Quartermast Advisors’ latest report on the creator economy reveals a robust resurgence in mergers and acquisitions (M&A) for the first half of 2025, with capital flooding back into the industry.

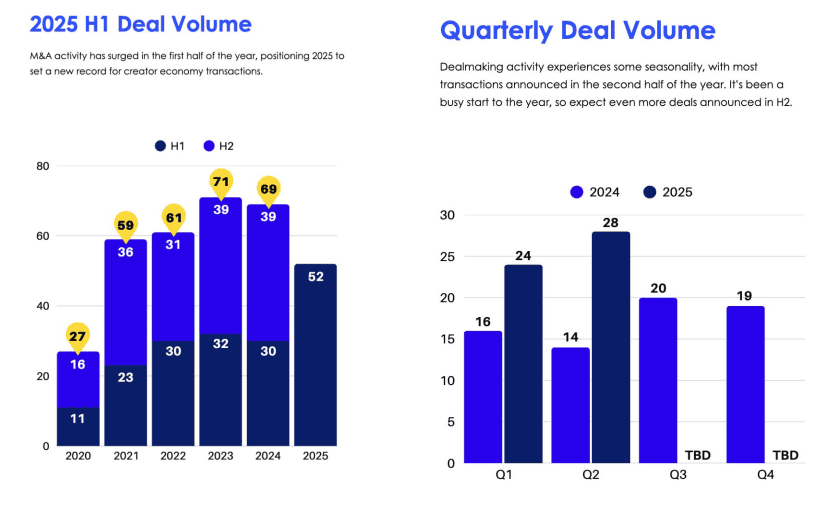

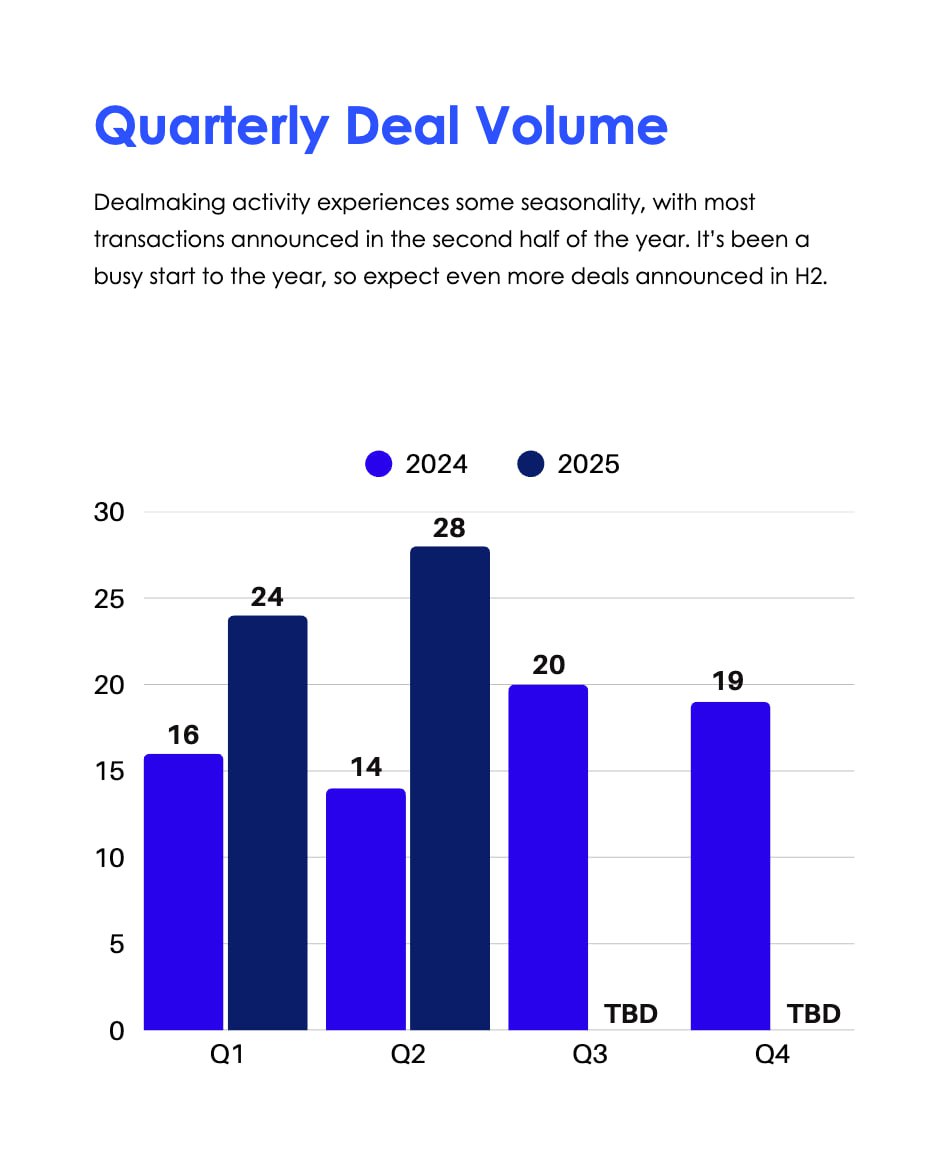

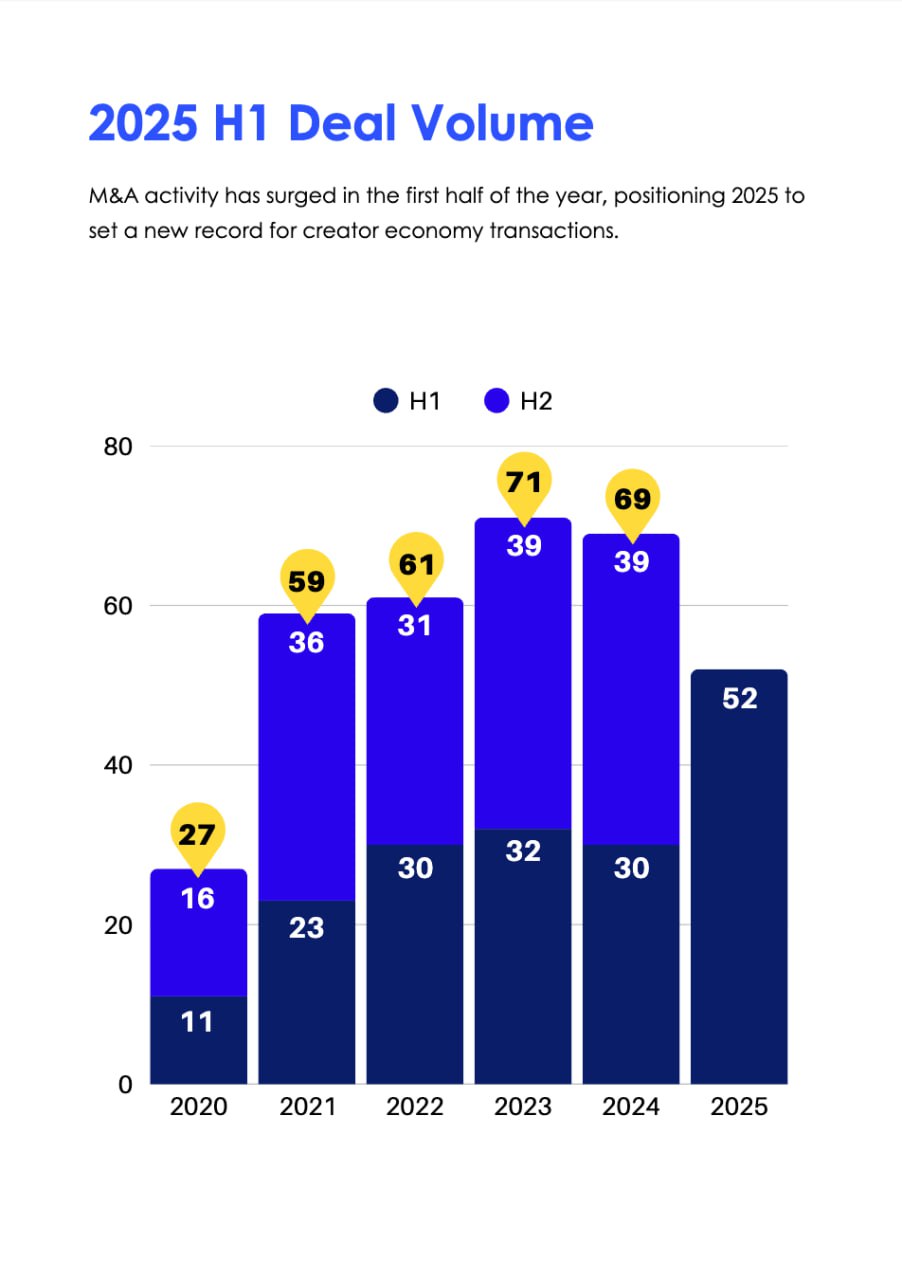

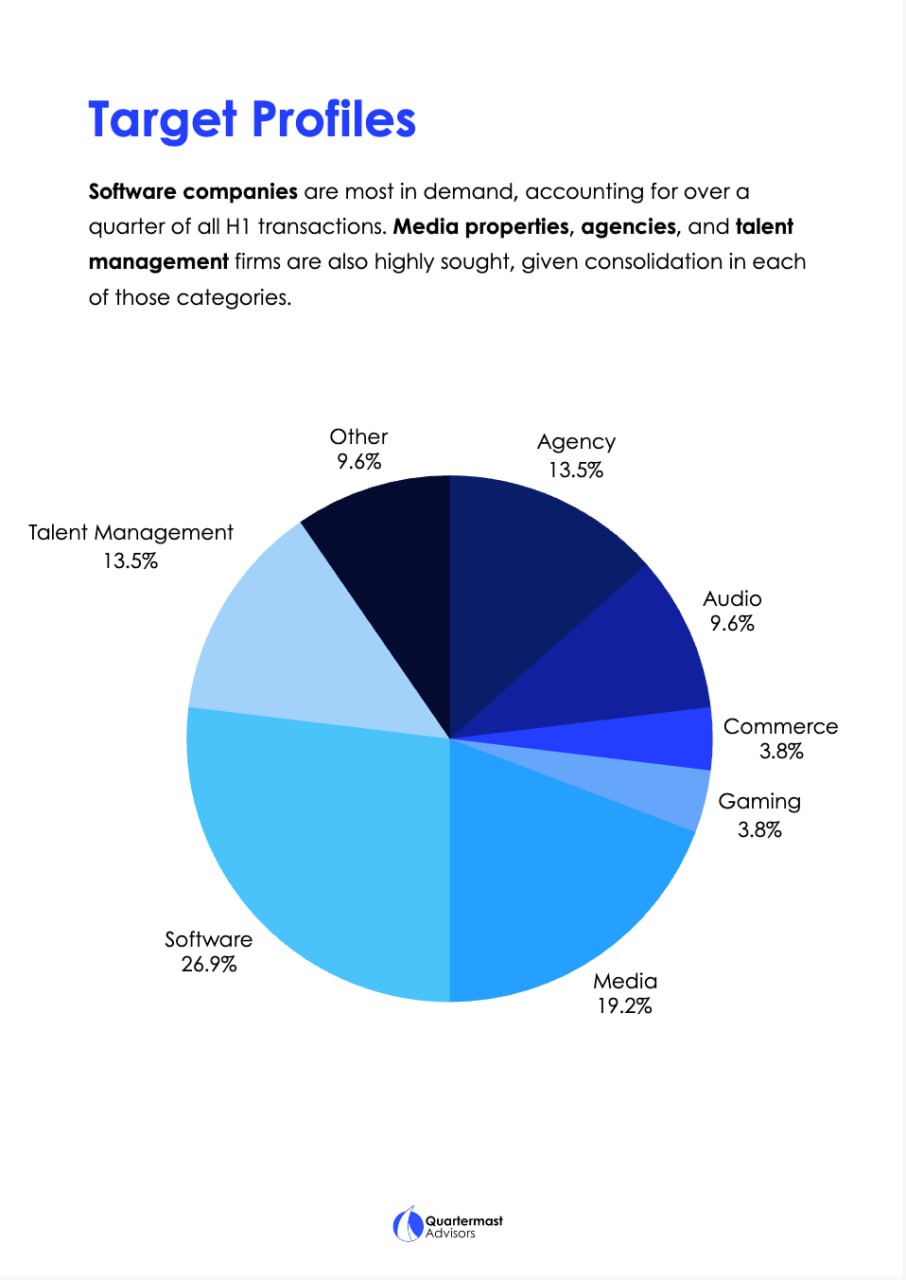

The report notes a remarkable 73% year-over-year increase in M&A activity, with 52 deals closed in just six months — matching the total number of transactions for the entire year of 2023. The focus has been on software, agencies, and media resources, signaling a maturing market hungry for consolidation.

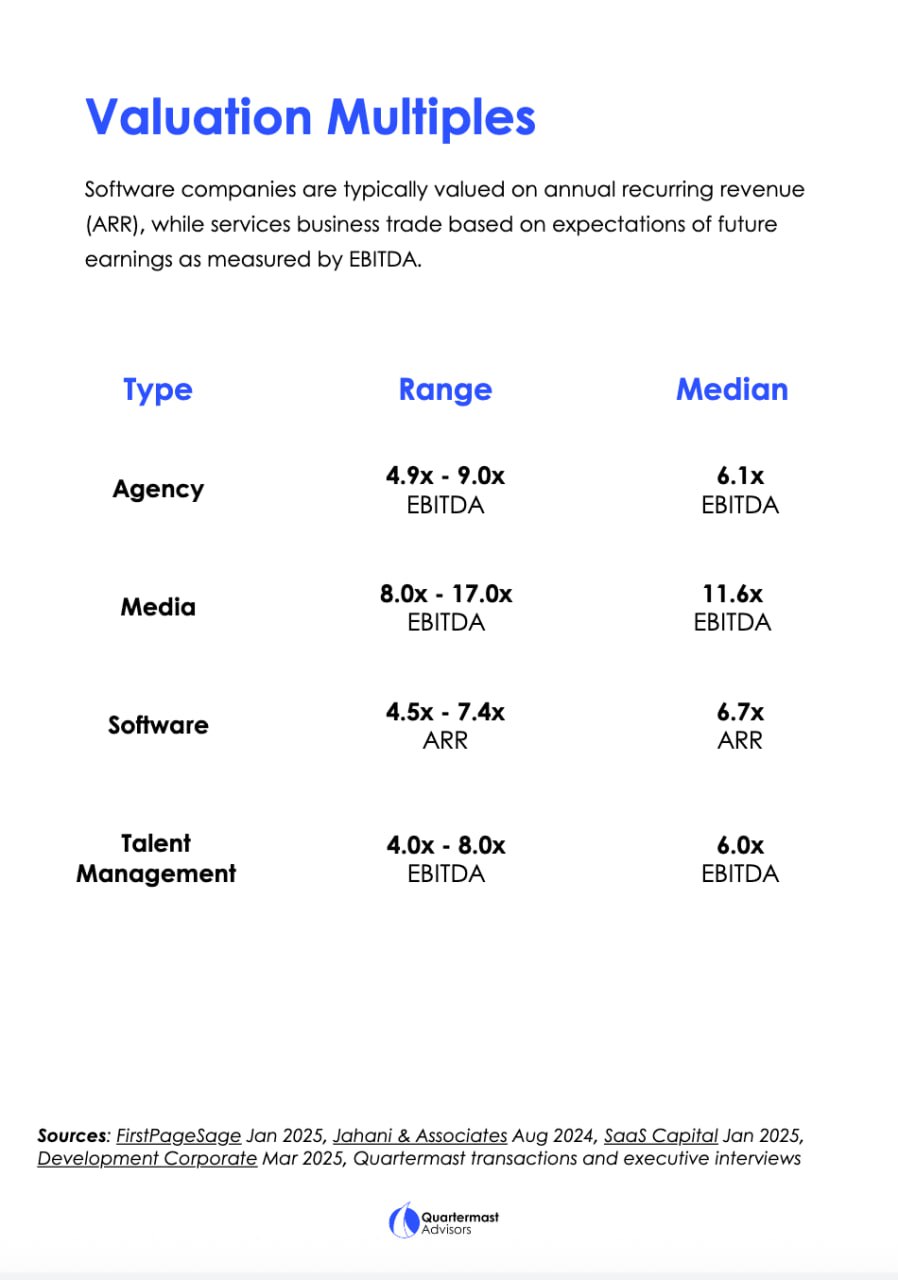

Valuation Trends and Investor Activity

Valuations in the creator economy remain strong, with averages ranging from 5× to 8× EBITDA. For SaaS companies, multiples are between 4.5× and 7.4× ARR, reflecting the high growth potential of these platforms. Private equity and venture capital are fueling the surge, with major players like PSG Equity, BlackRock, Clarion, and Andreessen Horowitz actively deploying capital. Notably, 79% of deals were concentrated in the United States, though interest in Europe and Latin America is gaining traction, hinting at a global expansion of the creator economy’s footprint.

Key Deals Driving the Boom

The first half of 2025 saw several high-profile transactions:

The first half of 2025 saw several high-profile transactions:

- - **Publicis Groupe** acquired influencer marketing platform **Captiv8** for $175 million, strengthening its position in social commerce and influencer marketing.

- - **PSG Equity** secured a majority stake in membership platform **Uscreen** for $150 million, capitalizing on the growing demand for subscription-based creator tools.

- - Foodtech company **Wonder** purchased media platform **Tastemade** for $90 million, showcasing unexpected buyers from adjacent industries entering the creator space.

- - Influencer platform **Later**, backed by Summit Partners, acquired social commerce brand **Mavely** for $250 million, a significant move in the affiliate commerce sector.

- - **Publicis Groupe** also acquired Brazil-based **BR Media Group** for approximately $96 million, expanding its influencer marketing capabilities in Latin America.

The emergence of foodtech and fashion brands as buyers highlights the broadening appeal of the creator economy, as diverse industries recognize the value of creator-driven content and commerce.

Quartermast’s Outlook for 2025

Quartermast projects continued momentum, forecasting over 100 M&A deals by year-end.

Quartermast projects continued momentum, forecasting over 100 M&A deals by year-end.

Key trends to watch include:

- - **Consolidation in talent management**, as agencies seek to streamline operations and expand their rosters.

- - **Increased M&A activity outside the U.S.**, with Europe and Latin America expected to see a reversal of the current 21% share of international deals.

- - A **new wave of influencer marketing platform acquisitions**, as brands and agencies aim to integrate advanced tech and data-driven solutions.

Also read:

- TIME Magazine Unveils Its Top 100 Creators List: A Celebration of Digital Pioneers

- Spotify’s Bold Video Push: Leaked Deck Reveals Ambitious Creator Strategy

- Epidemic Sound’s 2025 Creator Economy Report: Creators Turn Entrepreneurs Amid AI, Music, and Monetization Shifts

Why It Matters

The creator economy is no longer a niche market but a dynamic ecosystem attracting significant investment from both traditional and unexpected players. The influx of private equity, coupled with strategic acquisitions by companies like Publicis, underscores the industry’s potential for scalability and profitability. As Quartermast notes, the combination of proprietary technology, creator networks, and data analytics is driving these deals, positioning the creator economy as a cornerstone of modern marketing and commerce.

With the second half of 2025 poised for even greater activity, the creator economy is set to redefine how brands, platforms, and creators collaborate on a global scale.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).