In a landmark move that underscores the accelerating convergence of Wall Street and Web3, JPMorgan Chase has officially rolled out its digital deposit token, JPM Coin (JPMD), on Coinbase's Base blockchain.

This phased launch targets institutional clients, transforming tokenized dollar deposits into a seamless, 24/7 payment rail. Unlike volatile cryptocurrencies, JPM Coin represents direct claims on existing bank-held funds, enabling near-instantaneous transfers processed in seconds - a stark contrast to the multi-day settlements and business-hour restrictions of traditional banking systems.

Naveen Mallela, global co-head of JPMorgan's blockchain division Kinexys (formerly Onyx), highlighted the token's efficiency in a Bloomberg interview: "Payments settle in seconds, anytime, around the clock." This debut follows a rigorous pilot program involving key partners like Mastercard, Coinbase, and liquidity provider B2C2, who successfully executed test transactions.

Naveen Mallela, global co-head of JPMorgan's blockchain division Kinexys (formerly Onyx), highlighted the token's efficiency in a Bloomberg interview: "Payments settle in seconds, anytime, around the clock." This debut follows a rigorous pilot program involving key partners like Mastercard, Coinbase, and liquidity provider B2C2, who successfully executed test transactions.

The integration with Base, an Ethereum Layer-2 network optimized for low-cost, high-speed operations, positions JPMorgan as the first major U.S. bank to deploy a native payment product on a public blockchain.

From Private Ledger to Public Chain: The Evolution of JPM Coin

JPM Coin's roots trace back to 2019, when JPMorgan introduced it as an internal permissioned token on its proprietary blockchain for interbank settlements. Initially limited to Kinexys participants, the token has processed over $1 billion in daily volume for wholesale payments.

JPM Coin's roots trace back to 2019, when JPMorgan introduced it as an internal permissioned token on its proprietary blockchain for interbank settlements. Initially limited to Kinexys participants, the token has processed over $1 billion in daily volume for wholesale payments.

The shift to Base marks a pivotal expansion: while the original JPM Coin operated in a "walled garden" of vetted institutions, JPMD unlocks broader interoperability with public DeFi ecosystems, allowing seamless on-chain interactions without sacrificing regulatory compliance.

This public rollout aligns with JPMorgan's broader blockchain ambitions. The bank recently partnered with Singapore's DBS to develop an interoperability framework for tokenized deposits across public and permissioned networks - a system that could facilitate cross-border transfers of assets like JPMD and DBS's equivalents. JPMorgan has also opened Bitcoin exposure to its clients, further signaling a strategic pivot toward digital assets.

Key Advantages: Yield, Speed, and Collateralization

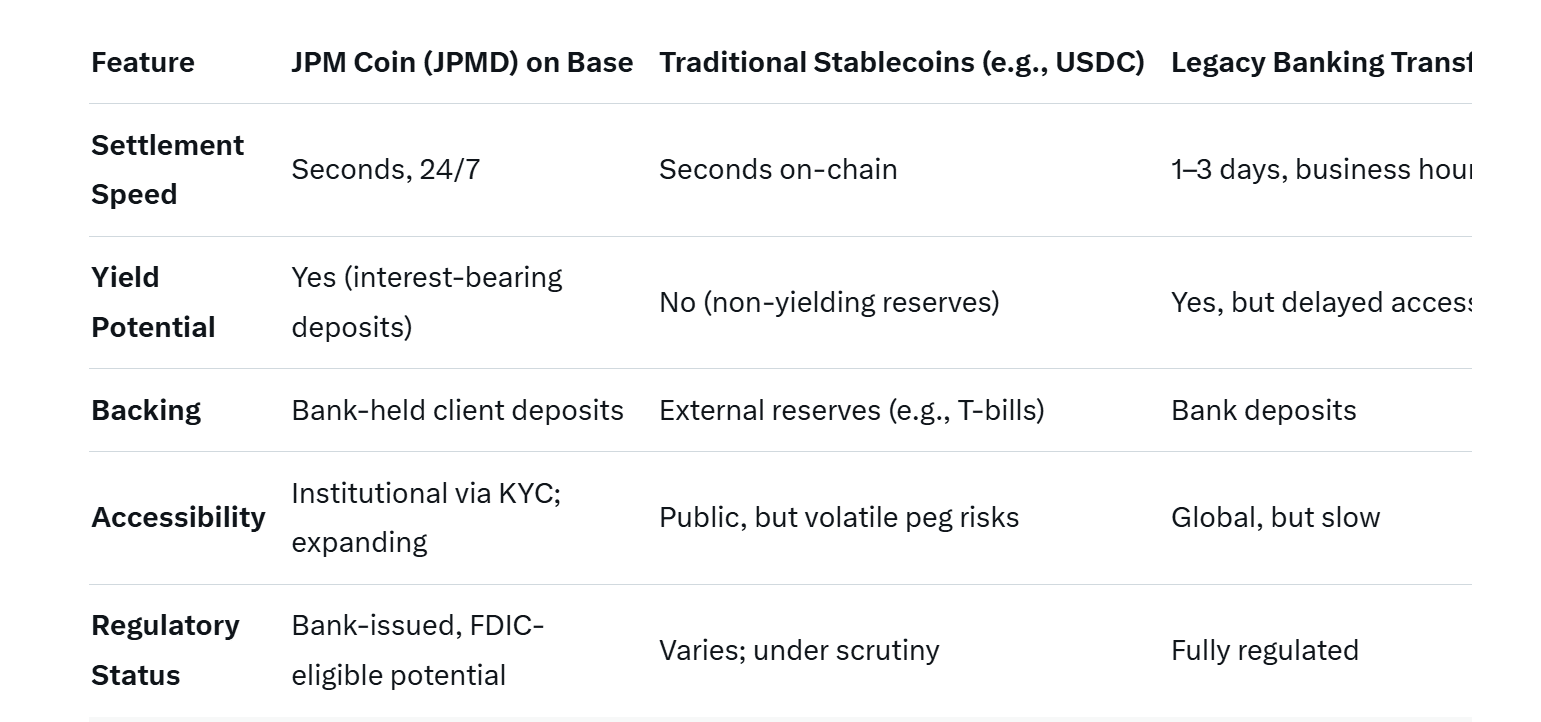

At its core, JPM Coin is a deposit token, not a stablecoin. Stablecoins like USDT or USDC are backed by off-balance-sheet reserves and typically offer no yield to holders. In contrast, deposit tokens are digital representations of funds already on a bank's books, inheriting the interest-bearing nature of traditional deposits.

At its core, JPM Coin is a deposit token, not a stablecoin. Stablecoins like USDT or USDC are backed by off-balance-sheet reserves and typically offer no yield to holders. In contrast, deposit tokens are digital representations of funds already on a bank's books, inheriting the interest-bearing nature of traditional deposits.

Mallela emphasized this edge: "While stablecoins attract a lot of buzz, deposit-based products offer a compelling alternative for institutional clients. They can generate income." JPMD holders could thus earn yields tied to JPMorgan's deposit rates, potentially making it attractive for treasury management.

Technically, transactions on Base leverage optimistic rollups for scalability, reducing fees to fractions of a cent while maintaining Ethereum's security. Early adopters report settlement times under 10 seconds, compared to 1–3 days for ACH transfers.

Moreover, JPMorgan confirmed that JPMD will be accepted as collateral on Coinbase's platform, enabling institutional clients to use it in margin trading or lending protocols.

This could unlock billions in idle capital: JPMorgan's $2.5 trillion in deposits alone represent a massive liquidity pool for tokenization.

Source: JPMorgan announcements and Bloomberg analysis

Broader Industry Momentum and Regulatory Horizons

JPMorgan's launch is part of a global tokenized deposit surge. HSBC rolled out its own service for corporate clients in Hong Kong and Singapore, later expanding to the UK and Luxembourg with local currency support. Citigroup, Santander, Deutsche Bank, and even PayPal are piloting similar initiatives, aiming to slash cross-border payment costs - which total $120 billion annually in fees, per McKinsey. In Qatar, a local bank integrated JPMorgan's blockchain for faster USD payments.

JPMorgan's launch is part of a global tokenized deposit surge. HSBC rolled out its own service for corporate clients in Hong Kong and Singapore, later expanding to the UK and Luxembourg with local currency support. Citigroup, Santander, Deutsche Bank, and even PayPal are piloting similar initiatives, aiming to slash cross-border payment costs - which total $120 billion annually in fees, per McKinsey. In Qatar, a local bank integrated JPMorgan's blockchain for faster USD payments.

Yet, expansion hinges on regulators. JPMorgan plans to grant access to clients' end-users and launch multi-currency versions, including a euro-denominated JPME (trademarked). A full rollout could include integration with deposit insurance schemes, enhancing safety. The U.S. OCC's prior approval for banks issuing stablecoins paves the way, but broader adoption awaits clarity from the SEC and Fed on tokenized assets.

Challenges remain: JPMD's "walled garden" design limits DeFi composability compared to open stablecoins, and banks risk deposit flight if yields lag. Still, with Base's TVL surpassing $2 billion, this could catalyze institutional inflows.

Also read:

Also read:

- Oops, What Happened? The Great AI Reverse Layoff is Underway

- Largest Miners Rely on AI Revenue Streams

- Altcoins Need Bitcoin Near All-Time Highs to Rally, Wintermute Argues

- What is Crawl Budget?

The Road Ahead: Tokenization's Tipping Point

JPM Coin's Base debut isn't just a tech upgrade - it's a vote of confidence in hybrid finance. As Mallela noted, "We're moving the industry forward in transacting on public blockchains." With pilots proving viability and partners like Coinbase bridging ecosystems, expect tokenized deposits to redefine $700 trillion in global payments.

For institutions, it's yield without the crypto chaos; for blockchain, it's legitimacy from the world's largest bank. As the rollout progresses, JPMorgan's token could tip the scales, proving that the future of money is programmable, profitable, and - finally - public.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).