As of late August 2025, American Eagle Outfitters (AEO) is facing a sharp decline in its stock price following a downgrade by Bank of America, which lowered the company’s rating from “Neutral” to “Underperform” — effectively advising shareholders to sell.

The move has sent shockwaves through the retail sector, with analysts pointing to a combination of short-term marketing wins and looming long-term challenges, chief among them the impact of Trump-era tariffs.

The Downgrade and Its Triggers

Bank of America’s decision reflects a reassessment of American Eagle’s financial outlook, driven by macroeconomic pressures rather than internal missteps. The downgrade came with a reduced price target, dropping from $11 to $10, and a 30% cut to the fiscal 2026 earnings per share estimate, now pegged at $0.9. This pessimistic shift underscores doubts about the retailer’s ability to sustain growth amid rising costs, with analysts citing the recently imposed Trump tariffs as the primary culprit.

These tariffs, which have escalated trade tensions with key markets like Canada, Mexico, and China, are expected to inflate the cost of imported goods—a critical factor for a brand like American Eagle, heavily reliant on global supply chains. The bank’s report warns that prolonged recovery challenges, coupled with weakening sales momentum outside core categories like denim, could erode profitability, making the stock less attractive to investors.

The Sydney Sweeney Effect

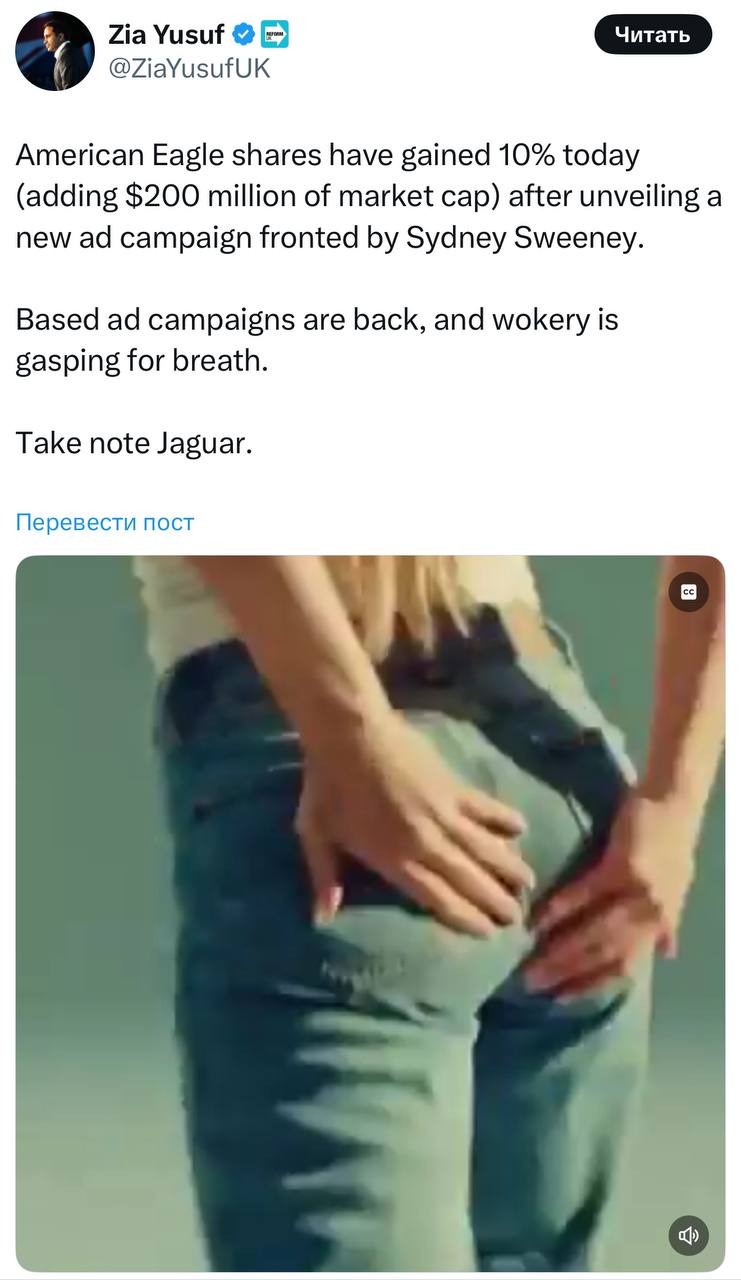

The downgrade arrives on the heels of a high-profile advertising campaign featuring actress Sydney Sweeney, which initially boosted the brand’s visibility. The “Sydney Sweeney Has Great Jeans” campaign, launched earlier this year, drove the actress’s namesake jeans to sell out and pushed the stock price to a six-month high of $13.39.

The downgrade arrives on the heels of a high-profile advertising campaign featuring actress Sydney Sweeney, which initially boosted the brand’s visibility. The “Sydney Sweeney Has Great Jeans” campaign, launched earlier this year, drove the actress’s namesake jeans to sell out and pushed the stock price to a six-month high of $13.39.

This short-term spike suggested a potential turnaround, with the campaign generating buzz and millions of impressions across social media.

However, analysts are skeptical about its long-term impact. While the ad succeeded in capturing attention and driving immediate sales, Bank of America contends it may not offset the broader financial headwinds.

The campaign’s success is seen as a fleeting lift rather than a sustainable solution, with experts questioning whether the brand can maintain momentum in intimates and swimwear—categories struggling amid tariff-related cost increases.

Tariff Troubles Take Center Stage

The Trump tariffs, including a 25% levy on imports from Canada and Mexico and a doubled 10% rate on Chinese goods, are the linchpin of this downturn. These measures, aimed at protecting American industries, have backfired for retailers like American Eagle by raising production costs. The Zacks Consensus Estimates project a 52.3% drop in full-year earnings to $0.83 per share and a 2.56% revenue decline to $5.19 billion, reflecting the strain of these tariffs on profitability.

Industry reports, such as those from J.P. Morgan, suggest the effective U.S. tariff rate could now approach 17%, further complicating the retail landscape. For American Eagle, the inability to pass these costs onto consumers without losing market share adds to the pressure, especially as competitors with domestic manufacturing gain an edge.

Also read:

- Hollywood to Adapt 1986 Racing Game OutRun into a Feature Film Directed by Michael Bay, Produced by Sydney Sweeney

- Gemini Unveils Tutor Mode: Now Teaching Languages, Coding, and Even Music Without the Hassle

- Google Agrees to $36 Million Fine in Australia Over Pre-Installed Search Deals

- Financial Benefits of Surety Bonds in Small Business

What Lies Ahead?

The stock’s decline has left investors wary, with shares shedding significant value in the wake of the downgrade. American Eagle’s fate hinges on its ability to navigate these tariff-induced challenges, potentially through strategic pricing adjustments or a pivot to domestic sourcing. The Sydney Sweeney campaign may have bought some time, but without a robust long-term strategy, the retailer risks deeper losses.

IFC’s past successes with niche-to-mainstream hits like *Late Night with the Devil* and *In a Violent Nature* offer a glimmer of hope—small adjustments can sometimes yield outsized results. Yet, with tariffs poised to reshape the retail sector, American Eagle’s next moves will be critical. As the market watches, the question remains: can a viral ad campaign outlast the economic storm, or will tariffs seal the company’s downward trajectory?