Cryptocurrency analysts are increasingly optimistic about the potential for an "altseason" starting in September, driven by several key market trends and macroeconomic factors.

An altseason, a period when altcoins outperform Bitcoin (BTC), may be on the horizon as market dynamics shift and investor sentiment evolves.

Bitcoin's Market Dominance Declines

One of the primary indicators fueling altseason speculation is the decline in Bitcoin’s market dominance.

One of the primary indicators fueling altseason speculation is the decline in Bitcoin’s market dominance.

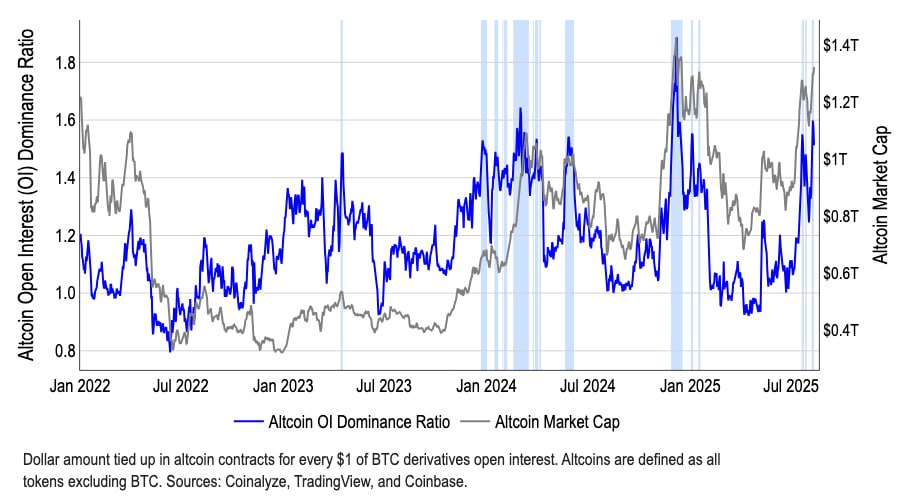

According to recent data, BTC’s share of the total cryptocurrency market capitalization has dropped from approximately 65% in May to around 59% in August.

This decline suggests a capital rotation from Bitcoin into altcoins, a hallmark of altseason.

As investors diversify their portfolios, smaller-cap altcoins often experience significant price surges, outpacing Bitcoin’s performance.

Federal Reserve Rate Cuts Could Catalyze Capital Inflows

Another catalyst for a potential altseason is the anticipated reduction in interest rates by the U.S. Federal Reserve, expected in September or October. Lower interest rates could prompt investors to move funds out of low-yield assets, such as the $7.2 trillion currently held in money market funds, into riskier assets like cryptocurrencies. Historically, loose monetary policies have driven speculative investments in altcoins, as retail investors seek higher returns in volatile markets. This influx of capital could provide the liquidity needed to fuel an altcoin rally.

Institutional vs. Retail Investor Dynamics

While institutional investors remain heavily focused on Bitcoin and Ethereum (ETH), which dominate their portfolios due to their established market positions and liquidity, altcoins typically rely on retail investor enthusiasm to drive significant price movements. The growing interest in decentralized finance (DeFi), layer-2 solutions, and emerging blockchain projects could attract retail capital, further amplifying altcoin performance. Analysts note that a surge in retail participation, combined with favorable macroeconomic conditions, could create the perfect storm for an altseason.

Also read:

- Slow Ventures’ $60M Creator Fund Attracts Over 700 Applications, Makes First $2M Investment in Woodworking YouTuber Jonathan Katz-Moses

- Paramount’s New Playbook: Series for Streaming, Films for Theaters – A Conservative Path Forward

- Google Tightens Rules for Cryptocurrency Wallets in Play Store

- Apple Follows the Adaptation Trend with a Miniseries Take on The Holiday

Conclusion

With Bitcoin’s market dominance waning, anticipated Federal Reserve rate cuts, and the potential for increased retail investor activity, September could mark the beginning of a robust altseason. While institutional focus remains on BTC and ETH, the broader altcoin market may benefit from capital inflows and renewed retail interest. As always, investors should remain cautious, as the cryptocurrency market remains highly volatile and speculative.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).