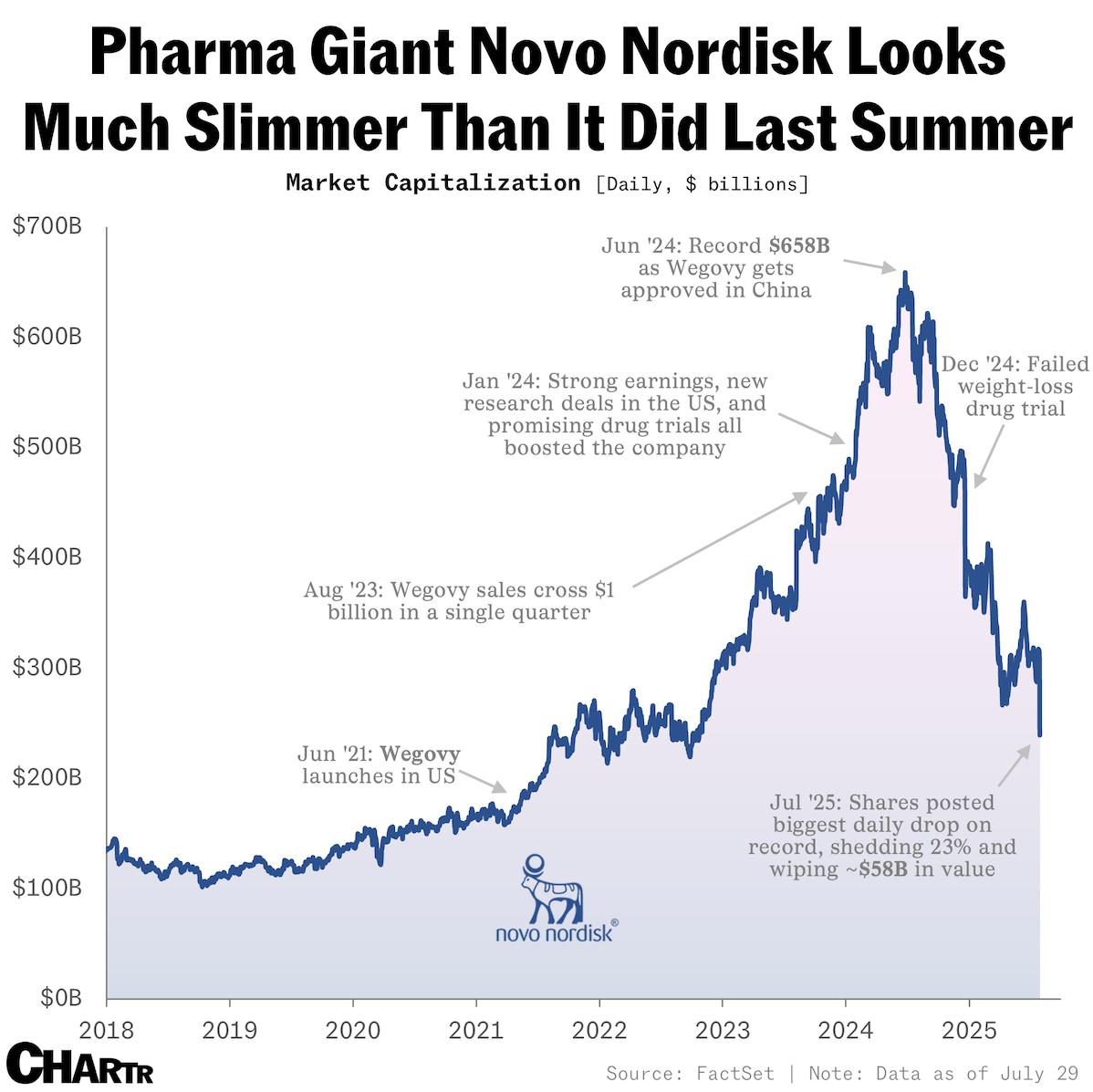

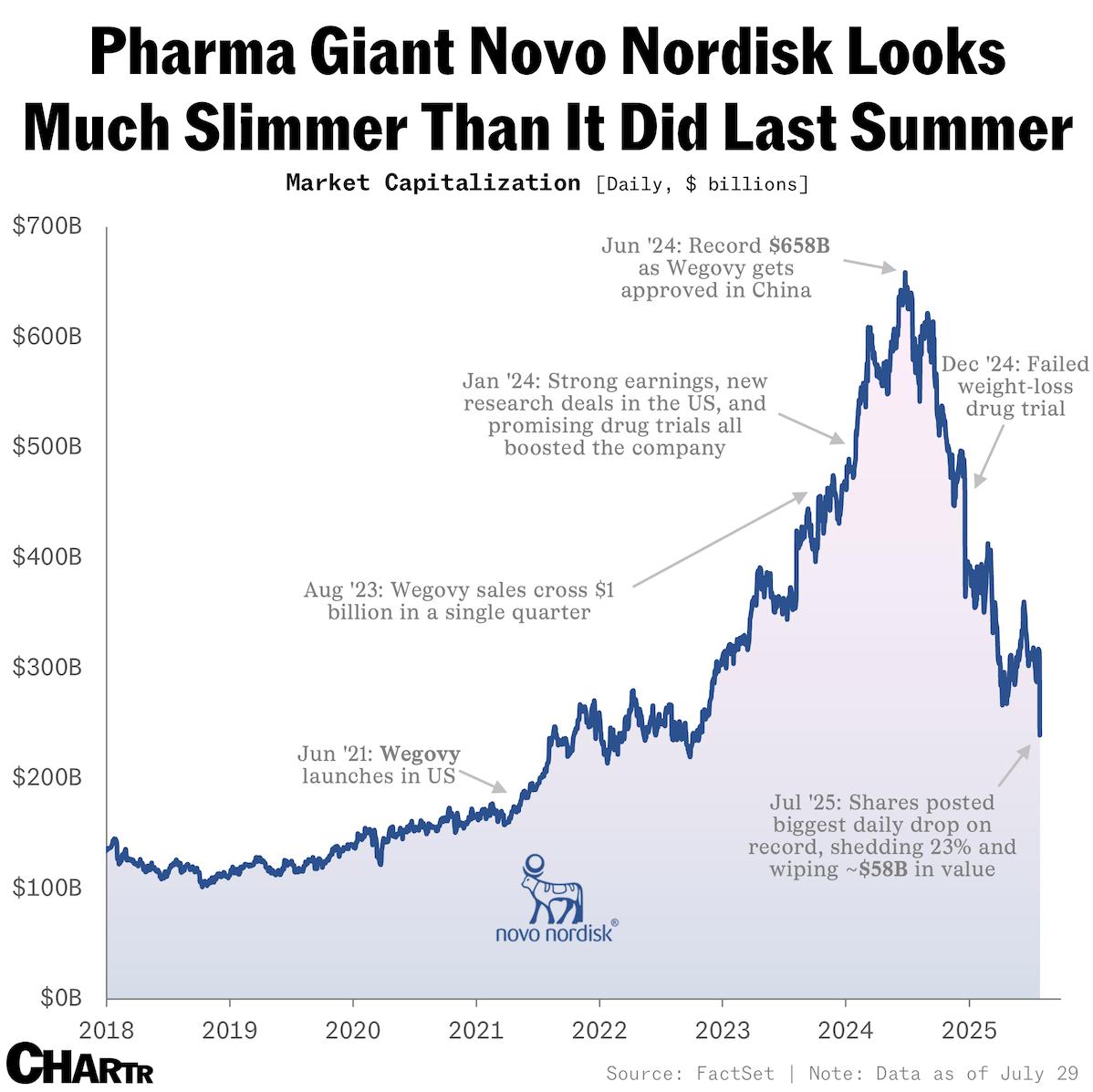

Just a year ago, in July 2024, Danish pharmaceutical giant Novo Nordisk, the maker of Ozempic and Wegovy, reigned as Europe’s most valuable company, outpacing luxury titan LVMH by over $200 billion.

Its market cap had soared to nearly $660 billion by mid-2023, a testament to the global craze for its GLP-1 class drugs, which became a symbol of the fight against obesity. Ozempic, launched in the U.S. in 2017, and its weight-loss sibling Wegovy had catapulted Novo to the forefront of the healthcare industry.

Its market cap had soared to nearly $660 billion by mid-2023, a testament to the global craze for its GLP-1 class drugs, which became a symbol of the fight against obesity. Ozempic, launched in the U.S. in 2017, and its weight-loss sibling Wegovy had catapulted Novo to the forefront of the healthcare industry.

But much has changed since then. Recently, the company’s stock plummeted 23% in a single day — the worst one-day drop in its history — after slashing its annual profit and sales forecasts. This dramatic decline raises questions about whether Novo’s first-mover advantage is slipping away, potentially mirroring the fate of once-dominant names like Myspace, BlackBerry, Yahoo Search, Zoom, and Peloton.

The rise of GLP-1 drugs in 2024 fueled Novo’s success, with Ozempic becoming a household name. However, the competitive landscape has shifted. U.S. rival Eli Lilly has gained ground with Mounjaro and Zepbound, drugs that reportedly deliver better weight-loss results with fewer side effects. Meanwhile, generic alternatives from HIMS and Noom are carving out market share, challenging Novo’s dominance.

The crisis deepened with the disappointing trial results of CagriSema, Novo’s next-generation obesity drug. Expected to outperform existing treatments, CagriSema fell short, eroding investor confidence and accelerating the stock’s decline.

This situation underscores a harsh business reality: being the first mover doesn’t guarantee lasting success. Novo’s early lead with Ozempic and Wegovy gave it a head start, but competitors have outmaneuvered it with superior products and adaptability. Eli Lilly’s aggressive pipeline and the rise of generics suggest that innovation and execution now outweigh initial market entry.

Like Myspace, which lost to Facebook’s social media evolution, or BlackBerry, overtaken by iPhone’s touchscreen revolution, Novo risks becoming a cautionary tale. Even Zoom, which dominated video calls during the pandemic, faded as rivals caught up, and Peloton’s fitness empire stumbled amid shifting consumer trends.

Also read:

- NotebookLM’s New Slide Feature Sparks Hype—But It’s Not Quite Video Generation

- Ideogram AI Unveils Character Model with Consistent Visual Identity

- TikTok Influencer Expands Reach with Eerily Realistic Digital Avatar

- Archive.com Levels Up Influencer Marketing with AI-Powered Creator Search and UGC Tools

For Novo, the path forward hinges on reinvention. The company’s legacy as a pioneer is undeniable, but without a robust response to competitors and a successful pivot —perhaps through new drug development or strategic partnerships — it could join the ranks of fallen giants. The moral? In business, the advantage of being first is fleeting unless backed by relentless innovation and resilience. As of August 2025, Novo’s story is a stark reminder that even the mightiest can falter if they fail to evolve.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).