As debates rage about an AI investment bubble - with OpenAI reportedly committing to hundreds of billions in future compute and infrastructure - recent leaks paint a more nuanced picture of the company's economics. Far from a pure money pit, OpenAI is demonstrating impressive improvements in unit economics, particularly for its paid services.

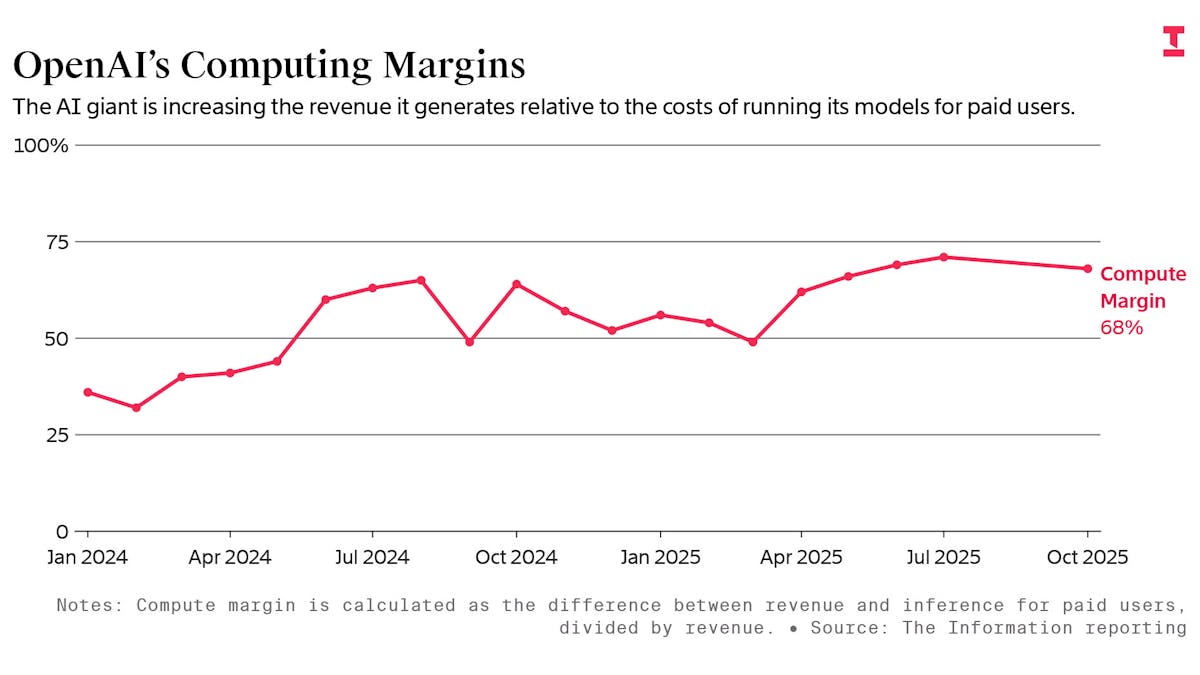

According to internal financials reported by The Information in December 2025, the company's "compute margin" - the share of revenue remaining after deducting inference costs for paying users - reached approximately 70% in October 2025.

According to internal financials reported by The Information in December 2025, the company's "compute margin" - the share of revenue remaining after deducting inference costs for paying users - reached approximately 70% in October 2025.

This marks a dramatic rise from 52% at the end of 2024 and roughly 35% in January 2024.

This metric is crucial in the AI space, where variable compute costs (GPUs, energy, and data centers) represent a significant ongoing expense unlike traditional SaaS, which enjoys near-100% gross margins after initial development.

OpenAI's gains stem from a combination of factors: model efficiency improvements (e.g., better quantization and distillation techniques), negotiated lower chip prices at scale, smarter routing of queries to cheaper models, and a shift toward higher-margin enterprise deals.

Notably, these margins apply primarily to paid tiers - ChatGPT Plus, Team, Enterprise, and API customers - while the vast free user base contributes minimal direct revenue but serves as a powerful acquisition funnel.

OpenAI's revenue trajectory underscores this progress. The company generated around $4 billion in 2024, exploding to an annualized run rate exceeding $19 billion by late 2025, with reports indicating it's on track to surpass its $13 billion full-year target. First-half 2025 revenue alone hit $4.3 billion, and monthly figures climbed to over $1 billion** by mid-year. Projections for 2026 suggest further doubling to $29 billion or more, driven by enterprise adoption, new agentic features, and potential expansions like advertising or affiliate commissions in ChatGPT.

Yet caveats abound. OpenAI maintains a massive free tier - hundreds of millions of weekly active users - with conversion to paid subscriptions historically around 3-5% (though exact current figures remain undisclosed). This strategy fuels growth but inflates absolute losses: the company burned $2.5 billion in the first half of 2025 alone, largely on R&D ($6.7 billion) and operations, with full-year cash burn projected at $8-8.5 billion. Overall gross margins hover lower (estimates around 40-50%) when including revenue shares to partners like Microsoft (nearly 20%) and free-tier subsidies.

Compared to rivals, OpenAI appears ahead on paid efficiency. Anthropic reportedly lagged with negative compute margins as recently as 2024, though it excels in certain server utilization metrics. Traditional cloud providers (AWS, Azure) operate AI services at 30-40% margins, highlighting OpenAI's edge in the model layer.

Stripping away the hype and absolute burn numbers, OpenAI resembles a classic high-growth startup: converging unit economics on core products, heavy upfront investment in scale (marketing via free access, R&D for moats), and a truly expansive Total Addressable Market.

The AI TAM isn't constrained like niche SaaS; as models integrate into workflows, agents, and multimodal tools, the Serviceable Addressable Market could realistically approach trillions. Long-term forecasts reflect this ambition: revenue potentially topping $125 billion by 2029, with agents and new products outpacing ChatGPT itself.

The AI TAM isn't constrained like niche SaaS; as models integrate into workflows, agents, and multimodal tools, the Serviceable Addressable Market could realistically approach trillions. Long-term forecasts reflect this ambition: revenue potentially topping $125 billion by 2029, with agents and new products outpacing ChatGPT itself.

Cash-flow positivity isn't expected until around 2029, per earlier projections, as OpenAI bets big on infrastructure (deals exceeding $1 trillion in commitments). Funding remains robust - recent rounds valuing it at hundreds of billions, with investors like SoftBank, Nvidia, and sovereign funds piling in.

If efficiency gains continue - driven by hardware advances and algorithmic breakthroughs - these bets could pay off handsomely.

In an industry where scale begets advantage, OpenAI's improving margins signal not just survival but potential dominance. While risks like regulatory scrutiny, competition, and chip shortages loom, the underlying economics suggest the company is building a sustainable engine beneath the spectacle.

For now, amid the bubble chatter, OpenAI's paid services are proving remarkably efficient - a quiet strength in a noisy race.

Also read:

- How Machine Learning Improves Accuracy in Legal and Delivery Management Tasks

- Monero Surges Ahead While Zcash Faces Headwinds in the Privacy Coin Arena

- 2025: The Year Large Language Models Revealed Their True Nature

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.