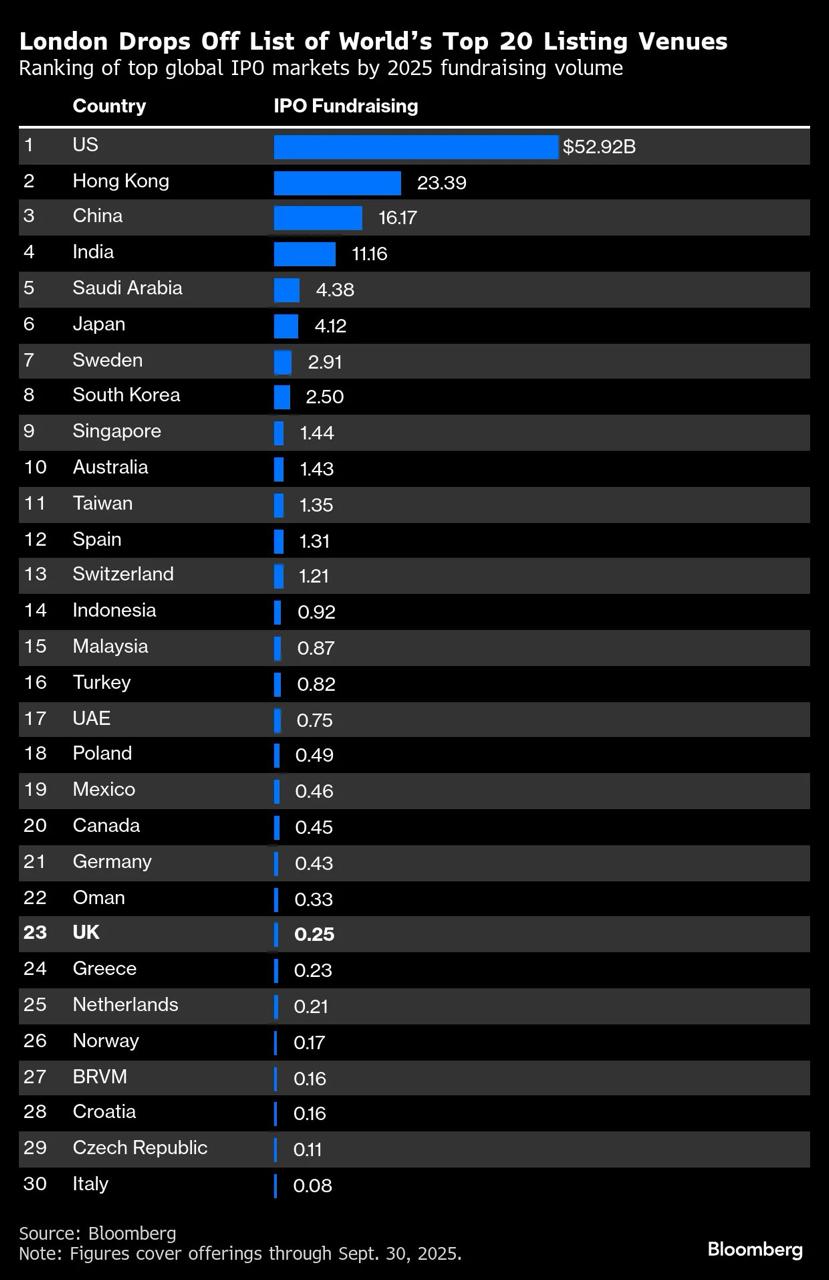

London, once the undisputed jewel of global finance, is witnessing a humiliating unraveling of its initial public offering (IPO) scene. As of September 2025, the London Stock Exchange (LSE) has plummeted to 23rd place in the world's busiest IPO rankings - a sharp three-spot drop that sees it eclipsed not just by powerhouses like New York and Hong Kong, but by emerging markets such as Mexico (19th, with $460 million raised) and even Singapore (9th, boasting $1.44 billion).

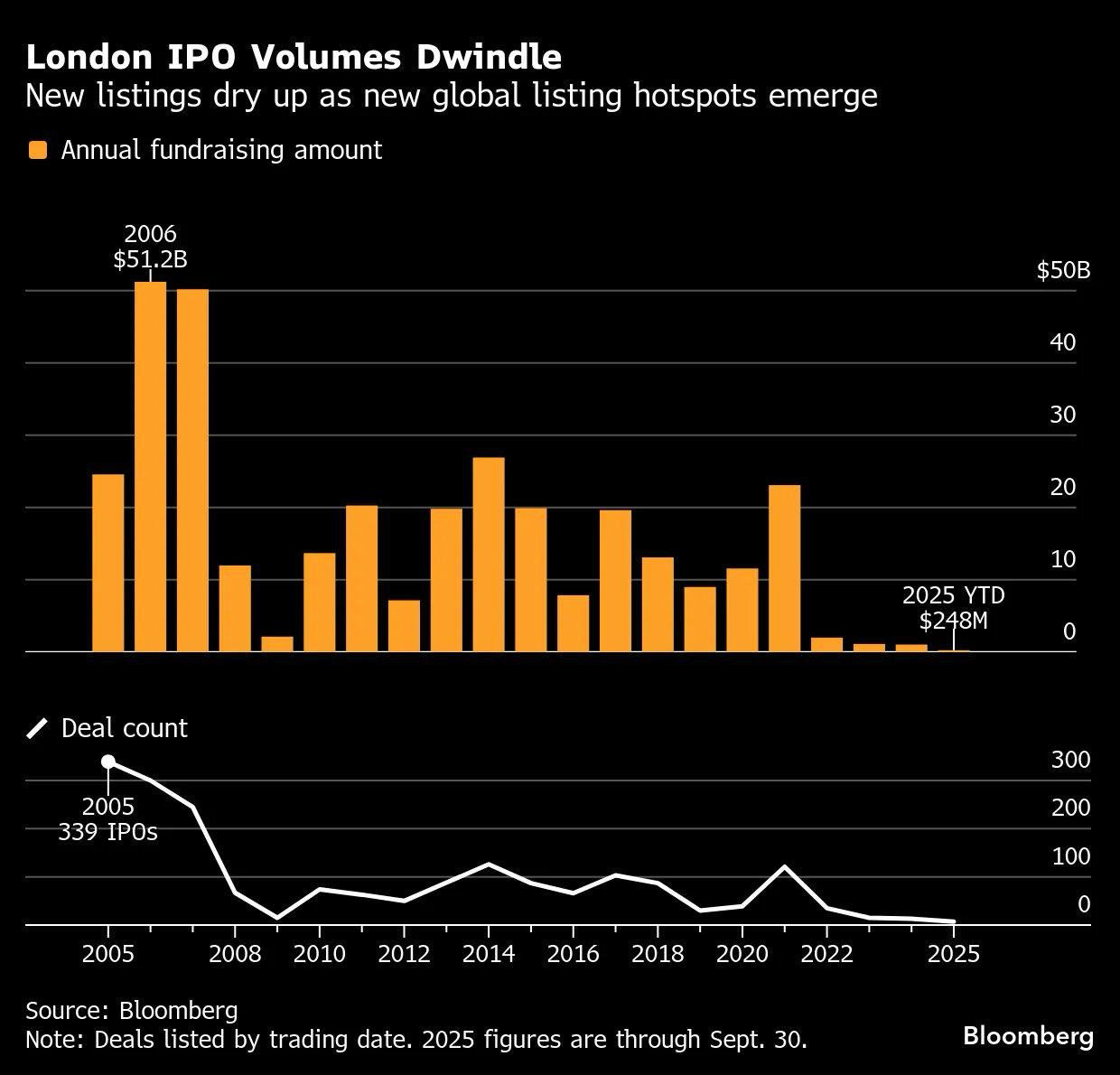

The total capital raised in London this year? A meager $248 million - a 69% nosedive from 2024 and the sorriest performance in over 35 years. This isn't just a blip; it's a seismic shift that's eroding the UK's status as a premier destination for companies going public.

From Dominance to Desolation: The Numbers Tell a Grim Tale

The LSE's woes are laid bare in the latest global IPO rankings, which track fundraising volumes through the third quarter of 2025. London's haul of $248 million pales against Singapore's sixfold success, driven by a flurry of property trust listings, or Mexico's surprising surge in frontier-market deals.

The LSE's woes are laid bare in the latest global IPO rankings, which track fundraising volumes through the third quarter of 2025. London's haul of $248 million pales against Singapore's sixfold success, driven by a flurry of property trust listings, or Mexico's surprising surge in frontier-market deals.

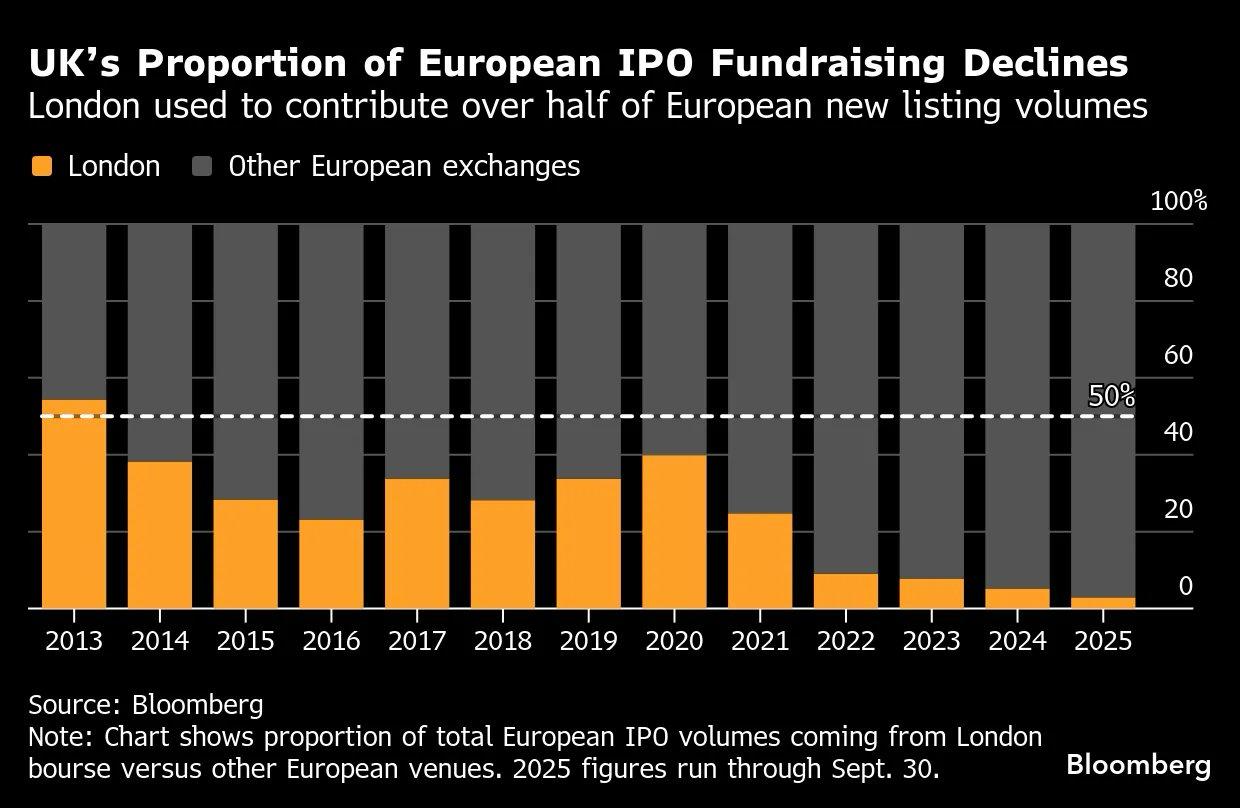

Even Oman, a Gulf minnow, edges ahead, underscoring how far the mighty have fallen. Within Europe, the decline is even starker: In 2013, the UK commanded over 50% of continental IPO activity; by 2025, that share has withered to a humiliating 3%.

The biggest "IPO" of the year? A modest £98 million ($128 million) listing by accountancy firm MHA in April—hardly the blockbuster debuts that once defined London, like Deliveroo's $10 billion splash in 2021.

Just nine listings in the first half of the year raised a collective £182 million, leaving the market resembling a "desert," as one analyst quipped. Compare that to the $51 billion bonanza of 2006, and the 99% evaporation is nothing short of catastrophic.

Why the Exodus? Valuations, Visibility, and a Vicious Cycle

At the heart of London's IPO drought lies a toxic cocktail of low valuations and structural woes. UK-listed stocks trade at a persistent discount - often 40-50% below US peers - making public debuts here feel like a fire sale.

At the heart of London's IPO drought lies a toxic cocktail of low valuations and structural woes. UK-listed stocks trade at a persistent discount - often 40-50% below US peers - making public debuts here feel like a fire sale.

Ambitious firms, from fintech darlings like Revolut to fast-fashion giant Shein, are fleeing to Nasdaq or NYSE, where deeper liquidity and higher multiples promise richer rewards. Revolut's CEO bluntly called a London IPO "not rational" due to the LSE's shallower pools of institutional buyers.

Private equity (PE) vultures are circling the undervalued carcasses left behind. With share prices languishing, UK companies have become prime takeover targets, allowing PE funds to scoop them up cheaply and keep them private longer - staving off the scrutiny of public markets.

"When valuations are low, private owners hesitate to IPO at a discount, while listed firms become takeover targets instead," notes Leonard Keller, a portfolio manager at Berenberg.

This "doom loop" has shrunk the pool of attractive listings, further depressing liquidity and investor interest.

Brexit's long shadow looms large, too. Post-2016 regulatory divergences and talent outflows have deterred international issuers, while a broader productivity slump has left Britain's economy sputtering compared to G7 peers. Add in macroeconomic headwinds—like spiking profit warnings (up 20% in Q2 2025 to 59 firms) - and the LSE feels like a relic in a world chasing tech-fueled growth elsewhere.

The Global Shake-Up: Singapore and Mexico Steal the Spotlight

As London fades, unlikely challengers rise. Singapore's leap to 9th reflects Asia's magnetic pull for real estate and tech IPOs, with $1.44 billion raised amid stable policies and tax perks. Mexico's 19th-place finish, with $460 million from energy and consumer plays, highlights Latin America's untapped vigor - nearly double London's volume despite near-zero activity in 2024. Even Stockholm leads Europe, hosting Verisure's €3 billion debut.

As London fades, unlikely challengers rise. Singapore's leap to 9th reflects Asia's magnetic pull for real estate and tech IPOs, with $1.44 billion raised amid stable policies and tax perks. Mexico's 19th-place finish, with $460 million from energy and consumer plays, highlights Latin America's untapped vigor - nearly double London's volume despite near-zero activity in 2024. Even Stockholm leads Europe, hosting Verisure's €3 billion debut.

These shifts aren't isolated; they're symptoms of a multipolar financial world where agility trumps legacy. Amsterdam tempts with EU access, while Dubai and Riyadh lure with oil wealth and reforms.

Also read:

- Google DeepMind and Commonwealth Fusion Systems Launch AI-Driven Nuclear Fusion Project

- The 100-Hour Workweek: The New Normal for Elite AI Researchers

- Nuclear Power in the US Keeps Getting More Expensive, While China’s Costs Have Halved

A Hub in Eclipse: London's Century-Old Crown Slips

For centuries, London has been the world's financial heartbeat - the birthplace of modern stock trading, home to the LSE since 1801. Yet today, as IPO volumes crater, that mantle feels perilously loose. The LSE's secondary market remains robust, but without fresh blood from listings, it risks irrelevance. Pension funds' aversion to UK equities exacerbates the "doom loop," starving the market of long-term capital.

Glimmers of hope flicker: Visma's €19 billion pivot from Amsterdam to London in July signaled potential, and whispers of Shein or De Beers spin-offs could inject billions in 2025's back half. Reforms - like mandating UK weightings in pensions or easing non-UK listing rules - could stem the bleed. Analysts tout London's "unique strengths" in governance and expertise, urging strategic tweaks to reclaim its edge.

But time is short. As Singapore surges and Mexico surprises, London's crisis is a wake-up call: Without bold reinvention, the City risks becoming a museum piece in the annals of finance. The question isn't if the hub can recover - it's whether it will seize the moment before the world moves on.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).