In the ever-evolving landscape of digital entertainment, YouTube has solidified its position as the top streaming platform, generating more than $60 billion in combined ad and subscription revenue for 2025. This milestone, revealed in Alphabet's latest earnings report, underscores the platform's transformation from a hub of user-generated content to a full-fledged media powerhouse rivaling traditional television.

Alphabet, Google's parent company, reported robust fourth-quarter results for 2025, with overall revenue climbing 18% year-over-year to $113.8 billion. For the full year, Alphabet's revenue surpassed $400 billion for the first time, reaching $402.8 billion—a 15% increase from 2024.

Alphabet, Google's parent company, reported robust fourth-quarter results for 2025, with overall revenue climbing 18% year-over-year to $113.8 billion. For the full year, Alphabet's revenue surpassed $400 billion for the first time, reaching $402.8 billion—a 15% increase from 2024.

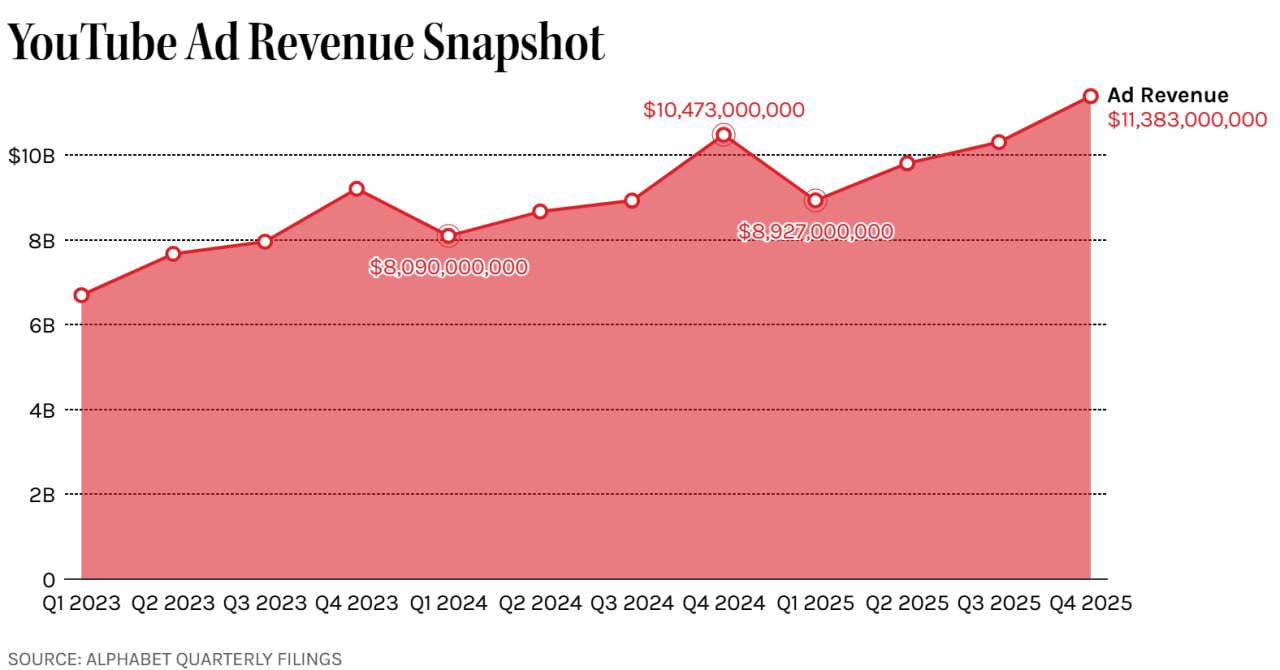

Within this, YouTube's performance stood out: its Q4 ad revenue alone grew 9% to $11.38 billion, though it slightly missed analyst expectations of $11.84 billion.

The platform's success is further highlighted by over 325 million paid subscriptions across Alphabet's consumer services, including YouTube Premium, Music, and TV, driven by strong adoption.

Sundar Pichai, CEO of Alphabet and Google, emphasized the platform's momentum in the earnings call: "YouTube’s annual revenues surpassed $60 billion across ads and subscriptions." This figure not only eclipses Netflix's 2025 revenue of about $45 billion but also positions YouTube as a dominant force in the industry, outpacing competitors in both scale and engagement.

Sundar Pichai, CEO of Alphabet and Google, emphasized the platform's momentum in the earnings call: "YouTube’s annual revenues surpassed $60 billion across ads and subscriptions." This figure not only eclipses Netflix's 2025 revenue of about $45 billion but also positions YouTube as a dominant force in the industry, outpacing competitors in both scale and engagement.

These impressive numbers come at a pivotal time for the streaming wars. Just days before Alphabet's report, Netflix co-CEO Ted Sarandos testified before the U.S. Senate Judiciary Committee's antitrust subcommittee on the company's proposed $82.7 billion acquisition of Warner Bros. Discovery. Sarandos argued that the merger would enhance Netflix's ability to compete in a market increasingly dominated by tech giants like YouTube. "YouTube is not just cat videos anymore," he stated during the hearing. "YouTube is TV."

Sarandos pushed back against monopoly concerns, noting that Netflix holds only about 9% of U.S. TV viewing time, which would rise modestly to 10% post-merger. In contrast, YouTube commands a larger share — 12.7% in December 2025, according to Nielsen data — making it the real behemoth in the space. He reiterated that overlooking YouTube as a primary competitor is "fantasy," given its vast content ecosystem and viewer base.

Sarandos pushed back against monopoly concerns, noting that Netflix holds only about 9% of U.S. TV viewing time, which would rise modestly to 10% post-merger. In contrast, YouTube commands a larger share — 12.7% in December 2025, according to Nielsen data — making it the real behemoth in the space. He reiterated that overlooking YouTube as a primary competitor is "fantasy," given its vast content ecosystem and viewer base.

While Sarandos downplayed the "cat videos" era, YouTube's short-form content remains a massive draw. YouTube Shorts, the platform's TikTok rival, averages billions of daily views, contributing significantly to overall engagement.

This blend of short clips, long-form videos, live streams, and premium offerings has turned YouTube into a one-stop entertainment destination, appealing to diverse audiences worldwide.

The hearing also touched on broader industry implications. Senators grilled Sarandos on issues like content diversity, residual payments for creators, and potential antitrust risks, with some Republicans criticizing Netflix's programming as "woke."

Yet, the focus on YouTube as the true disruptor highlights a shift: traditional streamers like Netflix are now positioning mergers as defensive moves against Silicon Valley's encroachment on Hollywood.

As Alphabet invests heavily in AI and infrastructure — projecting $175-185 billion in capital expenditures for 2026 — YouTube's growth trajectory shows no signs of slowing. For Netflix and others, competing with this "mahina" (as Sarandos might say) requires bold strategies, like the Warner Bros. deal. Whether regulators approve it remains uncertain, but one thing is clear: in the streaming arena, YouTube wears the crown, backed by billions in revenue and even more in views.

Also read:

- A Stark Lesson in Leveraged ETFs: How MST3 (3x MicroStrategy) Went from +1300% to -99% in Months

- Chaos in China's Bubble Tea Shops: Alibaba's Qwen AI Giveaway Sparks Massive Queues and Tops App Store Charts

- AI Frontier Explodes: Quasa's Top-5 Highlights — Claude 4.6, GPT-5.3-Codex, Kling 3.0 & More

Thank you!