In 2025, as cryptocurrency markets mature, converting stablecoins like USDT to privacy-focused assets like XMR has become a common strategy for users seeking to balance liquidity with anonymity. With increasing regulatory scrutiny on stablecoins and growing concerns over data privacy, this exchange allows holders to shift from a pegged asset to one designed for untraceable transactions. However, volatility in crypto rates, network fees on TRON, and potential delays due to mempool congestion can introduce risks like slippage if not managed properly.

USDT on the TRC20 standard operates on the TRON blockchain, known for its speed but susceptible to occasional congestion that affects confirmation times. Meanwhile, XMR's settlement on Monero's network emphasizes privacy but requires awareness of block times around two minutes. Understanding these dynamics helps minimize unexpected costs or delays during the usdt to xmr process.

What Is USDT (TRC20) and Why Convert to Monero (XMR) Now

USDT, or Tether, is a stablecoin pegged 1:1 to the US dollar, providing stability in volatile crypto markets. The TRC20 version runs on the TRON blockchain, enabling fast, low-cost transfers compatible with Ethereum-like standards but optimized for TRON's high throughput. According to Tether's official site, USDT tokens are backed by reserves including cash equivalents and other assets, though users should monitor transparency reports for peg stability.

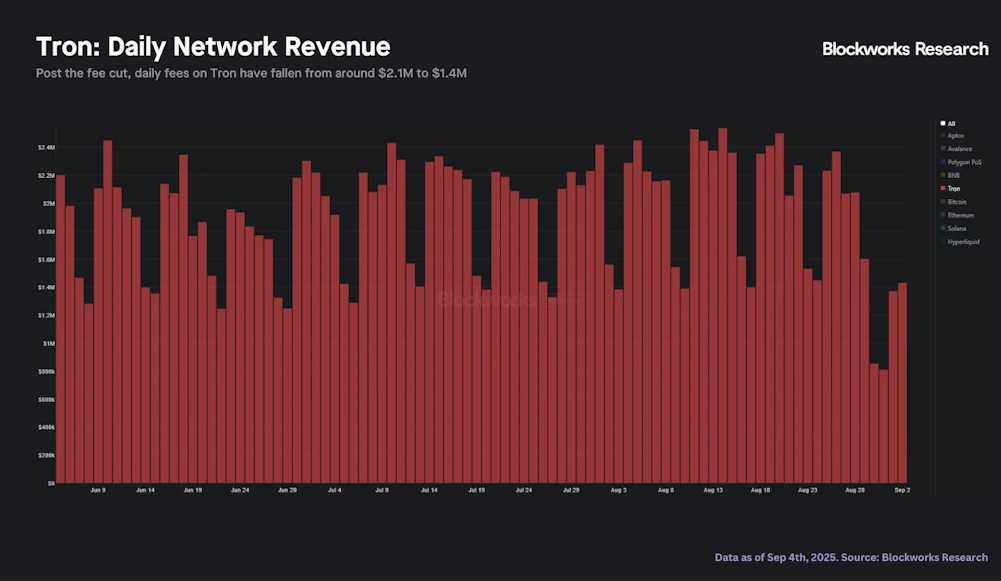

The TRC20 standard defines how tokens like USDT function on TRON, with transactions requiring energy and bandwidth resources that translate to minimal fees—often slashed further in 2025 updates to combat rising costs during high demand. This makes it ideal for holding value, but in an era of heightened surveillance, converting to XMR appeals to those prioritizing privacy amid global crackdowns on traceable assets.

Pros and Risks

USDT offers pros like price stability and quick liquidity on exchanges, but risks include potential de-pegging events, as seen in past stablecoin collapses, and exposure to centralized reserves that could face regulatory freezes. XMR, conversely, provides strong privacy through features like stealth addresses and RingCT, shielding transaction details, but it trades off with lower liquidity and higher volatility in niche markets.

Converting now in 2025 makes sense as privacy coins gain traction against tracking tools, though users must weigh USDT's low-risk holding against XMR's anonymity benefits. Network congestion on TRON can spike fees temporarily, while Monero's mempool backlogs during attacks or high volume might delay confirmations beyond the typical two-minute block time.

USDT to XMR Exchange Methods Compared

When planning a usdt to xmr exchange, options range from centralized exchanges (CEXs) to decentralized alternatives. Each method impacts fees, privacy, and speed, requiring users to evaluate trade-offs based on their needs.

CEXs like major platforms offer high liquidity but often mandate KYC, exposing user data and potentially triggering tax reporting. Non-custodial swaps, where users retain control of keys throughout, prioritize privacy without holding funds. P2P trades connect buyers directly but can involve trust issues and variable rates.

CEX vs Non-Custodial Swaps vs P2P — fees, KYC, speed

CEXs typically charge 0.1-0.5% fees plus network costs, with KYC mandatory for larger amounts, leading to slower onboarding but faster trades once verified. Non-custodial platforms avoid KYC, using automated protocols for swaps in 5-10 minutes, with fees baked into rates for transparency. P2P, via forums or apps, might have zero platform fees but risks escrow disputes and longer negotiation times.

For privacy seekers, non-custodial options shine, as they don't store user funds or data, contrasting CEXs' custodial models. In 2025, with TRON fees halved to under $1 per transaction on average, non-custodial swaps become more cost-effective during congestion. Learn more about exchange types in this guide on cryptocurrency platforms.

How to Exchange USDT to XMR with No Signup

Executing a convert usdt to xmr transaction without signup streamlines the process, focusing on speed and privacy. Non-custodial services allow users to input details directly, avoiding account creation while providing live exchange rates for informed decisions.

In practice, platforms offering swaps emphasize transparent fees and options like fixed or floating rates to handle volatility. For instance, with no signup required, you can quickly enter your amount and wallet address, ensuring a non-custodial flow where funds move directly between chains. This approach reduces risks from centralized holds, delivering XMR in typically 5-10 minutes after TRON confirmations

To perform a usdt to xmr exchange, select a service with live rates and proceed without delays from verification.

Enter amount → Provide XMR address → Confirm → Send → Receive

Here's a step-by-step guide based on standard non-custodial processes:

- Specify the USDT (TRC20) amount: Enter how much USDT you want to swap, and view the estimated XMR output via a live calculator, choosing fixed or floating rate.

- Provide your Monero wallet address: Input a valid XMR address; ensure it's correct to avoid loss, as transactions are irreversible.

- Confirm the quote and details, then send USDT: Review fees, expected time (around 5-10 min), and send to the provided deposit address on TRON.

- Receive XMR after confirmations: Once TRON network confirms (usually quick, but watch for congestion), XMR arrives in your wallet automatically.

This method supports anonymous swaps, with privacy preserved through direct wallet-to-wallet transfers.

Fixed vs Floating Rates: Which to Choose

In a swap usdt to xmr, rate type selection affects outcomes amid market volatility. Fixed rates lock in the quote, protecting against sudden drops, while floating adjusts to current conditions upon receipt.

Choose fixed for high-volatility scenarios, as it guarantees the amount if completed within the window. Floating suits stable markets, potentially yielding more if rates improve but risking slippage if they worsen.

The rate lock window, often around 12 minutes for fixed options, gives time to send USDT before expiration. Slippage occurs in floating rates due to market shifts between quote and confirmation, exacerbated by volatility.

In 2025's bull runs, fixed rates prevent losses from rapid XMR price swings, while floating might benefit from upward trends. Monitor live exchange rates to decide, factoring in network congestion that could extend beyond the window.

Fees, Live Rates, and Slippage Control

Fees in usdt to xmr swap include network costs on TRON and Monero, plus service margins—typically transparent and included in quotes. TRON's 2025 fee reductions make it economical, with averages below $1, though congestion can temporarily increase them.

Live rates from aggregators scan multiple sources for optimal pricing, helping control slippage by timing swaps during low volatility.

Network fees, quotes transparency, timing tips

TRON fees cover energy for TRC20 transfers, often minimal but rising with load; XMR fees are low due to dynamic block sizes. Quotes show all-in costs upfront.

Tip: Avoid peak hours to sidestep mempool backlogs—TRON confirms in seconds typically, Monero in minutes. Check mempool status for both chains to time entries and reduce slippage risks.

Speed and Privacy Considerations

Speed in usdt to xmr exchange hinges on network confirmations: TRON's fast blocks (3 seconds) enable quick USDT sends, while Monero settles in about 2 minutes per block, with full confirmation after several.

Privacy is core, with XMR using stealth addresses to unlink transactions and RingCT to hide amounts. Non-custodial swaps enhance this by avoiding data logs.

TRON needs 19-30 confirmations for security, but services often proceed after fewer during low congestion. XMR's model uses view keys for private scanning, with rare KYC only if flagged for anomalies.

In privacy coins like Monero, features deter tracking, as noted in discussions on shifting from traceable assets. Risk-based triggers mean most swaps remain anonymous.

Safety Checklist and Common Mistakes

Before any exchange:

- Verify wallet addresses twice to prevent typos.

- Use fixed rates in volatile markets; monitor slippage on floating.

- Check network status for TRON and Monero mempools to avoid delays.

- Confirm service is non-custodial and privacy-focused.

Common mistakes include rushing during congestion, leading to expired locks, or ignoring fees that eat into small swaps. Always use official sources like TRON docs for standards. Also, review stablecoin risks to understand USDT's backing.

Conclusion: When a Fixed or Floating USDT→XMR Swap Makes Sense

A fixed usdt to xmr exchange suits volatile periods, locking rates for certainty within the 12-minute window, ideal for privacy shifts without slippage surprises. Floating works in stable conditions, leveraging live rates for potential gains but requiring congestion awareness.

Ultimately, non-custodial, no-signup options balance speed (5-10 min) and privacy, making them practical in 2025's regulatory landscape. Weigh pros like low fees against risks such as network loads, and always prioritize wallet security for safe conversions.

Also reed: Tether to Discontinue USDT Support on Five Blockchains

The Living Markets: When Financial Markets Become Living Beings Atlas of Impossible Worlds