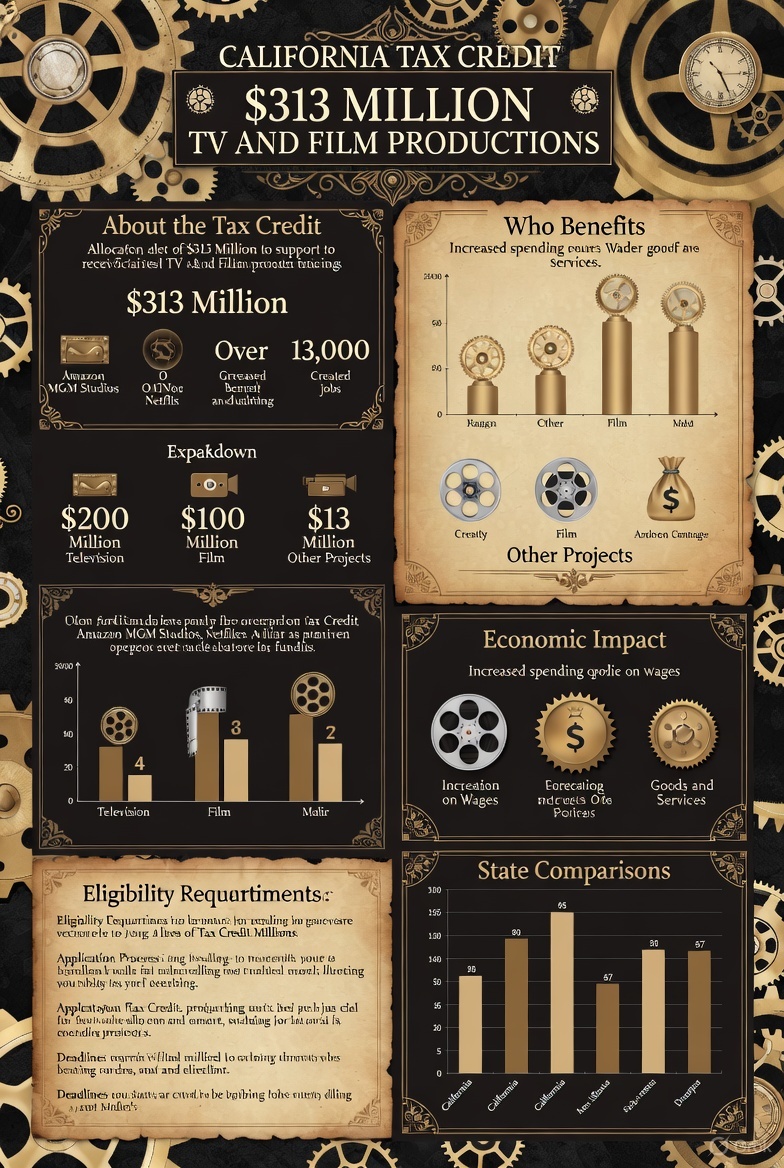

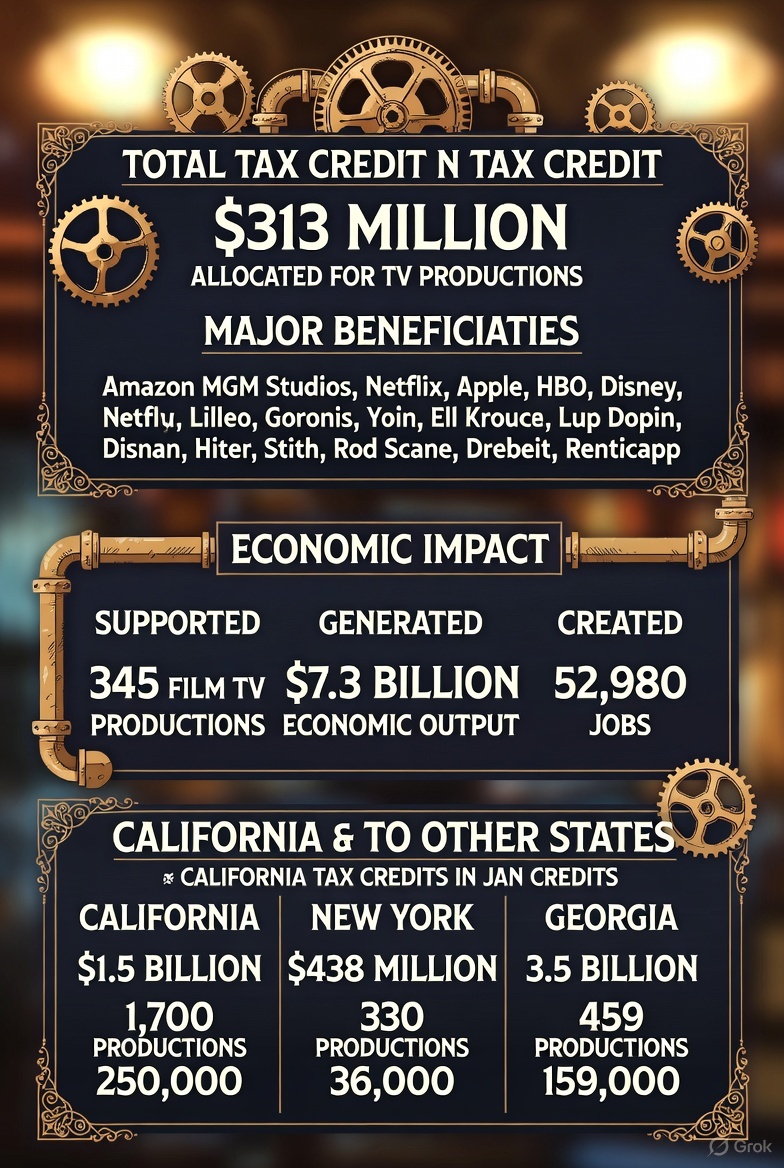

In a bold move to reclaim its crown as the undisputed epicenter of global entertainment, California has unleashed a staggering $313 million in tax credits for 17 television productions, set to ignite $1.2 billion in economic ripple effects and sustain over 5,000 high-wage jobs across the state.

This latest infusion, announced by the California Film Commission under the freshly expanded Program 4.0, isn't just fiscal firepower - it's a lifeline for an industry battered by strikes, wildfires, and the siren call of rival states' incentives. As production crews dust off their gear and studios scout sun-drenched lots from Los Angeles to San Diego, the Golden State is betting big on its magnetic allure: iconic backdrops, a deep bench of seasoned talent, and now, subsidies that make staying put irresistible.

This latest infusion, announced by the California Film Commission under the freshly expanded Program 4.0, isn't just fiscal firepower - it's a lifeline for an industry battered by strikes, wildfires, and the siren call of rival states' incentives. As production crews dust off their gear and studios scout sun-drenched lots from Los Angeles to San Diego, the Golden State is betting big on its magnetic allure: iconic backdrops, a deep bench of seasoned talent, and now, subsidies that make staying put irresistible.

The timing couldn't be more poignant. Since July 2025, when Governor Gavin Newsom signed off on doubling the program's annual cap from $330 million to $750 million, applications have surged by a jaw-dropping 400%. This isn't mere bureaucracy at work; it's a calculated counterpunch against "runaway production," where shows chase sweeter deals elsewhere.

Program 4.0 sweetens the pot with refundable credits - meaning studios get cash back even if they owe little in state taxes—plus new eligibility for animation, reality competitions, and independent fare. For relocating series, the base credit jumps to 35%, with bonuses for visual effects, local hires, and shoots beyond the bustling 30-mile "Studio Zone" around LA. The result? A projected 1,000 shooting days statewide, funneling $902 million in qualified spending, including $487 million in wages that will keep union grips, set designers, and extras thriving.

Leading the pack is Amazon MGM Studios, scooping up a hefty $74 million slice for two flagship series: the post-apocalyptic juggernaut Fallout and the spy-thriller reboot Mr. & Mrs. Smith. *Fallout*'s third season alone promises $166.3 million in qualified expenditures - a 21% leap from season two - while employing hundreds in a production that blends practical effects with sprawling wasteland sets evoking the game's irradiated vibes.

Leading the pack is Amazon MGM Studios, scooping up a hefty $74 million slice for two flagship series: the post-apocalyptic juggernaut Fallout and the spy-thriller reboot Mr. & Mrs. Smith. *Fallout*'s third season alone promises $166.3 million in qualified expenditures - a 21% leap from season two - while employing hundreds in a production that blends practical effects with sprawling wasteland sets evoking the game's irradiated vibes.

Showrunner Jonathan Nolan, fresh off *Westworld*, hailed the move as a "stand for the creative economy," crediting California's expanded incentives for anchoring the series' future here after its debut season wandered to New York, New Jersey, and Utah.

But the real drama unfolds in Mr. & Mrs. Smith's relocation saga. Donald Glover and Francesca Sloane's reimagining of the 2005 Angelina Jolie-Brad Pitt rom-com-turned-espionage caper had already navigated a rocky path: delays from the 2023 writers' and actors' strikes, plus a pivot from Italy's Lake Como to New York for season one.

Now, with nearly $32 million in credits (up from $22.4 million earlier this year), the sophomore outing shifts to LA County for 78 days of filming, injecting $80 million in local spend. Expect high-octane chases through palm-lined boulevards and tense stakeouts in Echo Park - perhaps even a cameo from industry vets like producer Mark Eidelshtein, whose fingerprints are all over Hollywood's indie scene. This isn't just a homecoming; it's a statement that California's incentives can outbid the Empire State's urban grit.

The migration trend is accelerating, up 10% since the program's revamp, as savvy producers weigh tax math against logistics. Netflix's *The Night Agent*, the breakneck thriller that hooked 98 million viewers in its first month, exemplifies the shift. After jetting through Vancouver, New York, Thailand, and Mexico for prior seasons, creator Shawn Ryan - LA native and The Shield alum - is steering season four to the City of Angels with a $31.6 million credit.

Over 90 days, it'll deploy 178 cast members, 334 crew, and 3,350 background days, burning through $80 million in qualified costs. Ryan's vision? A season rooted in LA's underbelly, amplifying the show's pulse-pounding bureau intrigue with SoCal authenticity. Paired with Forever's $63 million windfall for its second season, Netflix is doubling down on California as its West Coast fortress.

Over 90 days, it'll deploy 178 cast members, 334 crew, and 3,350 background days, burning through $80 million in qualified costs. Ryan's vision? A season rooted in LA's underbelly, amplifying the show's pulse-pounding bureau intrigue with SoCal authenticity. Paired with Forever's $63 million windfall for its second season, Netflix is doubling down on California as its West Coast fortress.

Yet, amid the glamour, whispers of a pivot emerge. While blockbusters like Baywatch's 12th-season revival snag $21 million to splash across Century City soundstages, the real growth story lies in scrappier indies.

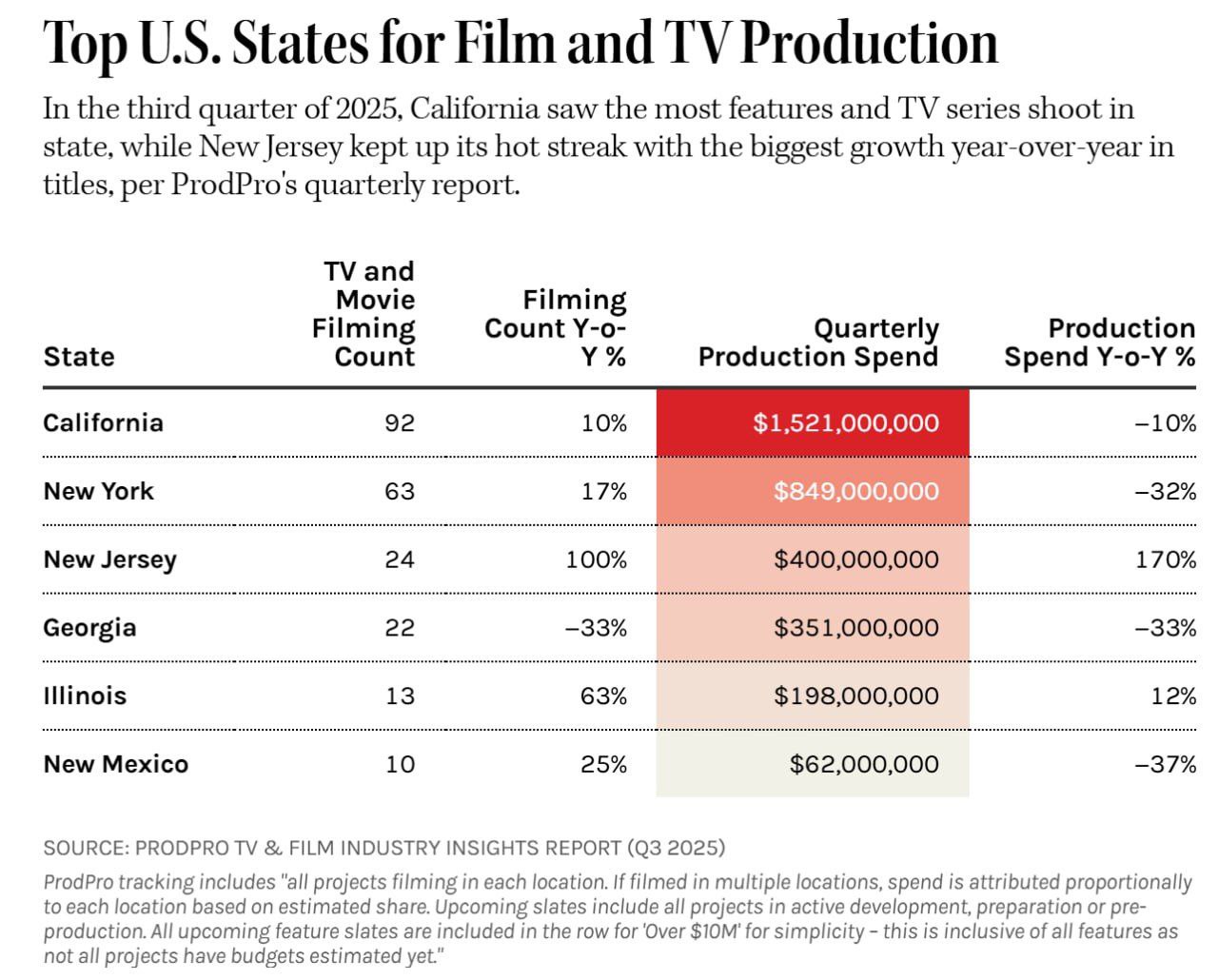

California's Q3 2025 production spend dipped 10% year-over-year to $1.5 billion, per ProdPro's insights report, as high-octane tentpoles give way to leaner features under $10 million.

These underdogs, now eligible for reserved $37.5 million pools, are flocking to the state - 42 independents greenlit in recent rounds alone. It's a democratizing force: think diverse voices tackling timely tales, from climate docs in Big Sur to queer rom-coms in the Valley, all buoyed by credits that level the playing field against Georgia's uncapped 30% rebates or New York's $800 million arsenal.

Zoom out, and the interstate arms race sharpens. California still dominates with 92 titles filming in Q3, but New Jersey's 100% title surge and $400 million spend (up 170%) signal a Northeast renaissance, fueled by 30-40% transferable credits. New York trails with 63 projects but a robust 23% growth in spend, while Georgia's 22 titles reflect a 33% dip amid post-production tweaks.

Illinois (+63% titles) and New Mexico (+25%) round out the top five, their incentives - up to 30% in NM's $130 million cap - luring shooters to deserts and urban sprawls. Texas and Louisiana are ramping up too, with broader rebates and no-caps pushing totals past $25 billion nationwide since the 1990s. Critics decry the "bidding war" as a zero-sum game, with studies pegging economic returns at just 20-30 cents per incentive dollar. But proponents counter: these aren't handouts - they're investments in a $100 billion industry that exports California's cool worldwide.

Also read:

Also read:

- Trump's AI Power Play: Crushing State Regulations to Forge a "Woke-Free" Future

- Waymo Just Unlocked Half of California — And Personal Car Ownership Might Never Recover

- China’s Box Office Just Broke Its Own 2024 Record — in October — Thanks to the “Ticket-Stub Economy”

As cranes rise at Hollywood Park Studios ahead of the 2028 Olympics and Television City's $1.25 billion glow-up adds 15 stages, the state's infrastructure renaissance syncs perfectly with this fiscal flex. Diversity mandates, now tying 4% of credits to inclusive hiring plans, ensure the boom benefits underrepresented crews, while 0.5% contributions fund training pipelines.

In an era of streaming wars and AI disruptions, California's gambit feels like a love letter to its creative soul: Come for the tax breaks, stay for the magic. With Fallou's vaults reopening and Night Agent's shadows lengthening over LA skylines, Hollywood's prodigal productions are trickling home. The question isn't if the state will recoup - it's how brightly the lights will burn.