Tether, the powerhouse behind the world’s most widely used stablecoin USDT, has released its Q2 2025 report, audited by the firm BDO, showcasing a financial surge that cements its status as a global financial titan.

As of June 30, over $157 billion in USDT circulated, with a year-to-date issuance of $20 billion, including a hefty $13.4 billion minted in the second quarter alone.

As of June 30, over $157 billion in USDT circulated, with a year-to-date issuance of $20 billion, including a hefty $13.4 billion minted in the second quarter alone.

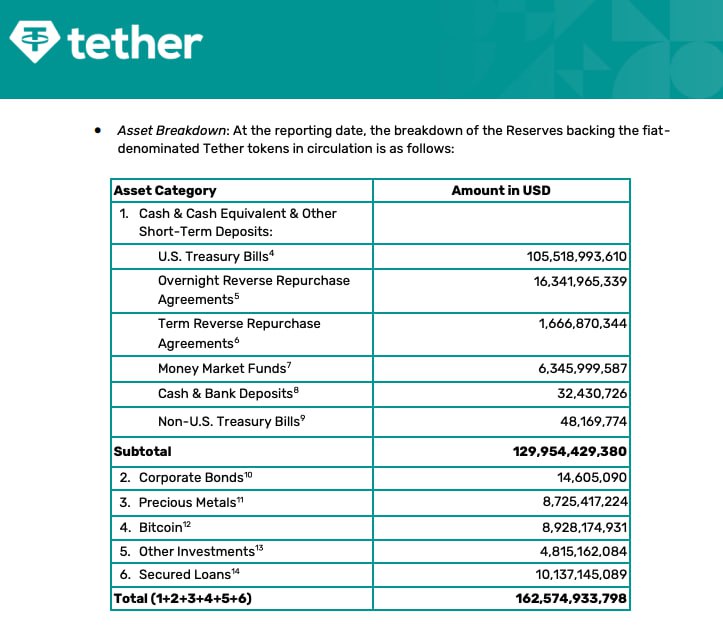

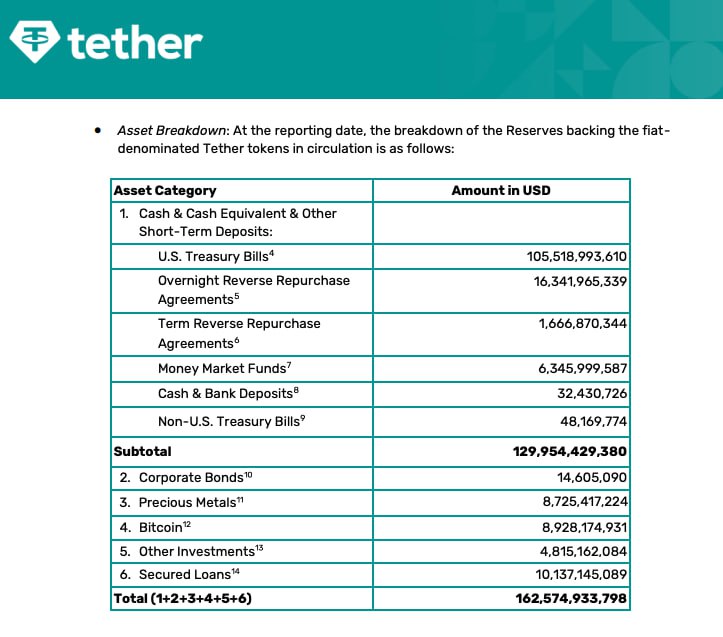

The report highlights Tether’s growing dominance in U.S. Treasury holdings, with its reserves in government bonds now totaling $127 billion — $105.5 billion in direct ownership and $21.3 billion via indirect instruments. This represents an $8 billion increase from the first quarter, positioning Tether among the world’s largest holders of American public debt, rivaling even some sovereign nations and institutional investors.

Profit figures are equally impressive, with a net profit of approximately $4.9 billion for Q2, pushing the year-to-date total to $5.7 billion. Of this, $3.1 billion stems from recurring income, while $2.6 billion reflects gains from strategic investments in Bitcoin and gold, where Tether holds roughly $9 billion in each asset. This diversified portfolio underscores the company’s shift toward safer, yield-generating assets, bolstering the stability of its USDT reserves.

Tether is also aggressively reinvesting its earnings. Since the start of the year, it has allocated around $4 billion to various ventures, including stakes in XXI Capital, the video platform Rumble, and the development of Rumble Wallet. The company’s investment scope extends to artificial intelligence, renewable energy, and communication technologies, signaling a broader vision beyond stablecoin issuance.

Also read:

- Spotify Boasts Subscriber Growth but Reports Losses

- Yandex Plus Subscriber Base Hits 43.2 Million, Driving Entertainment Revenue Growth

- Ethereum Turns 10: Celebrating a Decade of Decentralized Innovation

As Tether continues to expand its financial footprint, its Q2 2025 performance marks a milestone in the maturation of the stablecoin industry. With its growing reserves and profitability, Tether not only reinforces the stability of USDT but also sets a precedent for how digital asset firms can wield significant influence in traditional financial markets.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).