Hello!

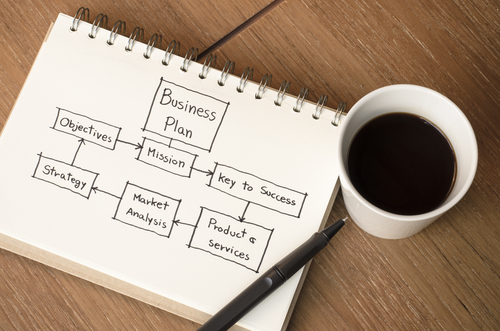

Our modern business landscape is filled with constant change. Industry trends come and go, demand changes, and different brands take the lead. While the success of a business is never guaranteed, a comprehensive business plan can help you safeguard your company’s future.

Effective business plans act as frameworks for team decision-making. They also help you stay focused on your goals and core mission, even when large-scale change is needed. Plus, they can help you secure outside funding when you need it. Investors and lenders look to business plans to determine your company’s longevity and profitability.

In this article, we’ll discuss nine sections you can include in your business plan to help your team stay afloat, even during turbulent times.

1. Executive Summary

An executive summary is a one-page overview that begins every standard business plan. It gives your stakeholders a brief understanding of what they’ll find in your document. You can use this section to introduce your company, then highlight key points from the rest of your business plan.

An executive summary is a one-page overview that begins every standard business plan. It gives your stakeholders a brief understanding of what they’ll find in your document. You can use this section to introduce your company, then highlight key points from the rest of your business plan.

While this step may seem superfluous, it can help busy teams get on the same page faster. When you share your business plan, not every team member will immediately have an hour to sit down and thoroughly read its contents.

But with an executive summary, each person involved will instantly know the key takeaways. They’ll be on the same page with the rest of the stakeholders and already be on track to making better decisions.

An engaging, positive executive summary is also key for attracting investors. Write this section last to ensure you’re including the most powerful details for potential funders.

2. Company Description

Business plans must solidify what your business does and what sets it apart.

You can begin your company description by providing a general description of your business, including your:

- Business name

- Location, service area, and/or website

- Number of years in business

- Business category

- Legal structure (sole proprietorship, LLC, C corporation, etc.)

Then, give an overview of the types of products or services you provide. What problems do your offerings solve? Who are your ideal customers? Answering both of these questions will help your audience differentiate you from your competitors.

Your company description is also a great place to establish your business model, which tells your readers how you make money. In the brainstorming phase of creation, you can use a business model canvas to help you put together your thoughts and ideas to build your model.

Your company description is also a great place to establish your business model, which tells your readers how you make money. In the brainstorming phase of creation, you can use a business model canvas to help you put together your thoughts and ideas to build your model.

It can keep you and your team organized and on track when all the creativity is flowing.

Even two brands with the same types of products can have two very different business models. For example, you can offer groceries via subscription (like HelloFresh) or retail (like grocery stores).

Once your overview is complete, offer a clear statement or two about what gives your company the competitive edge. For example, if you created an app that has more freemium users than any of its competitors, this can be a huge opportunity for you to scale your profits in the future.

3. Market Analysis

If you want your business to survive long-term, you need a realistic understanding of your industry and your position within it. That’s why including a market analysis section is critical.

In this part of your business plan, identify trends in your industry. Is demand projected to increase or decrease? Who is driving this demand? Use charts and graphs to help your readers visualize the objective data you gather.

In this part of your business plan, identify trends in your industry. Is demand projected to increase or decrease? Who is driving this demand? Use charts and graphs to help your readers visualize the objective data you gather.

Your market analysis is also a great place to dive deeper into who your target market is — including their demographic, geographic, and psychographic information — and the makeup of your current customer base.

Then, analyze your competitors. Clarify what products and services they offer and how their niche markets compare to yours.

While it can be tempting to make your market analysis biased toward your brand, it’s important to be clear about what competitors do better than you. This can help your team know where they can improve, and identify areas where your business can excel.

4. Products and Services

When there’s more clarity about the products and services you offer, your team can better communicate to customers how your brand can solve their problems. Whether your marketing team is creating campaigns or your sales team is doing consultations, they’ll be able to send consistent messages.

Use this section to go into detail about each product or service, how it works, and who it’s for.

5. Management and Operations Structure

Recuperating from sudden events can be difficult with a disorganized business. But with an organized business — one with clear managers, roles, and responsibilities — your company can function like a well-oiled machine. Collaboration becomes easier, communication can flow efficiently, and each person is held accountable for doing their part.

In your business plan, first identify who runs your company. Identify your founders, owners, and C-suite executives. If you’re using your business plan to get funding or form partnerships, make sure to include a little about each member’s background and why they’re the best fit for the job. But even if you’re only using your business plan internally, showing your leadership team’s expertise can help you achieve employee buy-in during times of change. Your team members will trust your leadership team’s knowledge and guidance.

After defining the leadership team, define the rest of your company’s structure with an organizational chart. This will help readers visualize what teams and locations your managers lead and who each employee should report to.

6. Sales and Marketing Plan

Having a marketing plan is critical for a successful business. It’s how you get your brand and its products or services in front of your target audience. Use this section to define the strategies and tactics you’ll use to attract, convert, and retain customers.

Business owners often use this section to identify their marketing channels, which may include social media, email, search engines, and more. Any paid advertising plans can also go here.

In addition to defining your marketing tactics, this part of your business plan can outline your pricing strategies. Explain how you’ll strategically price each of your products or services to maximize return on investment.

7. Financial Plan

Running a business costs money. It’s an obvious statement, but oftentimes, businesses don’t realize exactly how much. Your financial plan is an opportunity for you to break down how much you’re spending and where, so you don’t risk overspending.

Some common ongoing costs that you may face include:

Some common ongoing costs that you may face include:

- Salaries and wages

- Contractor fees

- Rent or mortgage

- Utilities

- Supplier fees

- Advertising costs

- Software subscriptions

- Printing and shipping

This budget can help you get more realistic about your daily spending. With smart budgeting in place, you won’t be under quite as much pressure if demand suddenly drops. Rather, you’ll have some breathing room and time to restrategize.

If you’re scaling an early-stage startup, you may also face large one-time costs like:

If you’re scaling an early-stage startup, you may also face large one-time costs like:

- Business registration fees

- Business licensing fees

- Office space deposits or down payments

- Equipment

- Web development

- Market research

Taking note of these costs in your business plan can help you identify how much funding you need to launch, then grow. This can also help you pinpoint where you need to save. For example, you may need to temporarily outsource your marketing until you’ve recuperated the cost of machinery and can hire an employee.

If you’re looking for external funding, this is the perfect section for you to place your funding request for investors, lenders, or donors.

8. Financial Projections

Financial projections will provide essential benchmarks for your business as you put your plan into action. Your projections should give you insight into where your revenue, net profit, and more should be during each quarter in the next five years. This way, if you’re not on track to hitting your goals, you can adjust your marketing strategies, target market, or other aspects of your business plan.

Financial projections will provide essential benchmarks for your business as you put your plan into action. Your projections should give you insight into where your revenue, net profit, and more should be during each quarter in the next five years. This way, if you’re not on track to hitting your goals, you can adjust your marketing strategies, target market, or other aspects of your business plan.

Offer readers your forecasted income statements, cash flow statements, and more. Use graphs and charts to organize your data.

This is a critical section for winning over your investors — but don’t provide overly optimistic projections just to appease them. Investors are smart and can easily sniff out unrealistic expectations (which may make you appear like an unfit leader).

Work with a professional financial consultant or a similar expert to create positive, but plausible projections based on your expected spending and current revenue.

9. Continuity Plan

All the categories listed above are part of a traditional business plan. But in light of the disruption caused by the coronavirus pandemic, it’s clear that one event can throw your plans off track. Adding a business continuity plan — which is basically a Plan B — to your business plan can help you:

- Respond faster to unexpected events

- Increase your business longevity

- Appeal to risk-averse investors

Great continuity plans first include potential problems that your business may face. For example, if suppliers are wiped out of a key product or if employees can’t come into the office.

Once you identify potential problems, collaborate with your team and consult with relevant experts, like financial planners or the Small Business Administration. Together, identify what actions you can take to alleviate or eliminate each issue and who needs to be involved to achieve the solution.

Create an Effective Business Plan

An extensive business plan can help you reduce guesswork and strategically grow your company. Including these nine elements in your final document will give your stakeholders a detailed look into what your company really does and how you operate. Sit down and plan to get on the fast track to achieving your business goals.

- Top 10 Habits that increase Your Financial Growth

- Top 5 Ways Artificial Intelligence Technology is Transforming the Financial Markets

- Best 10 Ways to Improve Your Financial Future

- How to Do SEO for Financial Services

- Breaking Down Barriers: How Digital Identity Is Bridging The Gap In Financial Inclusion

- Can Intelligent Automation Boost The Financial Services?

- Obtaining Long-Term Financial Stability

Thank you!

Subscribe to our newsletter! Join us on social networks!

See you!