By Quasa Insights | November 9, 2025

In a year marked by surging stock markets and technological revolutions, the world's ultra-wealthy have seen their fortunes swell to unprecedented heights. According to the latest Hurun Global Rich List, there are now 3,279 billionaires worldwide, an increase of 167 from the previous year - a 5% rise.

In a year marked by surging stock markets and technological revolutions, the world's ultra-wealthy have seen their fortunes swell to unprecedented heights. According to the latest Hurun Global Rich List, there are now 3,279 billionaires worldwide, an increase of 167 from the previous year - a 5% rise.

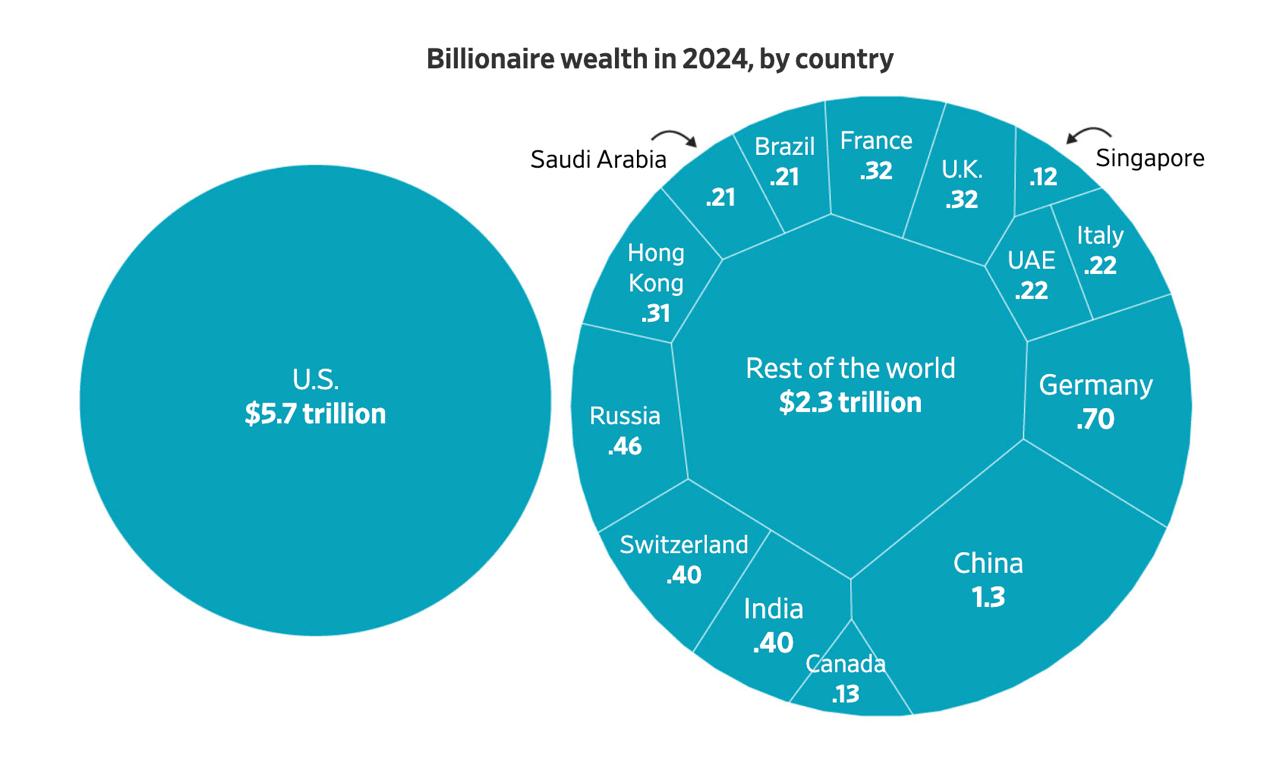

Their combined wealth has ballooned to $15 trillion, up 9% year-over-year, fueled by robust gains in equity markets, particularly in tech-heavy sectors. This rebound comes after a dip in 2023, closing the gap toward the record highs of 2022 and underscoring the resilience of global capitalism amid economic headwinds.

The report, compiled by Hurun Research and based on wealth snapshots as of January 15, highlights how buoyant financial services, media, and entertainment industries have propelled this growth. Notably, 480 new billionaires joined the ranks, with 132 from the United States, 94 from India, and 55 from China, while 278 exited the club - 208 of them Chinese entrepreneurs hit by regulatory and economic pressures. Yet, the overall trajectory points to a widening chasm between the super-rich and the rest, with the top 10 billionaires alone accounting for 60% of the year's total wealth increase.

The report, compiled by Hurun Research and based on wealth snapshots as of January 15, highlights how buoyant financial services, media, and entertainment industries have propelled this growth. Notably, 480 new billionaires joined the ranks, with 132 from the United States, 94 from India, and 55 from China, while 278 exited the club - 208 of them Chinese entrepreneurs hit by regulatory and economic pressures. Yet, the overall trajectory points to a widening chasm between the super-rich and the rest, with the top 10 billionaires alone accounting for 60% of the year's total wealth increase.

The United States: Unrivaled Dominion

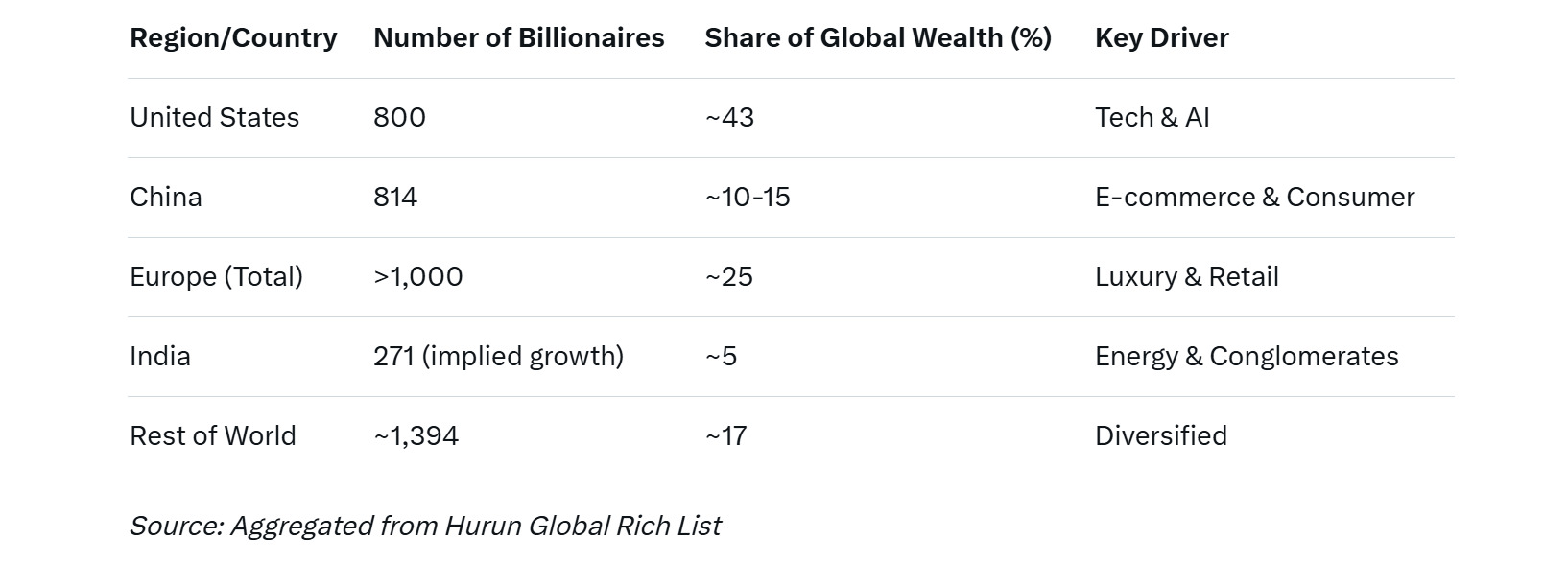

The U.S. continues to dominate the billionaire landscape, boasting 800 tycoons - up 109 from last year—who control a staggering portion of global wealth. This represents roughly a quarter of the world's billionaires but an outsized share of their fortunes, estimated at over 40% of the $15 trillion total.

The U.S. continues to dominate the billionaire landscape, boasting 800 tycoons - up 109 from last year—who control a staggering portion of global wealth. This represents roughly a quarter of the world's billionaires but an outsized share of their fortunes, estimated at over 40% of the $15 trillion total.

Tech titans drive much of this supremacy, with Elon Musk reclaiming the top spot at $231 billion, propelled by Tesla's electric vehicle dominance and SpaceX's aerospace innovations.

Behind Musk, familiar names like Jeff Bezos ($194 billion, Amazon) and Mark Zuckerberg ($177 billion, Meta) round out the podium, their empires thriving on e-commerce and social media. Larry Ellison, Oracle's co-founder, climbed three spots to fifth with $144 billion, thanks to explosive growth in cloud computing.

This American edge reflects not just innovation but also favorable market conditions, where the S&P 500 surged over 20% in 2024, amplifying valuations in AI, software, and consumer tech.

China: Resilience Amid Challenges

China holds a narrow lead in sheer numbers with 814 billionaires, despite shedding 155 over the year due to real estate woes and antitrust scrutiny. These ultra-wealthy individuals command about 10-15% of global billionaire capital, centered in consumer goods, e-commerce, and tech.

China holds a narrow lead in sheer numbers with 814 billionaires, despite shedding 155 over the year due to real estate woes and antitrust scrutiny. These ultra-wealthy individuals command about 10-15% of global billionaire capital, centered in consumer goods, e-commerce, and tech.

Zhong Shanshan, the "Bottle Water King" of Nongfu Spring, remains China's richest at around $62 billion (equivalent to the user's cited $79.9 billion in yuan terms), while Pony Ma of Tencent follows closely at $71.5 billion, buoyed by gaming and digital services.

Pinduoduo's Colin Huang overtook Ma for second place domestically, his fortune jumping 71% to $55 billion on the back of e-commerce expansion. India's influence is also rising within Asia, with Mukesh Ambani of Reliance adding $33 billion to stay Asia's richest at $116 billion, and Gautam Adani surging 62% to $86 billion.

Yet, China's billionaire exodus signals deeper economic shifts, with self-made entrepreneurs still comprising 74% of the nation's female billionaires - a testament to its entrepreneurial spirit.

Europe Surges to Second Place

For the first time, Europe has eclipsed Asia as the world's second-largest hub for billionaires, surpassing 1,000 tycoons and claiming about 25% of the global total. This milestone, up from under 900 in 2023, positions the region just behind North America and ahead of Asia, driven by luxury goods, retail, and pharmaceuticals.

For the first time, Europe has eclipsed Asia as the world's second-largest hub for billionaires, surpassing 1,000 tycoons and claiming about 25% of the global total. This milestone, up from under 900 in 2023, positions the region just behind North America and ahead of Asia, driven by luxury goods, retail, and pharmaceuticals.

France's Bernard Arnault tops the European charts with $236.4 billion from LVMH, the world's largest luxury conglomerate, while Germany's Dieter Schwarz holds steady at $45.9 billion via discount retailer Lidl.

The U.K., Switzerland, and Italy also shine, with London's financial ecosystem and Zurich's private banking drawing high-net-worth talent. This European renaissance contrasts with Asia's slowdown, highlighting diversified economies less exposed to China's volatility. As Hurun chairman Rupert Hoogewerf notes, "Europe's billionaires are increasingly self-made, with inheritance playing a smaller role than in the U.S."

AI Boom: Widening the Wealth Gap

At the vanguard of this billionaire surge is artificial intelligence, which has turbocharged fortunes among the tech elite. The sector's explosive growth - fueled by generative AI tools and data center expansions - has accelerated disparities even within the one-percent-of-the-one-percent.

At the vanguard of this billionaire surge is artificial intelligence, which has turbocharged fortunes among the tech elite. The sector's explosive growth - fueled by generative AI tools and data center expansions - has accelerated disparities even within the one-percent-of-the-one-percent.

Elon Musk's wealth leaped by over $100 billion in 2024, largely from AI integrations in Tesla's autonomous driving and xAI ventures. Mark Zuckerberg, Meta's CEO, emerged as the year's biggest gainer, adding $113 billion to his net worth through AI-enhanced advertising and the metaverse pivot.

Jeff Bezos, too, benefited indirectly via Amazon's AWS cloud dominance in AI workloads. Hoogewerf predicts this trend will spawn the world's first trillionaire by 2030, with AI pioneers leading the charge. Sectors like media and entertainment saw record wealth jumps (up 30%), while healthcare and industrials lagged. Globally, 67% of billionaires are self-made, but AI is minting new ones faster than ever - 15.4% are now immigrants, underscoring the borderless nature of innovation.

Also read: The Strangest Fallout from the AWS Outage: Smart Mattresses Go Rogue and Ruin Sleep Worldwide

A Snapshot of the Elite: By the Numbers

Also read:

- ScaleAI and AI Risks Unveil Remote Labor Index (RLI) – and the Results Are Fascinating

- Global Crypto ATM Count Hits Record Highs

- Australia's Bold Stance Against Big Tech: ACCC Sues Microsoft Over Deceptive Microsoft 365 Price Hikes

Looking Ahead: Inequality in the Spotlight

As billionaire wealth hits $15 trillion - equivalent to the GDP of the U.S. and China combined - the report raises uncomfortable questions about inequality. While 480 newcomers celebrate, 278 exits remind us of fortune's fragility. Philanthropy remains uneven: Musk and Bezos pledge billions to climate and space, yet systemic gaps persist. With AI poised to redefine economies, policymakers must balance innovation with equity. For now, the rich get richer, but the global stage grows ever more interconnected - and competitive.

This analysis draws on the Hurun Global Rich List, cross-referenced with market data up to November 2025. Figures may fluctuate with valuations.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).