The rapid advancement of artificial intelligence is fueling an unprecedented boom in data center infrastructure, with major players racing to secure the computational power needed to train next-generation models. In November 2025, Epoch AI, a research organization focused on AI trends, launched its Frontier Data Centers Hub - a publicly accessible tracker monitoring the largest AI-focused data centers in the United States.

This tool aggregates data from satellite imagery, construction permits, and public announcements to provide insights into timelines, power capacities, and primary users. While the dataset is incomplete - focusing solely on the biggest U.S. facilities and excluding smaller or international ones - it offers a glimpse into the escalating competition among tech giants.

Peter Gostev, an AI enthusiast, recently visualized this data in a compelling animation shared on X, breaking down cumulative power capacities by month and company from January 2025 to February 2028. His work highlights dramatic shifts in leadership, driven by ambitious expansions and multi-billion-dollar investments.

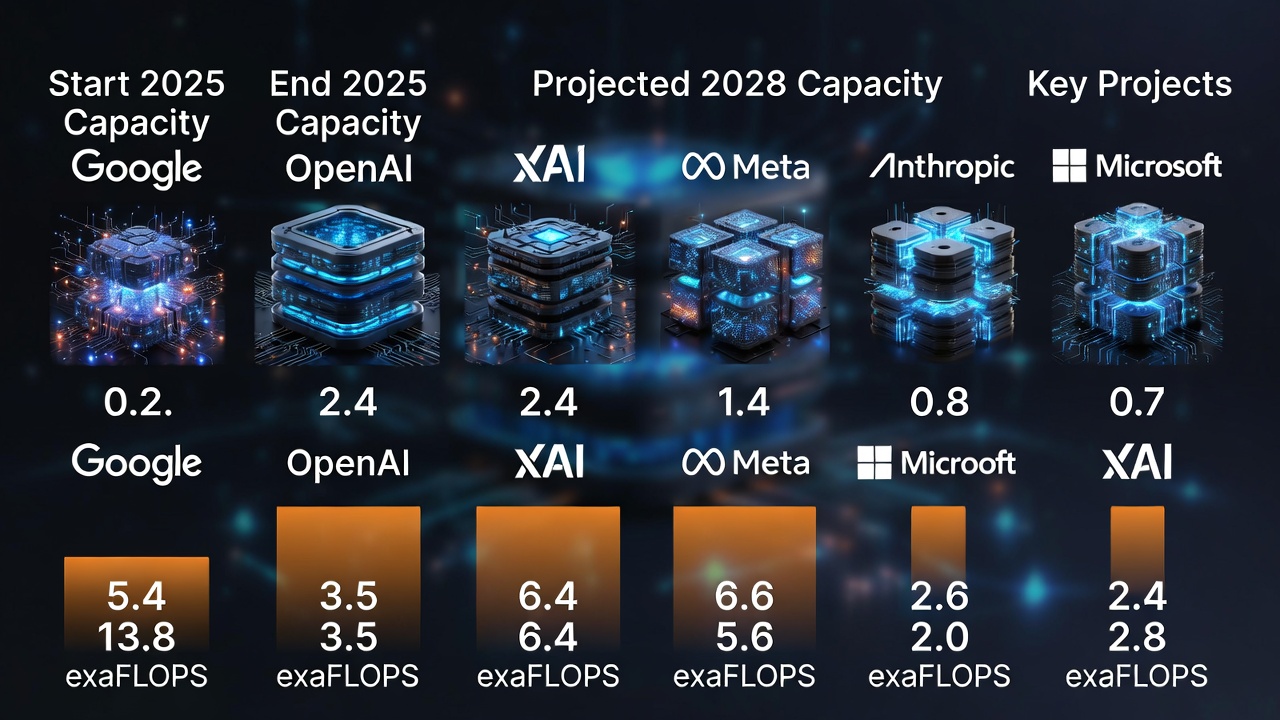

Early 2025: Google Dominates, But Gaps Persist

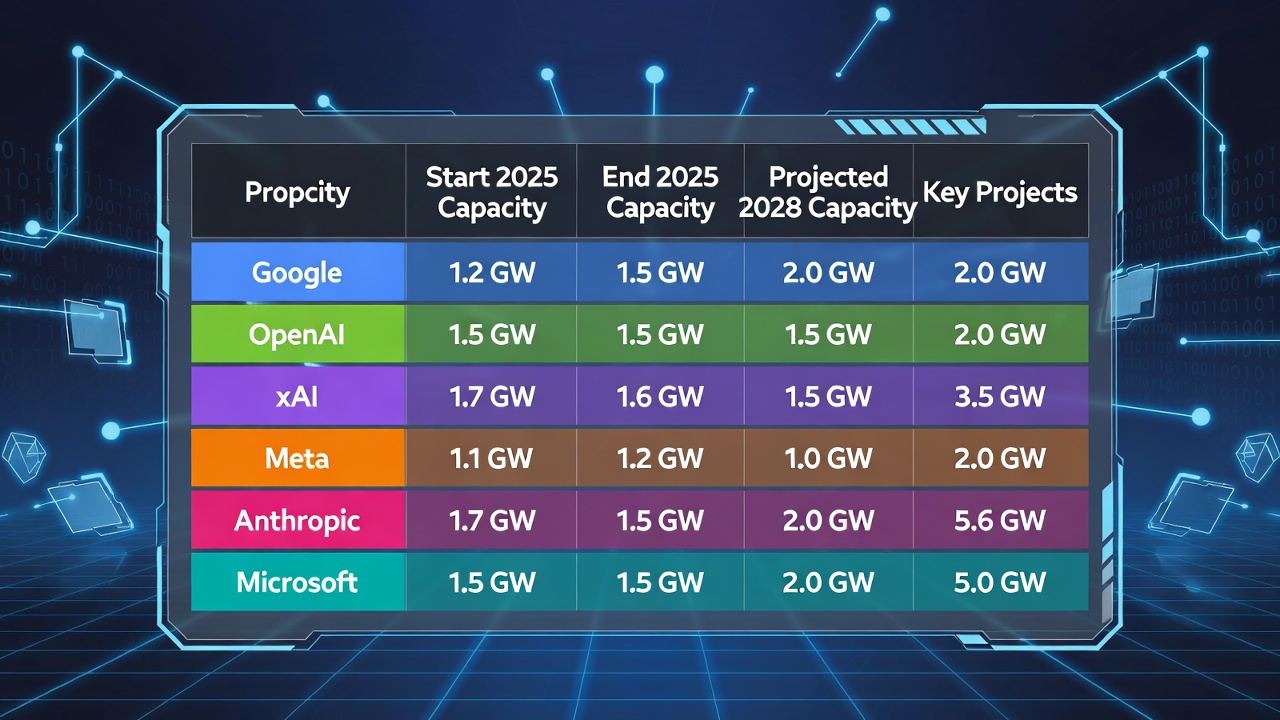

At the dawn of 2025, Google held a commanding lead in tracked data center capacity, boasting approximately 696 MW - more than quadruple OpenAI's 174 MW and Meta's 249 MW, according to Epoch AI's snapshots.

At the dawn of 2025, Google held a commanding lead in tracked data center capacity, boasting approximately 696 MW - more than quadruple OpenAI's 174 MW and Meta's 249 MW, according to Epoch AI's snapshots.

Anthropic and Microsoft registered zero in the tracker, underscoring its limitations: it only captures standalone large-scale projects, missing integrated or smaller facilities. For context, Microsoft's overall data center investments are massive; the company is on track to spend $80 billion in fiscal year 2025 on AI-enabled infrastructure alone.

xAI's entry disrupted this landscape mid-year. In September 2024, Elon Musk's startup launched Colossus-1, a supercomputer cluster in Memphis, Tennessee, initially powered by 100,000 Nvidia H100 GPUs and consuming about 150 MW. Remarkably built in just 122 days, it was doubled to 200,000 GPUs by early 2025, pushing its power draw to around 250 MW.

This vaulted xAI into second place, surpassing Meta and trailing only Google. xAI has since acquired a 1 million square foot site for a second Memphis facility, with plans to scale Colossus to 1 million GPUs and up to 1.2 GW in total capacity.

End of 2025: Anthropic Surges Ahead

By December 2025, the standings flipped dramatically. Anthropic emerged as the leader, thanks to a recent $50 billion investment in U.S. AI infrastructure announced in November. Partnering with Fluidstack, the company is building new data centers in Texas and New York, bolstering its capacity to train advanced models like Claude. This move, part of a broader expansion, positions Anthropic neck-and-neck with Google and OpenAI by year-end, while Meta lags behind xAI.

Gostev's visualization shows Anthropic's bar towering over competitors in late 2025, reflecting these fresh additions. However, the tracker's U.S.-centric focus means global efforts - such as Google's planned AI data center hub in Visakhapatnam, India, as part of a $15 billion investment from 2026 onward - are not included.

2026 and Beyond: OpenAI's Projected Dominance

The real escalation begins in 2026. In April, OpenAI is slated to activate Fairwater Mount in Wisconsin, a key component of its Stargate supercomputer project with Microsoft. This $15 billion, four-building campus in Mount Pleasant is expected to approach 1 GW in capacity, with 70% allocated to AI operations and the rest supporting local energy needs. Construction is set to complete by 2028, but early phases will propel OpenAI to the top spot.

The real escalation begins in 2026. In April, OpenAI is slated to activate Fairwater Mount in Wisconsin, a key component of its Stargate supercomputer project with Microsoft. This $15 billion, four-building campus in Mount Pleasant is expected to approach 1 GW in capacity, with 70% allocated to AI operations and the rest supporting local energy needs. Construction is set to complete by 2028, but early phases will propel OpenAI to the top spot.

From there, OpenAI maintains leadership through February 2028, ending with a staggering lead—potentially more than Meta and Anthropic combined, if all projections hold.

Epoch AI anticipates five data centers hitting 1 GW each in 2026 alone, underscoring the industry's gigawatt-scale ambitions. Stargate itself is part of a $500 billion, 10 GW national expansion by OpenAI, Oracle, and partners, with sites added in September 2025 to meet targets ahead of schedule.

To grasp the scale:

- OpenAI starts 2025 with roughly 174 MW (per tracker visuals) but ends at nearly 1 GW - a nearly 6x increase, supplemented by rumors that fine-tuning for models like GPT-5.2 may have utilized early Stargate resources.

- By August 2026, capacity triples, potentially enabling training of unprecedented "gigantic" AI systems.

- Come spring 2028, another tripling pushes OpenAI beyond 9 GW in tracked power, dwarfing rivals.

Meta, meanwhile, is investing $10 billion in a Louisiana AI data center, projected to be among the world's largest once operational. Microsoft continues its Fairwater buildout, while global projections from S&P Global estimate U.S. data center demand reaching 75.8 GW in 2026 and 108 GW by 2028.

Broader Implications and Caveats

This data center arms race represents one of history's largest infrastructure endeavors, with Big Tech - Meta, Alphabet (Google), Amazon, and Microsoft - poised to pour over $750 billion into AI over the next two years. Globally, 10 GW of new capacity is expected to break ground in 2025, with AI driving 33% of worldwide data center usage.

Yet, challenges loom: power grid strains, funding uncertainties (data center deals hit $61 billion in 2025 amid investor concerns), and environmental impacts. Epoch AI's hub notes its incompleteness, emphasizing U.S. focus and reliance on public data, which may delay or overlook shifts.

As Gostev's timeline illustrates, 2026 marks a tipping point with massive capacity influxes, but OpenAI's long-term edge hinges on execution. Skeptics question if all plans will materialize, given supply chain hurdles and regulatory scrutiny. Nonetheless, this tracker and visualizations like Gostev's demystify the opaque world of AI compute, revealing a future where power - literally - defines progress.

Also read:

- How an Indie Startup's Motion Console Outsold Xbox: Nex Playground's Meteoric Rise

- Microdramas Enter the Classroom: How US Universities Are Adapting to the Short-Form Storytelling Revolution

- Brazil Forces Apple to Open Its Walled Garden: A Deep Dive into the CADE Settlement and Global Antitrust Trends

Thank you!