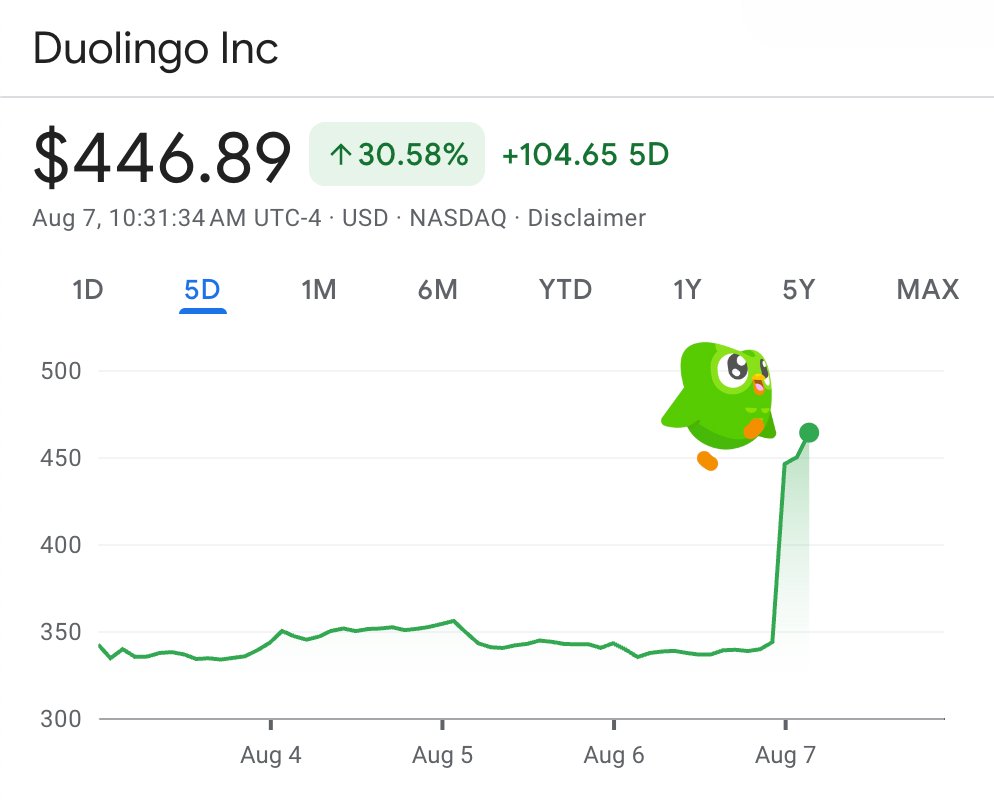

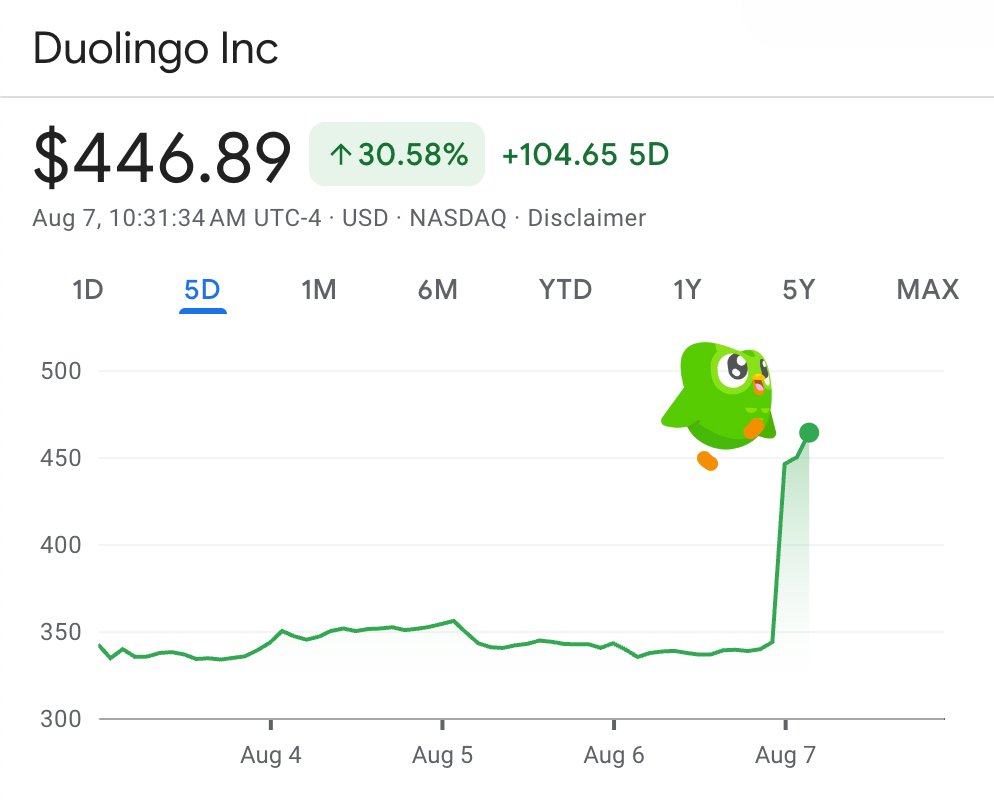

This week, Duolingo, Inc. has taken the stock market by storm, with its shares surging over 30% to close at $463.85 on Thursday, August 7, 2025. The catalyst?

A blockbuster second-quarter earnings report that exceeded expectations and showcased the language-learning platform’s meteoric rise, fueled by robust user growth, soaring profits, and strategic expansions into new markets and subjects. The company’s iconic green owl mascot, Duo, might just be sharpening its talons to dominate the financial markets.

A Stellar Q2 Performance

Duolingo’s Q2 2025 financials paint a picture of a company firing on all cylinders. The Pittsburgh-based edtech giant reported revenue of $252.3 million, a 41% year-over-year increase that beat Wall Street’s forecast of $240.7 million. Net profit soared to $44.8 million, or $0.91 per share, nearly doubling last year’s figure and surpassing analyst expectations of $0.58 per share by 56.9%.

Duolingo’s Q2 2025 financials paint a picture of a company firing on all cylinders. The Pittsburgh-based edtech giant reported revenue of $252.3 million, a 41% year-over-year increase that beat Wall Street’s forecast of $240.7 million. Net profit soared to $44.8 million, or $0.91 per share, nearly doubling last year’s figure and surpassing analyst expectations of $0.58 per share by 56.9%.

This exceptional performance prompted Duolingo to raise its full-year revenue guidance to $1.01–$1.02 billion, marking the first time the company projects crossing the $1 billion revenue threshold, up from its prior estimate of $987–$996 million.

User Growth Takes Flight

A key driver of Duolingo’s success is its rapidly expanding user base. Daily active users jumped 40% to nearly 48 million, up from 34 million a year ago, reflecting the platform’s ability to attract and retain learners globally. This growth is underpinned by Duolingo’s gamified approach, which keeps users hooked with streaks, leaderboards, and engaging lessons. The company’s freemium model, coupled with its premium subscription tiers like Duolingo Super and Max, continues to convert free users into paying subscribers, with subscription revenue now accounting for 83% of total revenue.

New Courses: Checkmate and Math Mastery

Duolingo’s strategic pivot beyond language learning is paying dividends. The company’s new chess and math courses, introduced to diversify its offerings, have struck a chord with users.

Duolingo’s strategic pivot beyond language learning is paying dividends. The company’s new chess and math courses, introduced to diversify its offerings, have struck a chord with users.

The chess course, launched in beta in April 2025, has seen rapid adoption, surpassing the performance of math and music courses among iPhone users with English interfaces.

These courses, bundled into the core subscription, are designed to enhance user engagement and reduce churn by catering to a broader range of learning interests.

By incorporating strategic thinking and problem-solving into its platform, Duolingo is positioning itself as a multi-subject educational powerhouse, appealing to users who thrive on interactive, gamified learning.

China: The Dragon of Growth

The real game-changer for Duolingo this quarter was its explosive growth in China, identified as the company’s fastest-growing market. A high-profile collaboration with Luckin Coffee, China’s ubiquitous coffee chain, proved to be a masterstroke. For several weeks, Luckin stores were adorned with Duolingo branding, featuring Duo-themed cups and drinks named after the app.

The real game-changer for Duolingo this quarter was its explosive growth in China, identified as the company’s fastest-growing market. A high-profile collaboration with Luckin Coffee, China’s ubiquitous coffee chain, proved to be a masterstroke. For several weeks, Luckin stores were adorned with Duolingo branding, featuring Duo-themed cups and drinks named after the app.

This partnership significantly boosted brand visibility and user acquisition in a market with immense potential. CEO Luis von Ahn highlighted China’s unexpected growth, noting that Asia is now the company’s top-performing region.

However, Duolingo Max, the AI-powered premium tier, is not yet available in China due to regulatory restrictions on non-local large language models, leaving room for even greater growth once approvals are secured.

AI: The Rocket Fuel

Artificial intelligence continues to be the wind beneath Duolingo’s wings. The company’s AI-driven features, such as the video-call conversation practice tool for premium subscribers, have enhanced user engagement and retention. Additionally, Duolingo’s acquisition of a London-based music gaming startup signals its ambition to further integrate AI into new educational domains.

By leveraging generative AI to create nearly 150 new language courses in Q1 2025 and streamline content development, Duolingo is scaling its offerings efficiently while maintaining quality. These innovations have not only driven user growth but also bolstered investor confidence, with analysts raising price targets to $515, citing Duolingo’s consistent performance and AI strategies.

Duo’s Market Menace

With a market capitalization approaching $20 billion and a stock price up 171.73% over the past year, Duolingo is no longer just a language-learning app—it’s a formidable force in the edtech space.

With a market capitalization approaching $20 billion and a stock price up 171.73% over the past year, Duolingo is no longer just a language-learning app—it’s a formidable force in the edtech space.

Retail sentiment has reached “extremely bullish” levels, with a 1,407% surge in user message volume in just 24 hours following the earnings release.

The company’s ability to exceed expectations while expanding profitability has analysts and investors alike buzzing with optimism.

However, some caution remains, with a slight deceleration in daily active user growth (now at 40%) noted as a potential concern, though this hasn’t dampened the market’s enthusiasm.

Also read:

- Free GPT-5 Is Here: OpenAI Unveils Its Smartest AI Yet, Redefining the Future of Intelligence

- Measure Studio Analyzes Lifespan of Long-Form Content and Shorts on YouTube

- Instagram Introduces Reposts: A New Way to Share Interests with Friends

- Permanent Work For a Salary Will Become an Anachronism.

Looking Ahead

As Duolingo continues its ascent, the company is poised to capitalize on the growing demand for AI-enhanced education. With its next earnings report slated for November 5, 2025, investors will be watching closely for signs of sustained momentum. For now, Duo the owl isn’t just teaching languages — it’s threatening to disrupt the stock market with its relentless growth. As Duolingo expands its educational galaxy with chess, math, and potentially more subjects, it’s clear that this edtech star is just getting started.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).