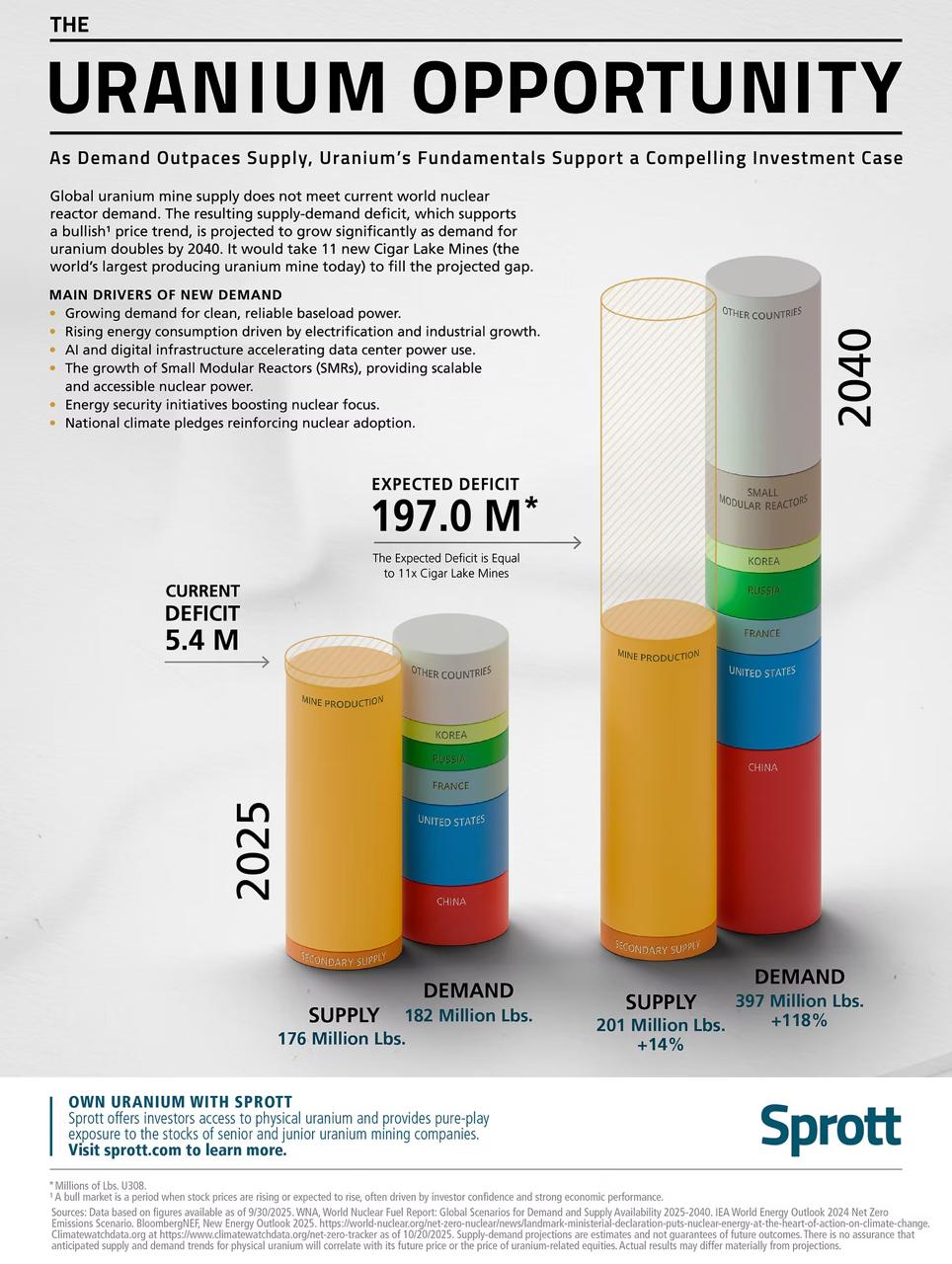

As the world accelerates its shift toward clean, reliable baseload power, uranium - the fuel powering nuclear reactors - is emerging as a critical bottleneck. Recent projections highlight a growing imbalance: In 2025, global demand is estimated at 182 million pounds of U₃O₈, while primary mine supply lags at 176 million pounds, creating an initial 6 million-pound deficit.

This gap is poised to widen dramatically, reaching 197 million pounds by 2040 as demand surges 118% to 397 million pounds and supply inches up only 14% to 201 million pounds.

This staggering shortfall - equivalent to the annual output of 11 Cigar Lake mines (the world's highest-grade uranium operation, producing around 18 million pounds per year) - signals a structural crisis unless new production ramps up swiftly.

Drivers Fueling Explosive Demand Growth

Several converging forces are propelling uranium needs:

Several converging forces are propelling uranium needs:

- Electrification and Data Centers: Rapid urbanization, industrial expansion, and AI-driven computing are skyrocketing electricity consumption. Nuclear provides carbon-free, 24/7 power ideal for these loads.

- Energy Security and Geopolitics: Nations are prioritizing domestic or allied supply chains, with uranium designated a critical mineral in the U.S. to reduce import reliance.

- Small Modular Reactors (SMRs): These factory-built, scalable units promise faster deployment and flexibility. Over 80 designs are in development, with first commercial units expected around 2030, adding significant fuel demand.

- Climate Commitments: Nuclear is key for deep decarbonization. At COP28 in 2023, 24 countries (later joined by more) pledged to triple global nuclear capacity by 2050 from 2020 levels, endorsing its role in net-zero pathways.

The World Nuclear Association's 2025 Fuel Report projects reactor requirements rising to ~150,000 tonnes U (over 390 million pounds U₃O₈ equivalent) by 2040 in its reference scenario, with higher cases exceeding 200,000 tonnes.

Supply Struggles to Keep Pace

Primary production faces headwinds: Long lead times (10-20 years for new mines), underinvestment post-Fukushima, and disruptions (e.g., Kazatomprom's sulfuric acid shortages). Secondary sources like inventories are depleting, leaving mines to bridge widening gaps.

Primary production faces headwinds: Long lead times (10-20 years for new mines), underinvestment post-Fukushima, and disruptions (e.g., Kazatomprom's sulfuric acid shortages). Secondary sources like inventories are depleting, leaving mines to bridge widening gaps.

Independent forecasts vary - UxC and others see balanced markets short-term but deficits post-2030 - yet the consensus points to tightening fundamentals requiring higher prices to incentivize restarts and greenfields.

Investment Implications in a Constrained Market

For investors, this mismatch underscores uranium's bullish case: Prices must rise to spur supply, potentially sustaining a multi-year upcycle. Physical trusts like Sprott's have amplified tightness by removing material from circulation.

For investors, this mismatch underscores uranium's bullish case: Prices must rise to spur supply, potentially sustaining a multi-year upcycle. Physical trusts like Sprott's have amplified tightness by removing material from circulation.

As nuclear renaissance gains momentum - backed by policy, technology, and necessity - the uranium story is shifting from cyclical commodity to strategic asset. The deficit starting in 2025 isn't a blip; it's the opening act of a prolonged supply crunch.

Also read:

- Vanguard Executive Likens Bitcoin to a 'Digital Labubu' Amid Platform's Crypto ETF Access

- MetaMask Breaks Barriers: Native Bitcoin Support Arrives, Unifying Crypto's Biggest Ecosystems

- Tether Eyes Up to $20 Billion Raise at $500 Billion Valuation, Explores Share Buybacks and Tokenization for Liquidity

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.