In the closing months of 2025, a wave of high-profile layoffs has swept through some of the world's largest corporations, affecting tens of thousands of employees.

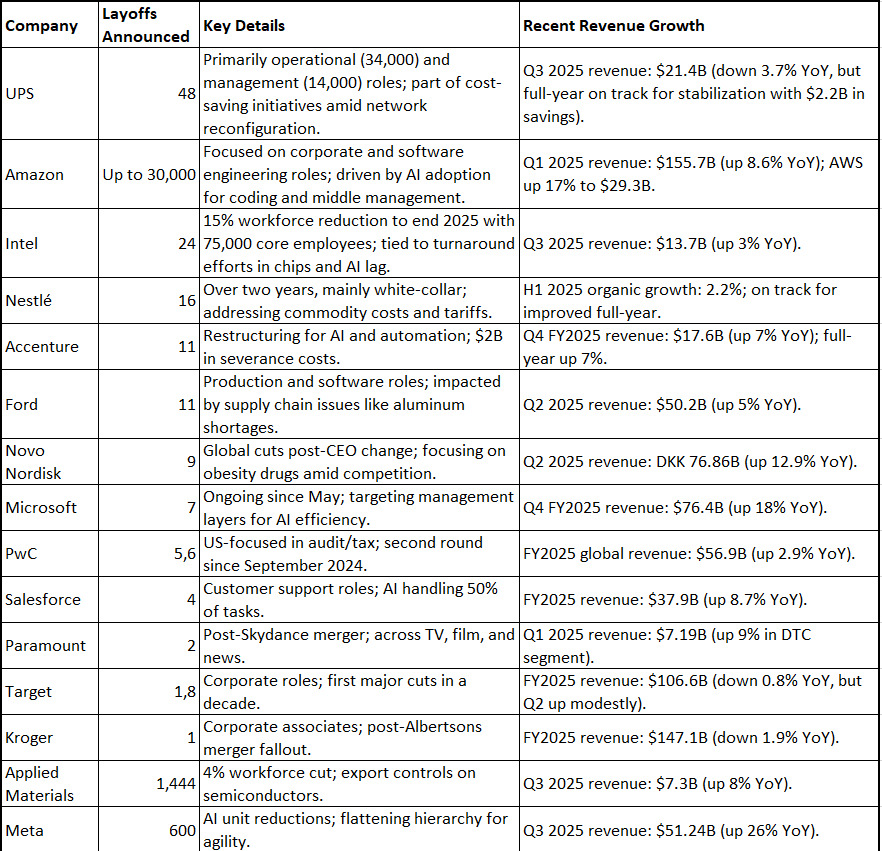

From logistics giants like UPS to tech behemoths such as Amazon and Meta, companies have announced significant workforce reductions - totaling over 200,000 jobs across the board. Yet, strikingly, these cuts come against a backdrop of robust financial performance: surging revenues, expanding market shares, and climbing key metrics.

From logistics giants like UPS to tech behemoths such as Amazon and Meta, companies have announced significant workforce reductions - totaling over 200,000 jobs across the board. Yet, strikingly, these cuts come against a backdrop of robust financial performance: surging revenues, expanding market shares, and climbing key metrics.

This paradox isn't a symptom of economic contraction but a clear signal of the transformative power of automation, robotics, and artificial intelligence (AI).

As businesses integrate these technologies, they're achieving unprecedented efficiency, but at the cost of traditional roles - particularly in linear, repetitive positions like support and warehousing.

A Snapshot of Layoffs in a Booming Economy

The layoffs, announced primarily between August and October 2025, span diverse industries from retail and manufacturing to tech and consulting.

Here's a breakdown of the most notable announcements:

These figures, drawn from company filings and earnings reports, reveal a common thread: despite trimming headcounts, most firms posted year-over-year revenue gains of 3-26% in recent quarters. For instance, Amazon's cloud arm (AWS) alone surged 17%, while Meta's ad revenue climbed 26%. Even in sectors facing headwinds like tariffs (e.g., Nestlé and Ford), underlying metrics like subscriber growth and market share held firm or improved.

Automation's Double-Edged Sword: Efficiency Over Headcount

The driving force behind these layoffs isn't belt-tightening in a downturn - it's technological disruption. AI and robotics are automating routine tasks at an accelerating pace, allowing companies to do more with less. UPS, for example, cited "streamlining initiatives" including facility closures and operational efficiencies, yielding $2.2 billion in savings by September 2025.

The driving force behind these layoffs isn't belt-tightening in a downturn - it's technological disruption. AI and robotics are automating routine tasks at an accelerating pace, allowing companies to do more with less. UPS, for example, cited "streamlining initiatives" including facility closures and operational efficiencies, yielding $2.2 billion in savings by September 2025.

Amazon's cuts targeted software engineers, coinciding with the rollout of AI tools like Kiro for coding, which now handles up to 50% of internal development work.

Similarly, Salesforce's 4,000 support role eliminations stem directly from Agentforce, its AI platform, reducing case volumes and backfill needs.

This trend extends beyond tech. In manufacturing, Intel's 24,000 cuts support a pivot to AI-competitive chips, with Q3 revenue up 3% despite the reductions.

Retailers like Target and Kroger are streamlining corporate functions to fund store-level investments, while Novo Nordisk's pharma efficiencies counter competition in GLP-1 drugs (e.g., Ozempic), where revenue grew 13% amid 9,000 job losses.

Economists and analysts, including those from Reuters and AP News, emphasize this isn't recessionary: U.S. unemployment remains stable, and job postings in high-skill areas are up. Instead, it's a "no-hire, no-fire" stasis evolving into proactive restructuring. As Fortune noted, white-collar roles - middle management and bureaucracy - are hit hardest first, with AI performing tasks "just as well, or better."

Also read:

- Humanoid Robot Neo — the Assistant Currently Piloted by Human Operators. Welcome to the Future

- China Deploys DeepSeek on Unmanned Tanks

- Remote Work = Cryptocurrency

The Road Ahead: Acceleration for Linear Roles, Opportunities for the Rest

Looking forward, this automation wave will intensify, particularly for "linear" positions in support, warehousing, and assembly. McKinsey estimates AI could automate 45% of work activities in these areas by 2030, up from 25% today. For UPS and Amazon, robotic warehouses and AI logistics could slash operational needs by 20-30% annually. Salesforce's CEO Marc Benioff bluntly stated: "Because of AI efficiencies, we need fewer heads."

Looking forward, this automation wave will intensify, particularly for "linear" positions in support, warehousing, and assembly. McKinsey estimates AI could automate 45% of work activities in these areas by 2030, up from 25% today. For UPS and Amazon, robotic warehouses and AI logistics could slash operational needs by 20-30% annually. Salesforce's CEO Marc Benioff bluntly stated: "Because of AI efficiencies, we need fewer heads."

The upside? Skyrocketing corporate efficiency. These firms project 10-20% margin expansions by 2027, funding innovations like Meta's $27B AI data centers or Accenture's $2B AI pivot. Globally, jobs aren't vanishing—they're evolving. The World Economic Forum forecasts 97 million new roles in AI, data, and creative fields by 2025, offsetting 85 million losses.

Yet, the transition demands adaptation. Linear roles will dwindle, but opportunities abound for those with energy, proactivity, creativity, and talent. As Microsoft’s Satya Nadella put it during recent earnings: "AI augments, not replaces - but only if you upskill." Governments and firms must invest in reskilling; programs like Amazon's Upskilling 2025 have already trained 300,000 workers for higher-value jobs.

In essence, 2025's layoffs herald not decline, but reinvention. Automation is the engine propelling these companies to new heights of productivity, proving that in an AI-driven world, growth and efficiency can coexist - even if it means saying goodbye to the old guard of work. For employees, the message is clear: embrace the change, or risk being automated out. The future favors the bold, the innovative, and the irreplaceable human spark.

As automation strips away linear jobs, traditional alternatives vanish: no safety nets, no regulated escapes. The only path to real freedom? Become an entrepreneur on unregulated platforms like Quasa, where crypto payments enable seamless global remote work without borders, banks, or bureaucratic chains - unleashing uncertainty's true potential over deterministic slavery.