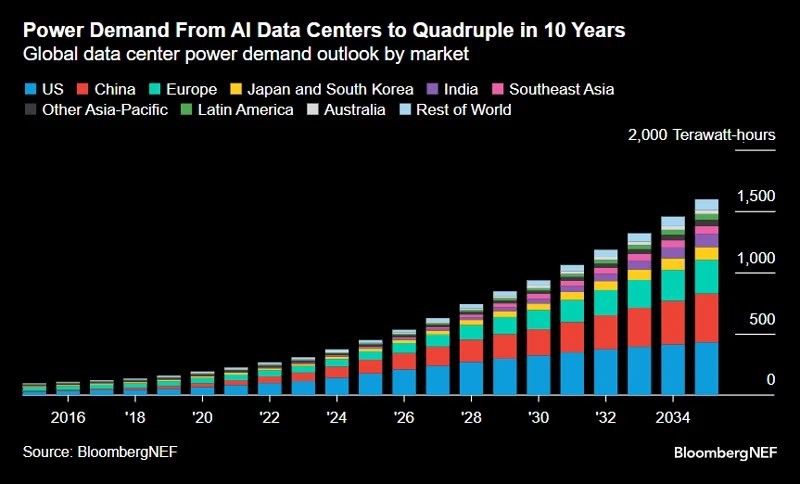

The AI revolution is devouring electricity at a pace that could redefine global energy markets - and it's only accelerating. According to BloombergNEF analysts, data centers powering AI could gulp down 1,600 terawatt-hours annually by 2035, equivalent to 4.4% of the world's total electricity consumption.

To put that in perspective, if AI data centers were a single country, they'd rank as the fourth-largest electricity consumer on Earth, trailing only China, the United States, and India. That's a fourfold surge from today's levels, outstripping even the voracious appetites of crypto mining or electric vehicle charging.

To put that in perspective, if AI data centers were a single country, they'd rank as the fourth-largest electricity consumer on Earth, trailing only China, the United States, and India. That's a fourfold surge from today's levels, outstripping even the voracious appetites of crypto mining or electric vehicle charging.

The United States is the undisputed epicenter of this surge. Home to hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud - which collectively operate over 5,000 data centers worldwide - the U.S. leads in AI infrastructure investment, with $200 billion committed to new builds through 2030.

Traditional hubs like Northern Virginia (the "data center alley" housing 35% of the world's internet traffic), Oregon, Texas, and Ohio are already straining grids, where AI facilities are gobbling up power faster than EVs, hydrogen projects, or any other emerging tech.

In Virginia alone, data centers consumed 25% of the state's electricity in 2024, up from 10% a decade ago, prompting emergency grid upgrades and blackouts during peak summer hours.

In Virginia alone, data centers consumed 25% of the state's electricity in 2024, up from 10% a decade ago, prompting emergency grid upgrades and blackouts during peak summer hours.

Efficiency is the silver lining - or so we hope. Modern data centers boast a power usage effectiveness (PUE) ratio of 1.2 to 1.4, down from 2.0 in 2010, thanks to liquid cooling, AI-optimized chips, and waste-heat recapture systems that now power nearby greenhouses or district heating. Nvidia's Blackwell GPUs, for instance, deliver 30 times the performance per watt of their 2018 predecessors.

Yet, as BloombergNEF notes, these gains are being outrun by sheer scale: AI training for models like GPT-4 requires 10,000 times more compute than GPT-2, and inference workloads (the daily queries powering ChatGPT) are exploding 10-fold yearly.

The net result? Electricity demand from AI could hit 945 TWh in the U.S. alone by 2030, rivaling California's total consumption.

Enter natural gas: the reluctant savior of the short term. With renewables like solar and wind intermittent and nuclear plants mired in permitting delays (only two new U.S. reactors online since 2016), gas-fired peaker plants are bridging the gap. In Texas, where data centers added 1.5 GW of demand in 2024, 70% of new capacity came from gas turbines.

Enter natural gas: the reluctant savior of the short term. With renewables like solar and wind intermittent and nuclear plants mired in permitting delays (only two new U.S. reactors online since 2016), gas-fired peaker plants are bridging the gap. In Texas, where data centers added 1.5 GW of demand in 2024, 70% of new capacity came from gas turbines.

Globally, gas underpins 60% of data-center expansions in emerging markets like India and Saudi Arabia, where AI hubs are sprouting amid oil-rich grids. Critics warn of a "dirty rebound": while AI promises carbon-cutting efficiencies, its energy footprint could add 2.5 gigatons of CO2 annually by 2030 - equivalent to all of Europe's aviation emissions - if fossil fuels fill the void.

China, the world's manufacturing behemoth, is racing to catch up, with state-backed AI clusters in Beijing and Shanghai demanding 200 TWh yearly by 2027. Europe lags but is pivoting hard: the EU's Green Deal mandates 40% renewable sourcing for data centers by 2030, spurring hyperscalers to build solar farms in Ireland and wind arrays off Denmark.

Also read:

Also read:

- How AI Is Quietly Rewiring Human Thinking: A New Landmark Review

- Don't Fear AI Intelligence. Fear AI Emotions.

- Make Joe Rogan Great Again: The King of Podcasts Reclaims His Throne in 2025

The AI power crunch isn't just an engineering puzzle - it's a geopolitical one. Nations with cheap, reliable grids (like the U.S. Southeast or China's Yangtze Delta) will attract trillions in AI investment, while others scramble for black-start generators. Policymakers face a dilemma: fast-track permits for gigawatt-scale facilities or watch jobs and innovation flee to sunnier shores. By 2035, AI could claim as much electricity as Japan does today (1,000 TWh), forcing a hard pivot to small modular reactors or fusion breakthroughs.

The machines are getting smarter, but they're also hungrier. The question isn't if we'll feed them - it's how, and at what cost to the planet we power.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) — the world's first remote work platform with payments in cryptocurrency.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.