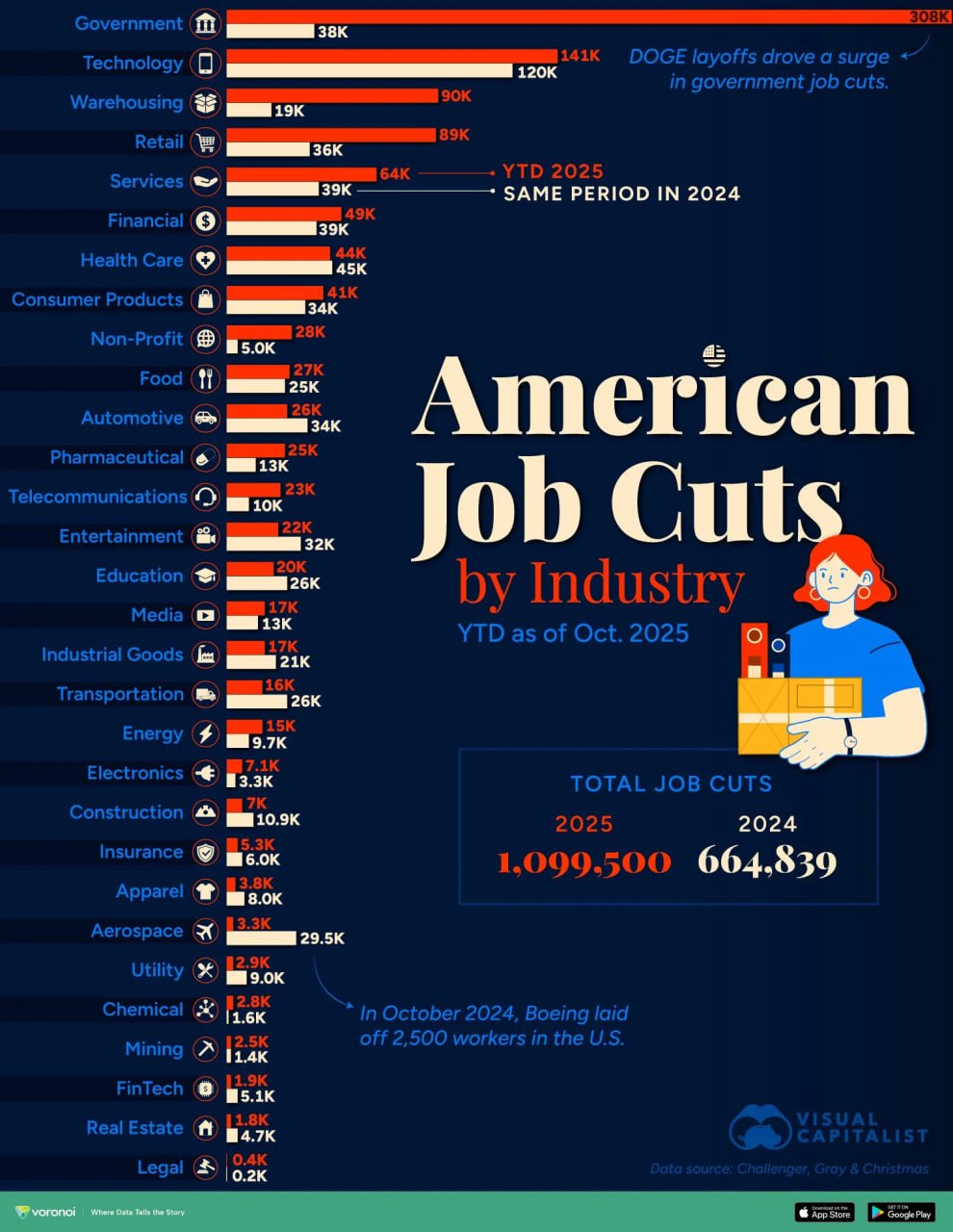

As 2025 draws to a close on December, the United States stands at a peculiar economic crossroads - one where the stock market dances on record highs amid a labor market echoing the ghosts of the Great Recession. Through November, U.S. companies announced a staggering 1,170,821 layoffs, a 54% surge from the same period in 2024 and the highest tally since the depths of the 2009 financial crisis.

This "forever layoffs" phenomenon - characterized by rolling, smaller-scale cuts rather than dramatic one-offs - has reshaped white-collar work, with tech alone shedding over 150,000 jobs as AI automates routine tasks.

This "forever layoffs" phenomenon - characterized by rolling, smaller-scale cuts rather than dramatic one-offs - has reshaped white-collar work, with tech alone shedding over 150,000 jobs as AI automates routine tasks.

Meanwhile, Gen Z college graduates are navigating what experts call the toughest entry-level market in decades: Job postings on platforms like Handshake plummeted 16% year-over-year from August 2024 to 2025, while applications per role spiked 26%, leaving over 60% of the class of 2026 pessimistic about their prospects. Half of employers now deem the entry-level landscape "poor" or "fair," per the National Association of Colleges and Employers.

Contrast this with the euphoric ascent of equities. The S&P 500 closed at 6,827.41 on December 12 - up 0.2% for the day and on pace for a third straight year of double-digit gains, with the index soaring 92% since the bull market's onset. It notched a fresh record on December 11, propelled by non-tech stalwarts like Visa and Home Depot, while the Dow surged 1.3% to another all-time high.

U.S. GDP, meanwhile, is tracking above 3% for the year, outpacing most forecasts, though roughly half of that expansion stems from unprecedented AI-fueled investments in data centers, chips, and models - trillions poured into infrastructure that promises productivity miracles but delivers few immediate jobs. (Note: Detailed FT data on AI's GDP slice was limited, but broader analyses confirm tech capex as a key driver, with the Chicago Fed estimating a 60-basis-point GDP boost from recent investments.)

This chasm - labor contracting like 2008, assets inflating like the roaring '20s - is no anomaly. It's the vanguard of a structural post-labor transition, where human toil yields to silicon and steel, reshaping everything from boardrooms to ballot boxes.

The Automation Avalanche: From Code to Cobots

At its core, 2025's divergence signals the dawn of an economy untethered from traditional labor inputs. Trillions in AI capital - fueled by hyperscalers like Amazon and Microsoft - have already erected data empires, but the real disruption looms in deployment. Goldman Sachs projects AI could displace 300 million full-time jobs globally by 2030, equivalent to 9.1% of the workforce, with a baseline 6-7% U.S. hit translating to a half-point unemployment spike during the transition.

At its core, 2025's divergence signals the dawn of an economy untethered from traditional labor inputs. Trillions in AI capital - fueled by hyperscalers like Amazon and Microsoft - have already erected data empires, but the real disruption looms in deployment. Goldman Sachs projects AI could displace 300 million full-time jobs globally by 2030, equivalent to 9.1% of the workforce, with a baseline 6-7% U.S. hit translating to a half-point unemployment spike during the transition.

The World Economic Forum echoes this, forecasting 92 million jobs displaced by 2030 against 170 million created - a net gain of 78 million, but skewed toward high-skill roles in AI, big data, and cybersecurity. Entry- and mid-level digital work - think data entry, basic analysis, and customer service - faces the brunt, with PwC estimating up to 30% of jobs automatable by the mid-2030s.

Scale this forward: Expect progressive U.S. displacements starting at ~10 million annually in 2026, ballooning to 100 million globally per year by the 2035-2045 horizon, per aggregated forecasts from McKinsey (14% global career shifts by 2030) and IMF (300 million affected). A CNBC survey of HR leaders reveals 89% anticipate AI impacting jobs in 2026, with 45% eyeing cuts to nearly half their workforce - not for efficiency alone, but amid broader cost pressures.

Physical labor follows suit. By 2029, robotics will hit economic viability for routine, mid-to-high-wage tasks in professional services, manufacturing, emergency response, and logistics. Citi Global Perspectives forecasts 1.3 billion AI-enabled robots by 2035 (rising to 4 billion by 2050), with humanoids alone penetrating 30% of industrial roles in developed markets. Global installations already doubled to 542,000 in 2024, projected to top 700,000 by 2028, per the International Federation of Robotics - addressing shortages in aging economies like the U.S. and Japan. Payback periods for humanoids? As low as 3.8 weeks against U.S. factory wages, per Citi, versus months for earlier models.

Near-Term Turbulence: Efficiency Gains, Asset Bubbles, and Bailouts

What unfolds macroeconomically? A cocktail of accelerated corporate streamlining and monetary mischief. Layoff velocity will spike—November's 71,321 cuts were the highest monthly since 2022—driving operational efficiencies as firms "do more with less." Equities?

What unfolds macroeconomically? A cocktail of accelerated corporate streamlining and monetary mischief. Layoff velocity will spike—November's 71,321 cuts were the highest monthly since 2022—driving operational efficiencies as firms "do more with less." Equities?

UBS pegs the S&P at 7,700 by end-2026 (a 12% climb from today), buoyed by 10% EPS growth to $305, Magnificent 7 dominance, and AI revenue surges - sidestepping corrections via FOMO and capex waves. J.P. Morgan concurs: Post-rate-cut growth hits 2.25% in 2026, with AI as a "second engine" offsetting consumer slowdowns.

To cushion the blow, expect QE redux: The Fed's December pivot - median dot signaling one 2026 cut—ushers $13.5 billion in bank liquidity, but a fraying jobs market (unemployment steady at 4.5%) demands more to avert unrest.

This deluge spills sideways: Crypto's $3.01 trillion cap, down 5.2% weekly, absorbs overflow amid its own paradigm shift - from hype to utility, with stablecoins at $27 trillion annually and DeFi TVL above $100 billion. Bitcoin's volatility ($86K base) persists, untethered from fundamentals, as regulatory tailwinds like the GENIUS Act funnel institutional cash.

Socially? Online vitriol from socialists, the jobless, and communists escalates - echoing Portland's 2020 unrest - but fades into adaptation, with "burned police cars" as footnotes. Dollar devaluation accelerates (exported via AI sales to China/EU), concentrating wealth in Mag7 and data lords while consumer purchasing power erodes. Tech deflation (cheaper software/services) offsets some pain, but margins swell and dividends... well, tech's still stingy.

Horizon Scan: UBI Experiments, Borders, and Ideological Upheaval

Longer-term, the vectors point to reinvention. Fiscal overhauls test UBI variants - universal, corporate-subsidized, or goods-tied - pivoting from labor-centric taxes to capital/tech levies, with second-order ripples (e.g., innovation incentives) murky.

Longer-term, the vectors point to reinvention. Fiscal overhauls test UBI variants - universal, corporate-subsidized, or goods-tied - pivoting from labor-centric taxes to capital/tech levies, with second-order ripples (e.g., innovation incentives) murky.

Regulators wrestle unemployment via "make-work" mandates, birthing absurd employment models. Immigration? Halted in tech havens; migrants lose appeal when LLMs outpace low-wage labor. Emerging markets? Obsolete - Bangladesh's cheap hands can't compete with $7.25/hour bots.

Politically, neo-Luddites ("Smash the servers!"), bureaucrats ("Regulate the bots!"), transhumanists ("Upload us all!"), and e-anarchists ("ChatGPT for Congress!") clash, fracturing the Overton window.

P.S.: This isn't prophecy - it's trajectory. For personal navigation, game out 3-4 scenarios: (1) Smooth AI diffusion (net 78M jobs by 2030, UBI lite); (2) Stalled rollout (prolonged stagnation, 14M net loss); (3) Robotics boom (4B units by 2050, physical UBI); (4) Backlash quake (regulatory freeze, 3% GDP drag). Hedge accordingly: Upskill in human-AI symbiosis, diversify assets, and watch the vectors. The post-labor world isn't coming - it's here.

Also read:

Also read:

- From Fortress of IP to AI Playground: Disney's $1 Billion Leap into OpenAI's Sora Universe

- BritCard Blues: Britain's Digital ID Dream Sparks a 2.9 Million-Strong Orwellian Nightmare

- The Quiet Colonization: How AI Is Rewriting the Way Humans Speak, Think, and Eventually Are

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.