South America's roads are humming with a new rhythm - one powered by batteries from Beijing. In a region long dominated by imported fossil-fuel guzzlers from Europe and Japan, electric vehicles (EVs) are surging onto the scene, and Chinese automakers are steering the charge.

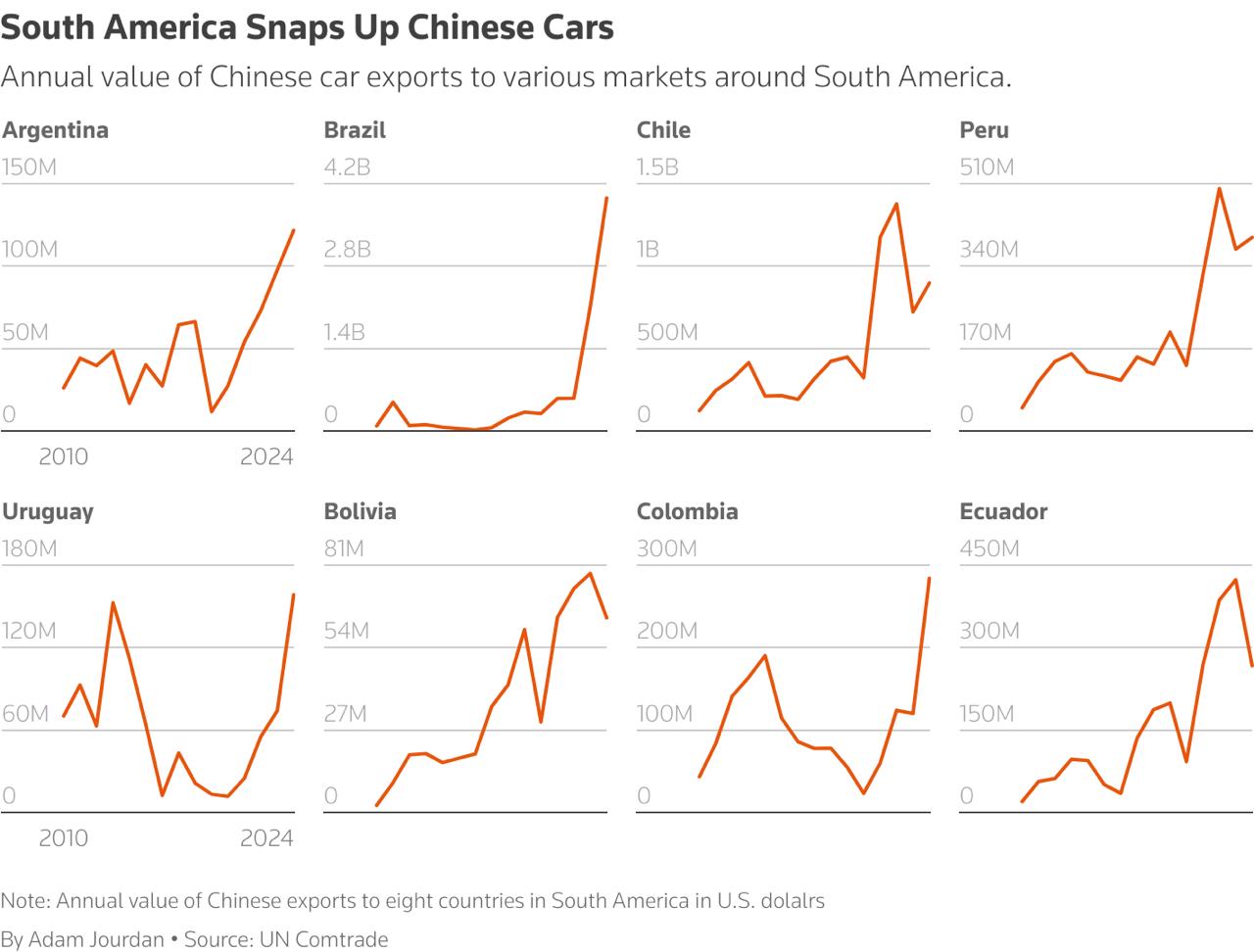

According to United Nations Comtrade data through 2024, the annual value of Chinese car exports to eight South American countries has skyrocketed, from modest trickles in 2010 to billions today. Brazil alone imported $4.2 billion worth in 2024, up from virtually nothing a decade ago, while Chile's haul hit $1.5 billion and Peru's $510 million. This isn't just trade stats; it's a seismic shift in mobility, fueled by affordability, smart partnerships, and a glaring absence: Tesla, the U.S. EV pioneer, still has no official footprint here.

The numbers tell a story of explosive growth. Latin America's overall EV penetration doubled to about 4% in 2024, per the International Energy Agency's Global EV Outlook 2025, and early 2025 data suggests it's accelerating.

The numbers tell a story of explosive growth. Latin America's overall EV penetration doubled to about 4% in 2024, per the International Energy Agency's Global EV Outlook 2025, and early 2025 data suggests it's accelerating.

Record highs include 10.6% of new car registrations in Chile in September 2025, 9.4% in Brazil in August, and a whopping 28% in Uruguay for the third quarter.

Across the region, Chinese brands like BYD, Chery, Geely, and Great Wall Motors (GWM) command nearly 30% of new passenger car sales in the first quarter of 2025 alone. BYD, the undisputed heavyweight, leads EV sales in Brazil, Colombia, Ecuador, and Uruguay, with 76,700 units sold in Brazil last year - a staggering 328% jump from 2023.

Why China, Not Tesla?

Tesla's silence in South America is deafening. Elon Musk's empire, which boasts over 50% global EV market share, has prioritized Europe, Asia, and North America, citing regulatory hurdles and infrastructure gaps.

Tesla's silence in South America is deafening. Elon Musk's empire, which boasts over 50% global EV market share, has prioritized Europe, Asia, and North America, citing regulatory hurdles and infrastructure gaps.

South America's charging network remains patchy - Brazil has about 17,000 public points as of late 2025, managed by players like Tupinambá Energia - but that's where Chinese firms excel. They flood the market with models priced 60% below Tesla's entry-level offerings: BYD's Seagull hatchback starts at around $19,000 in Uruguay, compared to $40,000-plus for a base Model 3 if it were available.

The secret sauce? Hyper-local strategies. Chinese exporters partner with established importers to customize vehicles for regional quirks - think rugged suspensions for Bolivia's altiplano roads or compact designs for São Paulo's gridlock. In Peru, BYD and Geely collaborate with local banks on low-interest credit lines, while dealerships run prize draws for buyers. "The Chinese struck first and struck hard," says Gonzalo Elgorriaga, a Uruguayan luxury dealer who pivoted to BYD models.

These tactics have doubled China's market share in Uruguay to 22% since 2023, with BYD claiming third place overall - behind only Chevrolet and Hyundai - across all vehicle types.

Uruguay: The EV Utopia Down South

No country embodies this revolution like Uruguay, a nation of 3.5 million that's become South America's EV darling. With 5,730 EVs sold in 2024 (a 218.5% year-over-year surge) and a 9.1% market share, it's outpacing even Costa Rica's 16%.

No country embodies this revolution like Uruguay, a nation of 3.5 million that's become South America's EV darling. With 5,730 EVs sold in 2024 (a 218.5% year-over-year surge) and a 9.1% market share, it's outpacing even Costa Rica's 16%.

Chinese imports dominate: BYD's affordable pickups and sedans are flying off lots, with one dealer noting, "I can buy three Chinese trucks for the price of two from traditional brands." Government incentives, like tax exemptions on EVs until 2035, supercharge the trend. Result? Uruguay's EV fleet grew 44% in the first nine months of 2025, turning Montevideo's streets into a showcase of battery-powered efficiency.

Brazil: The Giant Awakens

Brazil, the continent's automotive powerhouse with 200 million consumers, is the crown jewel. Chinese exports here ballooned to $4.2 billion in 2024, driven by BYD's dominance.

But it's not just imports: BYD kicked off assembly at a former Ford plant in Bahia in October 2025, while GWM repurposed a Mercedes-Benz site in August. These moves dodge looming tariffs - Brazil hiked EV import duties to 18% in 2024 (from 10%) and plans 35% by mid-2026 - to create jobs and leverage Mercosur trade pacts for regional exports by 2027. Labor groups grumble about "dumping," but consumers cheer: EV sales hit 9.4% of the market in August 2025, with Chinese models comprising the bulk.

Peru's Port of Change: Chancay as the New Gateway

Enter Peru's Chancay megaport, a $3.6 billion Chinese-built marvel opened in 2024 that slashes transpacific shipping times in half. It's now a redistribution nerve center: Cosco Shipping funneled 19,000 vehicles through it in 2025, with 3,057 arriving in July alone—up from 839 in January.

Enter Peru's Chancay megaport, a $3.6 billion Chinese-built marvel opened in 2024 that slashes transpacific shipping times in half. It's now a redistribution nerve center: Cosco Shipping funneled 19,000 vehicles through it in 2025, with 3,057 arriving in July alone—up from 839 in January.

Shipments fan out to Chile (where Chinese brands snagged 33% of the market by July 2025), Ecuador, and Colombia. Peru's own EV sales climbed 44% to 7,256 units in the first nine months of 2025, with BYD opening its fourth Lima dealership by year-end. As Cosco's Gonzalo Rios puts it, "Each ship brings 800 to 1,200 vehicles"—a lifeline for a region starved for affordable green tech.

Also read:

- China’s Box Office Just Broke Its Own 2024 Record — in October — Thanks to the “Ticket-Stub Economy”

- BBC's Desperate Pivot: Tim Davie Bets Big on "Project Ada" to Become the "British Netflix" — Even as He Exits Stage Left

- California Boosts Hollywood's Heartbeat: $313 Million in Tax Credits Lure Blockbusters and Jobs Back Home

Challenges and the Road Ahead

Not all smooth sailing. In Brazil, industry voices decry job losses from import floods, and reports of subpar conditions at BYD's Bahia plant drew scrutiny. Argentina's economic woes and high tariffs slowed progress until BYD's October 2025 debut. Yet, the momentum is undeniable. BloombergNEF forecasts Latin America's EV share hitting 10-20% by 2028, propelled by these investments. As Martin Bresciani, head of Chile's auto chamber CAVEM, notes, "The Chinese have demonstrated they match global standards in quality."

South America's EV dawn is Chinese-led, proving that in the race to zero emissions, it's not always the flashiest entrant who wins—it's the one that shows up, prices right, and partners smart. With Tesla on the sidelines, Beijing's automakers aren't just selling cars; they're recharging an entire continent.