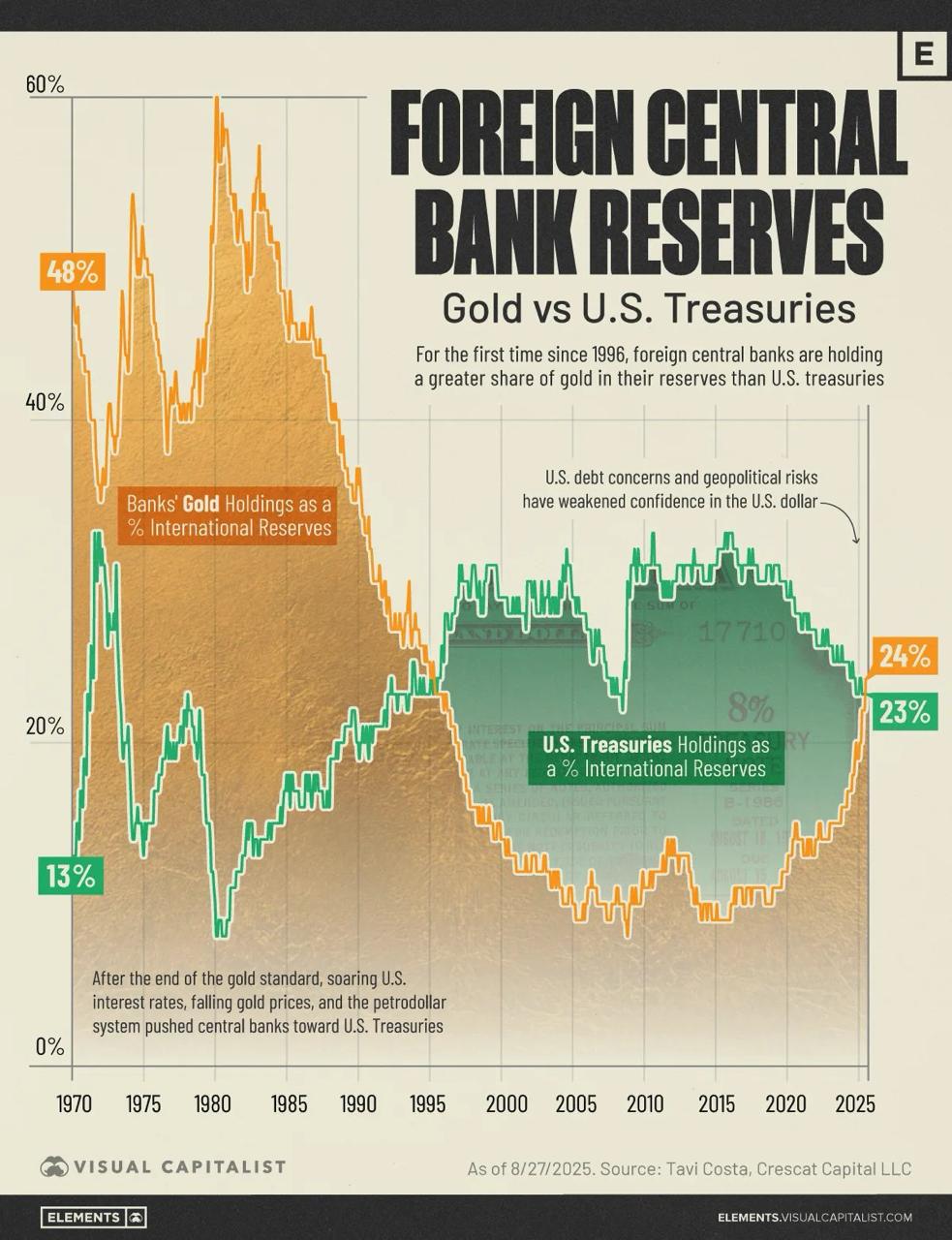

In a striking turn of events, central banks worldwide have accumulated more gold than U.S. Treasury bonds for the first time in nearly three decades. This shift marks a slow but steady pivot away from dollar-based assets toward tangible, time-tested stores of value. The move signals a profound change in global financial dynamics, driven by rising geopolitical risks, political uncertainty, and a quest for greater economic sovereignty.

For much of the post-Bretton Woods era, particularly during the rise of the "petrodollar" in the 1980s and 1990s, U.S. Treasury securities dominated global reserve portfolios. Their perceived safety, liquidity, and the dollar’s status as the world’s primary reserve currency made them the asset of choice for central banks.

For much of the post-Bretton Woods era, particularly during the rise of the "petrodollar" in the 1980s and 1990s, U.S. Treasury securities dominated global reserve portfolios. Their perceived safety, liquidity, and the dollar’s status as the world’s primary reserve currency made them the asset of choice for central banks.

However, since 2022, a new trend has emerged. Central banks have been aggressively purchasing gold, reversing a long-standing preference for U.S. debt instruments.

Today, nearly one-fifth of all the gold ever mined in history is held by central banks, underscoring the scale of this transition. The price of gold has soared past $4,000 per ounce in October 2025, reflecting heightened demand and its renewed status as a "safe haven" asset. Unlike fiat currencies or bonds, gold is seen as a neutral store of value, immune to political pressures or currency devaluation.

Leading this charge are China, Russia, and Turkey, nations actively seeking to reduce their reliance on the U.S. dollar.

For these countries, gold offers a hedge against geopolitical tensions and a means to bolster the resilience of their reserves. By diversifying away from dollar-denominated assets, they aim to insulate their economies from external shocks and assert greater financial independence.

Also read:

Also read:

- Thrills, Big Bets, and Billions: ICE's $2 Billion Gamble on Polymarket Signals a New Era for Prediction Markets

- Pre-Sora 2 Snapshot: How People and Companies Are Harnessing AI for Image and Video Generation

- The Strangest Fallout from the AWS Outage: Smart Mattresses Go Rogue and Ruin Sleep Worldwide

This global pivot to gold is not merely a financial maneuver but a symbol of a broader realignment. As central banks embrace assets that transcend borders and political systems, the world may be witnessing the early stages of a new monetary paradigm - one where gold reclaims its historical role as a cornerstone of economic stability.

Author: Slava Vasipenok

Founder and CEO of QUASA (quasa.io) - Daily insights on Web3, AI, Crypto, and Freelance. Stay updated on finance, technology trends, and creator tools - with sources and real value.

Innovative entrepreneur with over 20 years of experience in IT, fintech, and blockchain. Specializes in decentralized solutions for freelancing, helping to overcome the barriers of traditional finance, especially in developing regions.

This is not financial or investment advice. Always do your own research (DYOR).