The cryptocurrency market has been a whirlwind this December, with Bitcoin swinging wildly from sub-$85,000 lows to a fleeting $91,000 high in a matter of days. Liquidations topped $608 million in a single 24-hour span, and the Crypto Fear & Greed Index plunged to an "Extreme Fear" reading of 23/100 - levels not seen since the early 2022 bear market.

Conspiracy theories abound, from shadowy regulatory whispers to overleveraged whales dumping positions, while technical analysts point to overbought RSI signals and a strengthening correlation with volatile AI stocks. But as Ilya Sutskever might quip (in that delightfully casual "people on Twitter" vein), the truth likely sits in the messy middle: a sector outgrowing its speculative adolescence and grappling with the growing pains of maturity.

Conspiracy theories abound, from shadowy regulatory whispers to overleveraged whales dumping positions, while technical analysts point to overbought RSI signals and a strengthening correlation with volatile AI stocks. But as Ilya Sutskever might quip (in that delightfully casual "people on Twitter" vein), the truth likely sits in the messy middle: a sector outgrowing its speculative adolescence and grappling with the growing pains of maturity.

As of mid-December 2025, the total crypto market cap hovers around $3.01 trillion, down 5.2% in the past week amid broader risk-off sentiment tied to U.S. Federal Reserve signals on potential rate cuts and quantitative tightening's end - infusing $13.5 billion into banks but not yet trickling into digital assets. Yet beneath the turbulence, a seismic shift is underway.

Crypto is decoupling from pure hype, transitioning from a casino of token launches and Twitter buzz to a landscape where real revenue, user growth, and product velocity are starting to matter. The "token premium" - that magical markup for merely existing on a Layer-1 or riding a viral narrative - is evaporating, replaced by something alien to most projects: actual economics.

The Reckoning: Overvalued Hype Meets Harsh Realities

This maturation isn't gentle. Expect a brutal revaluation of multiples, with 95% of projects facing 3x+ haircuts as market caps compress to reflect fundamentals. Take Story Protocol ($IP), a Layer-1 blockchain aimed at tokenizing intellectual property for AI and creators. As of December 13, 2025, its market cap sits at $640 million with a fully diluted valuation (FDV) of $2.04 billion and a token price of $1.89 - down 6.95% in the last 24 hours amid $28 million in trading volume.

But here's the kicker: daily revenue hovers around a paltry $60, barely enough to cover a team's coffee budget, let alone sustain a billion-dollar ecosystem. Earlier peaks saw $IP hit $14.78 in September, buoyed by $216 million in funding from backers like a16z, but the disconnect between valuation and utility is glaring. Institutional interest, like Heritage Distilling's $82 million token allocation in August, provided a brief lift, yet without scalable revenue from licensing fees or staking, it's a house of cards.

But here's the kicker: daily revenue hovers around a paltry $60, barely enough to cover a team's coffee budget, let alone sustain a billion-dollar ecosystem. Earlier peaks saw $IP hit $14.78 in September, buoyed by $216 million in funding from backers like a16z, but the disconnect between valuation and utility is glaring. Institutional interest, like Heritage Distilling's $82 million token allocation in August, provided a brief lift, yet without scalable revenue from licensing fees or staking, it's a house of cards.

Near Protocol offers another cautionary tale. With a $2.11 billion market cap and $1.65 token price, NEAR boasts impressive tech - Nightshade sharding for scalability and AI-native intents - but fundamentals lag. Monthly active users peaked at 46 million in May 2025, yet DeFi TVL lingers at $132.89 million, dwarfed by Ethereum's $66.2 billion.

Q3 revenue clocked in at just $805,614 (down 0.8% quarter-over-quarter), driven by transaction fees averaging $0.0019. No meaningful user monetization, no dividends - just promises of chain abstraction and cross-chain magic that haven't yet translated to the balance sheet. This isn't isolated; it's the norm for the vast majority of the 10,000+ tokens cluttering exchanges.

The fallout? A capitulation event where 95% of projects shed 90%+ of value. But don't panic—this won't crater the overall market. As DeFi TVL across protocols like Aave and Morpho holds steady above $100 billion, the dead weight simply floats away, clearing space for survivors.

The Silver Lining: Explosive Growth from Real-World Rails

Paradoxically, this purge coincides with crypto's most blistering expansion yet. Stablecoins, the unglamorous backbone of programmable money, are exploding as every fintech giant piles in.

Paradoxically, this purge coincides with crypto's most blistering expansion yet. Stablecoins, the unglamorous backbone of programmable money, are exploding as every fintech giant piles in.

Transactions hit $27 trillion annually by late November 2025, underscoring their role in cross-border efficiency.

Klarna, the buy-now-pay-later behemoth once led by a crypto-skeptic CEO, flipped the script on November 25 with KlarnaUSD - a dollar-backed stablecoin built on Stripe's Bridge infrastructure and set for Tempo mainnet launch in 2026.

It's a testing-ground play for cheaper global payments, partnering with Privy for user-friendly wallets to onboard millions.

X (formerly Twitter) isn't far behind. Elon Musk's "everything app" vision inches closer with X Money, a payments platform teased for 2025 rollout.

A December job posting for a Technical Lead in Palo Alto hints at the scale: building scalable infrastructure for 600 million+ monthly users, emphasizing distributed systems, cryptographic transactions, and high availability.

"You'll apply your expertise in distributed systems, cryptography, transactions, and high-availability architectures to build a robust, scalable payments infrastructure," it reads - a foundational product at the fintech-social nexus, enabling money movement, payments access, and new digital experiences.

"You'll apply your expertise in distributed systems, cryptography, transactions, and high-availability architectures to build a robust, scalable payments infrastructure," it reads - a foundational product at the fintech-social nexus, enabling money movement, payments access, and new digital experiences.

Whispers from insiders and code leaks suggest crypto integration, possibly a native stablecoin like "xUSD" or USDC rails, aligning with Musk's Dogecoin affinity and SpaceX's Tether hedges. CEO Linda Yaccarino confirmed at CES 2025: "Buckle up - payments and creator opportunities are coming."

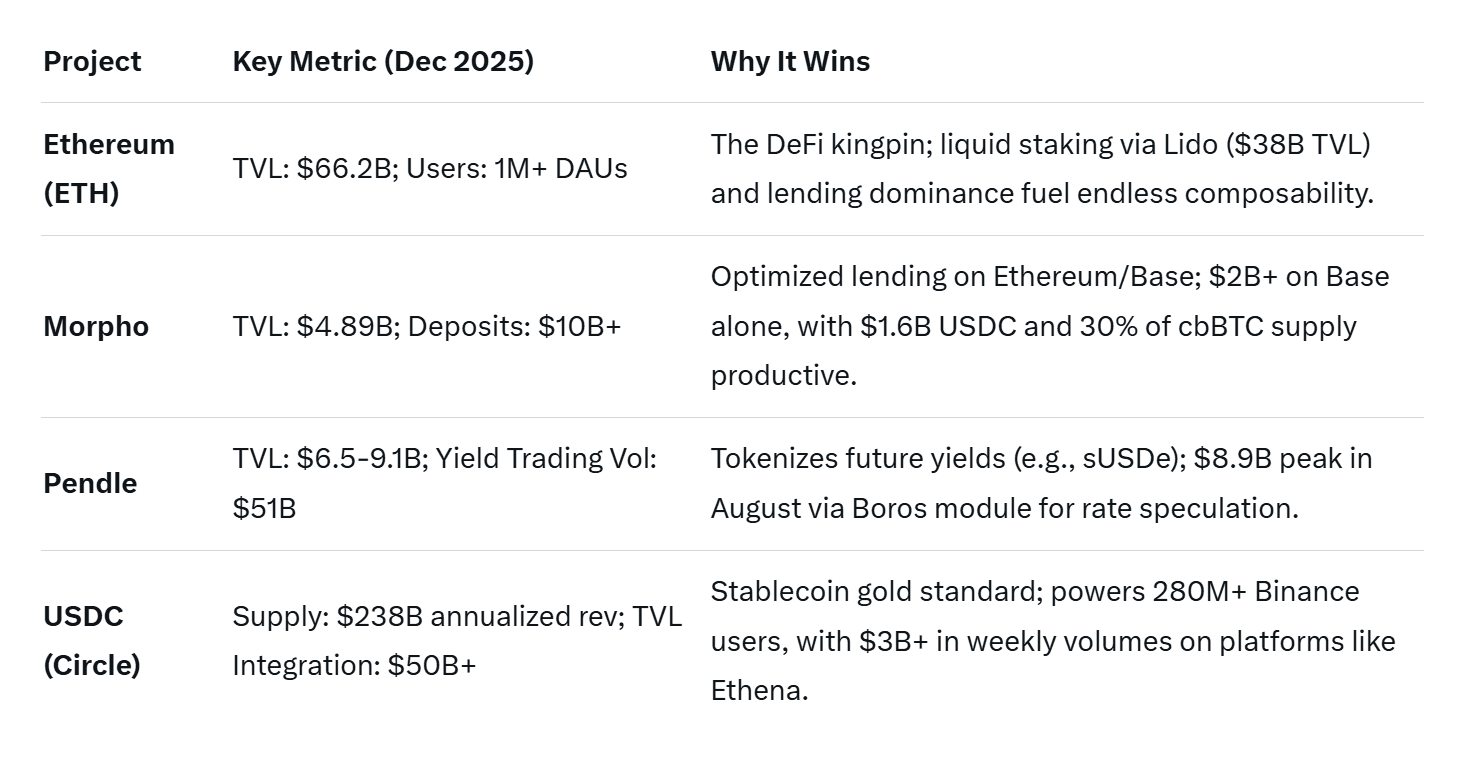

This isn't hype; it's infrastructure. The U.S. GENIUS Act and EU MiCA have flipped regulatory headwinds into tailwinds, boosting institutional confidence. AI agents and machine-to-machine payments will supercharge demand, with stablecoins as the only permissionless medium. Winners? The 0.1% with proven TVL, turnover, and users:

These aren't gambles - they're utilities. As agentic AI economies demand programmable dollars, expect TVL to balloon, with Pendle's yield markets alone hitting $4B on stablecoin primitives like Ethena's sUSDe.

The Enduring Allure of Gamblification: Attention's New Currency

Here's the controversial bit: Crypto's "gamblification" - that chaotic alchemy turning memes, DAOs, and gaming tokens into viral slot machines - won't fade. In a post-scarcity, post-labor world, attention is the scarcest resource, and financializing it (ideas, narratives, time, even people) is no fad. Gambling has hooked humans since antiquity; crypto just digitizes it with skin-in-the-game stakes.

Here's the controversial bit: Crypto's "gamblification" - that chaotic alchemy turning memes, DAOs, and gaming tokens into viral slot machines - won't fade. In a post-scarcity, post-labor world, attention is the scarcest resource, and financializing it (ideas, narratives, time, even people) is no fad. Gambling has hooked humans since antiquity; crypto just digitizes it with skin-in-the-game stakes.

Enter Pump.fun, Solana's meme launchpad that's redefined creator economies. Relaunched livestreaming in early 2025 with Project Ascend - a dynamic fee model sharing up to 1% of token market caps with streamers - has minted "creator coins" as a category. In September, it raked $2 million in daily fees (20x average), with creators pocketing $20 million in a record week.

Tokens like BunCoin hit $262,000 peaks via absurd streams (e.g., "hard-mode raids" at ballparks or gym slap-fests), while pros like ex-League player BunnyFuFuu earned $243,600 in days. Cumulative creator income? $19.3 million, with $PUMP's market cap at $8 billion. It's raw: 24/7 reality TV fused with token pumps, overtaking Rumble in streams and grabbing 1% of Twitch's share.

Serious crypto (lending rails, stablecoins) and this spectacle share little beyond cryptography and programmable incentives. One builds plumbing; the other monetizes dopamine. But both thrive in the same ecosystem.

Looking Ahead: Decoupling, Discipline, and Bitcoin's Wild Card

2025 closes with crypto at an inflection: "Serious" assets decouple, shedding speculative chaff for quant rigor - think discounted cash flows over FOMO multiples, with protocols like Aave's $50B TVL as benchmarks. The X Money hiring spree exemplifies this: Not just payments, but a bridge to billions via crypto-native tools.

Yet Bitcoin? It's the outlier. At ~$86,000, it could crater to $1,000 or moon to $1 million on ETF flows or halvings - product be damned. Its "digital gold" narrative endures, untethered from revenue.

Crypto's fever isn't ending; it's evolving. Hype dies, but utility - and a dash of chaos - endures. Buckle up: 2026's fundamentals will reward the builders, not the shillers.

Also read:

- From Fortress of IP to AI Playground: Disney's $1 Billion Leap into OpenAI's Sora Universe

- OpenAI's GPT-5.2 Revolution: Empowering Professionals with Frontier AI Intelligence

- Michael Saylor's Audacious Bitcoin Gambit: A Pledge to Absorb the Entire Supply and Lock It Away

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).