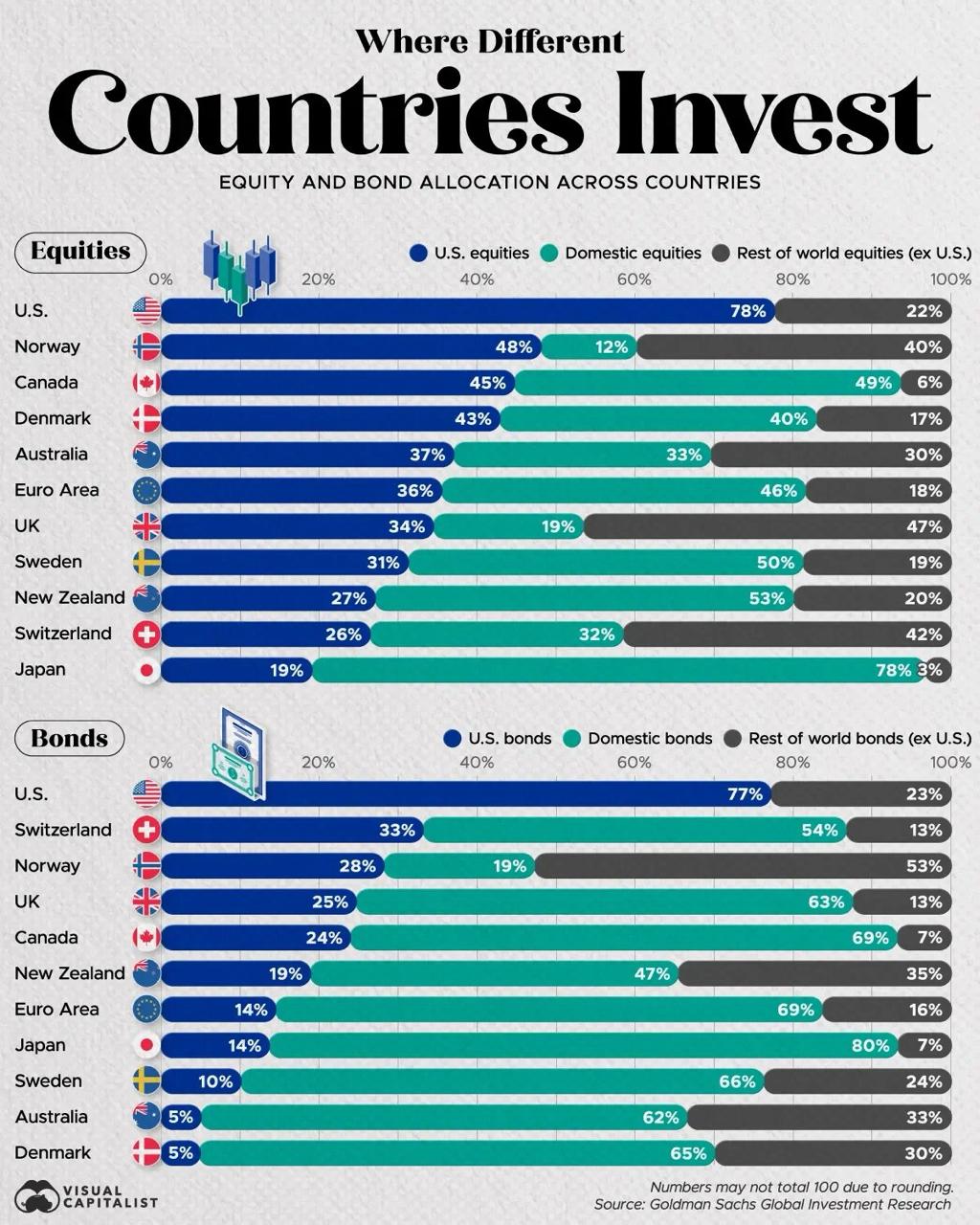

The classic investing puzzle known as home bias - the tendency for investors to overweight their domestic markets - remains alive and well, according to data from Goldman Sachs Global Investment Research visualized by Visual Capitalist. While globalization and low-cost ETFs make international diversification easier than ever, national preferences persist, often dramatically.

Equities: America's Overwhelming Home Advantage

U.S. investors exhibit the strongest home bias in equities, allocating 78% of their stock portfolios to domestic companies. This reflects confidence in the S&P 500's dominance, fueled by mega-cap tech giants and the dollar's reserve status.

U.S. investors exhibit the strongest home bias in equities, allocating 78% of their stock portfolios to domestic companies. This reflects confidence in the S&P 500's dominance, fueled by mega-cap tech giants and the dollar's reserve status.

At the opposite end, Japanese investors hold just 19% in home equities, with 78% in foreign stocks - likely seeking growth beyond a stagnant domestic market.

Notably, non-U.S. investors show significant affection for American stocks:

- Norway: 48% in U.S. equities

- Canada: 45%

- Denmark: 43%

These figures highlight America's outsized appeal, comprising over 60% of global market cap despite representing ~25% of world GDP.

Other patterns:

- Euro Area investors: 36% domestic, 46% rest of world

- UK: 34% domestic, reflecting post-Brexit caution

- Australia and New Zealand show balanced but outward-leaning tilts

Bonds: Even Stronger Local Loyalty

Home bias intensifies in fixed income, where familiarity, currency matching, and regulation play larger roles:

- U.S.: 77% domestic bonds

- Japan: 80%

- Euro Area: 69%

- Canada: 69%

Foreign bond exposure rarely exceeds 35%, underscoring risk aversion in safer assets.

Why Home Bias Persists – and Its Risks

Behavioral factors (familiarity, patriotism), information asymmetry, and currency hedging costs explain much of the phenomenon.

Behavioral factors (familiarity, patriotism), information asymmetry, and currency hedging costs explain much of the phenomenon.

Yet it carries costs: Reduced diversification increases vulnerability to country-specific shocks.

Goldman Sachs notes non-U.S. allocations to American assets have doubled over the past decade but remain below global weights, suggesting untapped potential.

In a multipolar world with rising geopolitical tensions, over-reliance on home markets - especially U.S. for Americans - may amplify volatility. As emerging markets grow and AI reshapes economies, broader exposure could enhance resilience.

The data reminds us: While home feels safest, true diversification often lies abroad. For long-term investors, balancing patriotism with prudence remains key.

Also read:

- College-Educated Americans Hit Record Share of Unemployment: A White-Collar Wake-Up Call

- The Ultimate Luxury: Extreme Privacy – How the Ultra-Wealthy Are Building Invisible Lives in Miami and Beyond

- The Looming Uranium Crunch: Why 2025 Marks the Start of a Structural Supply Deficit

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.