In 2025, the global drone industry has evolved from a niche technology to a cornerstone of national security, logistics, precision agriculture, and cinematography.

Drones, or unmanned aerial vehicles (UAVs), are no longer just military assets or hobbyist toys; they are indispensable tools for governments and industries worldwide, driving massive investments, innovation, and strategic competition. Data from platforms like StatRanker, which aggregates economic statistics from trusted sources such as the World Bank and the International Monetary Fund (IMF), alongside insights from industry reports, provide a detailed view of this rapidly growing sector.

This article explores the top 10 drone manufacturing countries in 2025, highlighting their contributions, market trends, and key players shaping the global landscape.

1. China: The Undisputed Drone Powerhouse

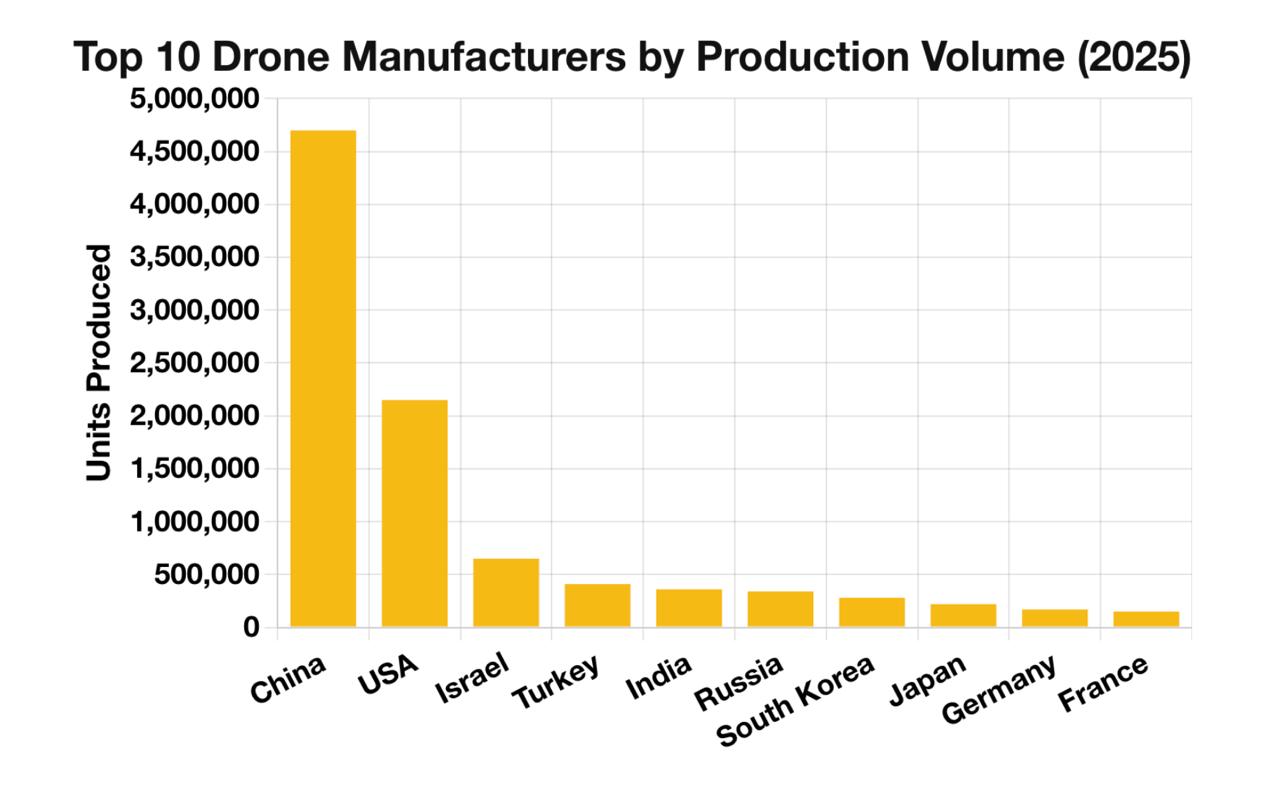

China leads the global drone market, commanding over 70% of the consumer and commercial drone market share, driven by industry giant SZ DJI Technology Co., Ltd.. In 2025, China’s drone production is projected to generate revenues of $1.53 billion in the consumer electronics segment alone, with total civilian drone production expected to surpass 200 billion yuan (approximately $27.5 billion).

Companies like DJI, Autel Robotics, and EHang dominate both consumer and industrial markets, producing over 300 drone models for applications ranging from aerial photography to urban air mobility (UAM). China’s low production costs, government subsidies (including $30 billion in EV and drone manufacturing investments), and a robust supply chain give it a competitive edge.

The country exports nearly 40 million drones annually, including 600,000 to the U.S. alone, despite increasing tariffs. However, concerns over cybersecurity and dependency on Chinese technology are prompting some nations to seek alternatives.

2. United States: Technological Leader in Military and Commercial Drones

The United States is a global leader in drone technology, particularly in military and high-end commercial applications. With an estimated fleet of 13,000 military UAVs in 2025, the U.S. maintains unmatched dominance in drone warfare. Companies like AeroVironment, Northrop Grumman, and Boeing produce advanced systems such as the Raven, Wasp, and MQ-9 Reaper for intelligence, surveillance, and reconnaissance (ISR).

Skydio is gaining traction in autonomous drone deployments for public safety and infrastructure inspections, bolstered by U.S. Department of Defense (DoD) contracts. The U.S. commercial drone market is projected to grow at a CAGR of over 8% from 2025 to 2030, driven by regulatory support from the Federal Aviation Administration (FAA) and demand in logistics and agriculture.

However, high production costs — nearly three times those in China — pose challenges to scaling consumer drone manufacturing.

3. France: European Pioneer in Commercial and Military Drones

France ranks among the top producers of commercial and military drones, with companies like Parrot SA and Thales Group leading innovation. Parrot maintains a strong presence in Europe, focusing on government and industrial applications with cybersecurity-compliant designs.

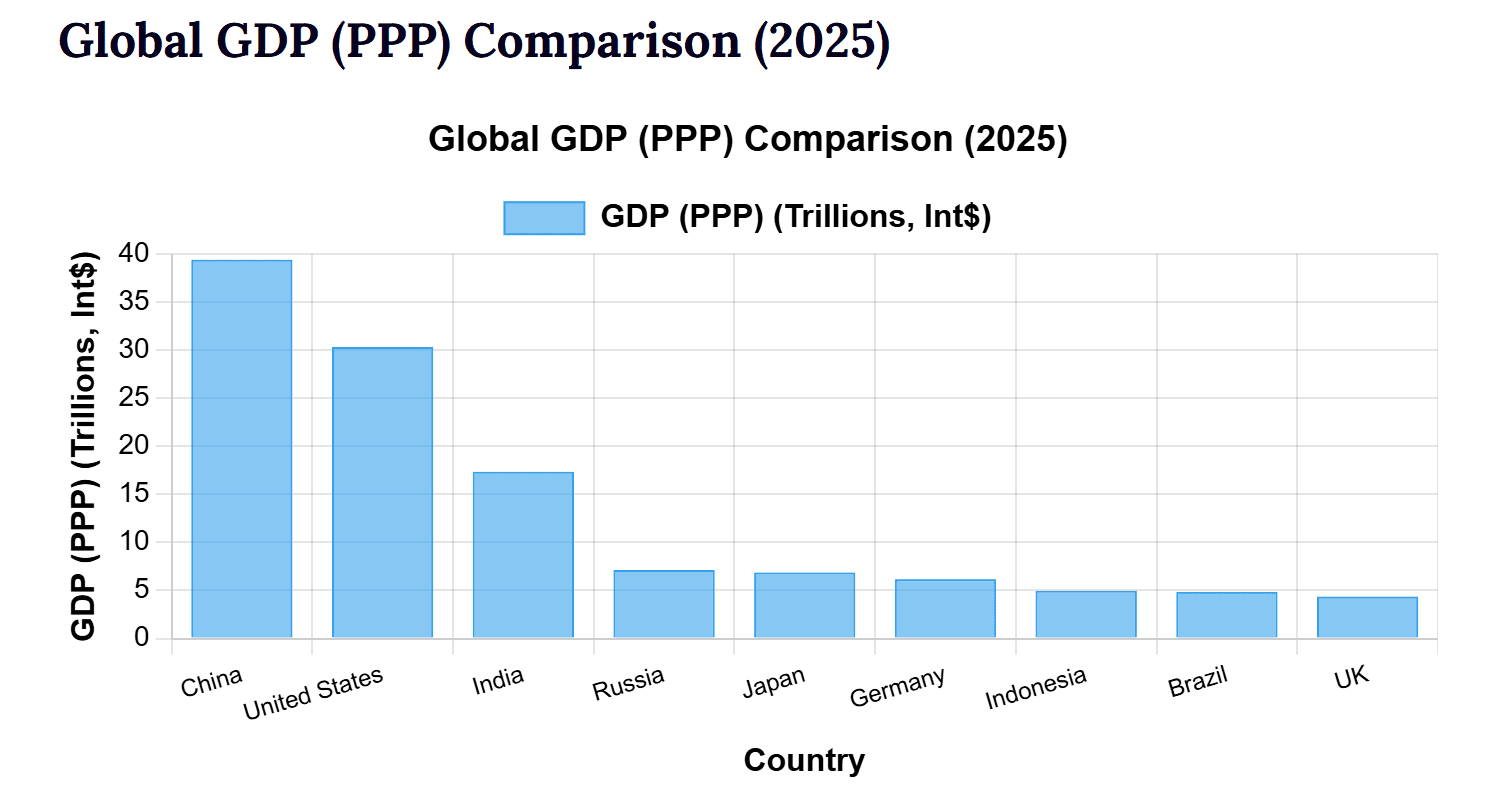

Thales Group’s expertise in defense electronics and integrated systems supports its production of advanced UAVs for military and security purposes. France benefits from a favorable regulatory environment and increasing adoption in agriculture and infrastructure inspection. The country’s drone market is part of Europe’s $29.8 trillion GDP (PPP) economy in 2025, driven by diversified industries and technological advancements.

4. Turkey: Rising Star in Military Drone Manufacturing

Turkey has emerged as a major player in military drone production, led by Baykar and Turkish Aerospace Industries. Drones like the Bayraktar TB2 and Akıncı have gained international recognition for their battlefield success, boosting Turkey’s export market and geopolitical influence. In 2025, Turkey’s focus on indigenous development reduces reliance on foreign suppliers, enhancing strategic autonomy. The country’s drones are cost-effective and tailored for specific operational needs, making them attractive to international buyers.

5. India: A Growing Hub for Drone Innovation

India’s drone industry is poised for significant growth, with projections estimating a $23 billion manufacturing potential by 2030, driven by defense and agricultural applications.

The government’s Drone Rules 2021 and Production Linked Incentive (PLI) program encourage domestic production, with companies like IdeaForge Technology Pvt. Ltd. leading the charge. Projects such as DRDO’s Rustom-II highlight India’s push for self-reliance in military drones.

The Drone International Expo 2025 in Delhi, featuring exhibitors from six countries, underscores India’s ambition to become a global drone hub.

6. Germany: Precision Engineering in Drone Technology

Germany’s engineering prowess drives its drone manufacturing sector, with a focus on industrial and defense applications. Companies like Flyability specialize in niche markets such as indoor inspections for mining and energy sectors. Germany’s $6.18 trillion GDP (PPP) in 2025 supports its role as a technological hub within Europe’s $29.8 trillion economy. Collaborative efforts with other European nations and compliance with EU regulations enhance Germany’s position in the commercial drone market.

7. Japan: Innovator in Smart Agriculture and Infrastructure

Japan leverages drones for smart agriculture and infrastructure inspection, supported by its $6.88 trillion GDP (PPP) economy. Companies like Yamaha and ACSL develop drones for precision farming and logistics, capitalizing on Japan’s advanced technology ecosystem. The country’s focus on integrating drones with IoT and 5G networks enhances their utility in smart city initiatives. Japan’s regulatory framework and investments in R&D position it as a key player in Asia’s drone market.

8. South Korea: Emerging Leader in Commercial Drones

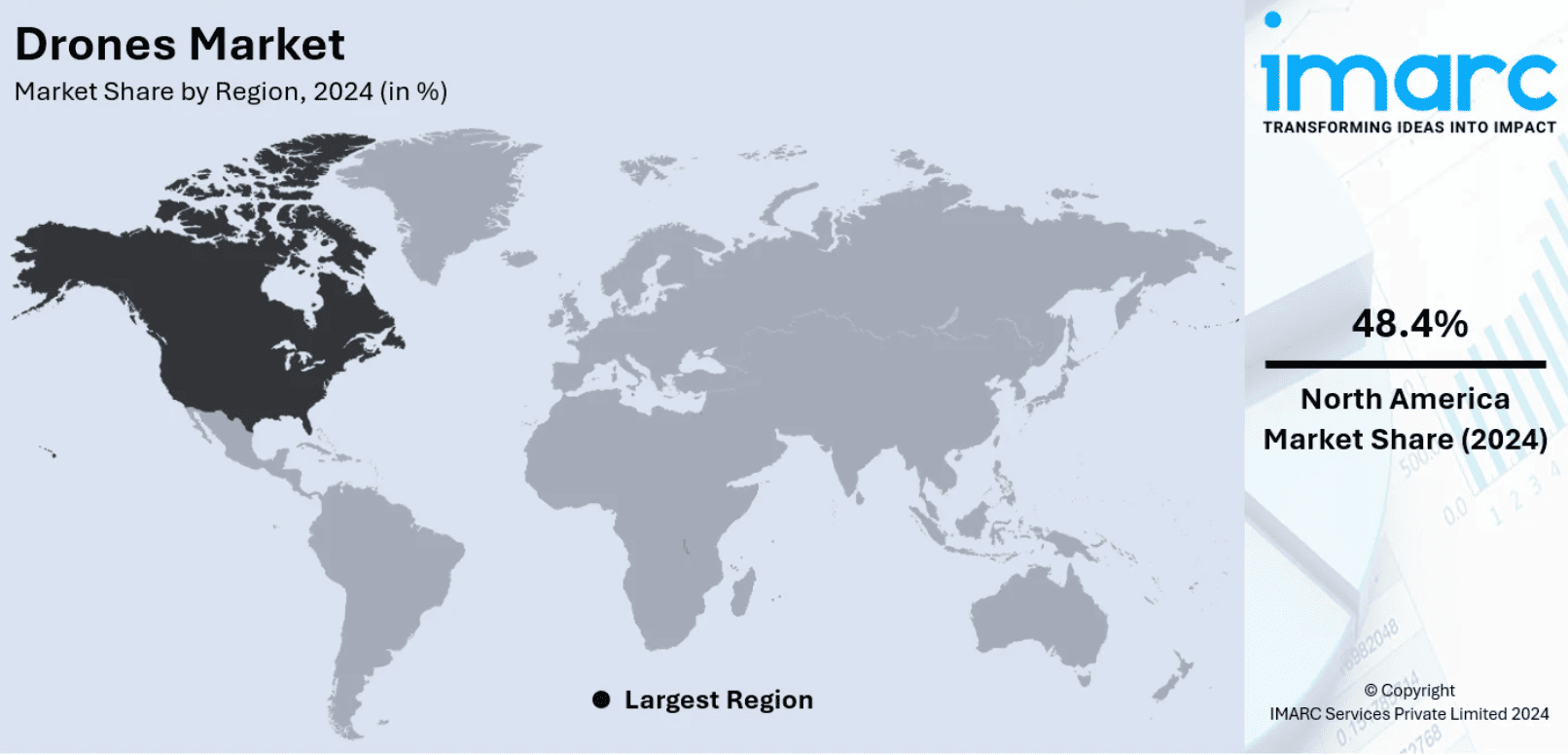

South Korea’s drone industry is gaining momentum, driven by companies like Hanwha Systems and a focus on smart agriculture and urban applications. The country’s adoption of drones for infrastructure inspection and public safety aligns with its technological advancements and regulatory support. South Korea’s role in the Asia-Pacific’s dominant 40.2% share of the global drone market in 2024 highlights its growing influence.

9. Canada: Niche Player in Drone Innovation

Canada contributes to the global drone market through specialized applications in agriculture, environmental monitoring, and public safety. The country’s $2.68 trillion GDP (PPP) supports its role in North America’s $32.1 trillion economy.

Canadian firms participate in international exhibitions like the Drone International Expo 2025, showcasing their capabilities alongside global leaders. Regulatory support and R&D investments bolster Canada’s niche but growing presence.

10. Russia: Military Drone Development Amid Challenges

Russia ranks among the top military drone producers, with a focus on indigenous development through companies like Kronstadt. Its $7.13 trillion GDP (PPP) supports defense investments, despite economic sanctions. Russia’s drones are deployed in surveillance and combat roles, but limited access to global markets and technological constraints hinder its commercial drone sector.

Trends and Analysis

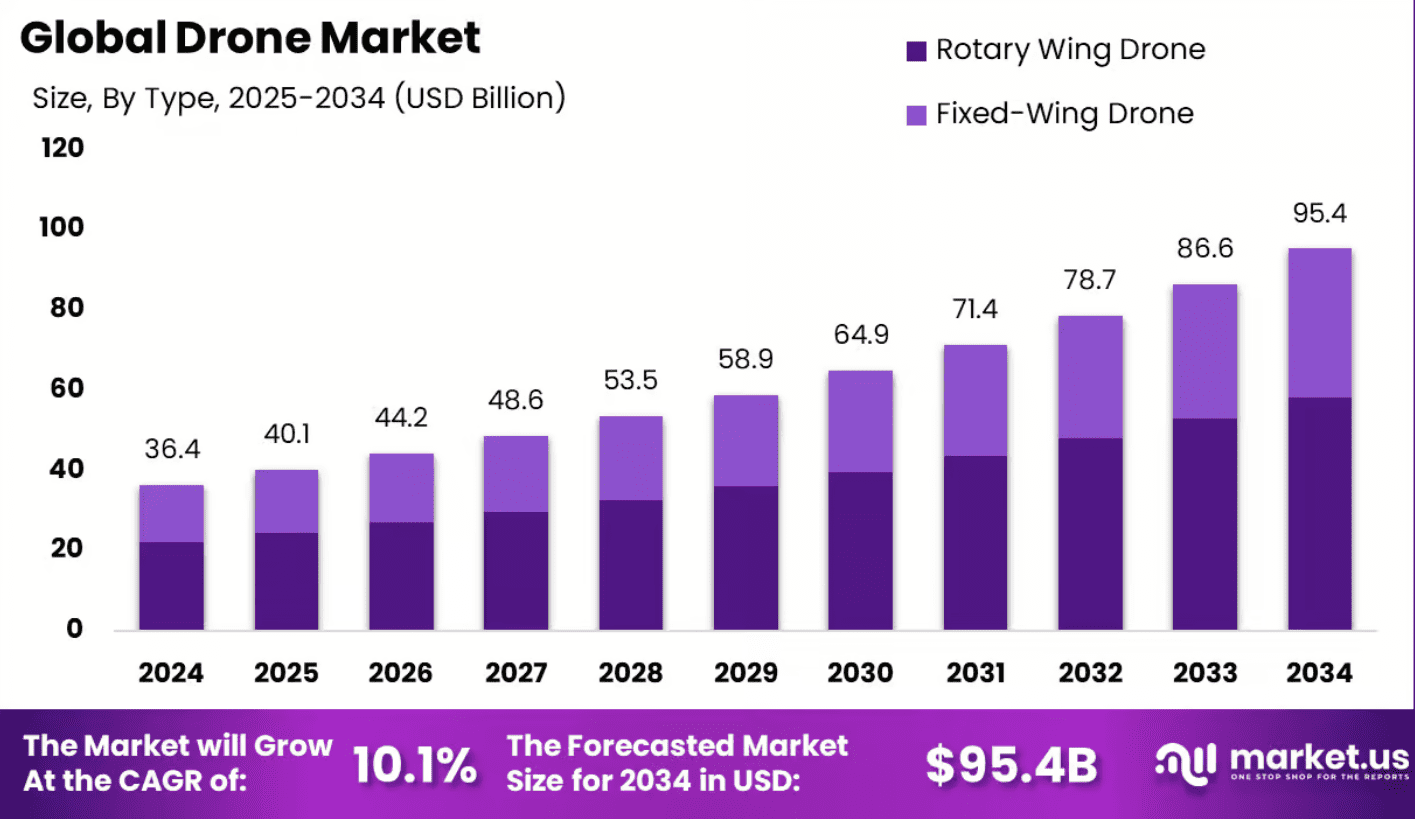

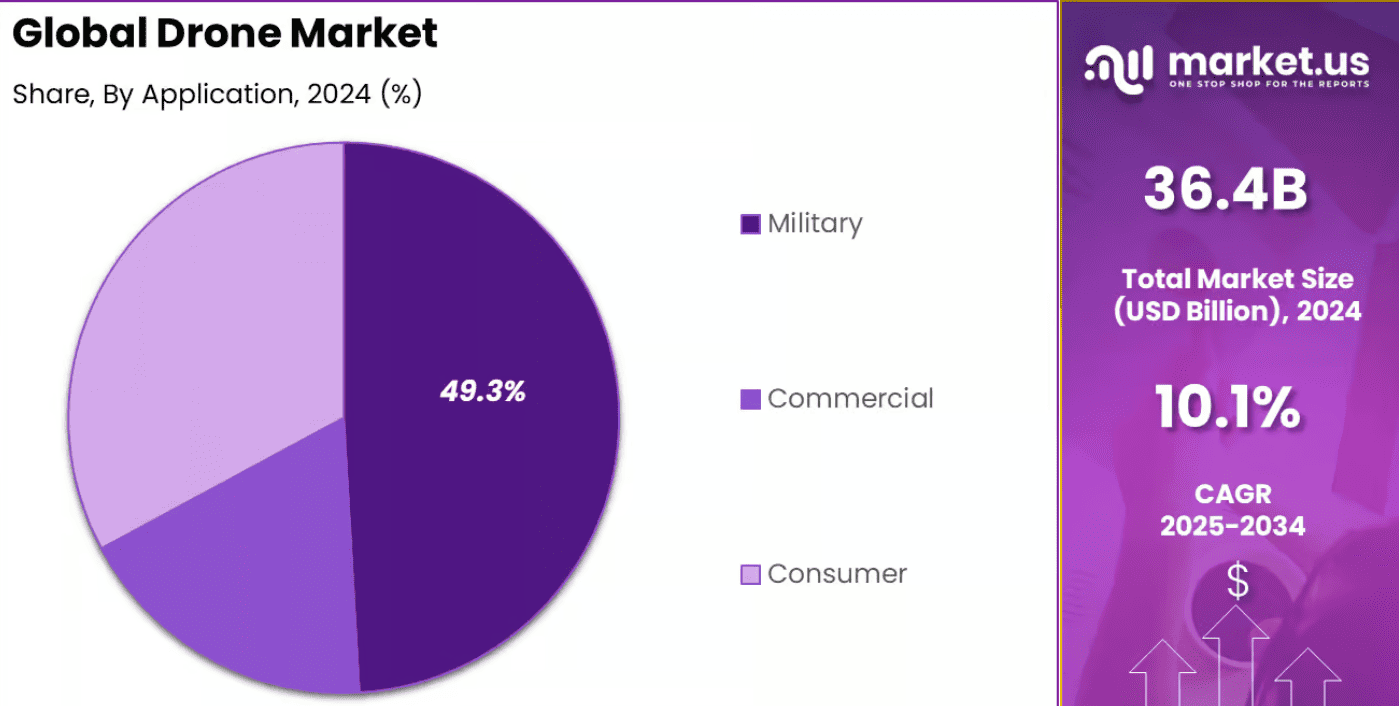

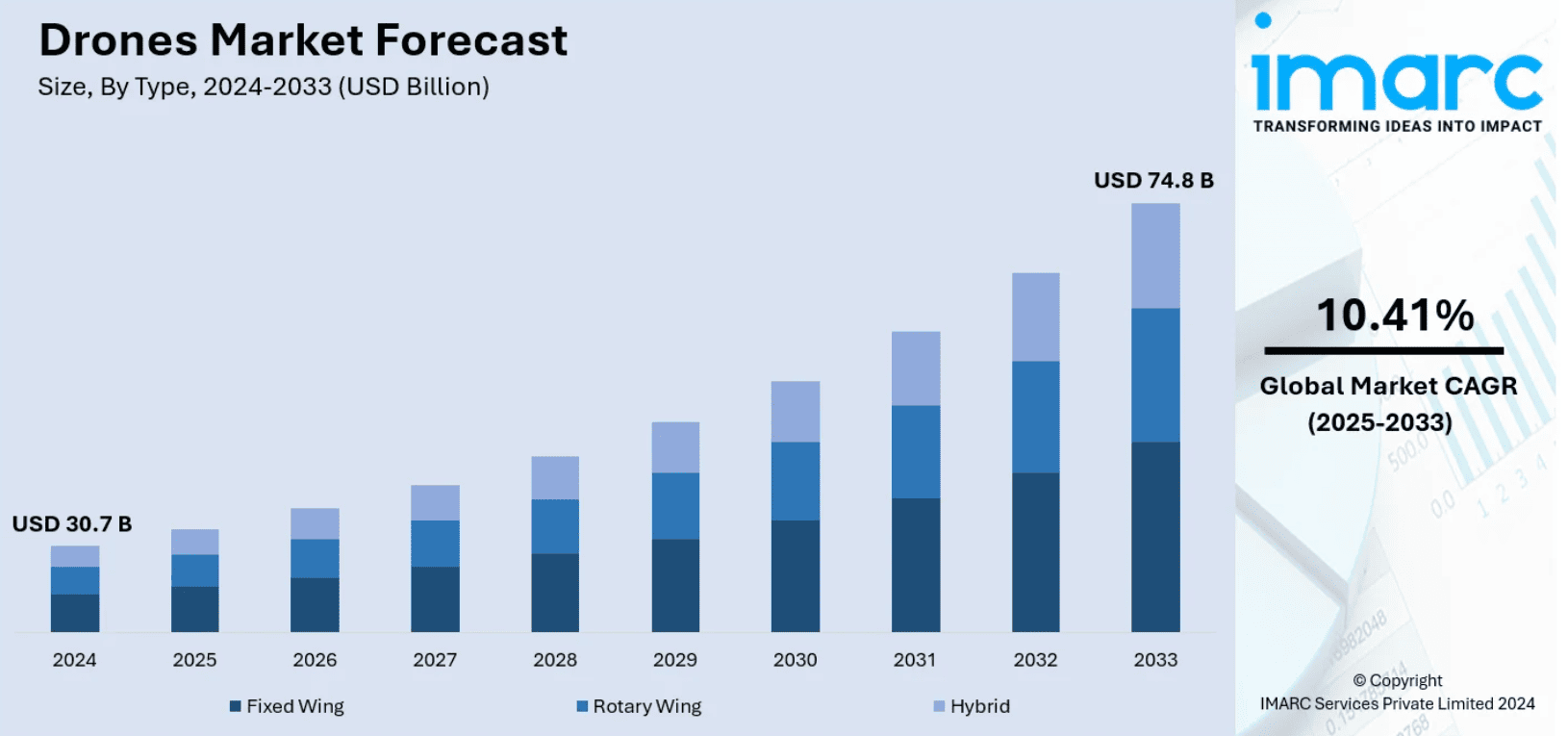

- Market Growth and Applications: The global drone market is projected to reach $63.6 billion in revenue by 2025, with a CAGR of 10.1% through 2034. Applications in agriculture (80% of future usage), logistics, and media dominate commercial growth, while military drones drive strategic investments.

- Technological Advancements: AI, IoT, and 5G integration are enhancing drone capabilities, enabling autonomous navigation and real-time data processing. Lightweight materials and battery efficiency improvements are extending flight times, particularly for fixed-wing drones, which hold a 52.5% market share.

- Regulatory Evolution: Countries like the U.S., India, and China are implementing supportive regulations to facilitate commercial drone adoption. The FAA’s Part 107 and BVLOS authorizations are expanding U.S. market opportunities.

- Geopolitical Dynamics: Drone exports by China, Turkey, and the U.S. are reshaping defense partnerships and global influence. However, tariffs and cybersecurity concerns are prompting nations to diversify supply chains.

Also read:

- 2025: The Year of AI Agents – What Are We Going to Do?

- Apple Sues YouTube Blogger John Prosser and Michael Ramachotti Over Alleged Trade Secret Theft

- Tickets for Christopher Nolan’s Odyssey Go on Sale a Year Early: Marketing Genius or Gift to Scalpers?

Conclusion

The drone industry in 2025 reflects a dynamic interplay of technological innovation, economic investment, and geopolitical strategy. China’s dominance in production volume and cost-effectiveness contrasts with the U.S.’s leadership in advanced military and commercial applications.

Emerging players like Turkey and India are leveraging indigenous capabilities to challenge established leaders, while countries like France, Germany, Japan, South Korea, Canada, and Russia contribute specialized expertise. As the global market grows, driven by AI, regulatory support, and diverse applications, the competition among these top 10 drone manufacturing countries will shape the future of this transformative technology.

**Sources**: StatRanker.org, IMF, World Bank, Statista, Drone Industry Insights, Times of India, NSIN, IMARC Group, BCC Research, MarketsandMarkets

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).