The traditional four-year Bitcoin cycle, long tied to the cryptocurrency’s halving events, is losing relevance, according to industry leaders. Following remarks from CryptoQuant’s CEO, Bitwise’s Chief Investment Officer, Matt Hougan, recently argued that the classic model of BTC cycles is fading.

A combination of diminishing halving impacts, favorable macroeconomic conditions, reduced systemic risks, and emerging corporate trends is reshaping the market. In place of the predictable four-year boom-and-bust, long-term growth trends are taking hold, driven by institutional adoption, regulatory clarity, and structural shifts in the crypto ecosystem.

A combination of diminishing halving impacts, favorable macroeconomic conditions, reduced systemic risks, and emerging corporate trends is reshaping the market. In place of the predictable four-year boom-and-bust, long-term growth trends are taking hold, driven by institutional adoption, regulatory clarity, and structural shifts in the crypto ecosystem.

The End of the Four-Year Cycle

For years, Bitcoin’s price movements have followed a four-year pattern, with peaks and troughs aligning closely with halving events that cut miners’ block rewards in half.

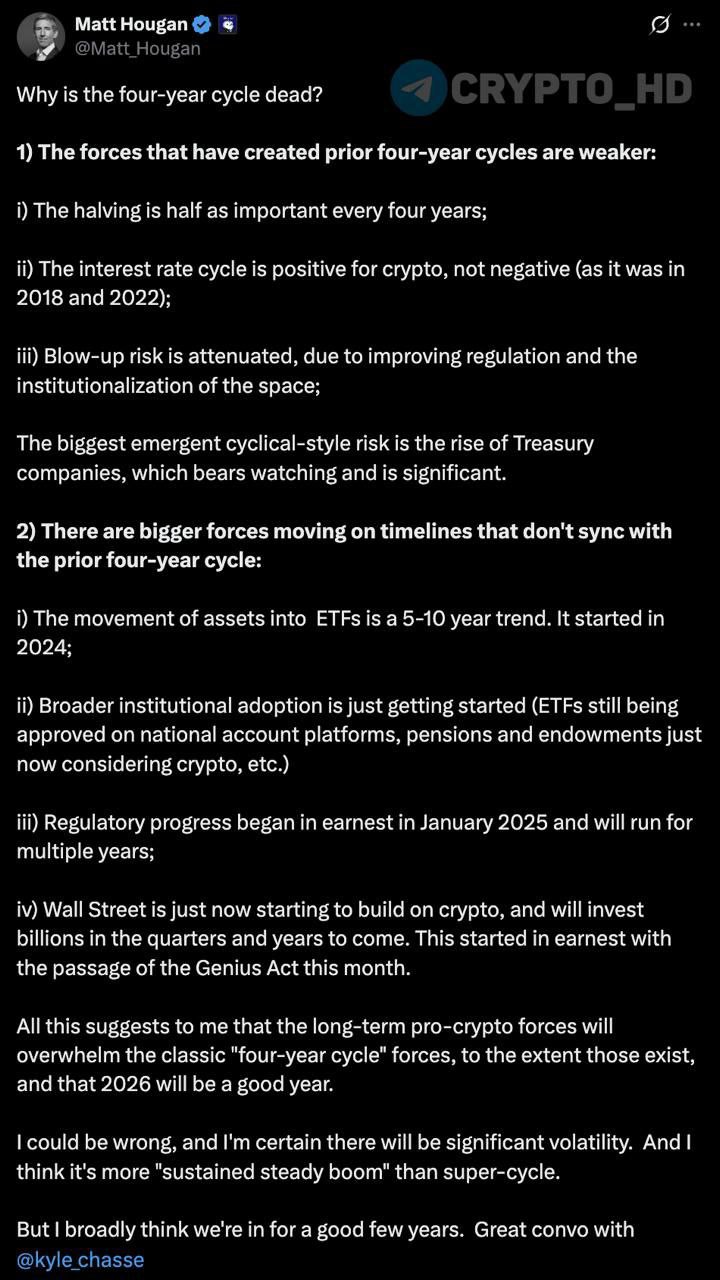

However, several factors are eroding this cycle’s predictive power:

- Diminishing Halving Impact: Each halving reduces Bitcoin’s inflation rate, but its significance wanes as issuance slows. The 2024 halving, reducing the reward to 3.125 BTC, had a muted effect compared to prior cycles, with supply dynamics less disruptive to price.

- Favorable Macro Environment: Unlike 2018 and 2022, when high interest rates and economic uncertainty pressured crypto markets, today’s macro conditions are supportive. Global central banks have eased monetary policies, reducing borrowing costs and creating a risk-on environment conducive to Bitcoin growth.

- Reduced Risk of Crashes: Regulatory advancements and institutional participation have stabilized the market. Tighter oversight since 2023 and the integration of crypto into traditional finance have lowered the likelihood of catastrophic sell-offs seen in earlier cycles.

- New Risk: Corporate Bitcoin Holdings: A growing number of companies, such as MicroStrategy and Block, hold significant Bitcoin on their balance sheets. While this bolsters demand, it introduces risks tied to corporate financial health and potential liquidations during market stress.

A Shift to Long-Term Trends

Rather than the volatile swings of the past, Bitcoin’s future is increasingly tied to structural, long-term drivers that promise sustained growth over the next 5–10 years:

Rather than the volatile swings of the past, Bitcoin’s future is increasingly tied to structural, long-term drivers that promise sustained growth over the next 5–10 years:

- ETF Inflows Are Just Beginning: Spot Bitcoin ETFs, launched in early 2024, have already attracted billions in assets, but experts see this as the early stage of a decade-long trend. Institutional and retail inflows are expected to grow as ETFs become a staple in portfolios, providing consistent demand.

- Institutional Investors Enter the Fray: Major financial players, including hedge funds and pension funds, are allocating to Bitcoin. This shift, driven by improved custody solutions and market infrastructure, marks a departure from retail-driven cycles of the past.

- Regulatory Clarity Takes Shape: Since January 2025, global regulators have accelerated efforts to create crypto-friendly frameworks. The U.S. passage of the GENIUS Act, which provides a clear regulatory path for digital assets, has boosted confidence, encouraging Wall Street to deepen its involvement.

- Wall Street’s Growing Role: The GENIUS Act has unlocked new opportunities for traditional financial institutions to engage with crypto. Major banks and asset managers are launching crypto products, further integrating Bitcoin into mainstream finance.

Not a Supercycle, but Steady Growth

Bitwise’s Matt Hougan emphasized that Bitcoin is not entering a “supercycle” of exponential, unchecked growth. Instead, he foresees a period of steady, sustainable appreciation driven by these structural shifts. The influx of institutional capital, coupled with regulatory tailwinds, creates a more resilient market less prone to the dramatic crashes of prior cycles.

Bitwise’s Matt Hougan emphasized that Bitcoin is not entering a “supercycle” of exponential, unchecked growth. Instead, he foresees a period of steady, sustainable appreciation driven by these structural shifts. The influx of institutional capital, coupled with regulatory tailwinds, creates a more resilient market less prone to the dramatic crashes of prior cycles.

However, risks remain, particularly from the concentration of Bitcoin in corporate treasuries, which could introduce volatility if macroeconomic conditions deteriorate.

Also read:

- Jack Dorsey’s Block Joins S&P 500 with ~20% Surge, Nears $50 Billion Market Cap Amid Bitcoin Payment Pilot

- Video Games: The New Relationship Therapist

- U.S. Streaming Video Market to Surge 33% by 2029, Exceeding $112 Billion

- What Equipment Do You Need To Start A Podcast?

Conclusion

The four-year Bitcoin cycle, once a cornerstone of crypto market analysis, is losing its grip. The diminishing impact of halvings, a supportive macro environment, reduced systemic risks, and the rise of corporate Bitcoin adoption signal the end of an era. In its place, long-term trends — ETF inflows, institutional investment, regulatory clarity, and Wall Street’s embrace — are setting the stage for a more stable, sustained growth trajectory. While challenges like corporate balance sheet risks linger, Bitcoin’s evolution into a mainstream asset class suggests a future defined not by cycles, but by enduring demand.