The phrase "All roads lead to Fanvue" has taken on new meaning in the world of AI influencers and content creators in 2025–2026. As platforms grapple with policies on synthetic media, one subscription-based site has emerged as the go-to destination for those monetizing AI-generated adult and influencer content.

Fanvue, a London-based platform launched in 2020 (with significant AI focus ramping up in recent years), positions itself as the leading AI-powered creator monetization hub. U

Fanvue, a London-based platform launched in 2020 (with significant AI focus ramping up in recent years), positions itself as the leading AI-powered creator monetization hub. U

nlike competitors that impose stricter limits on photorealistic AI, Fanvue has embraced synthetic creators — provided content is transparently labeled and doesn't involve impersonation or deepfakes of real people. This welcoming stance has driven explosive growth, especially in the adult-oriented creator space.

A major catalyst came in mid-2025, when Fansly — a direct rival — updated its Terms of Service (effective June 28, 2025) to ban photorealistic AI-generated content. The policy prohibits lifelike synthetic media, deepfakes, face-swaps, or AI that misrepresents itself as human performance. It also restricts fully automated AI interactions without human oversight. Many AI creators, facing sudden restrictions or bans, migrated elsewhere. Fanvue became the primary beneficiary as the only major adult subscription platform fully embracing from-scratch AI influencers.

OnlyFans, the market leader, allows AI content but requires it to resemble the verified human creator (no fully synthetic personas without ties to a real person). This leaves a clear gap that Fanvue exploits, attracting creators seeking unlimited scaling without burnout, scheduling conflicts, or real-world exposure.

OnlyFans, the market leader, allows AI content but requires it to resemble the verified human creator (no fully synthetic personas without ties to a real person). This leaves a clear gap that Fanvue exploits, attracting creators seeking unlimited scaling without burnout, scheduling conflicts, or real-world exposure.

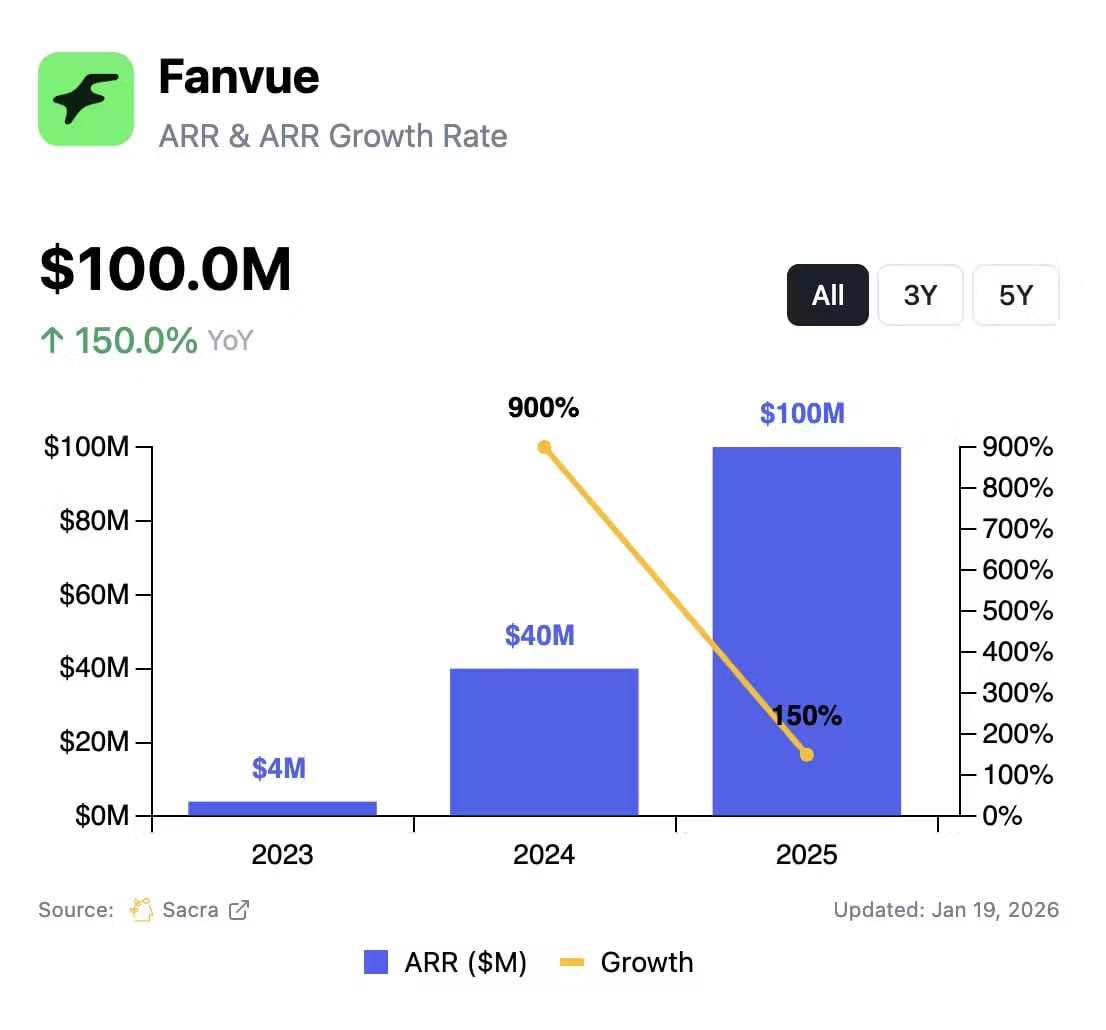

The numbers tell a compelling story. In January 2026, Fanvue announced it had surpassed $100 million in annualized revenue run rate (ARR), accompanied by a $22 million Series A funding round led by Inner Circle. This milestone followed rapid scaling: from an estimated $40 million ARR in 2024 to $100 million in 2025 (a roughly 150% year-over-year increase, per Sacra estimates), with some reports citing up to 450% YoY revenue growth in certain periods.

The platform now boasts over 17 million monthly active users, 250,000 creators, and added more than 20,000 creators in the month leading up to the announcement. Its workforce nearly tripled from 42 to 115 employees in a year.

AI has been a key driver. Reports indicate that AI-generated creators account for around 15% of platform revenues in recent periods, with top AI performers earning $20,000+ monthly through subscriptions (averaging $12.50/month), pay-per-view content, tips, and direct messages. Fanvue's built-in tools—AI analytics, voice cloning, automated messaging, content generation, and coaching—help creators (human or synthetic) scale efficiently. A striking 93% of creators use at least one AI feature.

This success contrasts with broader industry caution. While the creator economy grows toward a projected $500 billion valuation, platforms like OnlyFans (with billions in gross revenue) remain dominant but more conservative on pure AI personas.

This success contrasts with broader industry caution. While the creator economy grows toward a projected $500 billion valuation, platforms like OnlyFans (with billions in gross revenue) remain dominant but more conservative on pure AI personas.

Fanvue's bet on the "Creator-AI Economy" appears to be paying off, pulling in both mainstream figures (e.g., athletes sharing exclusive content) and anonymous AI operators who can produce infinite, niche-tailored material at near-zero marginal cost.

In short, for those serious about monetizing AI influencers — especially in adult or fantasy niches — Fanvue currently offers the clearest path to sustainable earnings. As policies evolve and competitors potentially loosen up, the landscape may shift, but right now, all signs point in one direction: toward Fanvue.

Also read:

- OnlyFans Models and Influencers Dominate U.S. 'Extraordinary Talent' Visas, Sparking Debate on Immigration Priorities

- How Is Passes, the Patreon and Fansly Competitor, Faring?

- Bithumb's $44 Billion Bitcoin Blunder: A Massive Internal Error That Shook Crypto Markets

Thank you!