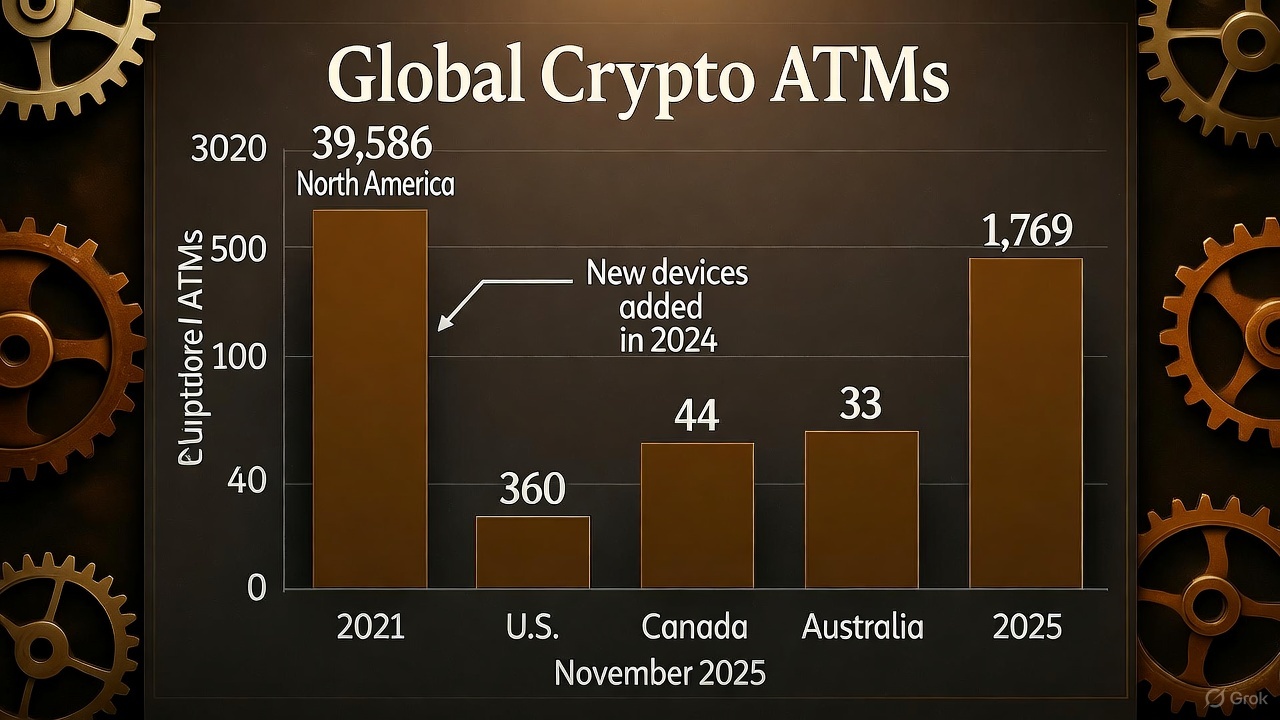

As of November 2025, the world has reached a milestone with 39,586 crypto ATMs in operation, nearing the peak levels seen in 2022. This resurgence underscores a renewed surge in cryptocurrency adoption, driven by expanding infrastructure and growing demand for accessible digital currency services. The rapid proliferation of these machines is reshaping the landscape of financial technology worldwide.

Regional Growth Leaders

The bulk of this growth is concentrated in North America, where over 83% of new crypto ATMs have been installed. In the United States, the network expanded by 360 machines, while Canada added 44, and Australia saw an increase of 33 units. This regional dominance highlights North America’s pivotal role in driving the global crypto ATM boom.

The bulk of this growth is concentrated in North America, where over 83% of new crypto ATMs have been installed. In the United States, the network expanded by 360 machines, while Canada added 44, and Australia saw an increase of 33 units. This regional dominance highlights North America’s pivotal role in driving the global crypto ATM boom.

Within the European Union, the number of crypto ATMs has risen to 1,769, reflecting a steady uptake of cryptocurrency services across the continent.

Meanwhile, Canada and Australia are showcasing remarkable growth trajectories since December 2022, with their networks expanding by 1,040 and 1,846 devices, respectively. These figures signal a robust appetite for decentralized financial tools in these markets.

A Surge in Installations

The momentum gained significant traction in October 2025, with 422 new crypto ATMs installed—a staggering 427.5% increase compared to September. This sharp uptick suggests a strong push by operators to capitalize on rising demand, possibly fueled by favorable regulations, increased public interest, and the integration of cryptocurrencies into mainstream financial systems.

The momentum gained significant traction in October 2025, with 422 new crypto ATMs installed—a staggering 427.5% increase compared to September. This sharp uptick suggests a strong push by operators to capitalize on rising demand, possibly fueled by favorable regulations, increased public interest, and the integration of cryptocurrencies into mainstream financial systems.

Also read:

- DeepSeek-OCR: A New Approach to Memory in AI

- Memory Is Back on Top: Samsung, SK Hynix, and Micron Ride the AI Supercycle

- The Marketing Strategist’s Competency Map: Julian Cole’s Framework for Building Unbreakable Plans

Looking Ahead

If the current installation pace holds, the global tally of crypto ATMs could surpass 40,000 by year-end. This potential milestone would mark a new era for cryptocurrency accessibility, reinforcing the infrastructure needed to support a growing user base. The rapid deployment reflects not only technological advancements but also a shifting economic landscape where digital currencies are becoming increasingly normalized.

As the industry continues to evolve, the expansion of crypto ATMs could further bridge the gap between traditional finance and the decentralized economy, offering users a tangible touchpoint for engaging with blockchain technology. With North America leading the charge and other regions like the EU, Canada, and Australia gaining ground, the future of crypto ATMs appears poised for continued growth.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).