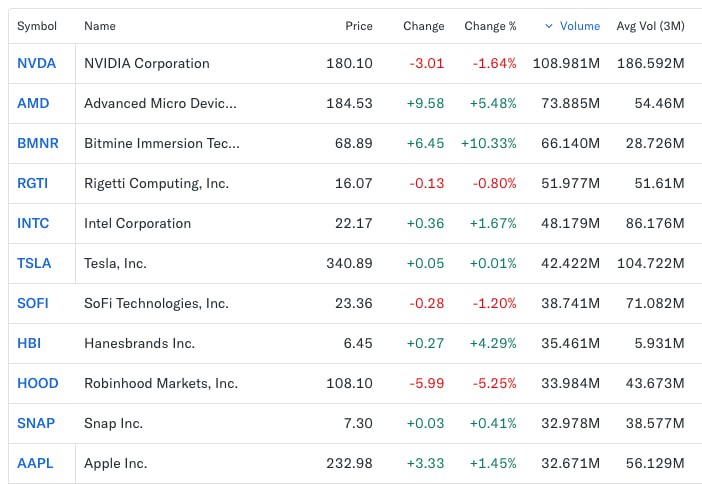

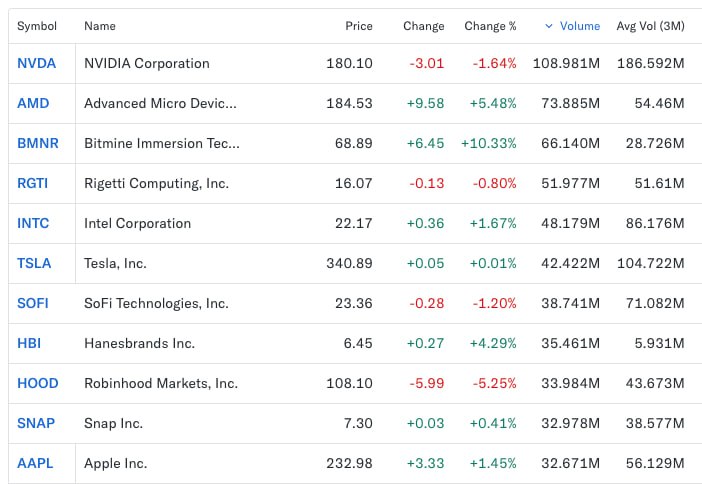

BitMine Immersion Technologies (ticker: BMNR), the largest publicly traded company with an Ethereum reserve, has claimed the third spot in trading volume on U.S. stock exchanges, according to data from Yahoo Finance.

The company trails only tech giants NVIDIA and AMD, surpassing other major players like Apple, Tesla, Intel, and Palantir.

The company trails only tech giants NVIDIA and AMD, surpassing other major players like Apple, Tesla, Intel, and Palantir.

Led by Fundstrat founder Tom Lee as chairman of the board and backed by PayPal co-founder Peter Thiel as a major shareholder, BitMine has rapidly risen to prominence. The company began building its cryptocurrency reserve in late June and, in less than two months, amassed 1,150,263 ETH, valued at over $5 billion.

This positions BitMine as the third-largest public holder of cryptocurrency by dollar value, behind only Michael Saylor’s Strategy and bitcoin-focused mining firm MARA Holdings.

BitMine has been raising capital through private stock placements. On August 12, the company filed documents to increase its authorized share issuance ceiling to $24.5 billion. With an ambitious goal of accumulating up to 5% of Ethereum’s total supply, BitMine is positioning itself as a key player in the crypto and tech investment landscape.

Also read:

- Artificial Intelligence in Companies: Not a Megaproject, but a New Literacy

- Grayscale Research Introduces Artificial Intelligence Crypto Sector, Expanding Its Crypto Sectors Framework

- China Unveils Cyborg with Human Brain: A Leap Toward Biohybrid Intelligence

The company’s meteoric rise in trading volume reflects growing investor interest in its unique strategy, blending traditional finance with cryptocurrency innovation. As BitMine continues to expand its Ethereum holdings, it is likely to remain a focal point for market watchers and investors alike.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).