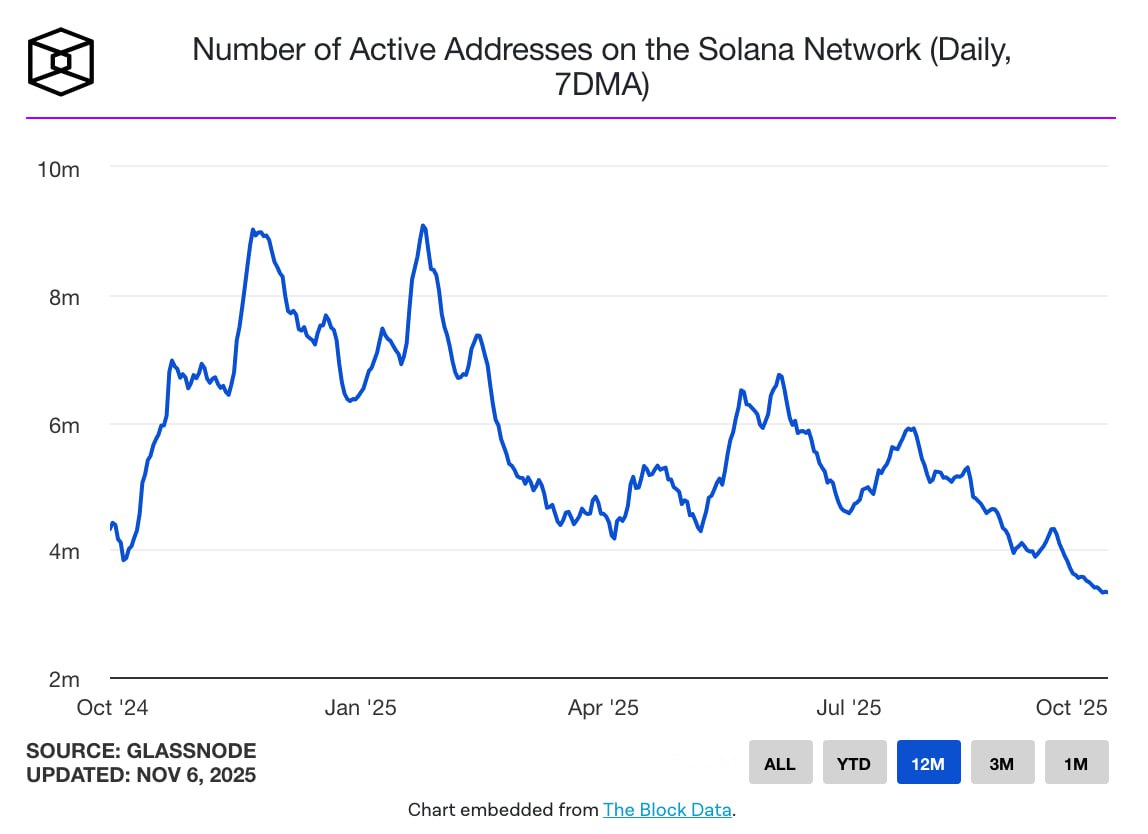

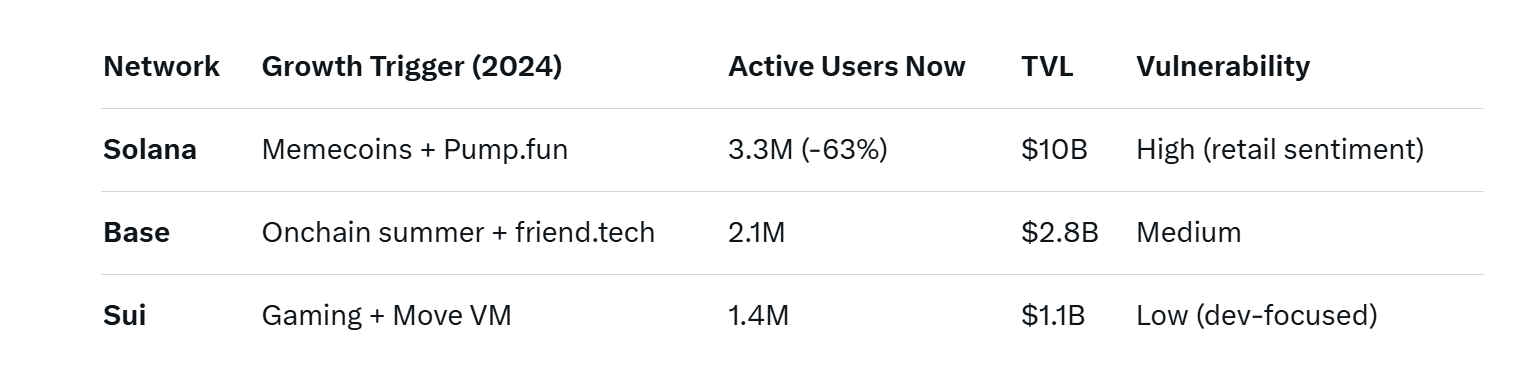

Solana’s once-red-hot network has cooled dramatically: active addresses have plunged to 3.3 million - the lowest in a year and nearly three times below January’s peak of over 9 million, according to The Block’s real-time dashboard. The surge-and-bust cycle? A textbook case of memecoin mania.

From late 2024 into early 2025, Solana became the undisputed memecoin launchpad king. Platforms like Pump.fun minted viral tokens in seconds, fueled by low fees (sub-$0.01 per swap) and blazing 400ms block times. Daily active users spiked as retail traders chased 1000x pumps in tokens like BONK, WIF, and POPCAT. But as the hype faded — with many tokens down 90%+ from ATH — so did the crowds.

Yet the network isn’t crumbling. Pump.fun still rakes in over $1 million in daily revenue, commanding ~90% of the memecoin launch market. And beneath the meme noise, Solana’s DeFi core remains rock-solid, with $10 billion in Total Value Locked (TVL) — flat month-over-month and dominated by powerhouses Jupiter, Kamino, and Jito.

Real-World Examples: From Meme Chaos to Institutional Infrastructure

1. Pump.fun — The Meme Factory That Won’t Die

- Launched: March 2024

- Peak daily revenue: $5.2M (January 2025)

- Current**: ~$1.1M/day

- Market share: 89.7% of all memecoin deployments

- Secret sauce: Bonding curve mechanics + instant liquidity + zero-code token creation

- > “We’re not a casino — we’re infrastructure for cultural moments.” — Pump.fun co-founder

Even as user counts drop, whales and syndicates keep spinning tokens, using bots to front-run launches and extract fees. The platform now auto-burns 10% of supply on failed launches, creating deflationary pressure on successful ones.

Even as user counts drop, whales and syndicates keep spinning tokens, using bots to front-run launches and extract fees. The platform now auto-burns 10% of supply on failed launches, creating deflationary pressure on successful ones.

2. Jupiter — The DEX Aggregator That Ate Uniswap’s Lunch

- TVL: $2.8B

- 24h volume: $1.4B

- Routes: 47+ DEXs, 200+ pools

- Edge: Limit orders, DCA, and perpetuals — all on Solana’s speed

-Growth: 340% TVL increase since Q4 2024

Jupiter’s Perps V2 now supports 120+ markets with leverage up to 100x, pulling in pro traders who left Ethereum for sub-second settlement.

3. Kamino — Automated Yield, Now With Real-World Assets

- TVL: $2.1B

- Flagship product: kTokens (auto-compounding vaults)

- New in 2025: RWA vault — tokenized U.S. T-bills yielding 4.8% APY, fully on-chain via Ondo Finance

- User base: 180,000+ stakers, 62% recurring deposits

A Solana-based hedge fund manager told The Block:

A Solana-based hedge fund manager told The Block:

> “We moved $40M from Aave to Kamino. Same yield, 1/10th the gas, instant rebalancing.”

4. Jito — MEV That Pays You

- TVL: $1.9B

- Innovation: Jito Tips — validators share MEV profits with stakers

- Result: SOL staking APY boosted to 8.2% (vs. 6.1% vanilla)

- Adoption: 68% of all staked SOL now runs through Jito bundles

This turns Solana into a passive income machine — no memecoin gambling required.

The Bigger Picture: One-Trick Networks vs. Antifragile Ecosystems

> “Networks that ride one narrative are fragile. Solana’s memecoin phase was a sugar rush — but the DeFi muscle memory is real.” — Delphi Digital

What’s Next for Solana?

- Firedancer validator client (Q4 2025) → 65,000 TPS target

- Token Extensions 2.0 → built-in compliance for RWAs

- Mobile-first focus → Phantom wallet now default on Brave and Opera browsers

- Institutional on-ramps → VanEck files for Solana ETF, 21Shares launches staked SOL ETP in Europe

Also read:

Also read:

- Solana is a Swamp: Launch Meme Coins on Ethereum, Says James Wynn

- 🇦🇷 Argentine Court Freezes Assets of LIBRA Memecoin Creator Amid Presidential Bribery Probe

- Altcoins Need Bitcoin Near All-Time Highs to Rally, Wintermute Argues

- Contact Form Design: 7 Best Practices You Should Follow

The Bottom Line

Yes, memecoin tourists have left the station. But Solana didn’t build a casino — it built a high-speed financial OS, and the builders never stopped shipping.

3.3 million active wallets today isn’t a death knell — it’s a return to fundamentals. The degens funded the runway. Now the $10B DeFi engine runs the show.

As one Solana core contributor put it:

> “We don’t need 9 million users flipping cat tokens. We need 1 million using Jupiter, Kamino, and Jito every day. We’re already there.”

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).