For years the narrative has been simple: while the West debates ethics and safety, China charges full-speed into humanoid robotics as a cornerstone of its next industrial revolution. Yet on November 26, 2025, the National Development and Reform Commission (NDRC), China’s top economic planning body, did something almost unthinkable: it publicly warned that the domestic humanoid-robot sector risks becoming a classic speculative bubble.

The statement was blunt. Despite hundreds of billions of yuan in combined government subsidies, local-investment funds, and private capital, “proven, large-scale commercial scenarios remain extremely limited.” Most of the 160+ companies now claiming to build humanoids are either brand-new startups or traditional manufacturers (home appliances, EVs, toys) pivoting overnight for a slice of the hype.

The statement was blunt. Despite hundreds of billions of yuan in combined government subsidies, local-investment funds, and private capital, “proven, large-scale commercial scenarios remain extremely limited.” Most of the 160+ companies now claiming to build humanoids are either brand-new startups or traditional manufacturers (home appliances, EVs, toys) pivoting overnight for a slice of the hype.

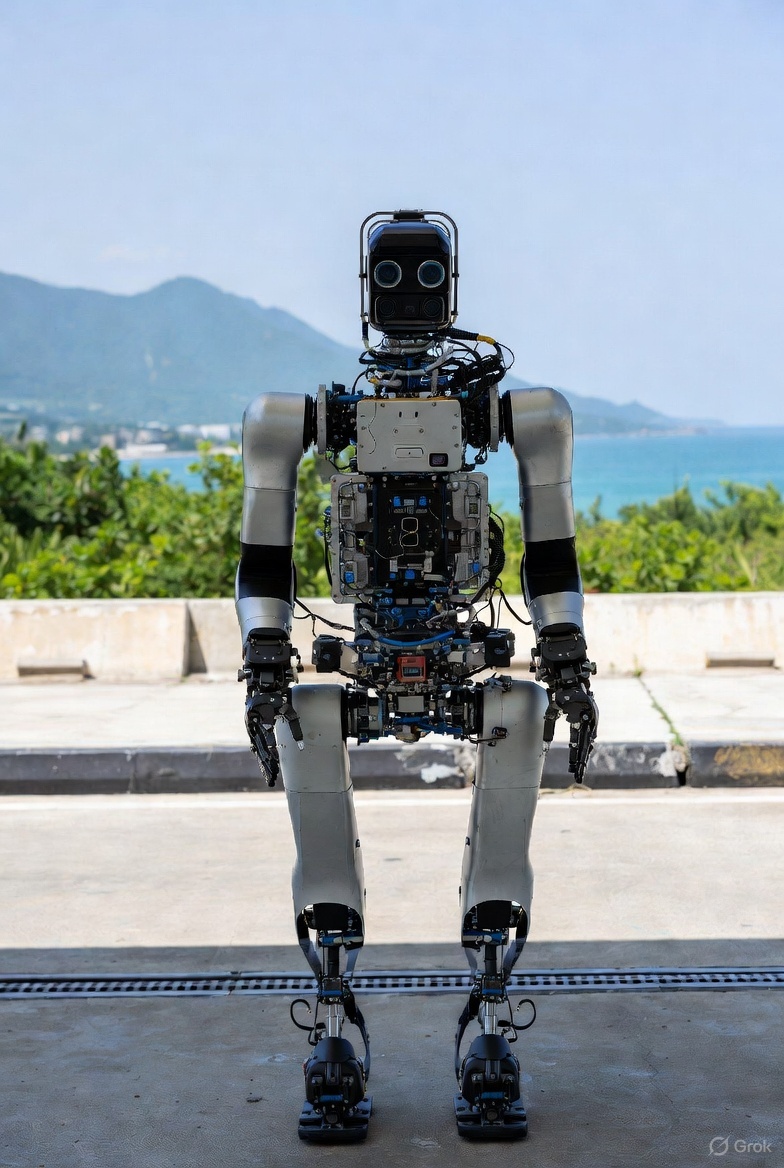

More than half lack any prior robotics experience. The result: an avalanche of near-identical prototypes that can walk, wave, and fold T-shirts in perfectly lit demos but struggle with real-world tasks like navigating uneven factory floors or working longer than 40 minutes without human intervention.

The numbers are dizzying. In 2024 alone, Chinese humanoid firms raised an estimated 48 billion yuan ($6.7 billion) across 89 funding rounds. Valuations have gone vertical: Unitree’s G1 is now valued at over $2 billion after a single $150 million round; Agibot, founded in 2023, hit unicorn status in under 18 months.

Local governments have thrown in another 120 billion yuan in direct grants and tax breaks, with cities like Shanghai, Shenzhen, and Hangzhou competing to be crowned “Humanoid Valley.” Production targets are surreal: Beijing wants 500 enterprise-grade humanoids deployed by end-2025 and 100,000 cumulative units by 2030.

Yet the NDRC report highlights a painful truth: outside of a handful of showcase factories (BYD, NIO, Geely) and the recent Walker S2 border deployment, almost no company can point to profitable, repeatable use cases at scale. Battery life, cost (still $90,000–$200,000 per unit), and reliability in dirty, hot, or unpredictable environments remain unsolved. Many “new” models are little more than rebranded versions of the same open-source designs with different plastic shells, leading regulators to worry about “low-level redundant construction” and “blind investment.”

Yet the NDRC report highlights a painful truth: outside of a handful of showcase factories (BYD, NIO, Geely) and the recent Walker S2 border deployment, almost no company can point to profitable, repeatable use cases at scale. Battery life, cost (still $90,000–$200,000 per unit), and reliability in dirty, hot, or unpredictable environments remain unsolved. Many “new” models are little more than rebranded versions of the same open-source designs with different plastic shells, leading regulators to worry about “low-level redundant construction” and “blind investment.”

This is peak irony: the same government that declared humanoid robots a “strategic emerging industry” in 2023 and poured state money into UBTech’s IPO (raising $270 million in Hong Kong in 2024) is now telling its own ecosystem to cool off.

The Ministry of Industry and Information Technology has already begun drafting certification standards and “negative lists” to curb duplicate projects, while several provinces have quietly frozen new humanoid subsidies pending proof of commercial viability.

The Ministry of Industry and Information Technology has already begun drafting certification standards and “negative lists” to curb duplicate projects, while several provinces have quietly frozen new humanoid subsidies pending proof of commercial viability.

The fear is familiar to anyone who lived through China’s solar-panel boom-and-bust of the 2010s or the EV overcapacity scare of 2023: massive state-backed investment → thousands of copycat factories → price war → wave of bankruptcies → painful consolidation → eventual global dominance. The difference this time is speed. The humanoid rush is happening in 24 months what took solar a decade.

Investors outside China are taking note. While global funds still pour money into Boston Dynamics, Figure, and Tesla Optimus, some are pausing on Chinese exposure. As one Shanghai-based VC put it: “When your own regulator uses the phrase ‘risk of bubble formation,’ that’s usually the exact top of the market.”

Also read:

Also read:

- Cryptocurrencies Have Become a Lifeline Against Hyperinflation in Emerging Economies

- Character AI Bans Users Under 18 and Launches “Stories” to Replace Open-Ended Chats

- OpenAI's High-Wire Act: Chasing $200 Billion in Revenue While Staring Down a $207 Billion Funding Abyss

For now, the machines keep marching out of factories, folding shirts on Douyin livestreams and saluting at trade fairs. Whether they become the backbone of Industry 5.0 or the most expensive lawn ornaments in history will be decided in the next 18–36 months. Beijing just made sure everyone knows the clock is ticking.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.