From Seoul's Neon Glow to New York's Volatility Vortex: A Trans-Pacific Trading Frenzy

Imagine a late-night ritual in Seoul: Thousands of young professionals, bleary-eyed and buzzing with adrenaline, swipe through mobile apps under the hum of K-pop playlists and instant ramen steam. It's not gaming or binge-watching - it's trading. But not on the tame Kospi exchange. No, these are South Korea's retail investors, channeling their inner Squid Game contestants, betting big on the wildest corners of Wall Street.

Imagine a late-night ritual in Seoul: Thousands of young professionals, bleary-eyed and buzzing with adrenaline, swipe through mobile apps under the hum of K-pop playlists and instant ramen steam. It's not gaming or binge-watching - it's trading. But not on the tame Kospi exchange. No, these are South Korea's retail investors, channeling their inner Squid Game contestants, betting big on the wildest corners of Wall Street.

Their weapon? Unbridled risk appetite, leveraged bets, and a herd mentality that's already pumped nearly $170 billion into US stocks by October's end - a near-doubling from the year's start.

What began as a domestic quirk - retail traders driving over half of Korea's daily volume - has gone global, injecting meme-stock mania into America's blue-chip facade. Wall Street, meet your new disruptors.

This isn't just capital flight; it's a cultural export. Korean traders, long schooled in high-volatility plays amid a market that's lagged the S&P 500 (up over 3x in KRW terms over the past decade, vs. Kospi's mere doubling), are now amplifying US extremes. "Korean retail investors are reinforcing the meme stock phenomenon in the US," warns Seiwoon Hwang, senior researcher at the Korea Capital Market Institute.

And as Owen Lamont, portfolio manager at Acadian Asset Management, quips: "The American market might just be turning into the Korean one - they've been buying speculative stocks for years. This could be America's future."

The Korean Trading DNA: Risk, Herd, and 24/7 Hustle

South Korea's retail boom traces to the 2020 pandemic, when easy-access apps like NH Investment & Securities democratized trading. With low interest rates and sky-high housing costs (Seoul apartments average 20x annual income), stocks became the great equalizer. But homegrown volatility - fueled by chaebol dominance and export sensitivity - bred a gambler's edge. Retailers here favor leverage (up to 5x on futures) and chase trends like EV batteries or AI chips, often in packs via KakaoTalk groups or Naver forums.

South Korea's retail boom traces to the 2020 pandemic, when easy-access apps like NH Investment & Securities democratized trading. With low interest rates and sky-high housing costs (Seoul apartments average 20x annual income), stocks became the great equalizer. But homegrown volatility - fueled by chaebol dominance and export sensitivity - bred a gambler's edge. Retailers here favor leverage (up to 5x on futures) and chase trends like EV batteries or AI chips, often in packs via KakaoTalk groups or Naver forums.

Now, that playbook is hitting Nasdaq after hours. A weakening won (down ~5% in three months, partly from dollar hoarding for US buys) makes American assets cheaper, while Kospi's AI-fueled rally (up 15% YTD, outpacing many globals) ironically pushes more abroad for diversification. Result? Record inflows: $10.2 billion into US equities and ETFs in Q1 alone, per depository data.

Deeper dive: Korean apps now integrate seamless US access via partnerships like Webull-Meritz, letting traders buy Tesla at midnight KST without FX headaches. And with 12% of holdings in banned-at-home products like 3x leveraged ETFs, it's pure adrenaline export. "They're not like other global investors—too aggressive," admits CLSA strategist Jungmin Shim.

Meme Mayhem: IonQ, Beyond Meat, and the Rollercoaster Rides

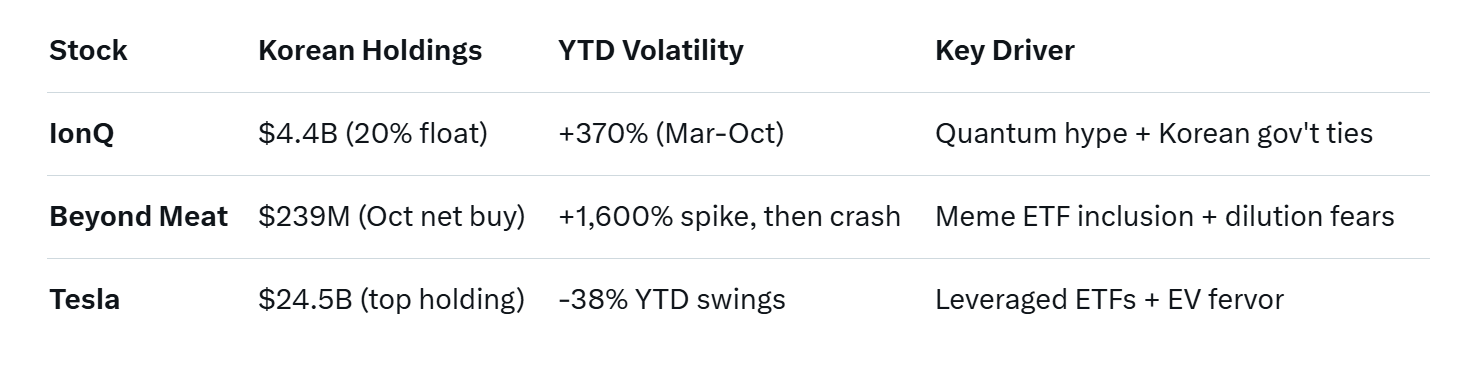

Koreans aren't nibbling blue chips - they're devouring the meme darlings, those sentiment-swayed stocks where Reddit whispers (or Naver echoes) dictate destiny. Take IonQ, the quantum computing upstart: From March to October, its shares rocketed 370%, with Koreans snapping up $4.4 billion—nearly 20% of the float, making it their fifth-biggest US holding.

Koreans aren't nibbling blue chips - they're devouring the meme darlings, those sentiment-swayed stocks where Reddit whispers (or Naver echoes) dictate destiny. Take IonQ, the quantum computing upstart: From March to October, its shares rocketed 370%, with Koreans snapping up $4.4 billion—nearly 20% of the float, making it their fifth-biggest US holding.

This isn't passive indexing; it's FOMO-fueled frenzy, mirroring 2021's GameStop squeeze but with quantum hype. IonQ's partnerships, like a multi-million deal with Korea's National Quantum Center, only stoke the fire - though skeptics eye its $168 million Q3 loss as a red flag.

Then there's Beyond Meat, the plant-based poster child turned meme cautionary tale. In October, Koreans net-bought $239 million amid a 1,600% four-day spike - fueled by Walmart expansions and ETF inclusions like Roundhill's Meme Stock fund.

But the crash followed: Shares diluted via 58.9 million new issuances, leaving 95% of Korean holders underwater. It's classic Squid Game: All-in on the promise of "green meat" salvation, only to watch volatility devour gains. Beyond's Q3 revenue ticked up to $70 million, but persistent losses underscore the gamble.

These aren't anomalies. Koreans hold $24.5 billion in Tesla (despite its 38% YTD dip) and billions in Nvidia, chasing AI dreams amid domestic underperformance. Their style? Herd-heavy: Social media tips spark stampedes, amplifying swings in small-caps where they own outsized stakes.

The Human Cost: Sleepless Nights and Shattered Dreams

Behind the billions are stories like Jung Ji-yeon's. The 37-year-old bank clerk poured 600 million won (~$410K) into a US portfolio - from Tesla blue-chips to Ocean Power Technologies' speculative waves.

Behind the billions are stories like Jung Ji-yeon's. The 37-year-old bank clerk poured 600 million won (~$410K) into a US portfolio - from Tesla blue-chips to Ocean Power Technologies' speculative waves.

Losses? Already 10 million won, with Ocean down 50% on dud tips from colleagues. "You can't build wealth just working - rates are low, home market's shaky. I believe in America," she says, trading till 4 AM KST, phone glow her only light.

Deeper: Inequality fuels this exodus. With youth unemployment at 7% and housing out of reach, stocks are a lottery ticket. A 2025 Chosun survey found 68% of under-40 Koreans trading US stocks cite "quick riches" as motive - echoing Squid Game's desperate debtors.

Yet, 40% report sleep loss and anxiety, per Korea Capital Markets Institute data. Regulators fret margin calls: Leverage in banned products risks a 2021-style wipeout.

Also read:

Also read:

- 🇦🇷 Argentine Court Freezes Assets of LIBRA Memecoin Creator Amid Presidential Bribery Probe

- Largest Miners Rely on AI Revenue Streams

- The Rise and Fall of Wearable AI: Why the Future Isn't in Your Pocket

- South Korea’s Digital Pearl Harbor: A Timeline of Coincidence or Cover-Up?

- Paramount+ Subscribers Get a Knockout Gift from New Leadership: Free UFC Access

Wall Street's Wake-Up: Volatility or New Normal?

US pros are rattled. Lamont warns this influx "distorts true company valuations," turning markets into sentiment casinos. Meme revivals - like Krispy Kreme or GoPro surges - now have trans-Pacific fuel, per Vanda Research. But silver lining? It democratizes access, pressuring firms like IonQ to innovate faster.

Kospi's glow (top global performer YTD on AI reforms) might stem the tide, but until then, expect more midnight marauders. As Hwang notes, this "speculative gene" could redefine Wall Street—not as a meritocracy, but a global game where the bold (or reckless) thrive.

In Squid Game terms, Korea's players aren't just joining - they're rewriting the rules. Win big or go home broke. But as Ji-yeon holds her Ocean shares, whispering "diamond hands" to her screen, one truth lingers: In this arena, survival demands more than luck. It demands nerve. And Wall Street's pulse? It's beating faster than ever.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).