Hello!

Nigeria, Africa's largest economy, has become a hotbed for cryptocurrency adoption, driven by several key factors. Firstly, the economic instability and high inflation rates within the country have pushed Nigerians towards cryptocurrencies as a means to hedge against currency devaluation. The naira's volatility, coupled with strict forex controls, makes cryptocurrencies an attractive alternative for storing and transferring value.

Secondly, the banking sector's inefficiencies, including high transaction costs and delays, have made decentralized finance (DeFi) platforms appealing.

Secondly, the banking sector's inefficiencies, including high transaction costs and delays, have made decentralized finance (DeFi) platforms appealing.

Cryptocurrencies allow for faster, cheaper, and more accessible financial transactions, particularly in a country where a significant portion of the population is unbanked or underbanked. The desire for financial inclusion has thus played a pivotal role in the crypto boom.

Another factor is the entrepreneurial spirit that thrives amidst Nigeria's challenging economic landscape. Young Nigerians, often tech-savvy and eager to bypass traditional financial systems, have embraced cryptocurrencies as a tool for innovation and entrepreneurship. This has led to the growth of numerous blockchain startups and the hosting of crypto-related events, further fueling the ecosystem.

Additionally, remittances play a crucial role. Nigeria is one of the world's top recipients of remittances, and cryptocurrencies offer a faster, less costly method for receiving and sending money across borders compared to traditional banking systems. This has been particularly useful for the Nigerian diaspora who wish to support their families back home without the hassles of banking fees and delays.

Additionally, remittances play a crucial role. Nigeria is one of the world's top recipients of remittances, and cryptocurrencies offer a faster, less costly method for receiving and sending money across borders compared to traditional banking systems. This has been particularly useful for the Nigerian diaspora who wish to support their families back home without the hassles of banking fees and delays.

Finally, the regulatory environment, although ambiguous, has not been overly restrictive. While there are warnings and occasional crackdowns on crypto trading, the lack of a completely prohibitive stance has allowed the market to flourish to some extent.

This regulatory grey area has fostered an environment where crypto can be explored without immediate legal repercussions.

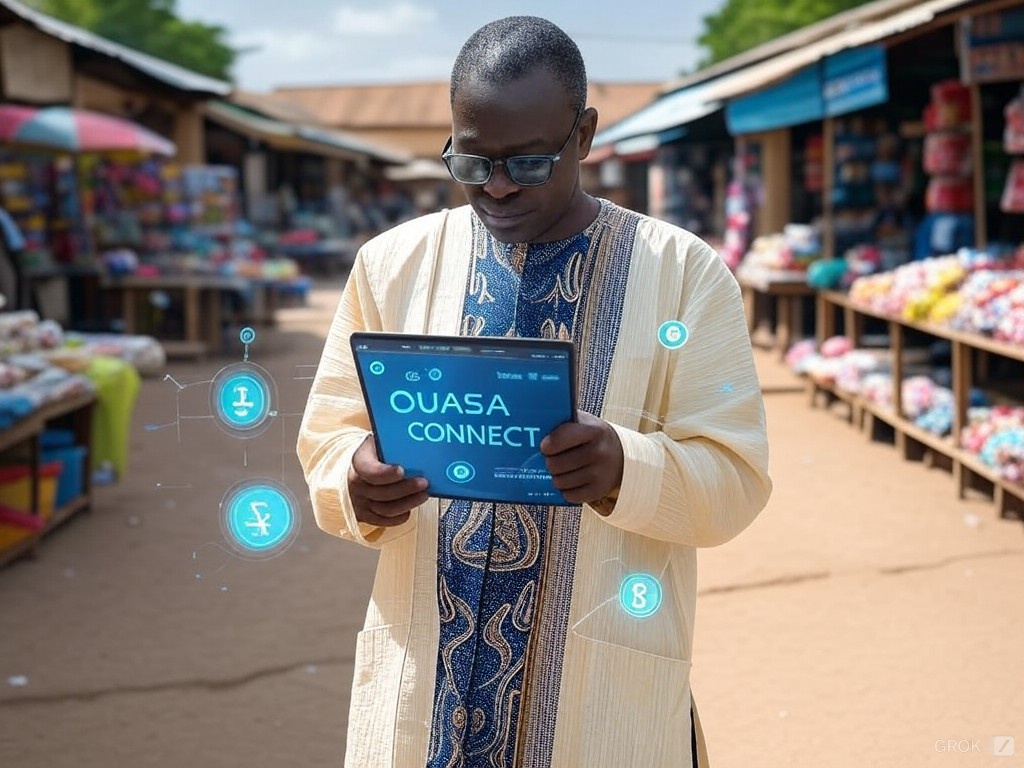

Quasa Connect - A Gateway to Cryptocurrency in Nigeria

Quasa Connect has emerged as one of the leading platforms facilitating the adoption of cryptocurrencies in Nigeria.

Quasa Connect has emerged as one of the leading platforms facilitating the adoption of cryptocurrencies in Nigeria.

The service emphasizes security and user education, providing resources to help Nigerians understand blockchain technology and manage their investments wisely.

With features like low transaction fees and instant transaction capabilities, Quasa Connect not only simplifies the process but also aligns with the urgent needs of Nigerian users for efficient and cost-effective financial solutions.

Quasa Connect as a Freelancer's Ally

Quasa Connect not only facilitates cryptocurrency transactions but also serves as an excellent tool for freelancers in Nigeria. The platform offers a seamless way for freelancers to receive payments in cryptocurrencies, which can be particularly advantageous for those dealing with international clients.

Quasa Connect not only facilitates cryptocurrency transactions but also serves as an excellent tool for freelancers in Nigeria. The platform offers a seamless way for freelancers to receive payments in cryptocurrencies, which can be particularly advantageous for those dealing with international clients.

Freelancers can benefit from the low transaction fees and instant payment processing, which are critical when working across time zones and with multiple project deadlines. Additionally, Quasa Connect's integration with blockchain technology ensures secure, transparent, and verifiable transactions, reducing the risk of payment disputes.

By enabling direct crypto payments, freelancers can avoid the costs and delays associated with traditional banking, making Quasa Connect an indispensable platform for those in the gig economy looking to streamline their financial operations.

Quasa Connect is designed to cater to the burgeoning interest in cryptocurrencies in Nigeria, offering a suite of features that make it a convenient and secure platform for crypto transactions:

Quasa Connect is designed to cater to the burgeoning interest in cryptocurrencies in Nigeria, offering a suite of features that make it a convenient and secure platform for crypto transactions:

- User-Friendly Interface: Even for those new to digital currencies, the interface is easy to navigate, ensuring that users can quickly get started with minimal learning curve.

- Support for Multiple Cryptocurrencies: The service supports a wide array of cryptocurrencies, from popular ones like Bitcoin and Ethereum to emerging altcoins. This variety caters to both seasoned traders looking for diverse investment options and new users interested in mainstream cryptos.

- Low Transaction Fees: One of the significant advantages of Quasa Connect is its competitive fee structure. The platform aims to keep costs low, which is crucial in a market where every naira counts, especially for small transactions or for those with limited financial resources.

- Instant Transactions: The platform facilitates fast transaction times, which is vital in a country where banking infrastructure can sometimes lead to delays. This speed is particularly useful for remittances and daily financial needs.

- Security Measures: Security is paramount, and Quasa Connect employs advanced encryption and security protocols to protect user data and funds. Features like two-factor authentication (2FA) add an additional layer of security to prevent unauthorized access.

- Educational Resources: Understanding cryptocurrency can be challenging, so Quasa Connect offers educational content to help users make informed decisions. This includes guides, tutorials, and updates on market trends, which are crucial for both new and experienced users.

- Mobile Accessibility: With a significant portion of the Nigerian population relying on mobile devices for internet access, Quasa Connect is optimized for mobile use, ensuring that users can manage their crypto portfolios on the go.

- Customer Support: Recognizing the importance of user support, Quasa Connect provides responsive customer service to handle queries, resolve issues, and guide users through the platform's functionalities.

- Community Engagement: The platform often engages with its user base through social media, forums, and events, fostering a community around cryptocurrency in Nigeria. This not only helps in spreading awareness but also in building trust and loyalty among users.

These features collectively make Quasa Connect a pivotal tool for those in Nigeria looking to engage with cryptocurrencies, aligning with both the technological needs and economic realities of the region.

Thank you!

Subscribe to our newsletter! Join us on social networks!

See you!