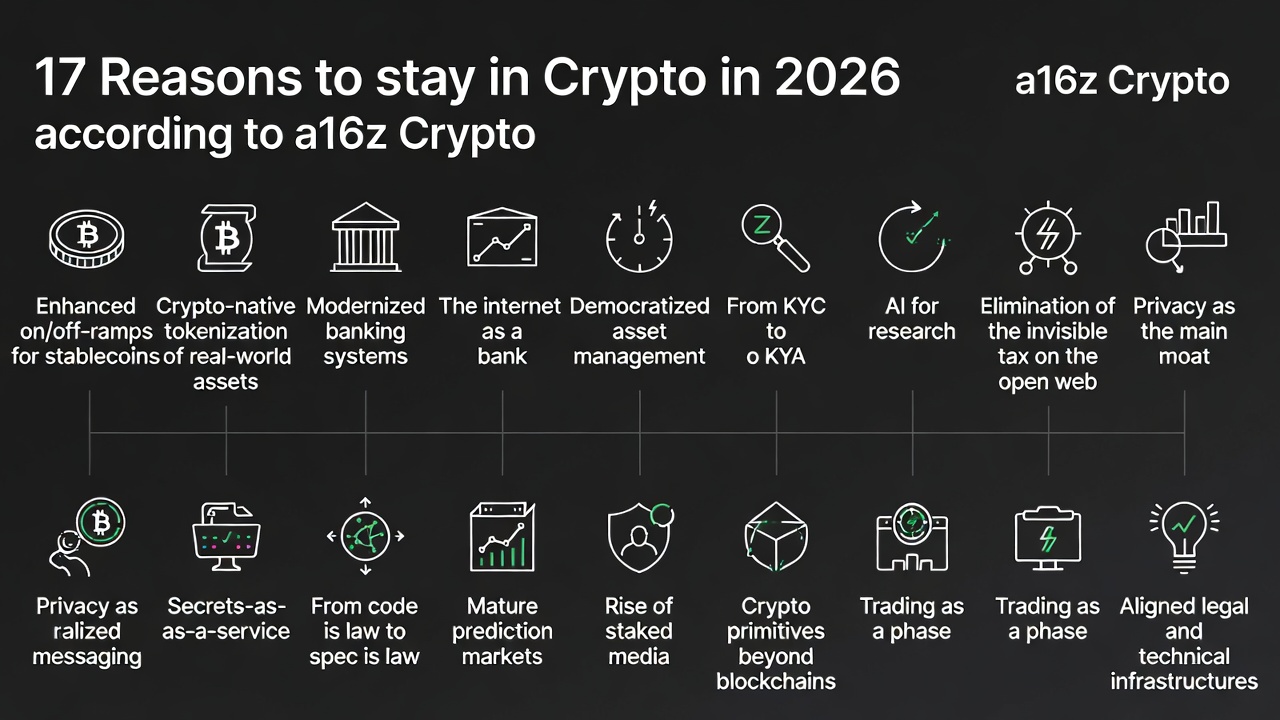

As we approach 2026, the crypto landscape continues to evolve at a breakneck pace, blending cutting-edge technology with real-world applications. Inspired by a16z crypto's forward-looking article on the big ideas shaping the industry, this unique exploration highlights 17 key reasons why crypto remains a vibrant and essential space to engage with.

We've expanded on each idea with fresh insights and supporting facts from recent developments in 2025, drawing from industry reports, startups, and trends to provide a well-rounded perspective. Whether you're an investor, builder, or enthusiast, these reasons underscore crypto's potential to transform finance, AI, privacy, and beyond.

1. Enhanced On/Off-Ramps for Stablecoins

Stablecoins have revolutionized value transfer, enabling near-instantaneous transactions for fractions of a cent. However, the real challenge lies in seamlessly connecting these digital assets to traditional financial systems.

Stablecoins have revolutionized value transfer, enabling near-instantaneous transactions for fractions of a cent. However, the real challenge lies in seamlessly connecting these digital assets to traditional financial systems.

In 2026, expect a surge in innovative startups bridging this gap by integrating stablecoins with local currencies, QR code payments, and debit cards, making them more accessible for everyday use. This could enable real-time cross-border payments for workers and instant settlements for merchants without traditional banking.

Supplementing this, 2025 saw stablecoins solidify as core financial infrastructure, with companies like BVNK onboarding 226 new customers and processing massive volumes. Startups such as EvaCodes and Antier Solutions emerged as top players in stablecoin development, focusing on efficient on-ramps.

Additionally, platforms like FinchTrade highlighted top USD on-ramp services, emphasizing liquidity and security enhancements.

2. Crypto-Native Tokenization of Real-World Assets (RWAs)

Traditional approaches to tokenizing off-chain assets like loans often fall short in efficiency. The future lies in originating debt directly on-chain, which slashes back-office costs and boosts accessibility compared to merely wrapping existing debts. This crypto-native method leverages perpetual futures (perps) and synthetics for deeper liquidity and better product-market fit, particularly in emerging markets.

In 2025, RWA tokenization gained traction with platforms like Tokeny mapping ecosystems including distributors and DeFi protocols. Projects such as Centrifuge and Ondo Finance led the charge, tokenizing assets like real estate and bonds. Tokenized U.S. treasuries exceeded $7.4 billion on public chains by September 2025, showcasing rapid growth.

3. Modernizing Legacy Banking Systems

Many banks still rely on outdated infrastructure from the 1960s to 1990s, including mainframes and COBOL code, where implementing new features can take years. Stablecoins offer a workaround, allowing institutions to layer innovative products atop these legacy systems without a complete overhaul, accelerating adoption of real-time payments.

Facts from 2025 reveal that 70% of global banks still depend on legacy systems, with 43% using COBOL. Reports emphasized how these systems hinder innovation, prompting calls for modular API-driven solutions to reduce costs and risks.

Facts from 2025 reveal that 70% of global banks still depend on legacy systems, with 43% using COBOL. Reports emphasized how these systems hinder innovation, prompting calls for modular API-driven solutions to reduce costs and risks.

The "Great Core Banking Awakening" in 2025 highlighted banks' shift away from these roadblocks.

4. The Internet Evolves into a Bank

With AI agents proliferating, money needs to flow as fluidly as data—instantly and programmatically. Smart contracts already speed up global payments, but new primitives in 2026 will treat value as routable packets, eliminating invoices, reconciliations, and manual processes for agent-driven commerce.

2025 developments included Visa's AI agents automating hundreds of purchases in pilot programs. The Agent Payments Protocol (AP2) was announced to power AI commerce. Ant International processed $1.5 trillion in transactions using AI, slashing FX costs by over 90%.

5. Asset Management Democratized for Everyone

Historically, personalized portfolios were a luxury for the wealthy. Tokenization combined with AI will change that in 2026, enabling automatic rebalancing, access to private markets, and superior yields via DeFi vaults - without requiring massive capital.

In 2025, J.P. Morgan launched its first tokenized money market fund, signaling a shift toward tokenization in wealth management. The World Economic Forum noted tokenization's application across asset lifecycles, from issuance to secondary markets. Broadridge's survey of 300 institutions showed tokenization moving from hype to reality.

6. Shifting from KYC to Know Your Agent (KYA)

As AI agents outnumber humans, they'll require "crypto passports" and credit histories for financial interactions. KYA frameworks will link agents to their owners, enabling non-human entities to borrow, transact, and assume liability responsibly.

As AI agents outnumber humans, they'll require "crypto passports" and credit histories for financial interactions. KYA frameworks will link agents to their owners, enabling non-human entities to borrow, transact, and assume liability responsibly.

2025 saw the rise of KYA concepts, with platforms like KnowYourAgent providing cryptographic attestation for agent verification. Trulioo outlined KYA as a framework for trusted agentic commerce. Vouched emphasized cryptographic ties for agents in scenarios like loan processing.

7. AI Powers Substantive Research in Crypto

AI models are already generating hypotheses and aiding discoveries. Crypto will facilitate model interoperability and fair compensation, fostering a polymath-style research that synthesizes ideas rapidly across domains.

In 2025, AI agents uncovered $4.6 million in smart contract exploits, with exploit revenue doubling every 1.3 months. a16z's State of Crypto report noted crypto's market cap surpassing $4 trillion, with AI convergence as a key trend. Nansen highlighted AI tools transforming crypto trading via predictive analytics.

8. Eliminating the Invisible Tax on the Open Web

AI agents scrape data without compensating creators, bypassing ads and eroding revenue. Blockchain-based nanopayments and attribution systems will automate rewards for useful content, preserving the open web's economic model.

AI agents scrape data without compensating creators, bypassing ads and eroding revenue. Blockchain-based nanopayments and attribution systems will automate rewards for useful content, preserving the open web's economic model.

2025 advancements included NOWPayments enabling nano payments via the feeless Nano currency. Discussions on nano-payments as alternatives to ads emphasized loyalty in digital journeys. CoinGeek explored how Bitcoin facilitates tiny payments for content.

9. Privacy as the Ultimate Moat

Private blockchains create unbreakable network effects: tokens are portable, but secrets aren't. This "winner-takes-all" dynamic locks in users, as migrating to less private systems risks data exposure.

In 2025, privacy became a hot narrative, with a16z calling it crypto's strongest moat. Funding surged for privacy projects, backed by firms like a16z and Coinbase Ventures. Privacy coins like Zcash surged 711% in value.

10. Decentralized Messaging Protocols

Quantum-resistant encryption alone isn't sufficient; true decentralization requires serverless protocols where users own their messages like currency, ensuring no single entity can shut down the network.

Quantum-resistant encryption alone isn't sufficient; true decentralization requires serverless protocols where users own their messages like currency, ensuring no single entity can shut down the network.

2025 saw Ontology's roadmap emphasizing privacy and decentralization in messaging. The MLS protocol forked into decentralized variants for secure chats. Dmail introduced peer-to-peer Web3 messaging with cross-chain protocols.

11. Secrets-as-a-Service

Blockchains struggle with confidential data — it's either fully public or reliant on centralized servers. Decentralized key management will allow smart contracts to control access, embedding privacy as a core network feature for auditors, doctors, and more.

Projects like Secret Network pioneered privacy-preserving smart contracts as "Privacy as a Service." Research on cryptographic patterns for secrets on-chain provided actionable insights. SCRT token powers governance on this confidential computing layer.

12. Evolving from "Code is Law" to "Spec is Law"

Hacks are unavoidable, but formal specifications (specs) as inviolable rules can prevent exploits by enforcing security properties, automatically rejecting violating transactions.

While "code is law" has been a crypto ethos since early days, 2025 discussions tested it in legal cases involving stolen assets. The Clarity Act aimed to provide regulatory frameworks aligning with this shift. English law recognized distinct property rights for crypto, evolving beyond pure code governance.

13. Prediction Markets Mature and Expand

Prediction markets will handle more complex events, with AI agents autonomously trading on signals for greater accuracy, complementing traditional polls rather than replacing them.

Prediction markets will handle more complex events, with AI agents autonomously trading on signals for greater accuracy, complementing traditional polls rather than replacing them.

2025 marked explosive growth, with economics markets expanding 905% to $112 million. Analysts predict trillion-dollar volumes by decade's end. Revenues could reach $10 billion by 2030, a five-fold increase.

14. The Rise of Staked Media

AI commoditizes content, diminishing its value. Staking tokens will restore credibility, as experts and media outlets put "skin in the game" to prove neutrality and honesty.

While direct "staked media" projects are emerging, 2025 staking trends included institutions like Staked supporting 45+ PoS assets for rewards. Grayscale noted staking's role in long-term income generation. This aligns with using stakes to validate media integrity.

15. Crypto Primitives Beyond Blockchains

By 2026, a single GPU could generate real-time proofs for CPU computations, making verifiable cloud computing affordable and trustworthy, even on remote servers.

2025 breakthroughs included EQTY Lab's verifiable compute on NVIDIA Blackwell architecture. Collaborations with Intel and NVIDIA introduced frameworks for governed AI workflows. zkGPU advanced verifiable GPU execution with cryptography.

16. Trading as a Phase, Not the Endgame

Many projects chase speculative trading for growth, but this cannibalizes long-term mindshare. Sustainable success in 2026 will prioritize product utility over perpetual speculation.

Many projects chase speculative trading for growth, but this cannibalizes long-term mindshare. Sustainable success in 2026 will prioritize product utility over perpetual speculation.

2025 insights emphasized sustainable models, with S&P Global defining contours for eco-friendly crypto enterprises. Block3 Finance advised on revenue strategies beyond trading. Empirical analyses proposed blockchain business frameworks for longevity.

17. Aligning Legal and Technical Infrastructures

Regulatory uncertainty has forced crypto projects to mimic corporations and avoid transparency. The Clarity Act will enable blockchains to operate as true networks—open, autonomous, and compliant.

In 2025, the Digital Asset Market Clarity Act (CLARITY Act) was introduced, focusing on CFTC oversight for digital commodities. It passed the House with bipartisan support. The CFTC aimed for clarity in spot markets, signaling a pro-innovation stance.

Also read:

- OpenAI Opens the Floodgates: ChatGPT Gets Its Own App Directory and Developer Submissions

- Coursera and Udemy Merge: A $2.5 Billion Bet on AI-Powered Lifelong Learning

- YouTube's Bold Leap: Streaming the Oscars and Reviving Hollywood's Biggest Night

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).