In an era where technological supremacy hinges on physical foundations, a stark contrast has emerged between the world's two superpowers.

The United States, once the undisputed leader in grand-scale engineering, now struggles to launch major projects amid regulatory hurdles, cost overruns, and political gridlock.

The United States, once the undisputed leader in grand-scale engineering, now struggles to launch major projects amid regulatory hurdles, cost overruns, and political gridlock.

Meanwhile, China is building at a pace that defies global norms, prioritizing infrastructure as the backbone of economic dominance and technological edge. This divergence isn't just about bricks and mortar — it's reshaping the global balance of power, particularly in energy and manufacturing, with profound implications for artificial intelligence (AI) and beyond.

The Energy Chasm: Solar and Nuclear Ambitions

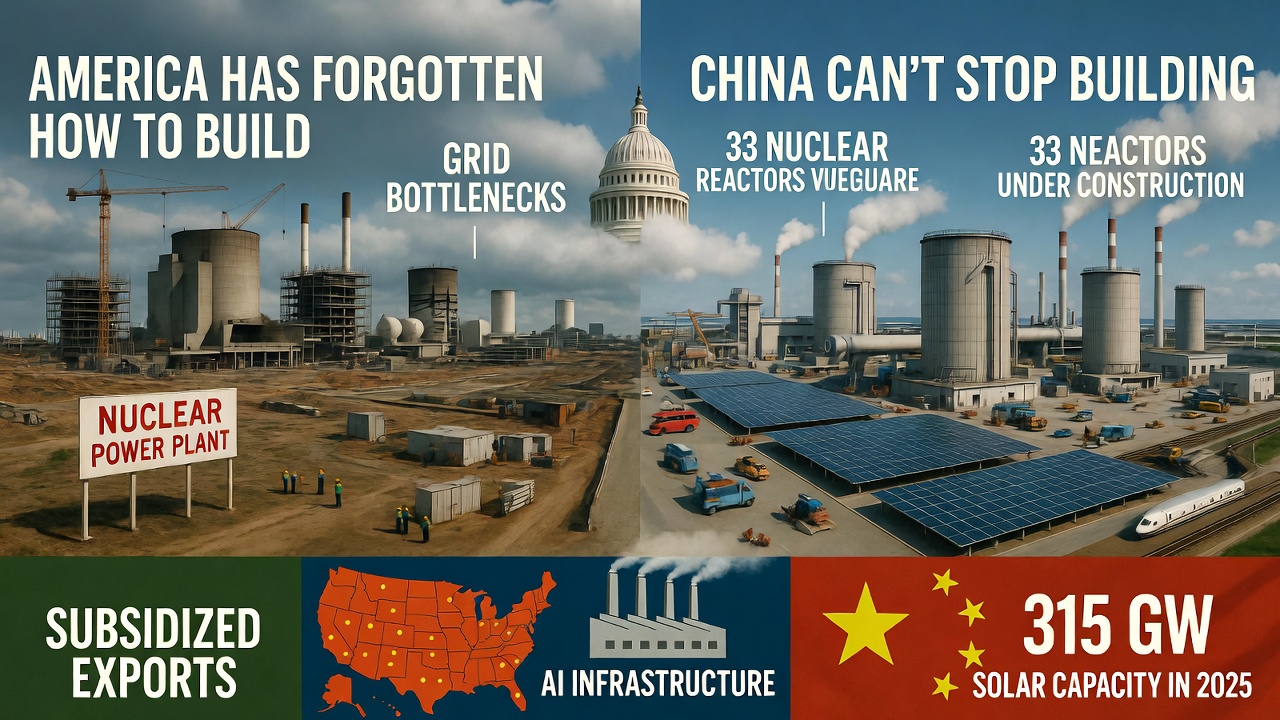

Energy infrastructure exemplifies this gap. The U.S. celebrates its solar achievements, with cumulative installed capacity reaching approximately 239 GW by the end of 2024. In 2025, the country added around 28 GW of new solar generation, a respectable figure but one that pales in comparison to China's output.

Energy infrastructure exemplifies this gap. The U.S. celebrates its solar achievements, with cumulative installed capacity reaching approximately 239 GW by the end of 2024. In 2025, the country added around 28 GW of new solar generation, a respectable figure but one that pales in comparison to China's output.

Beijing installed a staggering 315 GW of new solar capacity in 2025 alone — roughly ten times the U.S. annual addition — pushing its total to 1.2 TW. This relentless expansion isn't accidental; it's fueled by state subsidies, rapid permitting, and a focus on scaling renewables to meet surging demands from data centers and manufacturing.

Nuclear power tells a similar story. The U.S. has no reactors currently under construction as of early 2026, with recent projects like Vogtle plagued by delays and billions in overruns. In contrast, China has 33 reactors under construction, totaling 35 GWe of capacity.

Beijing's approach emphasizes speed and scale, with new units like those at Bailong and Lufeng breaking ground in rapid succession. This buildout positions China to dominate clean energy production, crucial for powering AI supercomputers that consume electricity equivalent to small cities.

China's energy boom — adding over 430 GW of wind and solar in 2025 alone — creates a strategic advantage in the AI race. As Elon Musk and Nvidia's Jensen Huang have warned, energy abundance will determine AI leadership. China's grid expansion, 80 times faster than the U.S., ensures cheap, reliable power for data centers, offsetting inefficiencies in domestic chips and enabling massive AI training operations.

Manufacturing Mastery: From Software to Hardware Hegemony

America's strength in software innovation — think Silicon Valley's AI algorithms — has long been touted as unassailable. Yet, China's focus on hardware and supply chains challenges this narrative. Beijing doesn't shy from "poor profitability metrics" if it secures market share and physical control. This mindset drives investments in factories, ports, and high-speed rail, turning China into the world's workshop on steroids.

The looming "second China shock" amplifies this threat. The first shock, post-WTO accession, decimated U.S. manufacturing jobs, accounting for about 25% of losses from 2000-2007. Now, amid economic slowdowns, China is flooding global markets with subsidized exports in high-tech sectors like EVs, batteries, and solar panels. This surge — exports surpassing $1 trillion in surplus — threatens deindustrialization worldwide, from Europe to emerging markets. Goldman Sachs predicts it could boost China's GDP by 0.6% annually while dragging down global growth by 0.1%, hitting high-tech producers hardest.

In a scenario where "everything you touch is made in one country," China gains leverage over global supply chains. This physical dominance underpins AI infrastructure, as data centers require vast quantities of chips, servers, and cooling systems—areas where China's manufacturing prowess shines.

Implications for Global Power: The AI Battlefield

The U.S. leads in AI models and chips, but China's infrastructure edge could erode this. Beijing's "infrastructure first" approach—building ultra-high-voltage grids and western data centers — ensures abundant, cheap energy for AI.

The U.S. leads in AI models and chips, but China's infrastructure edge could erode this. Beijing's "infrastructure first" approach—building ultra-high-voltage grids and western data centers — ensures abundant, cheap energy for AI.

Local subsidies like compute vouchers lower costs for domestic firms, fostering self-sufficiency despite U.S. export controls.

America's building paralysis — exemplified by stalled nuclear projects and grid bottlenecks — risks throttling AI growth. To compete, the U.S. must revive its construction ethos, streamlining regulations and investing in energy like China's dual-track strategy (renewables plus fossils for stability).

Also read:

- The Rise of AI Clones: Influencers and Coaches Selling Digital Versions of Themselves

- RIP App Store / Google Play? Manus Lowers the Barrier for AI-Generated Mobile Apps

- Gemini Knows Everything About You: Google's Personal Intelligence Turns AI into a True Personal Assistant

Conclusion: Relearning to Build or Risking Irrelevance

China's unstoppable building spree isn't just economic — it's a geopolitical strategy for dominance in AI and beyond. The U.S. must confront its "unlearning" of large-scale projects, or face a world where software innovation bows to hardware hegemony. As the second China shock unfolds, the choice is clear: rebuild, or be outbuilt.