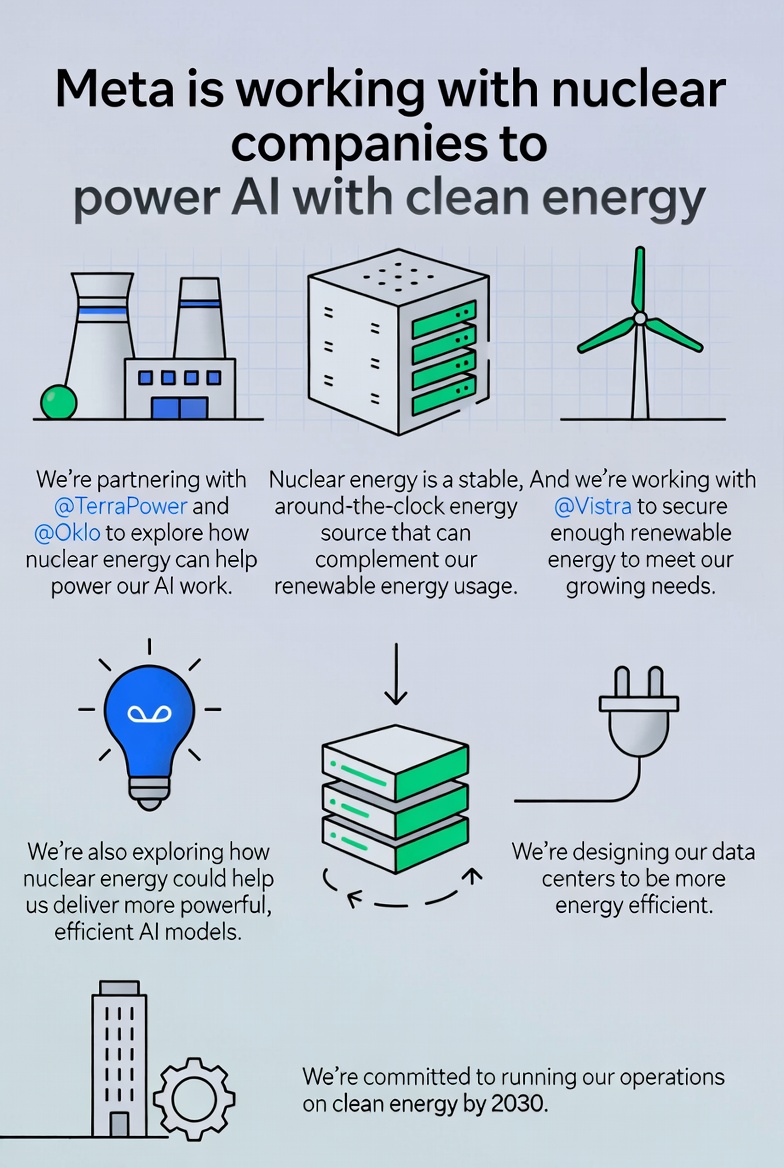

In a bold move to secure the massive energy demands of its artificial intelligence infrastructure, Meta Platforms has announced sweeping agreements with three nuclear energy companies: TerraPower, Oklo, and Vistra. These deals, unveiled on January 9, 2026, could unlock up to 6.6 gigawatts (GW) of nuclear power by 2035, positioning Meta as one of the largest corporate buyers of nuclear energy in U.S. history.

This initiative not only addresses the surging electricity needs of AI data centers but also revives aging nuclear assets and accelerates the deployment of advanced reactor technologies.

The Agreements: A Trifecta of Nuclear Power Plays

Meta's strategy combines long-term power purchase agreements (PPAs) with existing plants and financial backing for innovative small modular reactors (SMRs). The company is targeting reliable, carbon-free baseload power to support its "Prometheus" AI supercluster in New Albany, Ohio, and other operations across the U.S.

Meta's strategy combines long-term power purchase agreements (PPAs) with existing plants and financial backing for innovative small modular reactors (SMRs). The company is targeting reliable, carbon-free baseload power to support its "Prometheus" AI supercluster in New Albany, Ohio, and other operations across the U.S.

- Vistra Partnership: Meta has signed 20-year PPAs for 2,176 megawatts (MW) of capacity from Vistra's operational nuclear plants, including the Perry (1,268 MW) and Davis-Besse (908 MW) facilities in Ohio, as well as the Beaver Valley plant (1,872 MW) in Pennsylvania. Additionally, Meta is funding 433 MW of uprates — efficiency upgrades — at these sites, marking the largest nuclear uprates ever supported by a corporate customer. Deliveries from Vistra begin later in 2026, providing near-term relief for Meta's energy crunch.

These plants tell a story of nuclear resurgence. Just a few years ago, Perry, Davis-Besse, and Beaver Valley were slated for closure due to economic pressures and low power prices. Meta's financial commitment now enables Vistra to pursue license extensions, potentially keeping these reactors operational for decades longer. This not only preserves thousands of jobs but also bolsters grid reliability in the PJM Interconnection region, where Meta's data centers are concentrated.

- TerraPower Collaboration: Founded by Bill Gates in 2008, TerraPower represents Meta's deepest dive into advanced nuclear tech. The agreement provides funding for two initial Natrium sodium-cooled fast reactors, capable of generating up to 690 MW by 2032. Meta also secures rights to energy from up to six additional units, targeting 2.1 GW by 2035—for a total of eight reactors delivering 2.8 GW of baseload power plus 1.2 GW of integrated energy storage. This marks TerraPower's first major commercial order, validating years of development on its innovative design, which promises enhanced safety, efficiency, and waste reduction compared to traditional reactors.

- Oklo Development: Oklo, a startup focused on microreactors and SMRs, will receive prepayments from Meta to advance a 1.2 GW nuclear power campus in Pike County, Ohio. The project, featuring Oklo's Aurora fast reactors, aims to start delivering power as early as 2030. Oklo went public in 2024 via a special purpose acquisition company (SPAC) led by OpenAI CEO Sam Altman, who has long championed nuclear energy for AI applications. While there's no explicit confirmation that OpenAI will directly benefit from Oklo's output, Altman's involvement raises intriguing possibilities for cross-pollination between Meta's rivals in the AI space.

These deals build on Meta's prior 20-year PPA with Constellation Energy for an Illinois plant, solidifying its "barbell strategy" of blending established nuclear assets with cutting-edge innovations.

Market Reactions and Economic Ripple Effects

The announcement sent shockwaves through financial markets. Shares of Vistra (NYSE: VST) surged about 15% shortly after trading opened on January 9, 2026, reflecting investor confidence in the company's expanded role in the AI-energy nexus. Oklo (NYSE: OKLO) experienced an even sharper rise, jumping up to 20% in pre-market trading before settling around 15-19% gains.

The announcement sent shockwaves through financial markets. Shares of Vistra (NYSE: VST) surged about 15% shortly after trading opened on January 9, 2026, reflecting investor confidence in the company's expanded role in the AI-energy nexus. Oklo (NYSE: OKLO) experienced an even sharper rise, jumping up to 20% in pre-market trading before settling around 15-19% gains.

TerraPower, being privately held, didn't see public stock movement, but the deal underscores its viability in a competitive field.

Beyond stocks, the agreements promise economic boons. Meta estimates they will create thousands of construction jobs and hundreds of long-term operations roles, particularly in Ohio and Pennsylvania — rust belt states hungry for high-tech investment. On X (formerly Twitter), reactions ranged from enthusiasm about America's "golden age" of energy dominance to concerns over rising electricity costs for consumers as tech giants secure premium power.

Also read:

- Disney+ Embraces Vertical Video and AI: Targeting the First "AI-Native" Generation in 2026

- China as a Platform Nation: Nihao China App Redefines Inbound Tourism in the Digital Age

- TikTok's Stealth Entry into Micro-Dramas: The Quiet Launch of PineDrama

Broader Implications: AI's Energy Hunger and the Tech-Energy Convergence

The AI boom is devouring electricity at an unprecedented rate. By 2030, data centers could consume as much power as Japan or triple Turkey's annual usage, exacerbating grid strains and pushing tech firms toward "bring your own power" models. Meta's nuclear push follows similar moves by peers: Microsoft's reactivation of Three Mile Island (835 MW by 2028), Google's SMR deal with Kairos Power (500 MW), and Amazon's investment in X-energy.

The AI boom is devouring electricity at an unprecedented rate. By 2030, data centers could consume as much power as Japan or triple Turkey's annual usage, exacerbating grid strains and pushing tech firms toward "bring your own power" models. Meta's nuclear push follows similar moves by peers: Microsoft's reactivation of Three Mile Island (835 MW by 2028), Google's SMR deal with Kairos Power (500 MW), and Amazon's investment in X-energy.

While this invigorates the nuclear sector — long dormant amid regulatory hurdles and public skepticism — it poses risks for tech companies. Diving into "brick-and-mortar" industries like energy could erode profit margins, as capital-intensive infrastructure eats into the high returns investors expect from software giants. Critics on X warn this signals an inflating AI bubble, with hyperscalers overcommitting to unproven tech amid hype. Yet, proponents argue it's essential for sustainable growth: Nuclear offers 24/7 reliability that renewables like solar and wind can't match without costly batteries.

In Australia, where nuclear bans persist, Meta's deals serve as a "wakeup call," highlighting how restrictions limit access to advanced tech that could complement renewables. Globally, this tech-nuclear fusion could accelerate the energy transition, but it demands careful navigation of regulatory, safety, and economic challenges.

Meta's nuclear ambitions underscore a pivotal shift: As AI reshapes the world, the quest for power is reshaping industries. Whether this fuels innovation or bursts a bubble remains to be seen, but one thing is clear — the race for gigawatts is on.