By Quasa Insights | November 9, 2025

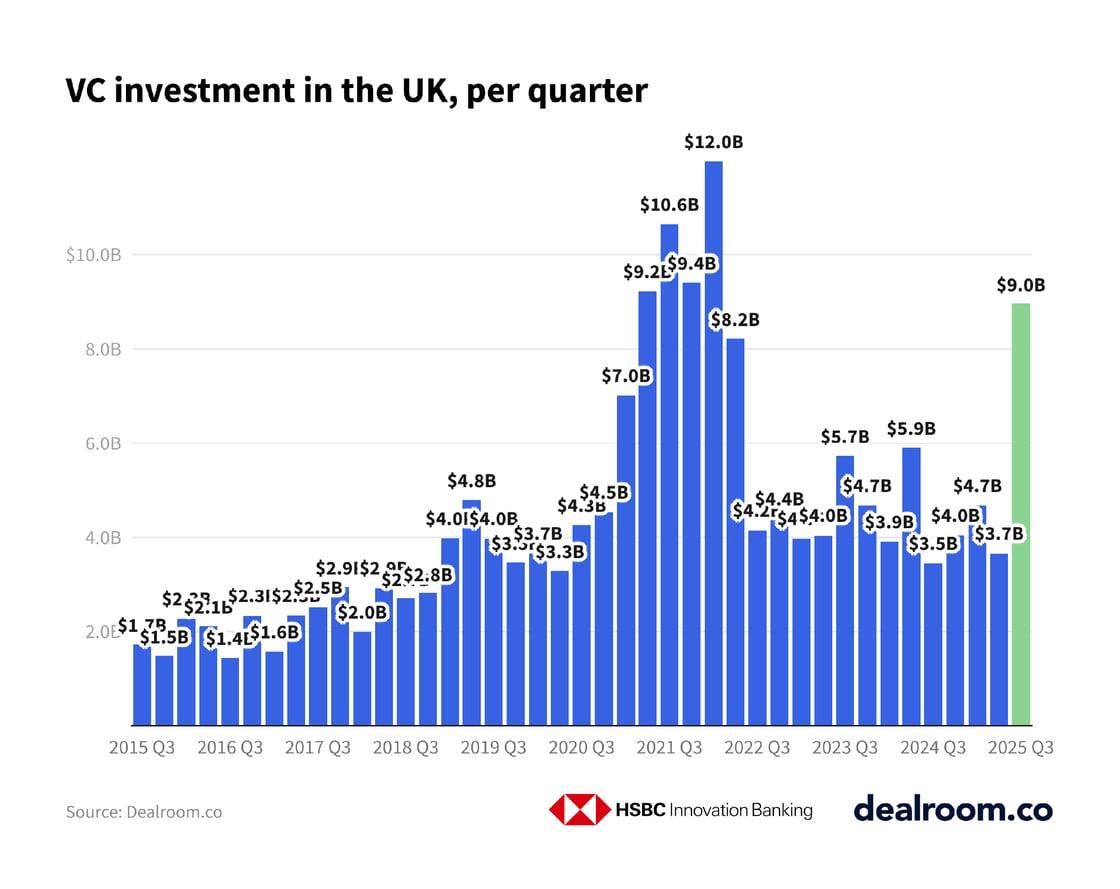

In a resounding vote of confidence for Britain's innovation ecosystem, UK startups and scaleups raised a staggering $9 billion in venture capital during the third quarter of 2025. This surge has propelled year-to-date funding to $17.3 billion, already surpassing the entire 2024 total and positioning the UK on track for over $23 billion by year-end - the third-highest annual figure in the nation's history, trailing only the record-breaking peaks of 2021 and 2022.

This remarkable rebound signals a robust recovery and sustained momentum in the UK's tech landscape. As Simon Bumfrey, Head of Banking at HSBC Innovation Banking UK, noted, "UK venture capital has rebounded with strength across all stages this year. The return of billion-dollar megarounds, alongside record early-stage activity, signals renewed investor confidence in the UK's innovation economy."

A Surge Across All Stages: Megarounds Lead the Charge

The growth wasn't confined to any single phase of company development; funding increased across seed, early-stage, and growth rounds. Particularly eye-catching was the explosion in megadeals - those exceeding $100 million - which skyrocketed by more than 400% compared to the previous year. This resurgence of large-scale investments underscores investors' appetite for high-potential UK ventures, with 12 major rounds fueling much of Q3's activity.

Notably, while artificial intelligence (AI) has dominated global headlines, only three of these megadeals were AI-related, a stark contrast to the US market where AI commands a disproportionate share of funding. Instead, UK investors showed broader enthusiasm, diversifying into established strengths beyond the AI hype.

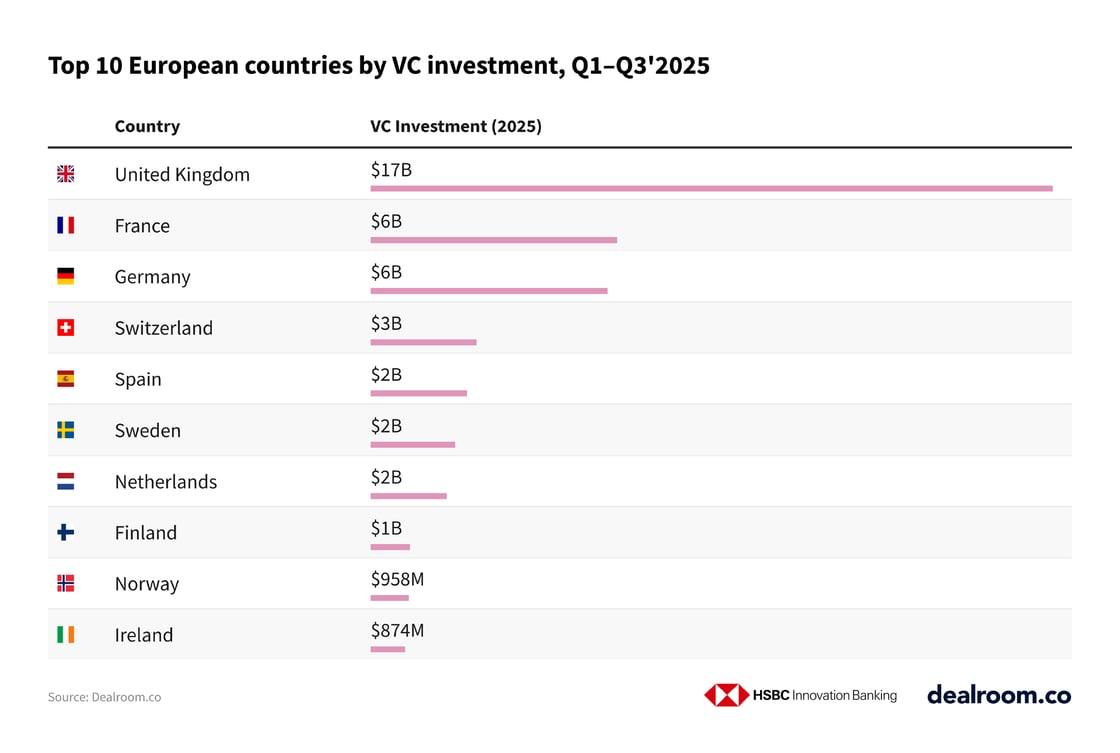

Europe's Undisputed Leader: Outpacing the Continent

The UK's dominance extends far beyond its borders. With $17.3 billion raised in the first nine months of 2025, Britain has attracted more venture capital than France, Germany, and Switzerland combined - a combined $15 billion. This lead solidifies the UK's position as Europe's premier destination for tech investment, outstripping even the next four largest markets on the continent.

The geographic spread of this capital further highlights the UK's maturing ecosystem. Of the 1,458 funding rounds recorded this year, 45% occurred outside London, with hotspots like Cambridge ($2 billion), Oxford ($406 million), and the Cardiff-Newport area ($172 million) emerging as key innovation hubs. This decentralization is fostering a more resilient and nationwide innovation network.

Sector Spotlights: Fintech Reigns, Quantum Leaps Forward

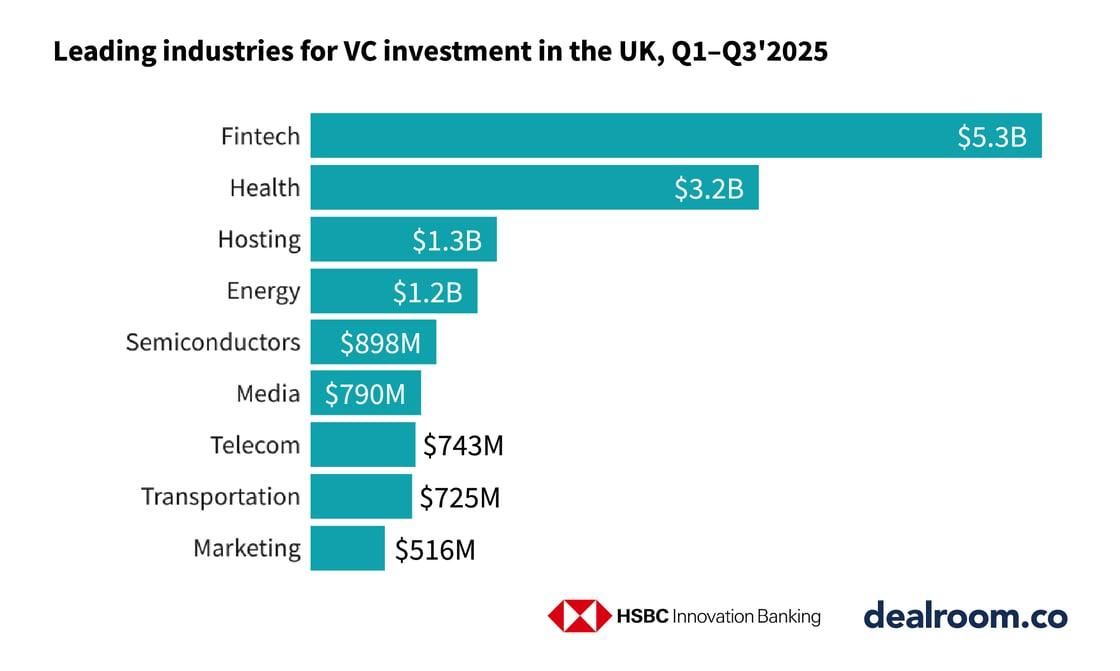

Investor interest spanned multiple high-growth sectors, with fintech, health, hosting, and energy leading the pack. Fintech, in particular, stole the show, securing $5.3 billion year-to-date and outpacing healthcare - the second-largest sector at $2.4 billion. Standout deals included Revolut's massive raise, alongside $160 million Series B for Xelix and $120 million for Tide, demonstrating the enduring appeal of UK's financial innovation prowess.

Health tech also thrived, benefiting from the UK's world-class research institutions and clinical expertise. Hosting and energy sectors rounded out the top performers, reflecting growing demand for scalable infrastructure and sustainable solutions amid global challenges like climate change and digital transformation.

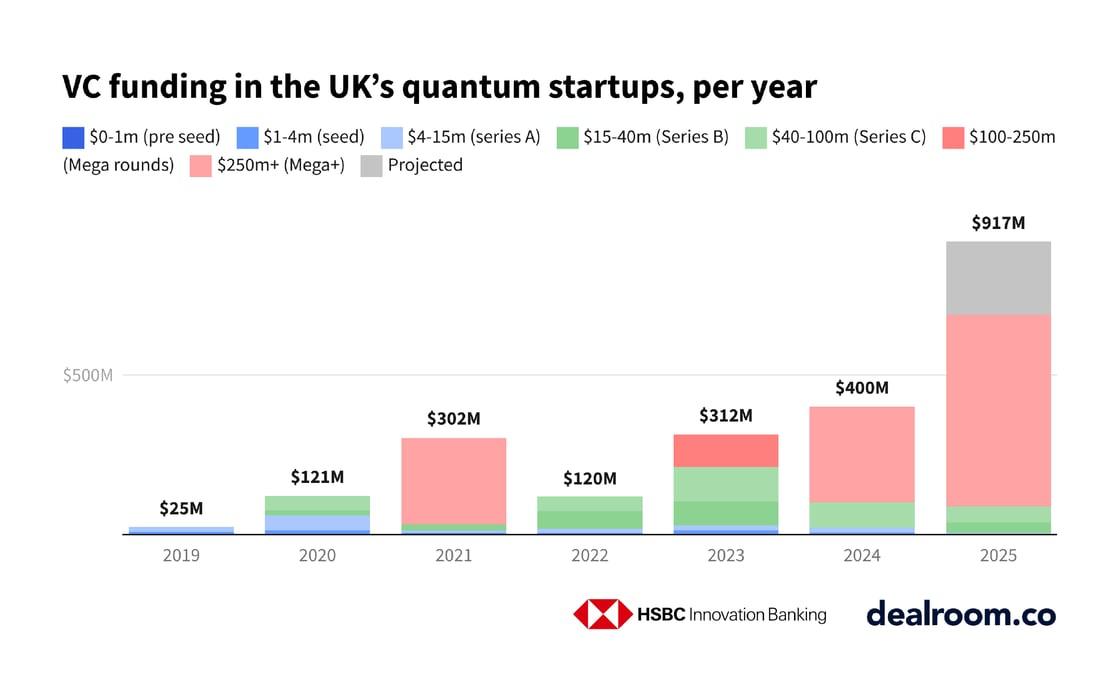

A rising star in this diverse portfolio is quantum technologies. UK quantum startups have already attracted $688 million over the first three quarters, with projections estimating a full-year total of $917 million. This growth aligns with government initiatives like the £400 million Defence Innovation Fund, which is channeling resources into frontier tech and deep science. As the UK leverages its academic strengths in quantum computing and related fields, this sector could become a cornerstone of future economic competitiveness.

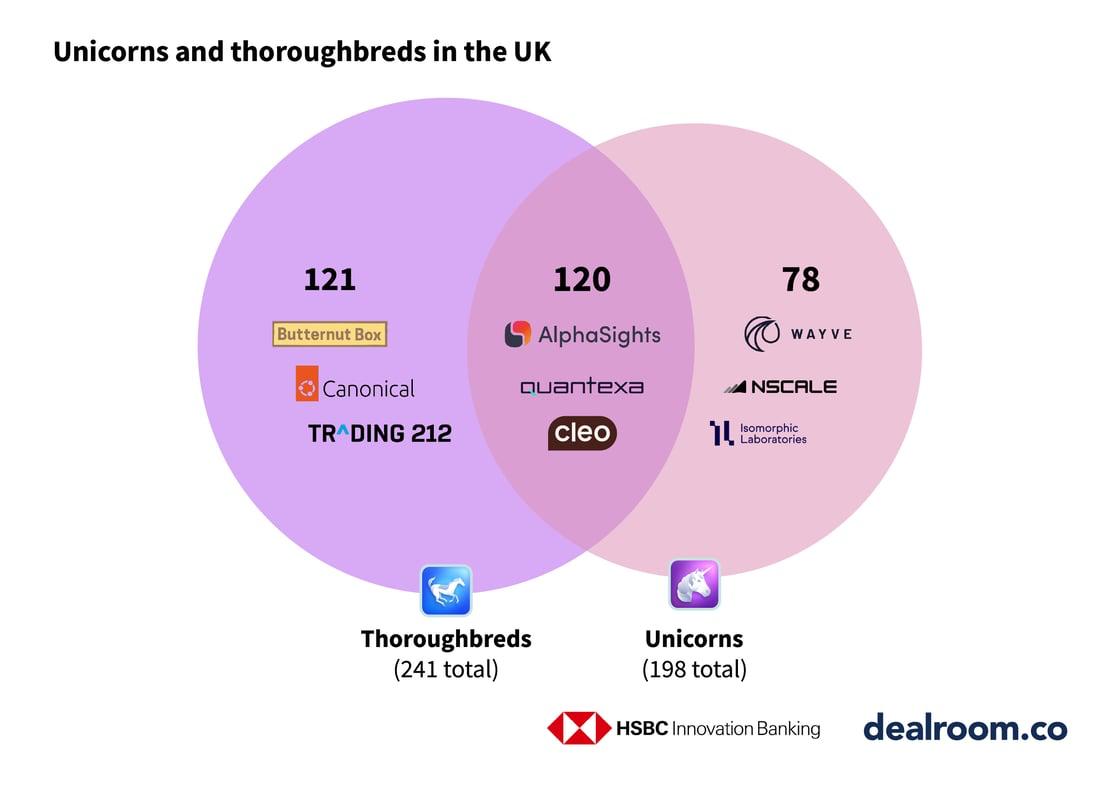

Unicorn Factory: 13 New Additions to a Thriving Herd

The funding boom is translating into tangible success stories. In 2025 alone, the UK minted 13 new unicorns - privately held startups valued at over $1 billion - bringing the national total to 198. This milestone not only celebrates individual triumphs but also illustrates the ecosystem's capacity to nurture global-scale enterprises. From fintech disruptors to health tech innovators, these unicorns are exporting British ingenuity worldwide.

Also read:

- China's AI Toy Revolution: Companions for a Lonely Generation

- The Silver Market's Dramatic Shift: From Surplus to Chronic Deficit

- Global Billionaire Boom: 3,279 Tycoons Control $15 Trillion

Looking Ahead: A Blueprint for Sustained Growth

As 2025 draws to a close, the UK's venture capital landscape appears brighter than it has in years. Projections point to a $23.1 billion finish, eclipsing 2024 and rivaling historical highs. Yet, challenges remain: attracting more pension fund capital, bolstering support for emerging managers, and ensuring regulatory clarity for deep tech.

As 2025 draws to a close, the UK's venture capital landscape appears brighter than it has in years. Projections point to a $23.1 billion finish, eclipsing 2024 and rivaling historical highs. Yet, challenges remain: attracting more pension fund capital, bolstering support for emerging managers, and ensuring regulatory clarity for deep tech.

Organizations like the British Private Equity & Venture Capital Association (BVCA) advocate for measures such as expanding tax incentives like SEIS and EIS, and initiatives to unlock institutional investments. With US investors increasingly eyeing UK opportunities - drawn by the market's resilience and diversity - the stage is set for even greater inflows.

In essence, the third quarter of 2025 wasn't just a financial milestone; it was a testament to the UK's enduring appeal as a global innovation powerhouse. As Bumfrey aptly put it, the nation is proving itself "not only as Europe’s leading tech hub but a global centre where innovative ideas scale into successful, impactful businesses." With continued momentum, 2026 could mark the dawn of an even more golden era for British entrepreneurship.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).