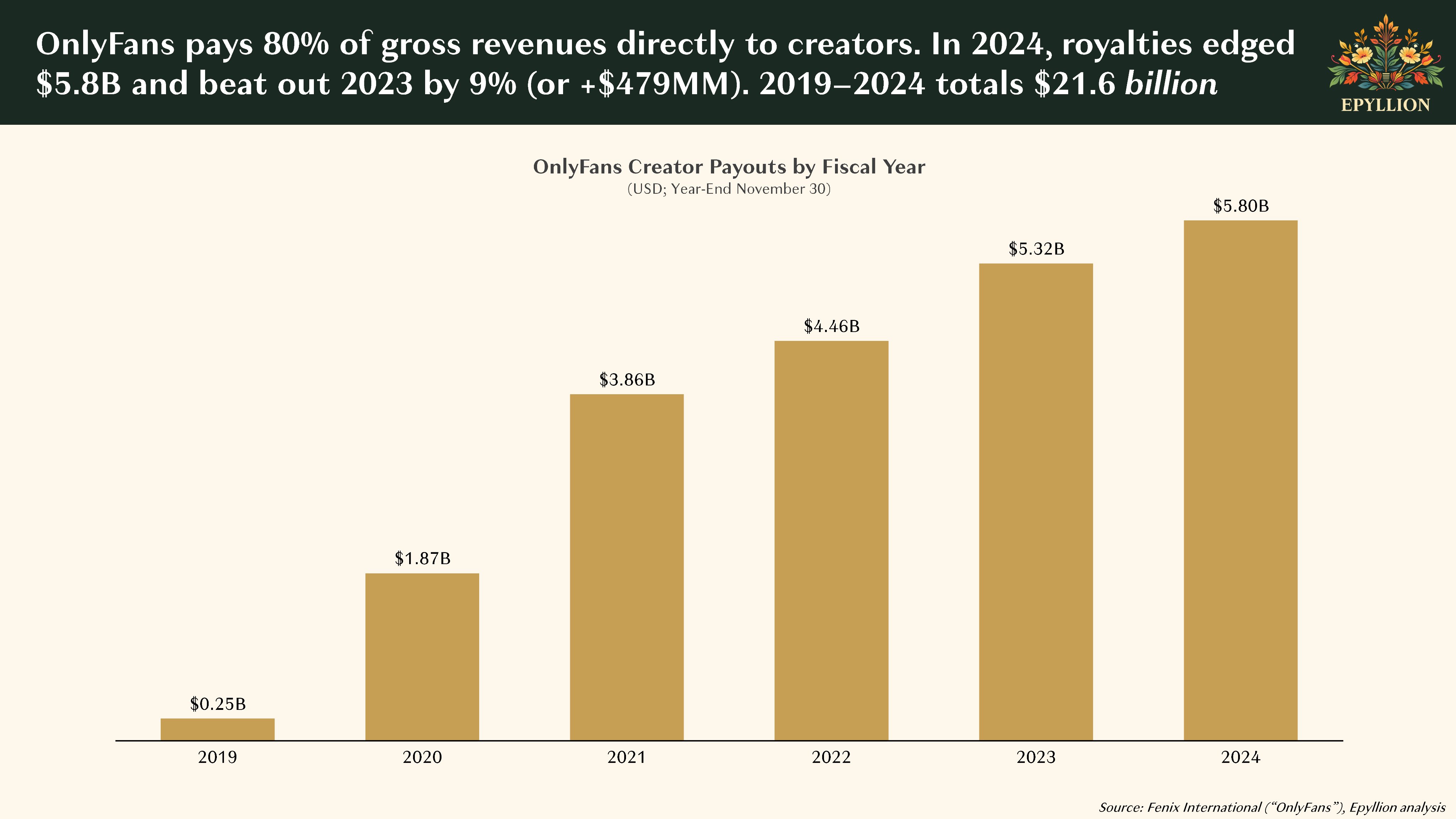

In London's buzzing tech scene, OnlyFans CEO Keily Blair took center stage at Bloomberg Tech, revealing a jaw-dropping milestone: since its launch in 2016, the platform has paid out over $25 billion to content creators worldwide.

"There’s not very many companies that can talk about creating wealth for others rather than just profiteering," Blair said, spotlighting how OnlyFans has empowered millions to earn directly from their fans.

"There’s not very many companies that can talk about creating wealth for others rather than just profiteering," Blair said, spotlighting how OnlyFans has empowered millions to earn directly from their fans.

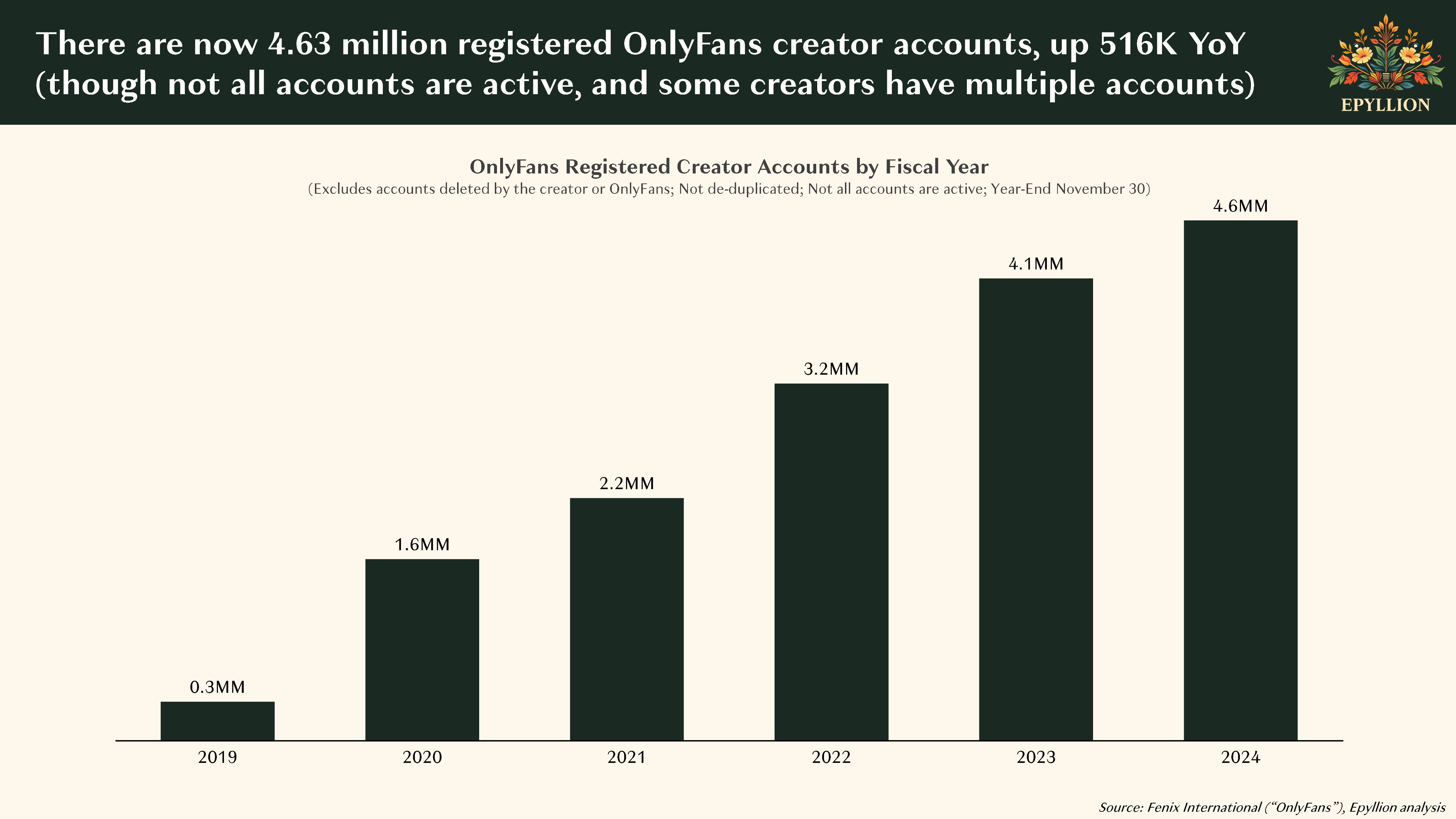

This figure is striking, especially given the platform’s reputation. While OnlyFans now hosts diverse content like fitness, comedy, music, and even cricket - thanks to sign-ups like England cricketer Tymal Mills - its core remains adult-oriented material.

Yet, the numbers speak for themselves: in nearly a decade, OnlyFans has transformed user-generated content into a lucrative career path, thriving in a crowded digital space.

The Business Model: 20% Commission on Empowerment

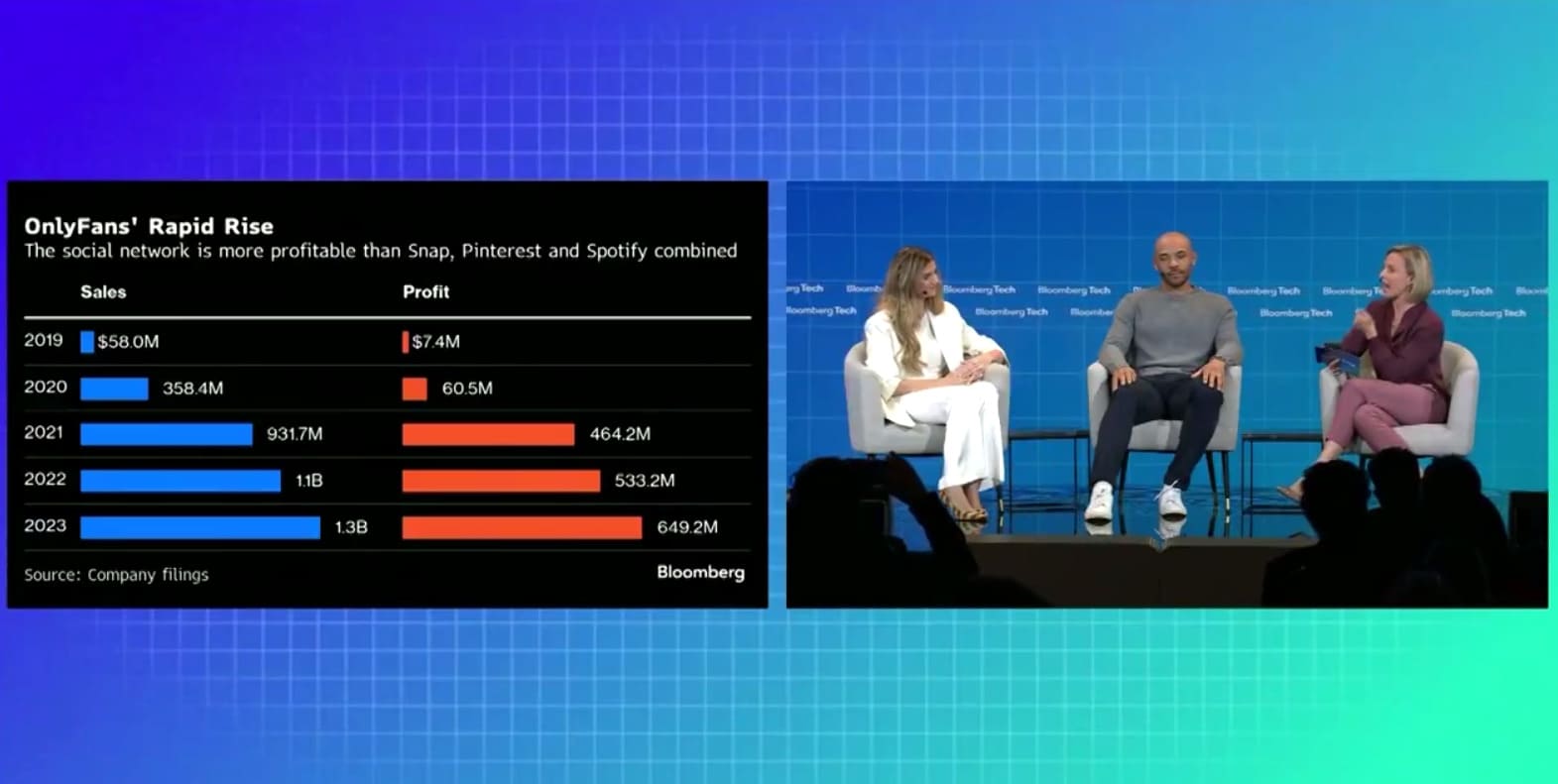

OnlyFans’ model is simple yet potent. The platform takes a 20% cut from subscriptions, pay-per-view videos, photo sales, and private chats, leaving creators with the majority. This includes exclusive videos, premium photo sets, and personalized messaging, fostering intimate fan-creator connections. In 2023, this ecosystem generated $6.6 billion in revenue for the company, with profits of $485 million.

OnlyFans’ model is simple yet potent. The platform takes a 20% cut from subscriptions, pay-per-view videos, photo sales, and private chats, leaving creators with the majority. This includes exclusive videos, premium photo sets, and personalized messaging, fostering intimate fan-creator connections. In 2023, this ecosystem generated $6.6 billion in revenue for the company, with profits of $485 million.

Blair, who became CEO in July 2023 after a career in data privacy and compliance law, emphasized the platform’s evolution. Beyond NSFW (not safe for work) content, OnlyFans now features wellness, sports, and cooking tutorials. Still, adult content drives about 70% of its creator base. Blair insists that AI-generated alternatives can’t replace human authenticity - fans want the real deal.

The $8 Billion Sale: Tempting Profits, Thorny Risks

With such robust financials, it’s no surprise that owner Leonid Radvinsky is eyeing a sale, reportedly valuing OnlyFans at $8 billion. Discussions involve investor groups like the Forest Road Company. Radvinsky, who’s pocketed over $1 billion in dividends since 2021, sees a chance to cash out on a business that’s grown from $375 million in 2020 revenue to a multi-billion-dollar giant.

But buyers are hesitant. Institutional investors, managing conservative funds like public pensions or police unions, fear reputational backlash. A retirement fund tied to a site known for explicit content is a tough sell.

But buyers are hesitant. Institutional investors, managing conservative funds like public pensions or police unions, fear reputational backlash. A retirement fund tied to a site known for explicit content is a tough sell.

Past controversies, including a 2023 probe linking OnlyFans to U.S. sex trafficking cases and a £1 million UK fine for age verification failures, heighten these concerns. Investors worry about uncovering illegal content, like child exploitation or nonconsensual material, during due diligence.

The collapse of Passes, a fan-content app that imploded in 2023 amid executive misconduct allegations, looms large. Its founders were ousted, and the company folded - a warning for anyone navigating NSFW ventures. Regulatory pressures add to the challenge: Sweden’s upcoming laws criminalizing certain paid performances and U.S. lawsuits over trafficking could slash valuations significantly.

NSFW’s Paradox: Money Printers with a Catch

NSFW businesses like OnlyFans are cash machines. Low overhead, direct monetization, and loyal subscribers yield sky-high margins. A 20% commission scales effortlessly, outpacing many tech giants in per-user profitability. But this strength is also the problem: the stigma repels mainstream investors, turning a potential quick sale into a drawn-out ordeal.

Diversification - non-adult content grew 15-20% last year - helps, but doesn’t fully clean the brand’s image. Buyers like Forest Road might rebrand OnlyFans as a broader creator hub, but they’ll demand protections, like earn-outs tied to regulatory compliance or carve-outs for risky content. An IPO, once considered, seems unlikely after investor hesitancy stalled earlier talks.

Also read:

Also read:

- OnlyFans Star with Dual Vaginas Discusses How Her Unique Anatomy Has Boosted Her Adult Career

- OnlyFans Creator Discloses the Latest 'Taboo' Sexual Fantasy Gaining Popularity

- Last year, the collective earnings of OnlyFans creators surpassed the total salaries of all NBA players.

A Prolonged Path Forward

Blair’s optimism at Bloomberg Tech signals confidence: OnlyFans could cement itself as a creator-economy leader in the next five years, AI-proof and globally compliant. But the $8 billion sale looks tricky.

Expect lengthy negotiations, valuation cuts, and possibly a turn to private equity players comfortable with the edge. For now, OnlyFans proves the raw power of the creator economy - and the reality that in tech, big money comes with bigger baggage.

As Blair said, it’s about "wealth creation." Whether that extends to Radvinsky’s payout or the platform’s next chapter remains uncertain. One thing is clear: in a content-obsessed world, OnlyFans isn’t going anywhere - it’s just navigating how to cash out without sparking a firestorm.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).