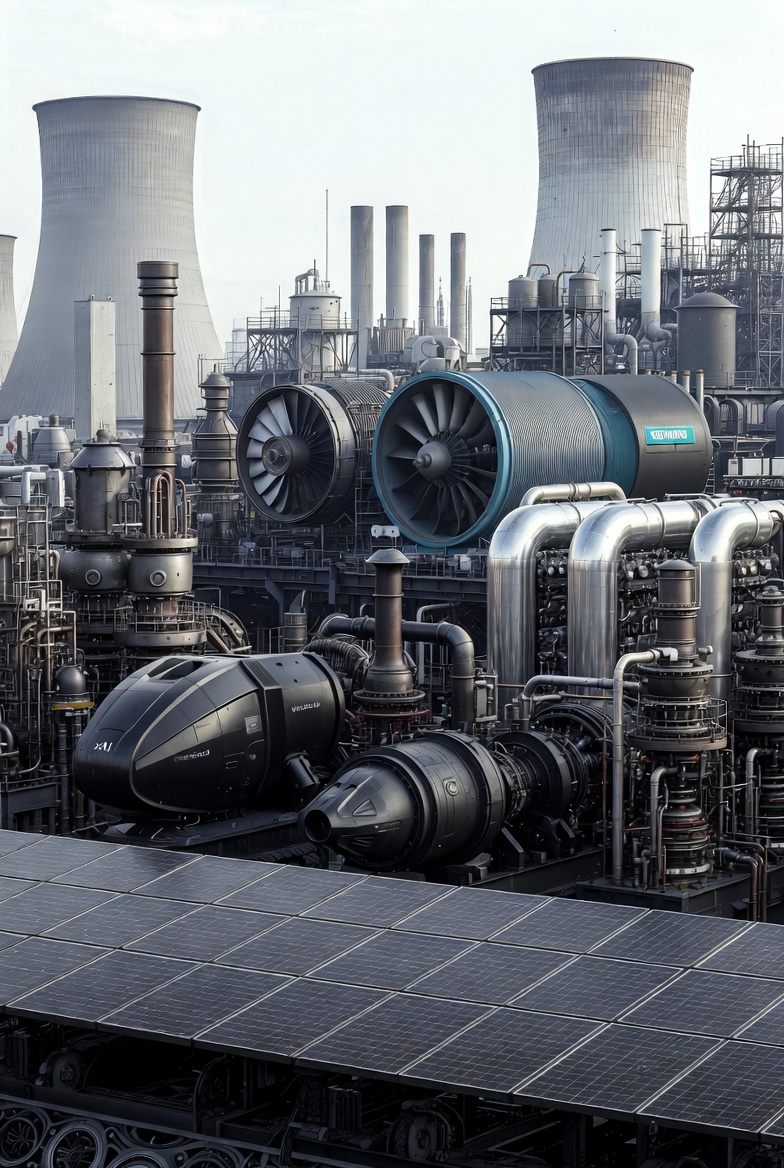

BYOG has emerged as a game-changer, allowing AI companies to deploy data centers in months rather than years. This approach involves installing gas-fired turbines, engines, or fuel cells directly on-site, often as "bridge power" until grid connections catch up.

The concept unites three main technologies:

The concept unites three main technologies:

- Aeroderivative Gas Turbines: Derived from jet engines, models like GE Vernova's LM2500 (34 MW) and LM6000 (57 MW) or Mitsubishi Heavy's FT8 (30 MW) ramp up in 5-10 minutes. They're pricier at $1,700-4,000/kW but ideal for quick starts. Demand for these has surged, with GE Vernova's orders up 33% year-over-year.

- Industrial Gas Turbines and Reciprocating Engines: Cheaper options like Siemens' SGT-800 or Solar Turbines' Titan series (16-60 MW) take longer to ramp (around 20 minutes) but cost $1,500-2,000/kW. High-speed engines like Jenbacher's J624 (4.5 MW) or medium-speed ones like Wärtsilä's (7-20 MW) offer flexibility.

- Solid-Oxide Fuel Cells (SOFCs): Bloom Energy's modules (325 kW each, scalable to tens of MW) deploy in weeks, boast high efficiency (heat rate 6,000-7,000 BTU/kWh), and skip EPA approvals, though at $3,000-4,000/kW.

xAI pioneered this with its Colossus cluster: 100,000 GPUs online in four months using rented Solar Turbines SMT130 (16 MW) and 34 Jenbacher units from VoltaGrid, backed by Tesla Megapacks for surges.

By late 2025, xAI had over 500 MW of such capacity, including a 1.9 GW order from Doosan Enerbility for Colossus 2. OpenAI and Oracle followed with a record 2.3 GW onsite gas plant in Texas, while Meta's Socrates South in Ohio uses a hybrid of three turbine types and 15 Caterpillar engines for 306 MW redundancy. Even Goldman Sachs and Newmark are financing 1.5 GW private gas plants in Texas for AI sites.

Beyond Gas: Renewables, Nuclear, and Batteries in the Mix

While BYOG provides speed, AI giants are diversifying for sustainability and cost. Microsoft inked a 20-year deal to restart Three Mile Island's nuclear Unit 1, and Oklo - backed by OpenAI's Sam Altman - aims for small modular reactors (SMRs) by 2027-2028.

While BYOG provides speed, AI giants are diversifying for sustainability and cost. Microsoft inked a 20-year deal to restart Three Mile Island's nuclear Unit 1, and Oklo - backed by OpenAI's Sam Altman - aims for small modular reactors (SMRs) by 2027-2028.

Google pairs data centers with 640 MW solar in West Texas and deals for wind, storage, and behind-the-meter generation. Amazon secured $1 billion in tax breaks for Oregon data centers powered by renewables, while Meta commits to "water-positive" operations by 2030, using reclaimed wastewater and geothermal.

Batteries are crucial for grid stability: Tesla's Megapacks handle load fluctuations, and startups like Eos Energy (zinc-based) and Base Power create virtual power plants from distributed storage.

Ørsted's 300 MW solar-plus-battery array powers Meta's Mesa campus. Nuclear players like Constellation Energy (CEG) supply carbon-free baseload, with uranium from Cameco (CCJ) fueling the renaissance.

Challenges: Reliability, Costs, and Supply Chains

BYOG isn't without pitfalls. Achieving 99.93% uptime requires overbuilding—e.g., 64% extra capacity for a 1.4 GW site - driving costs to $175/MWh, double typical industrial rates. Emissions rise due to lower efficiency, prompting regulatory tweaks, but permitting can still delay by a year.

Supply chains strain: GE Vernova, Siemens, and Mitsubishi face backlogs to 2028-2029, with bottlenecks in rare-earth materials like yttrium and rhenium.

Supply chains strain: GE Vernova, Siemens, and Mitsubishi face backlogs to 2028-2029, with bottlenecks in rare-earth materials like yttrium and rhenium.

New entrants like Boom Supersonic (1.2 GW aero-turbines for Crusoe) and Wärtsilä (800 MW US contracts) are filling gaps.

Water usage is another concern: Data centers guzzle billions of gallons for cooling, leading companies like Amazon and Meta to pledge water restoration and use non-potable sources.

Also read:

- Champagne and the Stroke of Midnight: How Moët & Chandon Engineered a Global New Year's Ritual

- 2026 Entertainment Outlook: Nolan's Epic Triumph, Streaming Shakeups, Disney Drama, and AI's Cautious Embrace

- The Hidden Depths of Coca-Cola's Santa Claus: More Than Just a Holiday Mascot

The Economic Imperative and Future Impacts

Despite higher costs, BYOG's speed justifies the investment - AI's $1.5 trillion global spend in 2025 could top $2 trillion by 2026. OpenAI's $1.4 trillion infrastructure deals underscore this. Looking ahead, hybrids will dominate: Onsite generation as backup post-grid hookup, plus software from Gridcare or Texture for optimization.

Data centers are evolving into energy projects, reshaping industries from metallurgy to crypto mining. As AI demand triples electricity needs by 2030, this "energy-AI nexus" will dictate innovation, with winners in nuclear (Oklo, NuScale), batteries (Tesla, Eos), and renewables (First Solar, NextEra). The AI race isn't just about chips 0 it's about electrons.