Market Dynamics in 2025: A Closer Look at the Numbers

As 2025 draws to a close, the silver market's deficit has not only persisted but intensified. The year is on track to record the fifth consecutive annual shortfall, with demand projected to reach 1.21 billion ounces while total supply - combining mine production, recycling, and net hedging - falls short at approximately 1.03 billion ounces. This results in a 182 million-ounce deficit for 2025 alone, the largest in over a decade.

Industrial fabrication, the dominant force, is expected to consume 732 million ounces, representing 60.5% of total demand - a record high.

Industrial fabrication, the dominant force, is expected to consume 732 million ounces, representing 60.5% of total demand - a record high.

Within this category:

- Solar photovoltaics: 261 million ounces (+5.5% YoY)

- Electronics & electrical: 298 million ounces (+4% YoY)

- Ethylene oxide & brazing alloys: 48 million ounces (stable)

- Other industrial: 125 million ounces (+6% YoY)

Meanwhile, physical investment demand has surged, with **silver bar and coin minting** up **12%** to 285 million ounces, driven by retail investors in North America and Europe seeking inflation hedges and portfolio diversification amid currency volatility.

On the supply side:

- Mine production: 835 million ounces (–1.2% YoY), with declines in Peru, Mexico, and China offsetting modest gains in Argentina and Australia.

- Recycling: 195 million ounces (+3% YoY), constrained by lower industrial scrap availability despite higher prices.

- Net producer hedging: Minimal, as producers remain largely unhedged, benefiting from spot price strength.

The result? Above-ground stocks continue to erode. Visible inventories at exchanges like COMEX, LME, and Shanghai Futures Exchange have fallen to under 800 million ounces - the lowest since 2011 - representing less than 10 months of global demand.

Geopolitical and Macro Tailwinds

Silver’s bullish case is reinforced by several converging macro and geopolitical trends:

Silver’s bullish case is reinforced by several converging macro and geopolitical trends:

1. U.S. Critical Minerals Strategy

In early 2025, the U.S. Department of the Interior officially classified silver as a critical mineral under the Energy Act of 2020, citing its essential role in renewable energy, defense electronics, and medical technologies. This designation unlocks federal funding for domestic exploration, streamlined permitting, and R&D into recycling and substitution mitigation.

2. China’s Dual-Carbon Goals

China, consuming over 25% of global silver, has accelerated its 2060 carbon neutrality roadmap. The 14th Five-Year Plan (2021–2025) targeted 1,200 GW of wind and solar capacity by 2030 - now upgraded to 1,500 GW. Each GW of solar requires ~18–22 tons of silver, implying 27,000–33,000 tons (870–1,060 million ounces) of cumulative demand by 2030 from new installations alone.

3. India’s Silver Awakening

India, traditionally a jewelry and investment market, is rapidly industrializing its silver use.

India, traditionally a jewelry and investment market, is rapidly industrializing its silver use.

The National Solar Mission and Make in India electronics push have boosted local PV and 5G component manufacturing. Industrial silver offtake in India grew 18% in 2024 and is forecast to rise another 15% in 2025, reaching 85 million ounces.

4. Currency Debasement and Safe-Haven Flows

With global debt-to-GDP ratios exceeding 350% and central banks cutting rates into 2026, silver benefits from dual monetary and industrial premiums.

Unlike gold, silver offers beta to economic growth - rising with industrial activity - while retaining safe-haven appeal during uncertainty.

This hybrid status has attracted institutional inflows: silver ETFs globally added 112 million ounces in 2025, the strongest since 2020.

Supply-Side Innovation: Can Technology Close the Gap?

With traditional mining unable to keep pace, attention turns to alternative supply solutions:

With traditional mining unable to keep pace, attention turns to alternative supply solutions:

1. Urban Mining and E-Waste Recycling

Only 15–20% of silver in electronics is currently recovered. New hydrometallurgical and bioleaching technologies promise recovery rates above 90%. Companies like Umicore and Redwood Materials are scaling plants to process millions of tons of e-waste annually, potentially adding 50–80 million ounces of recycled silver by 2030.

2. Thrifting in Solar

PV manufacturers have reduced silver loading from 130 mg/cell in 2015 to 90 mg/cell in 2025, a 30% reduction. Next-gen copper plating and zero-silver pastes are in pilot stages, but face challenges in efficiency and durability. Even aggressive thrifting is projected to **only slow demand growth**, not reverse it - solar silver use is still expected to double by 2035.

3. Deep-Sea and Space Mining?

Polymetallic nodules on the Pacific seafloor contain silver alongside manganese and cobalt. The International Seabed Authority is finalizing exploitation regulations, with commercial operations possible by 2028–2030. Meanwhile, asteroid mining remains speculative - but companies like AstroForge are testing silver-rich near-Earth objects.

4. Primary Silver Mine Pipeline

Only 12 major primary silver projects are in development globally, with first production not expected before 2027. Combined, they could add 120 million ounces annually - but at all-in sustaining costs (AISC) above $28/oz, well above current margins for many producers.

Price Outlook: 2026 and Beyond

Analyst consensus sees average silver prices in 2026 at $36–$42/oz, with:

Analyst consensus sees average silver prices in 2026 at $36–$42/oz, with:

- Bull case ($55+): Accelerated EV/solar buildout, supply disruptions in Peru/Mexico, sustained monetary easing.

- Bear case ($28–$32): Global recession, delayed green capex, successful thrifting breakthroughs.

- Base case ($38): Continued 150–200 million oz annual deficits, modest recycling gains, stable industrial growth.

Longer-term, $60–$80 by 2030 is increasingly viewed as plausible if no major supply response emerges. Some analysts, citing peak silver analogies to peak oil, warn of $100+ prices in a net-zero 2050 scenario without aggressive substitution or recycling.

Investment Implications

.jpg)

Also read:

- ScaleAI and AI Risks Unveil Remote Labor Index (RLI) – and the Results Are Fascinating

- Global Crypto ATM Count Hits Record Highs

- China's AI-Powered Drone Revolution: Planting 100,000 Trees a Day to Combat Deforestation

Conclusion: A New Silver Standard?

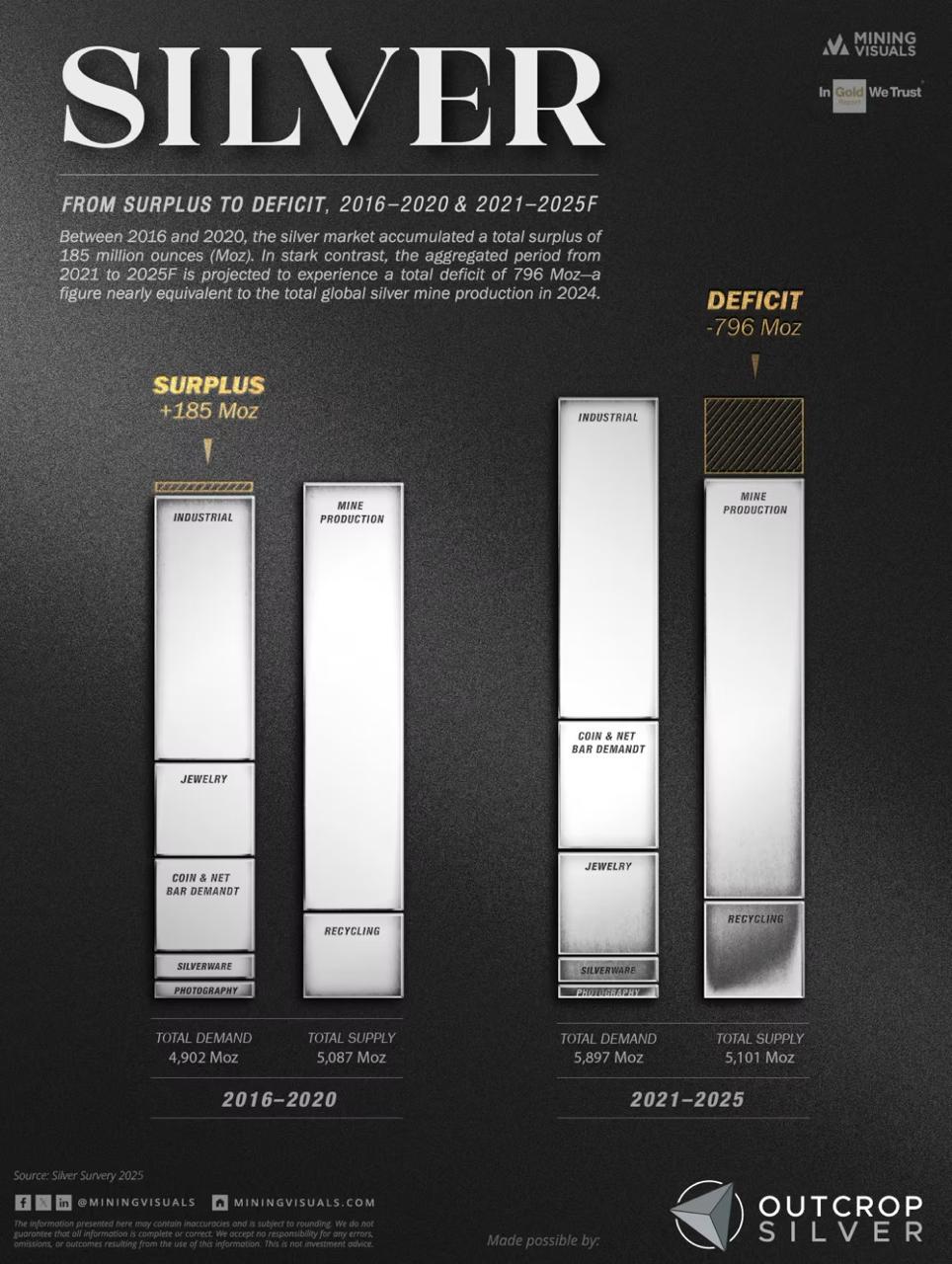

The global silver market has crossed a Rubicon. What began as a cyclical imbalance in 2021 has solidified into a multi-decade structural deficit, driven by the inexorable rise of the electrified, digitized, decarbonized economy. With less than 10 years of known economic reserves at current consumption rates - and no silver-specific mining boom in sight - the metal’s scarcity premium is only beginning to be priced in.

For investors, industrials, and policymakers alike, silver is no longer a footnote to gold or a niche commodity - it is a strategic choke point in the global technology stack. Those who recognize this early will navigate the coming volatility with advantage. The age of silver abundance is over. The age of Silver 2.0 - scarce, strategic, and indispensable - has begun.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).