On February 7, 2026, South Korea's major cryptocurrency exchange Bithumb became the center of global attention after a catastrophic operational error during a routine promotional event.

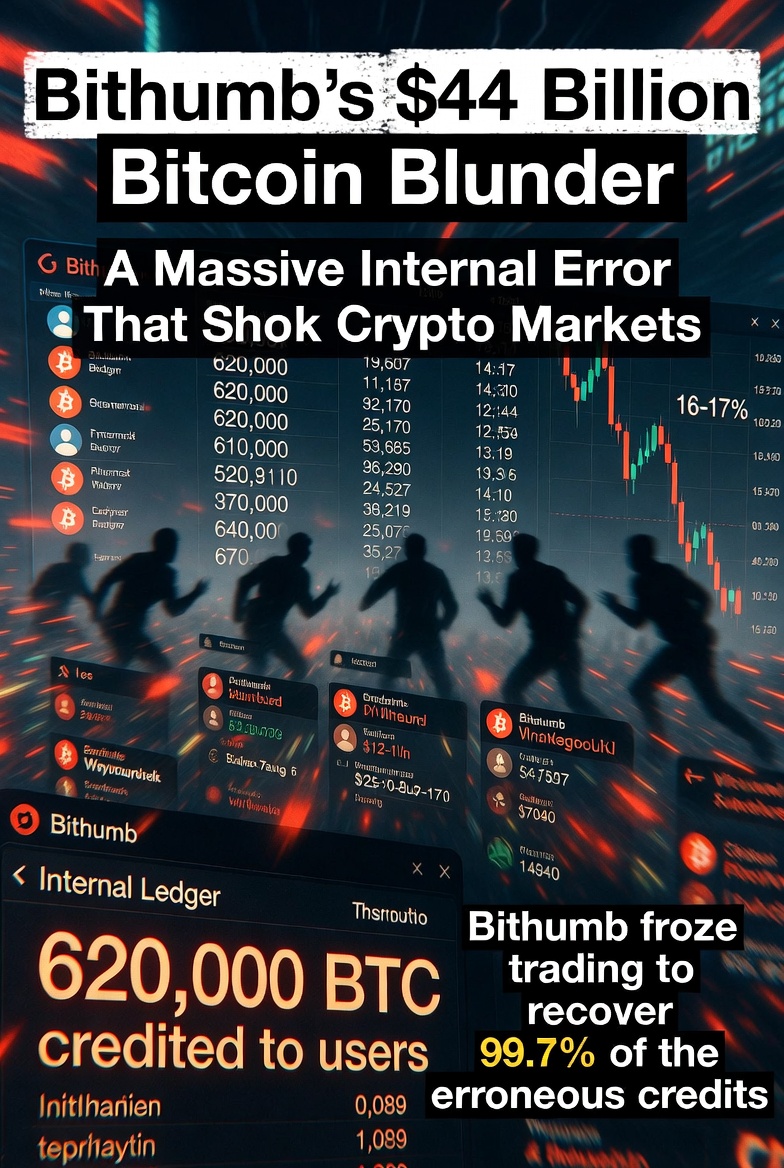

The platform accidentally credited approximately 620,000 Bitcoin — valued at around $44 billion at the time — to hundreds of users instead of the intended small cash rewards of roughly 2,000 Korean won (~$1.40–$1.50) per participant.

The platform accidentally credited approximately 620,000 Bitcoin — valued at around $44 billion at the time — to hundreds of users instead of the intended small cash rewards of roughly 2,000 Korean won (~$1.40–$1.50) per participant.

This glitch, caused by a simple unit entry mistake (Bitcoin instead of Korean won), briefly turned ordinary users into multi-millionaires on paper and triggered a sharp sell-off on Bithumb's platform.

What Happened: The "Random Box" Promo Gone Wrong

Bithumb had launched a promotional giveaway to reward active users, planning to distribute modest cash prizes to a select group of 695 participants. Instead of sending the correct amount in KRW, a configuration or manual error resulted in each winner receiving at least 2,000 BTC — collectively amounting to 620,000 BTC across the affected accounts.

Bithumb had launched a promotional giveaway to reward active users, planning to distribute modest cash prizes to a select group of 695 participants. Instead of sending the correct amount in KRW, a configuration or manual error resulted in each winner receiving at least 2,000 BTC — collectively amounting to 620,000 BTC across the affected accounts.

At Bitcoin prices around $70,000–$71,000 per coin during the incident, the erroneous distribution represented a staggering $40–44 billion in market value.

The exchange quickly identified the issue within 20–35 minutes of the distribution. Bithumb immediately froze trading and withdrawals for the 695 impacted accounts to prevent mass outflows. According to the company, 99.7% of the mistakenly credited Bitcoin was recovered, leaving only about 0.3% (roughly 1,788 BTC, or ~$125–170 million) unaccounted for after some users sold or transferred the assets before restrictions took effect.

Not a Hack — Just a Human Error

Bithumb emphasized that the incident was not the result of a hack, external breach, or security compromise. No client funds were stolen, and the exchange's actual reserves and cold storage remained secure.

The error stemmed from an internal mistake in the reward distribution process — essentially, a typo or unit misconfiguration that multiplied tiny cash prizes into full Bitcoin units. This created "fake" or internal ledger credits that never existed on the Bitcoin blockchain; only when users attempted to withdraw did the system attempt to convert them into real on-chain BTC.

Only a tiny fraction — reportedly 0.3% of affected users (approximately 2 individuals) — managed to successfully withdraw real Bitcoin before the freeze. The rest saw their windfall reversed once the exchange clawed back the credits.

Market Impact and Aftermath

The glitch caused immediate chaos on Bithumb's order books. Bitcoin's price on the platform plunged as much as **16–17%** as panicked users (and bots) dumped the erroneous balances, briefly creating a local flash crash before prices rebounded. Globally, Bitcoin experienced volatility but no sustained collapse.

The glitch caused immediate chaos on Bithumb's order books. Bitcoin's price on the platform plunged as much as **16–17%** as panicked users (and bots) dumped the erroneous balances, briefly creating a local flash crash before prices rebounded. Globally, Bitcoin experienced volatility but no sustained collapse.

Bithumb apologized publicly, promised to reimburse any users who incurred losses during the panic sell-off, and reassured clients that their legitimate funds remained safe.

The incident exposed glaring weaknesses in operational controls: inadequate validation checks, insufficient automated safeguards against extreme unit errors, and reliance on manual oversight for high-stakes reward distributions.

Also read:

- YouTube: The Undisputed Streaming Leader with Over $60 Billion in 2025 Revenue

- A Stark Lesson in Leveraged ETFs: How MST3 (3x MicroStrategy) Went from +1300% to -99% in Months

- Chaos in China's Bubble Tea Shops: Alibaba's Qwen AI Giveaway Sparks Massive Queues and Tops App Store Charts

A Wake-Up Call for Crypto Exchanges

This is not the first time a major exchange has suffered from internal errors or mismanagement, but the scale of Bithumb's blunder is unprecedented. The episode highlights a fundamental risk in centralized exchanges: internal ledger balances can be inflated or miscredited far beyond actual reserves, creating the illusion of massive wealth until withdrawal attempts expose the shortfall.

While Bithumb recovered nearly all the erroneous credits, the incident raised serious questions about risk management, internal auditing, and the ability of platforms to prevent catastrophic operational failures. For users, it served as a stark reminder that centralized exchanges operate on trust — trust in their systems, controls, and ability to correct mistakes before real funds disappear.

As crypto markets mature, incidents like this underscore the need for stronger operational resilience, automated sanity checks, and greater transparency in how exchanges handle promotions and internal accounting. In the end, what began as a $1.50 reward giveaway turned into a $44 billion cautionary tale about the fragility of centralized crypto infrastructure.