In the high-stakes world of venture capital, few firms stand out as boldly as Andreessen Horowitz, commonly known as a16z.

Founded in 2009 by tech visionaries Marc Andreessen and Ben Horowitz, this Silicon Valley powerhouse has redefined what it means to be a venture fund.

Founded in 2009 by tech visionaries Marc Andreessen and Ben Horowitz, this Silicon Valley powerhouse has redefined what it means to be a venture fund.

Rather than simply writing checks and waiting for returns, a16z operates like a full-service accelerator, blending investment with hands-on support to propel startups toward dominance. Drawing from its track record of backing unicorns like Airbnb, Coinbase, and Slack, let's unpack the most critical and unconventional elements of how a16z is structured and operates — elements that set it apart from traditional VC players.

An Ecosystem, Not Just a Checkbook

At its core, a16z isn't merely a fund doling out capital; it's an integrated growth machine designed to nurture startups from seed to scale. When a16z invests, it doesn't stop at funding. The firm provides comprehensive operational support, including talent acquisition — helping companies recruit top engineers, executives, and specialists through its dedicated HR network.

At its core, a16z isn't merely a fund doling out capital; it's an integrated growth machine designed to nurture startups from seed to scale. When a16z invests, it doesn't stop at funding. The firm provides comprehensive operational support, including talent acquisition — helping companies recruit top engineers, executives, and specialists through its dedicated HR network.

Legal counsel is on tap to navigate regulatory hurdles, while operational mentoring ensures startups build sustainable infrastructures, from supply chains to financial systems.

This "full-stack" approach stems from the founders' own entrepreneurial backgrounds: Andreessen co-created Netscape, and Horowitz led Opsware (sold to HP for $1.6 billion).

They understand that capital alone isn't enough — startups need expertise to survive cutthroat markets. As Horowitz once put it in his book The Hard Thing About Hard Things, building a company is about solving real-world problems, and a16z embeds that philosophy into its model.

Industry-Specific Funds for Targeted Bets

To minimize misses and maximize impact, a16z structures its investments around specialized funds tailored to key sectors. This vertical focus allows domain experts to dive deep, reducing risk and enhancing value-add for portfolio companies.

To minimize misses and maximize impact, a16z structures its investments around specialized funds tailored to key sectors. This vertical focus allows domain experts to dive deep, reducing risk and enhancing value-add for portfolio companies.

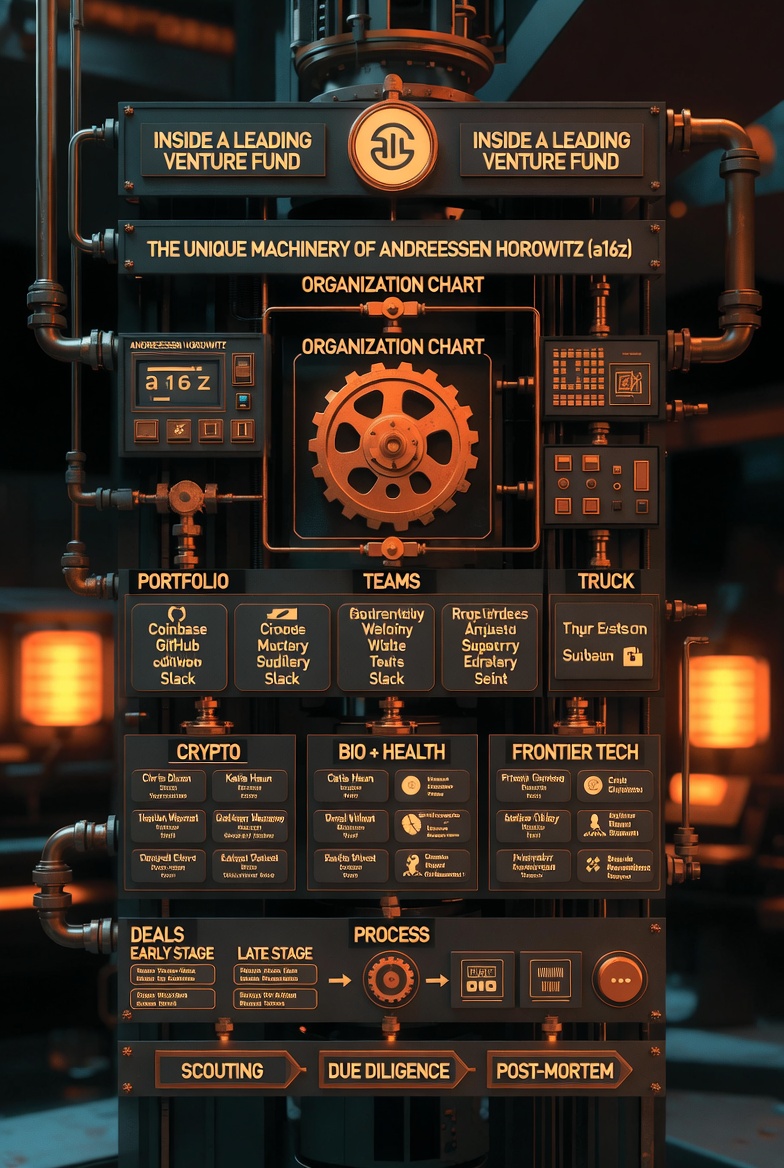

Key funds include:

- AI and Infrastructure: Focused on artificial intelligence, cloud computing, and foundational tech like data centers. This fund backs innovators reshaping digital backbone technologies.

- Crypto/Web3: A dedicated arm for blockchain, decentralized finance, and digital assets, which has been instrumental in mainstreaming crypto.

- American Dynamism (Defense and GovTech): Investing in national security tech, aerospace, and public sector innovations—areas once shunned by VC but now booming.

- Bio + Healthcare: Targeting biotech, life sciences, and health tech, from drug discovery to telemedicine.

- And more, including consumer tech, enterprise software, and fintech.

Each fund operates semi-autonomously with its own partners, analysts, and networks, ensuring specialized guidance. This contrasts with generalist funds that spread bets thinly across industries.

The Growth Fund: Betting on Near-Leaders

Beyond early-stage ventures, a16z runs a separate Growth Fund for companies on the cusp of market leadership. These aren't scrappy startups but proven entities with robust products, steady revenue (often in the tens or hundreds of millions), and clear paths to IPO or acquisition. Checks here are massive—often $100 million or more—compared to seed rounds of a few million.

The strategy? Accelerate scaling through advanced mentoring, M&A advice, and global expansion support. It's less about invention and more about domination, targeting firms poised to capture massive market segments. This stage-agnostic approach lets a16z capture value across a company's lifecycle, from inception to public markets.

Creating Waves, Not Riding Them: The Narrative Engine

What truly distinguishes a16z is its proactive role in shaping markets rather than reacting to them. Traditional VCs invest quietly and hope for organic growth; a16z invests aggressively — often with outsized checks — and then amplifies the narrative to drive valuations skyward.

What truly distinguishes a16z is its proactive role in shaping markets rather than reacting to them. Traditional VCs invest quietly and hope for organic growth; a16z invests aggressively — often with outsized checks — and then amplifies the narrative to drive valuations skyward.

The firm acts as a media powerhouse: publishing in-depth longreads on emerging trends (e.g., via their blog and Future publication), hosting podcasts like a16z Podcast with founders and experts, and leveraging influencers for buzz.

They pour resources into portfolio marketing, crafting stories that attract talent, customers, and follow-on investors.

This "narrative investing" creates a flywheel effect. When a16z backs a company, it's a signal to the ecosystem: "This is the future." Skeptical peers think, "If a16z is committing big, it must be legit," leading to pile-on investments that inflate valuations. As "venture bulls," a16z doesn't wait for hype—they manufacture it.

Iconic Examples of a16z's Playbook in Action

a16z's strategy has yielded blockbuster wins by betting early and loud on overlooked or controversial sectors:

a16z's strategy has yielded blockbuster wins by betting early and loud on overlooked or controversial sectors:

- Crypto Revolution (2013 Onward): While Bitcoin was dismissed as a dark web gimmick post-Silk Road scandal, a16z invested heavily in Coinbase. By 2016–2017, they launched a crypto fund, fueling the Web3 boom. Coinbase's 2021 IPO valued at $86 billion validated their vision.

- Defense Tech Renaissance (2017–2018): Entering Anduril (founded by Palmer Luckey) and Shield AI, a16z branded it "American Dynamism" — a euphemism for defense innovation. Once taboo in VC circles due to ethical qualms, this sector exploded amid geopolitical tensions, with Anduril now valued at over $14 billion.

- Creator Economy Boom (2017 Onward): Investments in Patreon, Substack, and Shopify championed micro-influencers over traditional media. a16z's thought leadership — articles and pods proclaiming the "creator economy's rise"—sparked a trend, drawing billions in follow-on capital.

Of course, not every swing connects. High-profile flops include Clubhouse (peaked during COVID but faded), late-stage WeWork (infamous for overvaluation), and numerous crypto bets that tanked in the 2022 bear market. Yet, with hits like Instagram (early backer via acquisition), Oculus (sold to Facebook), and GitHub (to Microsoft), a16z's hit rate sustains its $35+ billion in assets under management.

Also read:

- Baidu Releases ERNIE 5.0: A Multimodal AI Juggernaut with Efficient MoE Architecture

- Techniques and Tools for Developing Brand Tone of Voice

- Micron Warns of Unprecedented Memory Shortage: AI Demand Reshapes Global Tech Supply Chains Beyond 2026

Why a16z Matters in the VC Landscape

In a VC world dominated by data-driven bets and herd mentality, a16z's model—ecosystem support, specialized funds, growth-stage firepower, and narrative mastery — positions it as a trendsetter. It's not just about returns (though they've delivered: over 20x on some funds); it's about architecting industries. For aspiring founders, landing a16z means more than money — it's a launchpad. For the tech ecosystem, it's a reminder that bold, opinionated investing can reshape the future.

As venture capital evolves amid AI hype and economic shifts, a16z's blueprint offers lessons: Success isn't passive—it's engineered. Whether you're an investor, entrepreneur, or observer, understanding a16z reveals how one fund can turn speculation into self-fulfilling prophecy.