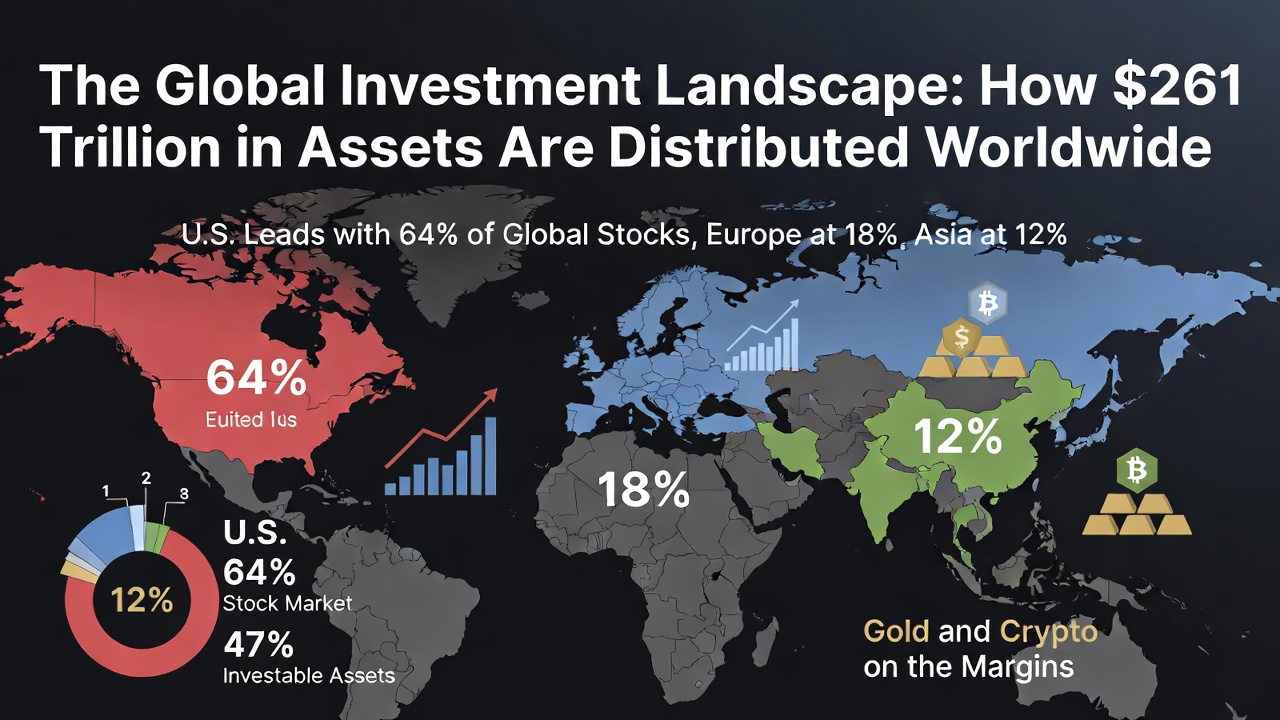

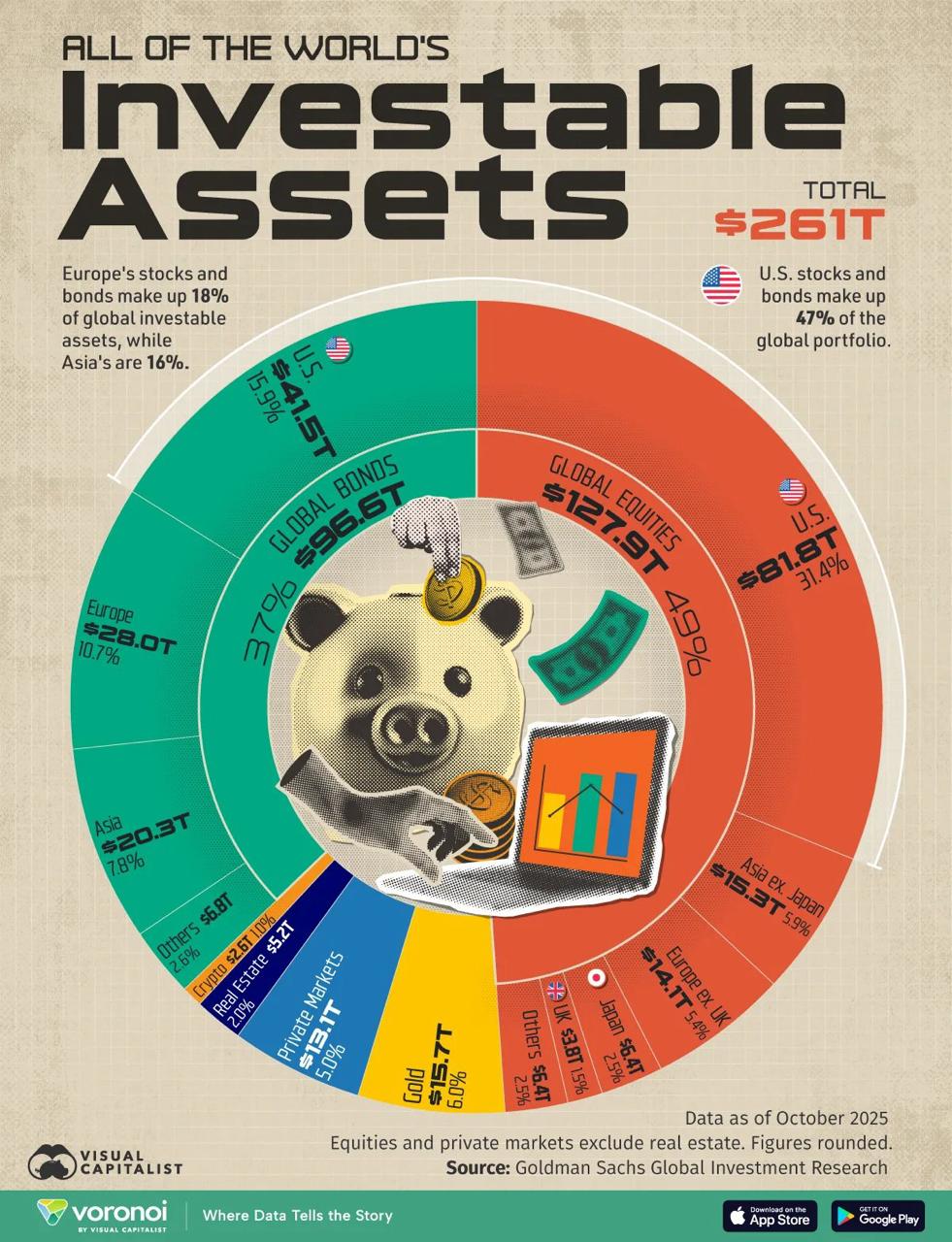

As of early 2026, the world's investable assets — encompassing stocks, bonds, gold, cryptocurrencies, and other instruments — total approximately $261 trillion. This staggering figure reflects the immense scale of global finance, where capital flows shape economies, influence policies, and drive innovation.

Yet beneath the headline number lies a story of concentration, regional disparities, and evolving trends. Drawing on recent analyses from financial institutions and market data, this article breaks down the distribution of these assets, highlighting the dominance of certain markets and the implications for investors.

Stocks: The Engine of Growth, Led by the U.S.

Equities represent the largest slice of the global pie, with the total value of world stocks reaching $127.9 trillion. This asset class captures corporate ownership and growth potential, making it a cornerstone for long-term wealth building.

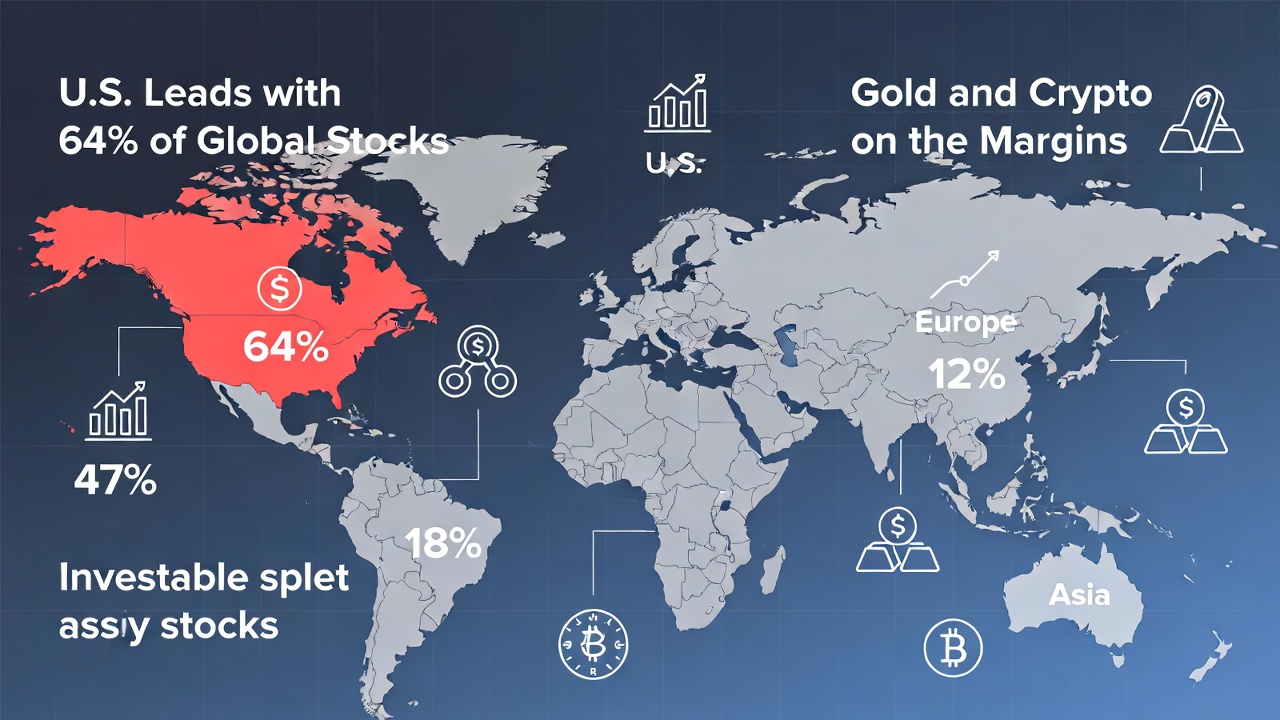

The United States stands out as the undisputed leader: the U.S. stock market accounts for 64% of global equity capitalization. Powerhouses like the S&P 500 and Nasdaq, home to tech giants such as Apple, Microsoft, and Nvidia, have benefited from innovation, strong corporate earnings, and investor confidence.

The United States stands out as the undisputed leader: the U.S. stock market accounts for 64% of global equity capitalization. Powerhouses like the S&P 500 and Nasdaq, home to tech giants such as Apple, Microsoft, and Nvidia, have benefited from innovation, strong corporate earnings, and investor confidence.

This dominance underscores America's role as a hub for high-growth sectors like technology and AI, where valuations have soared amid post-pandemic recovery and monetary policies.

Beyond the U.S., the picture is more fragmented. Europe and Asia contribute significantly but lag in relative terms, with emerging markets showing varied performance (more on that below).

Bonds: Stability with a Western Tilt

Fixed-income securities, primarily bonds, provide a counterbalance to stocks' volatility, offering steady income through interest payments. The global bond market is valued at $96.6 trillion, emphasizing its role in funding governments, corporations, and infrastructure.

Here again, the U.S. leads with a 43% share, driven by the depth of its Treasury market and corporate debt issuance. Europe follows closely at 29%, bolstered by sovereign bonds from stable economies like Germany and France, as well as the eurozone's integrated financial system. This Western concentration reflects investor preferences for perceived safety and liquidity in developed markets.

The Broader Portfolio: U.S. and Europe Dominate

When combining stocks and bonds — the core of most investment portfolios — the U.S. holds 47% of the world's investable assets. This commanding position highlights America's financial hegemony, supported by robust institutions, innovation ecosystems, and the dollar's reserve currency status.

When combining stocks and bonds — the core of most investment portfolios — the U.S. holds 47% of the world's investable assets. This commanding position highlights America's financial hegemony, supported by robust institutions, innovation ecosystems, and the dollar's reserve currency status.

Europe, encompassing the EU and UK, claims about 18% — a respectable but secondary role, constrained by slower growth and regulatory fragmentation.

Asia excluding Japan accounts for just 12%, despite the region's population and economic dynamism. This underrepresentation points to challenges like market accessibility, geopolitical risks, and varying development levels.

Within Asia, growth trajectories diverge sharply. India's equity market has expanded at an average annual rate of 16% over the past five years, fueled by digital transformation, demographics, and reforms. In contrast, China's market grew at only 2.8% annually, hampered by regulatory crackdowns, real estate woes, and trade tensions. These disparities illustrate how local policies can amplify or mute global trends.

Alternative Assets: Gold and Crypto on the Margins

Beyond traditional securities, alternatives add diversification. Gold, valued at $15.7 trillion, comprises about 6% of global assets. As a hedge against inflation and uncertainty, its appeal surged during 2025's volatile markets, with holdings in ETFs and central banks driving much of the value.

Cryptocurrencies, meanwhile, remain a niche player at roughly 1% or $2.6 trillion. Bitcoin and Ethereum dominate, but the sector's volatility — amplified by regulatory scrutiny and speculative bubbles — keeps it from mainstream integration. Still, crypto's growth from near-zero a decade ago signals its potential as a digital alternative.

Also read:

- NVIDIA Unveils Earth-2: The World's First Fully Open, Accelerated AI Weather & Climate Platform

- Tencent's HunyuanImage 3.0-Instruct: The Thinking Multimodal Model That Redefines Precise Image Editing

- AI Turns Scientists into "Paper Factories": Productivity Soars, But Discovery Flattens

Implications for Investors and the Global Economy

This $261 trillion distribution reveals a world of imbalances: heavy U.S. reliance, European steadiness, and Asian potential tempered by uneven progress. For investors, it underscores the benefits of global diversification — while U.S. assets offer growth, emerging markets like India provide high-upside opportunities.

Yet challenges loom. Concentration in U.S. tech and bonds raises systemic risks: a downturn in one area could ripple worldwide. Moreover, as inflation persists and interest rates fluctuate, the allure of alternatives like gold may grow.

In sum, the global investment map is a testament to economic evolution — but also a reminder that dominance today doesn't guarantee it tomorrow. As markets adapt to AI, sustainability, and geopolitics, savvy investors will look beyond the giants to capture the next wave of value.