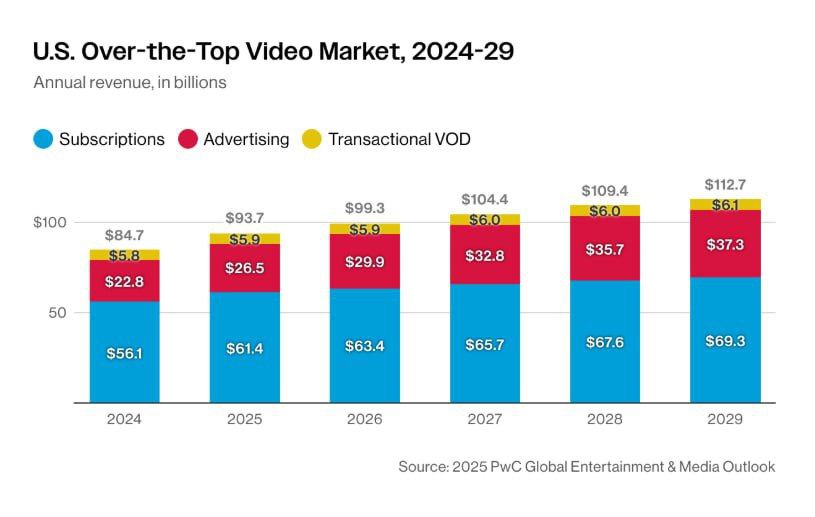

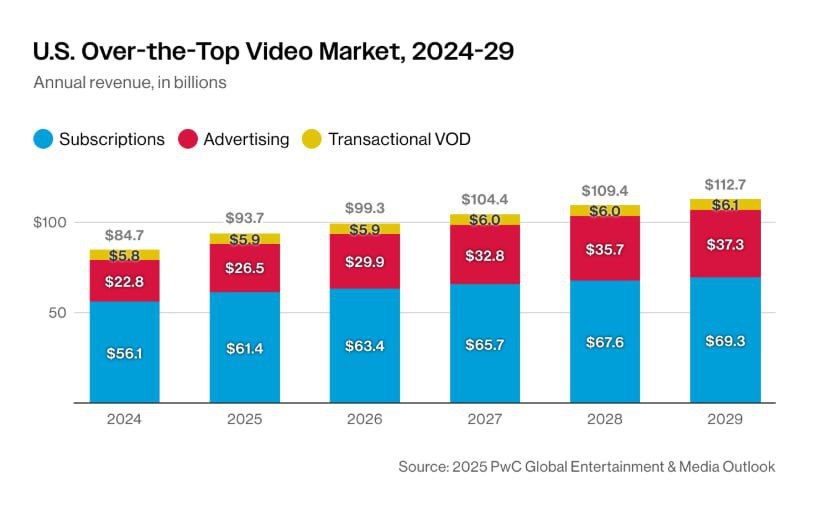

The U.S. streaming video market is poised for significant growth, with analysts from PwC projecting a 33% increase by 2029, pushing its value past $112 billion. The U.S. remains the most influential and largest market, generating $61.9 billion in 2024 — dwarfing China’s $10.8 billion in comparison. This upward trajectory suggests streaming platforms still have room to expand.

To fuel this growth and counter market saturation, companies plan to raise prices, cut costs, crack down on password sharing, and introduce new bundles packed with sports streaming. While these strategies might not reinvent the wheel, they continue to prove effective in driving revenue. The focus on sports, in particular, could lure audiences seeking live content, keeping the industry dynamic.

Also read:

- Battle of the Titans: YouTube and Netflix Clash in a New Phase of the Streaming Wars

- YouTube Remains King of the Hill: Ad Revenue Soars 13% to $9.8 Billion in Q2

- OpenAI Announces Date for DevDay 2025

- First Teaser for Avatar 3 Finally Drops: A Dark Journey Awaits

Meanwhile, traditional television faces a grim outlook. PwC forecasts a 5.4% annual decline in the sector’s growth rate. In 2024, 41.1% of U.S. households subscribed to paid TV, a sharp drop from 61.9% in 2020. By 2029, that figure is expected to fall to just 28.8%, signaling a clear shift as the cord-cutting trend accelerates. As streaming platforms boldly look ahead, the writing is on the wall for cable and satellite TV, with the cord set to be cut for good in many American homes.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).