Hello!

The cryptocurrency ecosystem is an industry that has become extremely popular among investors, including beginners. It’s due to high profitability and dynamic price changes. But this is not the only group of entrepreneurs who benefit from the implementation of digital solutions.

No doubt, the growth of the BTC ecosystem is based on advanced technologies—Blockchain, NFT and others. But you should not underestimate the development of hardware for virtual reality and the Metaverse.

Before you decide to buy bitcoin and start investing in cryptocurrencies, be sure to read our guide. The most popular cryptocurrency that everyone knows and talks about is Bitcoin.

As the popularity of the BTC market has risen, thousands of other altcoins have emerged with varying market capitalizations — Polkadot, Chainlink, Dogecoin, QUASA (QUA) and many others.

Each project has a different scope. So enthusiasts who prefer this payment tool can diversify their investments.

Fundamentals of Investing

Awareness is one of the most important traits of a good investor, whether people prefer digital assets or stocks. This means that you have to follow the news, read the analytics of professionals and delve into reports in detail.

When investing their own money, people should find the answers to questions about why they are doing this and what value they see in Bitcoin and other projects.

The key step is to determine the right moment to enter the market — the so-called timing. As with any investment, it is essential to deal with rate fluctuations well before making your first trade. The key parameters depend on the fluctuation for the main coins — Bitcoin, Chainlink, Ethereum, Cardano and Uniswap.

The key step is to determine the right moment to enter the market — the so-called timing. As with any investment, it is essential to deal with rate fluctuations well before making your first trade. The key parameters depend on the fluctuation for the main coins — Bitcoin, Chainlink, Ethereum, Cardano and Uniswap.

Although digital assets and standard ways of investing differ. Any professional can confirm this. Digital assets are specific — the rise in price of one coin can lead to a general boom which is not always a trend for a regular currency.

Perhaps the most fundamental question people should ask themselves before investing in cryptocurrencies is why are they doing it. Only motivated enthusiasts can achieve higher profits. Now, there are countless investment tools available but large corporations choose this area. There are definitely good reasons for this, because the risks are very high.

Price Fluctuations — Cryptocurrencies vs Common Assets

Like the stock market, the cryptocurrency ecosystem has its own exchanges and brokers. Through such platforms, people can buy or sell their coins and withdraw funds. It is the same as stock trading, but with fewer restrictions on market participants and intermediaries.

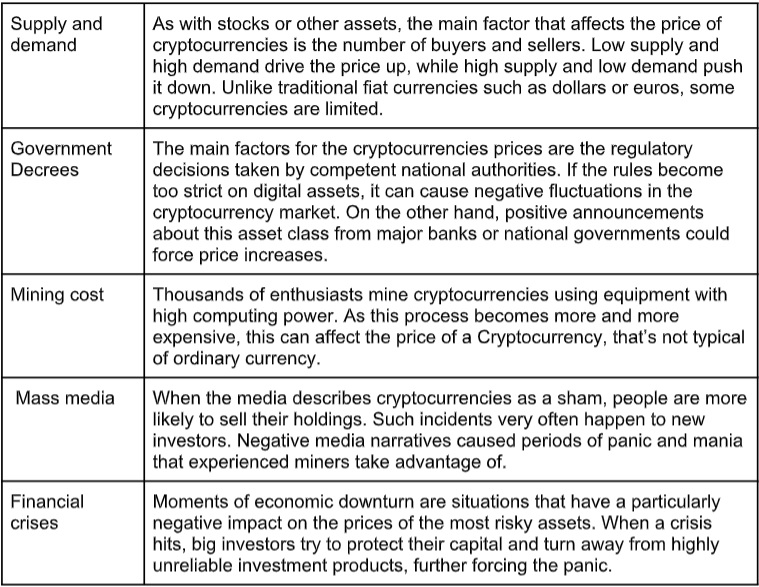

Bitcoin, apart from stablecoins, is the most stable and oldest coin. But other projects such as Ethereum, Solana or QUASA may overtake BTC in popularity. If we are talking about price fluctuations — for digital and conventional assets — it’s important to consider the following:

How Stable are Cryptocurrency Rates?

If traders compare the volatility of Bitcoin, Ethereum and other cryptocurrencies, they will inevitably find out that price fluctuations are significant.

If traders compare the volatility of Bitcoin, Ethereum and other cryptocurrencies, they will inevitably find out that price fluctuations are significant.

It’s both a disadvantage and an advantage, depending on the preferences of the investor. Growths and falls in different periods are inevitable and are determined by political crises and economic factors.

As for the price of the cryptocurrency, in March 2020, one BTC was paid an average of $4,000, while in January 2021, the price increased tenfold to $40,000. Continuing its boom, BTC hit an all-time high of $65,000 at the end of April 2021. Then, in May, the price dropped to $35,000. Such fluctuations will be of interest to many traders. This is because the net profit can reach 100-200%.

Blockchain & e-Commerce

Cryptocurrencies are digital assets that can be used for online shopping. Such coins are protected by cryptography, so they cannot be counterfeited or issued twice. Such a payment tool is based on Blockchains which, in turn, are based on a chain of computers that form a peer-to-peer network.

Are Blockchain and Cryptocurrencies the Same Thing?

Blockchain is a system for recording information that prevents hacking and loss of an asset. With the standard currency, investors do not always have such advantages.

Each block in the Blockchain contains a record of multiple transactions. Every time users send funds, new data is added to the ledger. The Blockchain database store a large amount of information that can be used by multiple contractors at the same time.

Investing in Innovation & Safety

Now, most investment markets are diversified. People can try to profit from buying shares of Blockchain-based companies, developing Metaverses or NFTs.

Now, most investment markets are diversified. People can try to profit from buying shares of Blockchain-based companies, developing Metaverses or NFTs.

The potential income from such investments may be less than the profit from CFD trading due to the lack of leverage and less volatility of the traditional market compared to the cryptocurrency market. But this is not a reason to abandon this way of earning which is based on flexibility and security.

Cryptocurrency are stored in so-called "e-wallets" which users can access with a private key — a super-strong password. If the code is forgotten or lost, it’s impossible to send funds.

*Melissa Robertson is a freelance writer who believes that with well-chosen words you can convey the right idea to a wide audience. Melissa is attentive to details, responsible, ready to develop in the profession.

Thank you!